Bonding Curves Explained: How Token Prices Are Set in AMMs and Launches

Jan, 19 2026

Jan, 19 2026

When you buy a new token on a decentralized exchange, you might not realize it’s not like buying stocks. There’s no bid-ask spread, no market maker shouting orders, no order book waiting for someone to match your trade. Instead, the price changes automatically as you buy - and that’s because of a bonding curve.

What Exactly Is a Bonding Curve?

A bonding curve is a smart contract that links a token’s price directly to how many tokens are in circulation. It’s not a guess. It’s math. Every time someone buys a token, the contract mints a new one and raises the price slightly. Every time someone sells, the contract burns the token and lowers the price. No middlemen. No matching. Just code. Think of it like a vending machine that charges more each time you buy a soda - not because it’s running out, but because the price is programmed to go up with every purchase. The curve defines that price path. It’s the same math used in Uniswap, Bancor, Aavegotchi, and dozens of other DeFi projects. The curve isn’t always a straight line. Some go up slowly. Others shoot up fast. The shape decides how the token behaves. Linear curves raise the price by a fixed amount per token - say, $0.10 more for each new token. Exponential curves make early buyers pay less, but later buyers pay way more. Logarithmic curves slow down as supply grows, which is why some stablecoins use them.How Bonding Curves Power Token Launches

Before bonding curves, launching a token meant pitching to exchanges, paying listing fees, and hoping someone would trade it. Most tokens failed before they even started. Bonding curves changed that. Projects like Aavegotchi used bonding curves to launch GHST tokens in 2021. Users bought GHST with DAI, and the price climbed as more tokens were minted. No IPO. No centralized exchange. No gatekeepers. Over 12,000 people bought tokens directly, with 82% distributed fairly to early participants. That’s the power of a bonding curve: it democratizes access. The curve ensures liquidity from day one. Even if only 10 people buy, the contract holds the reserve (usually ETH or DAI) and pays out when someone sells. There’s no need to wait for a whale to dump 100,000 tokens. The system is self-sustaining.How They Work in Secondary Trading

Not all bonding curves are for launches. Uniswap’s constant product formula (x * y = k) is a type of bonding curve too. It doesn’t look like a typical curve - it’s hyperbolic - but it still follows the same logic: as you buy more of Token A, you pay more because you’re reducing the supply of Token B in the pool. That’s why Uniswap can handle billions in daily volume without order books. The curve adjusts price in real time. If you buy $5,000 worth of a small-cap token, the price moves up as you buy - not because the market is panic-selling, but because the math forces it. This is why AMMs dominate DeFi. As of January 2026, bonding curve-based DEXs hold $142.7 billion in locked value - 78% of all decentralized exchange liquidity. Uniswap alone accounts for 63% of that.

Why Slippage Is a Big Deal

The biggest downside? Slippage. If you try to buy $10,000 worth of a token with a steep exponential curve, you won’t pay $10,000. You’ll pay $11,500 - because the price keeps rising as you buy. Sovryn’s documentation calls this out clearly: “The price is actually higher than NumberOfTokens * CurrentPrice.” That’s because the contract calculates the integral of the curve - the total area under the price path - not just the final price point. In 2024, Chainalysis recorded $2.3 million in losses across 17 protocols from developers miscalculating these integrals. One user on Reddit described buying $500 worth of GHST during its launch - only to find out they paid $720 because the curve moved mid-transaction. This isn’t a bug. It’s a feature. But it’s also why retail traders often get burned. If you’re buying more than a few hundred dollars’ worth, you need to understand the curve shape. Finematics’ YouTube tutorial on bonding curves has over 1.2 million views - mostly from people who lost money the first time and went back to learn.Advantages: Liquidity, Transparency, Fairness

The benefits are real. First, liquidity is guaranteed. No matter how small the market, the curve always has funds to pay sellers. That’s impossible with order books. Second, pricing is transparent. You can look at the smart contract and see exactly how the price will change with each token. No hidden fees. No manipulation by market makers. Third, it’s fair. Early adopters pay less. Latecomers pay more. No insider trading. No pre-mines. No centralized teams dumping tokens on the public. That’s why 68% of users in CoinGecko’s 2025 DeFi report rated bonding curves highly for token launches.Disadvantages: Manipulation, Volatility, Regulatory Risk

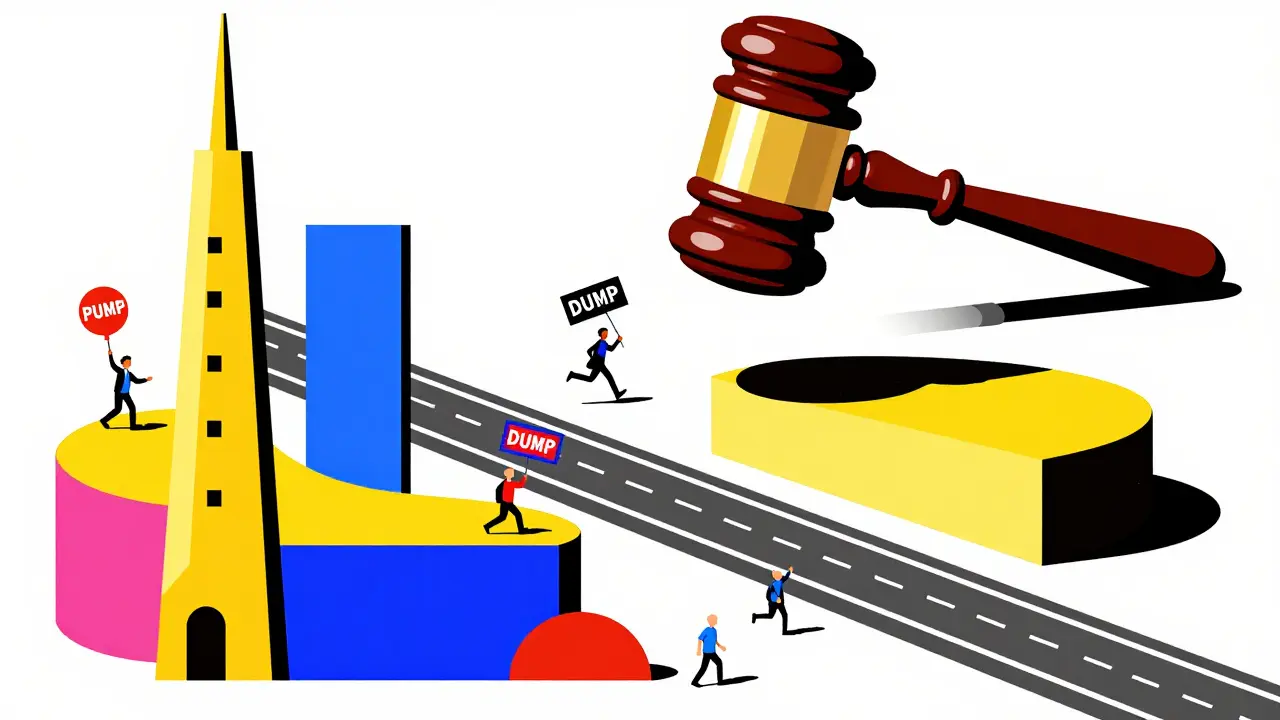

But it’s not perfect. Low-liquidity curves are easy to manipulate. A single wallet with $50,000 can buy up a small token and dump it, triggering panic sells. Coinbase’s 2024 analysis flagged this as a major risk in early-stage launches. Then there’s the disconnect from reality. Bonding curves don’t care about news, adoption, or community sentiment. They only respond to supply. In 2023, the LBank token’s price diverged 37% from broader market valuation within 48 hours - not because of trading volume, but because the curve kept rising even as sentiment crashed. And regulators are watching. In 2024, the SEC shut down Nirvana Capital’s bonding curve token, calling it an unregistered security. The court found that the predictable price increase created an “investment contract” - meaning buyers were betting on future price gains, not just using the token.

What’s Next? Hybrid Curves and L2 Optimization

The next wave isn’t pure bonding curves. It’s hybrids. Uniswap v4, released in late 2025, lets developers plug in custom “hooks” - meaning you can now combine bonding curves with limit orders. Want to set a max price? You can. Want to pause minting if the price hits $10? You can. Bancor v3, launched in November 2024, uses oracle data to adjust the curve dynamically. If ETH drops 15%, the curve can slow its price growth to avoid overpricing the token. And Ethereum’s Layer 2 scaling efforts are targeting bonding curve gas costs. Minting and burning tokens used to cost $50+ in gas. Now, on zkSync and StarkNet, it’s under $2.Should You Use a Bonding Curve?

If you’re launching a token: yes. It’s the most reliable, fair, and liquid way to distribute tokens without centralized intermediaries. If you’re trading: proceed with caution. Know the curve shape. Calculate slippage before you click buy. Use tools that show the integral price, not just the current price. If you’re a developer: learn Solidity and how to calculate integrals. Mess up the math, and you’ll lose millions. Use Uniswap’s v3 code as a reference - it’s the most battle-tested. Join their Discord. Ask questions. The community is huge.Final Thoughts

Bonding curves aren’t magic. They’re math. And math doesn’t lie. But it doesn’t care about human emotion, news, or macro trends either. That’s why they work so well for launches - and why they struggle in volatile secondary markets. They’ve replaced the old model of token distribution. They’ve made DeFi accessible. They’ve given retail investors a fair shot. But they’re not the endgame. The future belongs to systems that combine bonding curves with real-time data, user-controlled limits, and lower costs. The curve is just the foundation. The house is still being built.How does a bonding curve set the price of a token?

A bonding curve uses a mathematical function - like linear, exponential, or logarithmic - to link a token’s price directly to its circulating supply. When someone buys a token, the smart contract mints a new one and increases the price according to the curve. When someone sells, the contract burns the token and lowers the price. The price isn’t set by buyers and sellers - it’s set by code.

Are bonding curves only used for new token launches?

No. While they’re popular for launches (like Aavegotchi’s GHST token), they’re also used for ongoing trading. Uniswap’s constant product curve (x*y=k) is a type of bonding curve that powers secondary trading across thousands of tokens. It ensures continuous liquidity without order books.

Why do I pay more than expected when buying a large amount of tokens?

Because the price changes as you buy. If you try to buy 1,000 tokens at once, the contract doesn’t use the starting price for all of them. It calculates the total cost by adding up the price at each step along the curve - this is called the integral. So if the price rises from $1 to $3 over 1,000 tokens, you pay the sum of all those intermediate prices, not just $3,000. This is called slippage, and it’s built into the system.

Can bonding curves be manipulated?

Yes, especially if the reserve pool is small. A single wallet with enough funds can buy up most of the supply, push the price way up, then sell quickly for a profit. This is called a “pump and dump” on a bonding curve. Projects with low liquidity are most vulnerable. Larger, well-funded curves like Uniswap’s are much harder to manipulate.

Are bonding curves legal?

It depends. In 2024, the SEC shut down Nirvana Capital’s bonding curve token, ruling it an unregistered security because the predictable price increase made it look like an investment contract. If the token’s main appeal is profit from price appreciation - not utility - regulators may step in. Always consult legal counsel before launching a token with a bonding curve.

What’s the difference between a bonding curve and a traditional order book?

Order books rely on matching buyers and sellers - if no one wants to sell at your price, your order doesn’t fill. Bonding curves don’t need counterparties. The contract itself is the market. It always has funds to buy or sell, so your trade executes instantly, no matter the size. But you pay for that convenience with slippage.

Which tokens use bonding curves today?

Major projects using bonding curves include Uniswap (v2 and v3), Bancor, Aavegotchi (GHST), Sovryn, and SushiSwap’s MISO launchpad. Most new DeFi tokens launched since 2021 use some form of bonding curve for initial distribution. Over 12% of all token launches in 2025 used bonding curves as their primary mechanism.

How do I calculate slippage on a bonding curve before buying?

Most wallets and DEX interfaces (like Uniswap or Bancor) show you the expected price impact before you confirm the transaction. But for deeper analysis, you need to know the curve’s formula. For a linear curve P = a + b*S, you’d integrate from your current supply to your target supply. Tools like Token Terminal and DeFiLlama now offer slippage calculators for popular curves. If you’re not sure, buy smaller amounts first.