How to Switch Between Mutual Fund Schemes in India Without Triggering Tax

Dec, 8 2025

Dec, 8 2025

Switching between mutual fund schemes in India doesn’t have to mean paying more taxes-if you know the right moves. Many investors assume changing funds means selling one and buying another, which triggers capital gains tax. But that’s not always true. There are legal, common, and smart ways to move your money between schemes under the same fund house without triggering tax liability. And if you’re holding equity funds for over a year, you’re already sitting on tax-free gains. The trick isn’t avoiding taxes entirely-it’s avoiding unnecessary taxes.

Understand the Two Types of Switches

There are two ways to switch mutual fund schemes: redemption + repurchase and systematic transfer plan (STP) or switch request within the same fund house. Only one of these avoids tax.If you redeem your units in Scheme A and then buy units in Scheme B, the tax is triggered at the time of redemption. That’s true even if you use the same money to buy the new fund. The tax authority sees it as two separate transactions: a sale and a purchase.

But if you request a direct switch from Scheme A to Scheme B within the same mutual fund house, it’s treated as a single transaction-just a reclassification of your holdings. No redemption happens. No capital gains are realized. No tax is due.

For example: You hold ₹5 lakh in HDFC Equity Fund (growth option). You want to move to HDFC Large Cap Fund. You don’t need to sell. You just log into your account, select ‘Switch’, choose HDFC Large Cap Fund as the destination, and submit. Done. No tax. No paperwork. No delay.

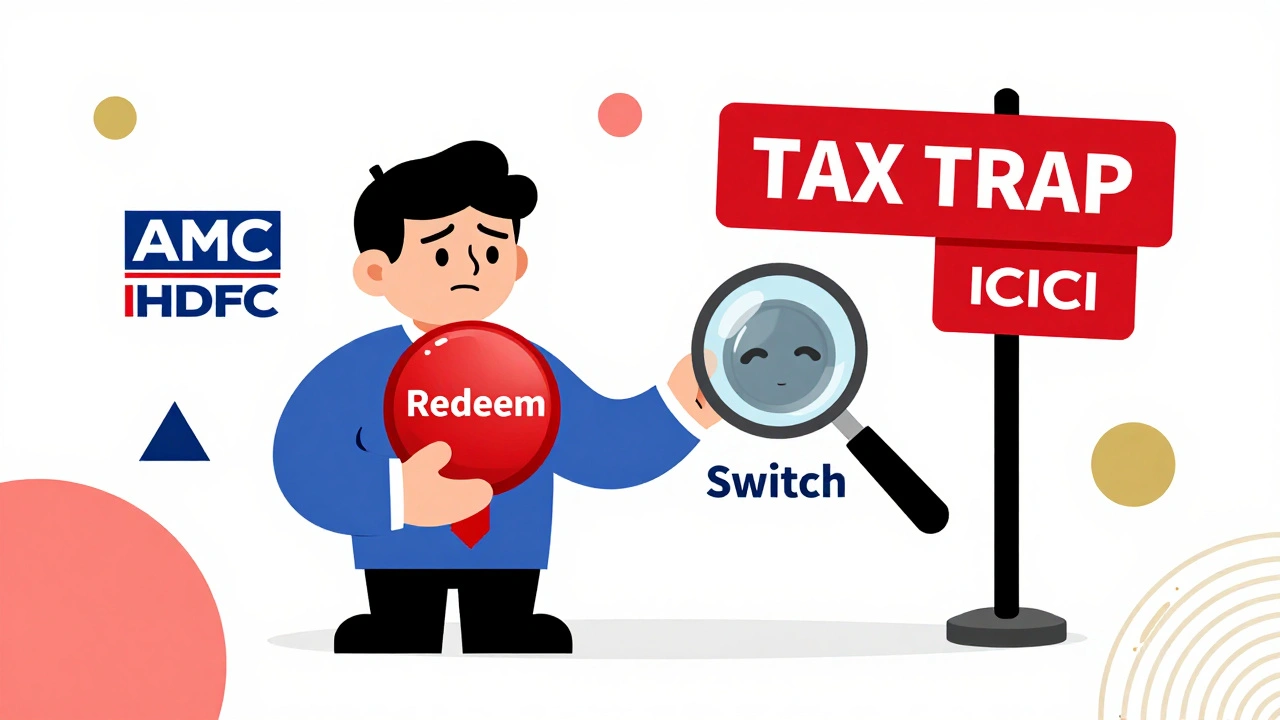

Only Switch Within the Same Fund House

This is the golden rule: switches only avoid tax if they happen between schemes managed by the same AMC (Asset Management Company).You can’t switch from HDFC Equity Fund to ICICI Prudential Bluechip Fund and avoid tax. That’s a redemption and repurchase across two different fund houses. The tax department treats it as a sale, even if you immediately reinvest.

So before you think about switching, check:

- Is the source fund and target fund under the same AMC?

- Does the AMC offer a direct switch option in your portal or app?

- Are both schemes open for fresh investments?

Most major AMCs like SBI, Axis, Kotak, Nippon India, and ICICI Prudential allow intra-fund-house switches. You’ll find the option under ‘Transactions’ or ‘Portfolio’ in your online dashboard. If you don’t see it, call customer service-sometimes it’s hidden.

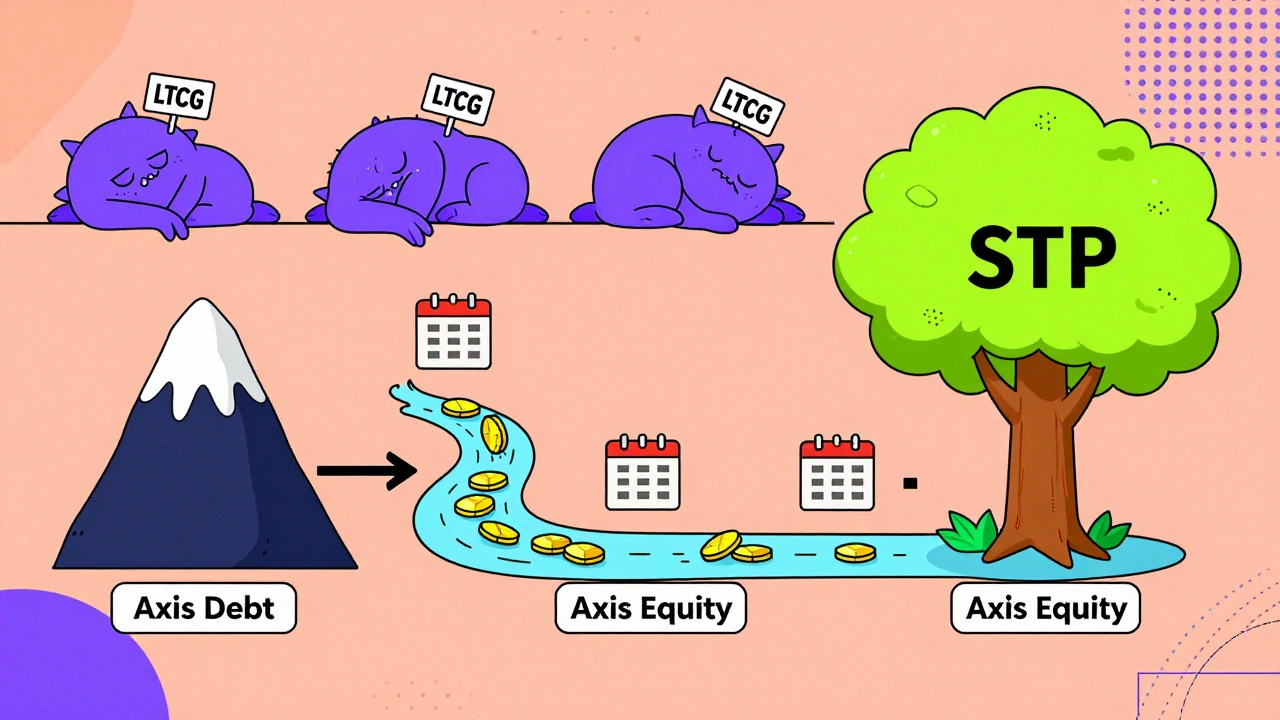

Use STP to Avoid Tax on Lump Sum Switches

What if you want to move a large lump sum-say ₹10 lakh-from a debt fund to an equity fund? Redeeming ₹10 lakh from a debt fund held for less than three years? That’s taxable at your income tax slab rate. Ouch.Instead, use a Systematic Transfer Plan (STP). You don’t redeem the entire amount. You leave it in the source fund and set up automatic transfers-say ₹20,000 every month-to the target equity fund.

Each transfer is treated as a partial switch within the same AMC. No full redemption. No lump sum capital gain. You spread the tax liability over months or years. And if the source fund is an equity fund held over a year, each transfer is tax-free.

Example: You have ₹8 lakh in Axis Short Term Debt Fund (held 11 months). You want to move to Axis Equity Fund. Set up an STP of ₹65,000/month for 12 months. Each month, ₹65,000 moves automatically. You pay tax only on the capital gain portion of each ₹65,000 transfer-spread over a year, not all at once.

Switching from Dividend to Growth Option? Tax-Free

A common switch investors make is moving from a dividend option to a growth option within the same scheme. Many think dividends are ‘free money’-but they’re not. The fund pays out dividends by reducing its NAV, and when you switch to growth, you’re not selling anything.Switching from dividend to growth (or vice versa) within the same mutual fund scheme is treated as a change in payout preference-not a sale. No capital gain is triggered. No tax. You can do this anytime, even if you’ve held the fund for a week.

Just make sure you’re switching options within the same scheme, not switching schemes. Example: Switching from ‘ICICI Prudential Balanced Advantage Fund - Dividend’ to ‘ICICI Prudential Balanced Advantage Fund - Growth’ is tax-free. Switching to ‘HDFC Balanced Advantage Fund - Growth’ is not.

Know the Tax Rules That Apply

Even if you switch within the same AMC, tax rules still apply to the underlying holdings:- Equity funds (more than 65% in Indian equities): Long-term capital gains (LTCG) above ₹1 lakh/year are taxed at 10%. Short-term (held under 1 year): taxed at 15%.

- Debt funds: LTCG (held over 3 years): taxed at 20% with indexation. Short-term: taxed at your income tax slab.

- Hybrid funds: Tax treatment depends on equity exposure. If equity is above 65%, taxed like equity funds. Below 65%, taxed like debt funds.

So if you’re switching from an equity fund held for 18 months to another equity fund, you’re fine-no tax. But if you’re switching from a debt fund held for 2 years to an equity fund, you’re still liable for LTCG on the debt fund portion. The switch itself doesn’t trigger tax, but the original holding does.

What About Switching Between Direct and Regular Plans?

This is a tricky one. Direct plans have lower expense ratios. Regular plans pay commissions to advisors. You can’t switch directly from a regular plan to a direct plan within the same AMC.Why? Because they’re treated as two different schemes, even if they track the same index. Switching from ‘SBI Bluechip Fund - Regular Plan’ to ‘SBI Bluechip Fund - Direct Plan’ counts as a redemption and repurchase. You’ll trigger capital gains tax.

So what’s the workaround? You can’t avoid tax here. But you can minimize it. If you’ve held the regular plan for over a year and your gains are under ₹1 lakh, you can switch without paying tax. If gains are higher, consider switching in small chunks over multiple years to stay under the ₹1 lakh LTCG exemption.

When Switching Is Always Taxable

There are three situations where you can’t avoid tax, no matter what:- You switch between AMCs (e.g., HDFC to ICICI).

- You switch from regular to direct plan.

- You redeem and reinvest manually, even if you use the same money.

Some investors think they can ‘trick’ the system by withdrawing and immediately reinvesting. That’s not a switch-it’s a redemption. The tax department doesn’t care if you bought back the same fund the next day. It’s still a sale.

Also, if you switch from one fund to another and the target fund has a lock-in (like ELSS), you’re still liable for tax on the redemption side. The lock-in only applies to the new investment, not the old one.

How to Actually Do a Tax-Free Switch

Here’s the step-by-step process to switch without tax:- Log in to your mutual fund account via the AMC’s website or app (e.g., Groww, Zerodha, or the AMC’s own portal).

- Go to your portfolio and find the fund you want to switch from.

- Click ‘Switch’-not ‘Redeem’ or ‘Sell’.

- Select the target fund (must be from the same AMC).

- Choose the number of units or the amount to switch.

- Confirm the switch. You’ll get a confirmation email or SMS.

- Check your portfolio after 2-3 business days. Units in the old fund should reduce; new units should appear.

Pro tip: Always check the NAV date. Switches are processed at the closing NAV of the day you submit the request. Submit before 3 PM on a business day to lock in that day’s price.

Common Mistakes That Trigger Unnecessary Tax

Most people lose money on switches because they don’t know the rules. Here are the top 3 mistakes:- Using ‘Redeem’ instead of ‘Switch’-even when both options are visible.

- Switching from a debt fund to equity fund without using STP, causing a big tax bill.

- Assuming ‘same name = same AMC’-e.g., ‘Reliance Mutual Fund’ and ‘Nippon India Mutual Fund’ are different, even if both have ‘Reliance’ in the scheme name.

Also, don’t switch just because a fund underperformed. Check the reason. Is it market volatility? Temporary? Switching too often can trigger multiple small tax events that add up over time.

When to Switch-and When Not To

Don’t switch for the sake of switching. Here’s when it makes sense:- You’re moving from a high-cost regular plan to a low-cost direct plan (but accept the tax hit).

- Your risk profile changed-e.g., from aggressive to balanced.

- You’re rebalancing your portfolio after a market surge.

- You want to lock in tax-free gains in equity funds and move to a safer option.

Don’t switch if:

- The target fund has a higher expense ratio.

- You’ve held the fund less than a year and are in a high tax bracket.

- You’re chasing past returns-past performance doesn’t predict future results.

Remember: The goal isn’t to switch often. It’s to hold the right fund for the right reason-and avoid paying tax when you don’t have to.

Final Checklist Before Switching

Before you click ‘Switch’, run through this:- Is the target fund from the same AMC?

- Is the switch option available in my account?

- Have I held the source fund for over a year (if equity)?

- Am I using ‘Switch’, not ‘Redeem’?

- If moving a large amount, should I use STP instead?

- Will this switch affect my SIP or goal-based plan?

If you answer yes to all, you’re good to go. No tax. No stress. Just smarter investing.

Can I switch mutual funds between different fund houses without paying tax?

No. Switching between different AMC’s (like from HDFC to ICICI) is treated as a redemption followed by a purchase. Capital gains tax applies based on how long you held the original fund. To avoid tax, you must switch within the same fund house.

Is switching from dividend to growth option taxable?

No. Changing from dividend to growth (or vice versa) within the same mutual fund scheme is not considered a sale. It’s just a change in how returns are distributed. No capital gain is triggered, so no tax is due.

What is the difference between a switch and an STP?

A switch moves your entire investment at once from one scheme to another within the same AMC. An STP (Systematic Transfer Plan) moves a fixed amount regularly-say monthly-from one fund to another. STP helps spread out tax liability over time, especially useful for large lump sums.

Can I switch from a regular plan to a direct plan without tax?

No. Regular and direct plans are treated as different schemes by the tax department. Switching between them counts as a redemption and repurchase. You’ll trigger capital gains tax. The only way to move to a direct plan without tax is to wait until your gains are under ₹1 lakh (for equity) or use STP over multiple years.

Do I need to declare a mutual fund switch in my income tax return?

Only if the switch triggers capital gains. If you switched within the same AMC and no redemption occurred, you don’t need to report it. But if you redeemed and repurchased-even if you reinvested the same money-you must report the gain in your ITR under ‘Capital Gains’.