Mutual Fund Expense Ratio in India: How Fees Impact Your Long-Term Returns

Dec, 31 2025

Dec, 31 2025

When you invest in a mutual fund in India, you’re not just paying for the fund manager’s expertise-you’re also paying for the cost of running the fund. These costs are bundled into something called the expense ratio. It sounds technical, but it’s one of the most important numbers you’ll ever see on your mutual fund statement. And if you ignore it, you could be losing thousands of rupees over time-money that could’ve stayed in your pocket and grown with your investments.

What Exactly Is an Expense Ratio?

The expense ratio is the percentage of your investment that goes toward covering the fund’s operating costs each year. That includes the fund manager’s salary, administrative fees, marketing expenses, legal costs, and even the cost of buying and selling stocks inside the fund. It’s deducted automatically from your returns, so you don’t see it as a separate bill-but it’s still coming out of your money.

For example, if you invest ₹1,00,000 in a fund with a 1.5% expense ratio, you’re paying ₹1,500 every year just to keep your money in that fund. That’s not a one-time fee. It happens every single year, even if the fund doesn’t make money. And over 20 years? That’s ₹30,000 gone-without you ever writing a check.

How Expense Ratios Work in India

In India, the Securities and Exchange Board of India (SEBI) sets strict limits on how much fund houses can charge. As of 2025, the maximum expense ratio allowed depends on the size of the fund’s assets:

- Up to ₹500 crore: 2.25%

- ₹500 crore to ₹750 crore: 2.00%

- ₹750 crore to ₹2,000 crore: 1.75%

- ₹2,000 crore to ₹5,000 crore: 1.60%

- ₹5,000 crore to ₹10,000 crore: 1.50%

- Over ₹10,000 crore: 1.25%

These caps are there to protect investors, but they’re not the whole story. Many funds charge far less than the maximum-especially index funds and direct plans. That’s where the real savings happen.

Direct Plans vs Regular Plans: The Big Difference

Here’s the secret most new investors don’t know: the same mutual fund can have two different versions-one with a higher expense ratio, and one with a lower one. They’re called regular plans and direct plans.

Regular plans are sold through advisors, brokers, or platforms that earn commissions. That commission gets baked into the expense ratio-often adding 0.5% to 1.5% extra. Direct plans are bought straight from the fund house, with no middleman. No commission. Lower fees. Same fund.

Take the HDFC Equity Fund. The regular plan has an expense ratio of 1.95%. The direct plan? Just 1.05%. That’s a 0.9% difference. On ₹5 lakh invested, that’s ₹4,500 less paid in fees every year. Over 15 years, with a 12% annual return, that difference turns into over ₹1.8 lakh extra in your pocket.

Why Even Small Fees Matter Over Time

People think, “It’s just 1%-how bad can it be?” But compounding doesn’t care about small numbers. It cares about consistency.

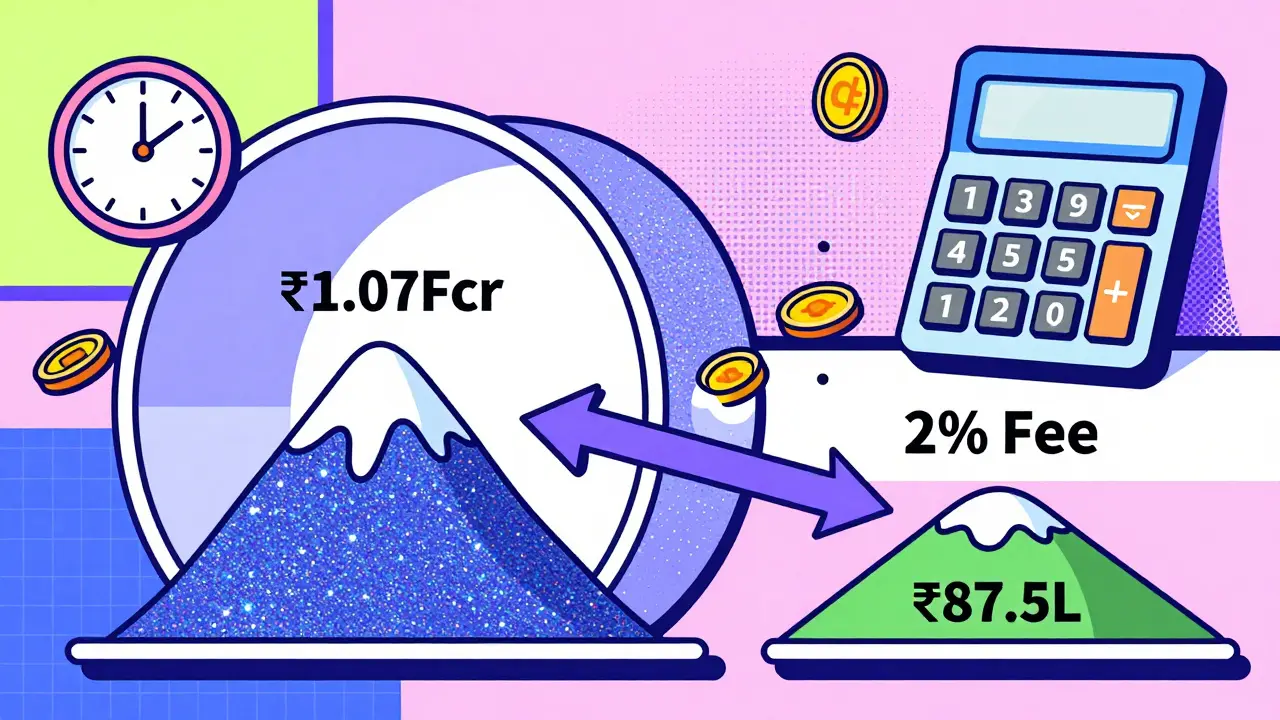

Let’s say you invest ₹10,000 per month for 20 years in two different equity funds. Both return 12% per year before fees. One has a 1% expense ratio. The other has 2%.

After 20 years:

- 1% fee → ₹1.07 crore

- 2% fee → ₹87.5 lakh

You lose ₹19.5 lakh-nearly 18% of your final amount-just because of the fee difference. That’s not a typo. That’s math. And it’s happening right now to people who didn’t check their fund’s expense ratio.

What’s a Good Expense Ratio?

There’s no universal “good” number-it depends on the type of fund.

- Index funds: 0.1% to 0.5%. These track the market, so they don’t need expensive managers. Stick to these if you want low-cost growth.

- Active equity funds: 1.0% to 1.8%. If you’re paying more than 2%, you better have proof the fund consistently beats the market-and most don’t.

- Debt funds: 0.3% to 0.8%. These are less risky, so fees should be lower. Anything above 1% is a red flag.

- ELSS (tax-saving funds): 1.2% to 2.0%. These are often sold with aggressive marketing. Check if the direct plan is cheaper.

As a rule of thumb: if the expense ratio is over 1.5% for an equity fund and you’re not getting top-quartile returns every year, you’re paying too much.

Where to Find the Expense Ratio

You don’t need to call your broker. You don’t need to dig through paperwork. The expense ratio is always listed on:

- The fund house’s official website

- AMFI (Association of Mutual Funds in India) portal

- Investment platforms like Groww, Zerodha, or Upstox (look under “Fund Details”)

- Your monthly statement

Always check the latest fact sheet-expense ratios can change. A fund that had a 1.2% ratio last year might jump to 1.6% if it’s underperforming and the fund house tries to cover losses with higher fees.

Other Hidden Costs You Should Know

Expense ratio isn’t the only cost. There are others you might not see:

- Exit load: A fee if you withdraw within a year (usually 1% for equity funds).

- Transaction fees: Some platforms charge ₹50-₹150 per SIP or lump sum.

- Portfolio turnover cost: Every time a fund buys or sells stocks, there’s a brokerage fee. High turnover = higher hidden costs. Look for funds with turnover under 50% per year.

These don’t show up in the expense ratio, but they still eat into your returns. A fund with a 1% expense ratio and 80% turnover might be costing you more than a 1.5% fund with low turnover.

How to Lower Your Fund Costs

You don’t have to accept high fees. Here’s how to reduce them:

- Switch from regular to direct plans. It takes 2-3 days and costs nothing.

- Choose index funds for broad market exposure. They’re cheaper and often outperform active funds.

- Compare expense ratios before investing. Use platforms like Value Research or Morningstar to filter by cost.

- Avoid funds with high exit loads unless you’re sure you’ll hold for 3+ years.

- Consolidate funds. Holding 10 small funds with 1.5% fees each? Combine them into 2-3 low-cost ones.

One investor I spoke to had 12 mutual funds-each with different expense ratios. After consolidating into three direct index funds, his annual fees dropped from ₹28,000 to ₹6,500. That’s ₹21,500 back in his pocket every year.

The Bottom Line

Your mutual fund’s expense ratio isn’t just a number on a screen. It’s the silent thief of your wealth. Over decades, even 0.5% extra in fees can cost you lakhs. You don’t need to be a finance expert to fix this. You just need to check the number-and act on it.

Start today: log into your mutual fund account. Find your top fund. Look at the expense ratio. If it’s above 1.5% and it’s a regular plan, switch to the direct version. It’s the easiest, most powerful move you can make to boost your returns-with zero risk and no timing involved.

That’s not investing advice. That’s just smart math.

Is a lower expense ratio always better?

Not always-but in most cases, yes. Lower fees mean more of your returns stay with you. However, if a fund with a slightly higher expense ratio consistently beats its benchmark by 3-5% annually over 5+ years, the extra cost may be justified. But this is rare. Most actively managed funds don’t outperform their index after fees.

Can expense ratios change after I invest?

Yes. Fund houses can change expense ratios, but they must notify you in advance. SEBI requires this notice to be published on their website and sent to investors. Always check the latest fact sheet every 6 months, especially if your fund’s performance suddenly drops.

Do debt funds have lower expense ratios than equity funds?

Generally, yes. Debt funds don’t require as much research or trading as equity funds, so their operating costs are lower. Most good debt funds have expense ratios under 0.6%. If you’re paying more than 1%, you’re likely overpaying unless it’s a specialized or international debt fund.

Should I avoid mutual funds with high expense ratios entirely?

Not necessarily-but be very careful. High fees are a red flag unless the fund has a proven track record of beating its benchmark by a wide margin over multiple market cycles. Most don’t. For most investors, low-cost index funds are the better choice. If you’re unsure, start with direct index funds and only consider high-fee funds after thorough research.

How do I switch from a regular plan to a direct plan?

Log in to your mutual fund platform (like Groww, Zerodha, or the fund house’s website). Find your existing fund. Look for an option to switch to the direct plan. You’ll need to redeem your current units and reinvest in the direct plan. There’s no exit load if you’ve held it for over a year. The process takes 2-3 business days. You keep the same fund manager and portfolio-just pay less.

Next step: Review your top three mutual funds right now. Check their expense ratios. If any are above 1.5% and you’re not sure why, switch to the direct version. That’s all you need to do to start earning more-without taking on more risk.