Section 54 Exemption in India: How to Avoid Capital Gains Tax on Property Sale

Jan, 17 2026

Jan, 17 2026

When you sell a property in India and make a profit, the government wants a cut - that’s capital gains tax. But there’s a legal way to avoid paying it entirely, and it’s called Section 54 exemption. If you’re selling a residential property and planning to buy another, this rule can save you tens of lakhs. It’s not a loophole. It’s a provision written into the Income Tax Act, and millions of Indians use it every year to reinvest wisely.

What is Section 54 Exemption?

Section 54 of the Income Tax Act, 1961, lets you avoid paying long-term capital gains tax if you use the money from selling your old house to buy a new one. The catch? The new property must be residential, and you must follow strict timelines. You can’t just pocket the profit and spend it on a vacation or a car. The law wants you to reinvest in housing.

For example, if you sold your 2BHK apartment in Pune for ₹80 lakh and made a profit of ₹40 lakh after adjusting for inflation and purchase costs, you’d normally owe around ₹8 lakh in tax. But if you buy a new house worth ₹80 lakh within the allowed time, you pay zero tax on that ₹40 lakh gain. That’s the power of Section 54.

Who Qualifies for This Exemption?

Only individuals and Hindu Undivided Families (HUFs) can claim Section 54. Companies, firms, or trusts cannot use it. The property you’re selling must be a residential house - not land, commercial space, or a plot. It doesn’t matter if you lived in it or rented it out. As long as it was classified as a residential property at the time of sale, you’re eligible.

Also, you must have held the property for at least 24 months. If you sold it sooner, the profit is treated as short-term capital gain and taxed at your income slab rate - no exemption applies.

How to Claim the Exemption: The 3 Rules

There are three non-negotiable conditions to get full tax exemption under Section 54:

- You must buy a new residential property in India.

- You must buy it within 2 years after the sale date, or construct one within 3 years.

- The cost of the new property must be equal to or greater than the capital gain amount.

Let’s say your capital gain is ₹35 lakh. You need to spend at least ₹35 lakh on the new house. If you only spend ₹30 lakh, you’ll still owe tax on the remaining ₹5 lakh. But if you spend ₹40 lakh, you get full exemption on the ₹35 lakh gain.

Important: The new property doesn’t have to be in the same city. You can sell in Delhi and buy in Jaipur. You can even buy under construction - as long as you complete it within 3 years.

What If You Can’t Buy Right Away?

Sometimes, the right property isn’t available immediately. Maybe you’re waiting for possession, or the market is tight. Section 54 gives you a safety net: you can deposit the sale proceeds into a special bank account called the Capital Gains Account Scheme (CGAS).

This isn’t a regular savings account. It’s a government-mandated deposit account opened at a notified bank. You can’t withdraw the money for anything else - not for education, not for medical bills, not even for a down payment on a car. The only legal use is to buy or build a new residential property.

Once you open a CGAS account, you have 3 years to complete the purchase or construction. If you don’t use the money by then, the unutilized amount becomes taxable in the fourth year. So this isn’t a way to delay taxes forever - it’s a temporary pause while you find the right home.

Can You Buy More Than One Property?

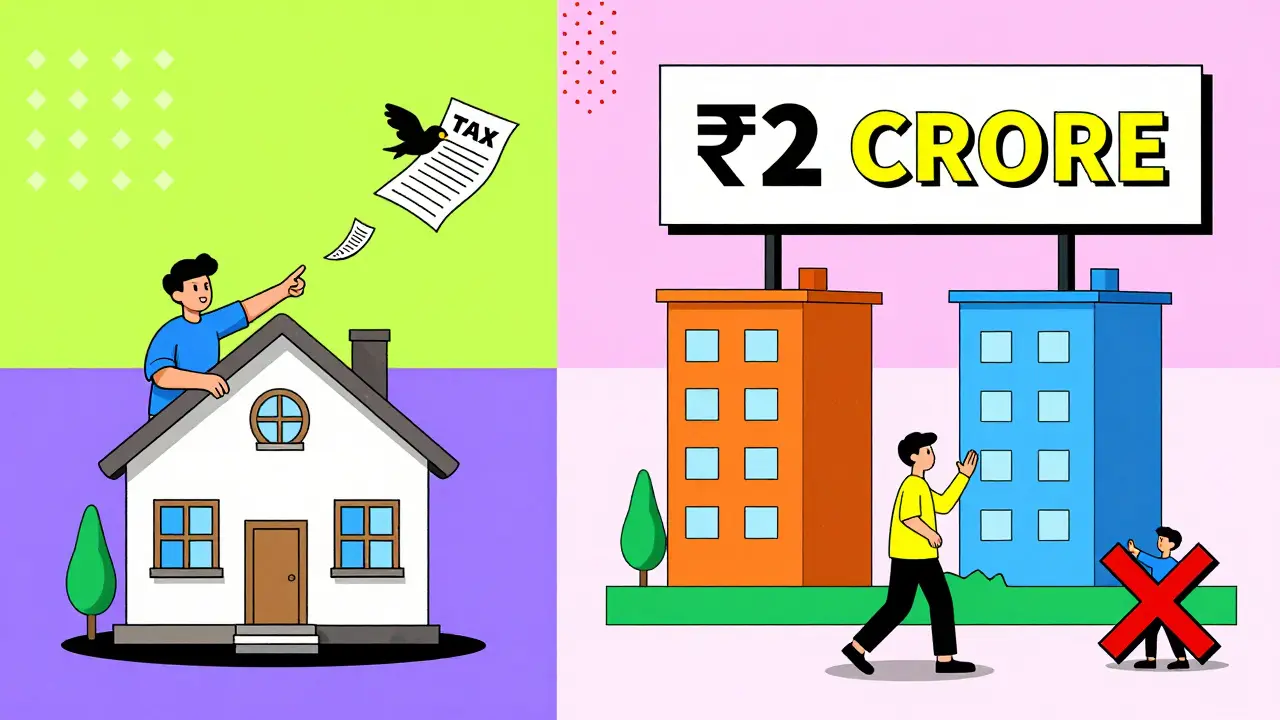

Yes - but only under a special condition. Since 2014, you can buy two residential properties and still claim Section 54 exemption, but only if your total capital gain is ₹2 crore or less. This rule was introduced to help middle-class families upgrade homes without being hit with a huge tax bill.

For example, if you sold your old house and made a ₹1.8 crore gain, you can buy two flats worth ₹1 crore each. You’ll get full exemption because the total gain is under ₹2 crore. But if your gain is ₹2.1 crore, you can only buy one property, or you’ll pay tax on the excess.

This ₹2 crore limit applies to the total capital gain, not the total sale value. So even if you sold your house for ₹5 crore, if your gain after indexation was only ₹1.5 crore, you’re still eligible to buy two homes.

What Happens If You Sell the New Property Later?

This is where people get caught off guard. If you buy a new house using Section 54 and sell it within 3 years, the tax exemption you got earlier gets reversed. The government treats the original gain as taxable again.

Let’s say you sold your old house in January 2024, bought a new one in November 2024, and claimed full exemption. Then in May 2026 - just 18 months later - you sell the new house. The ₹40 lakh gain you saved in 2024 now becomes taxable in 2026. You’ll have to pay capital gains tax on it, plus interest.

That’s why experts advise: don’t treat the new property as a quick flip. Section 54 is meant for long-term housing reinvestment, not short-term speculation.

Can You Use Section 54 Along With Other Tax Savings?

You can combine Section 54 with Section 54F (exemption on selling non-residential assets) if you’re selling multiple properties. But you cannot claim Section 54 and Section 54EC (investment in bonds) for the same gain.

Section 54EC lets you invest in NHAI or REC bonds to save tax, but the limit is ₹50 lakh per financial year. If your gain is ₹60 lakh, you could use ₹50 lakh for bonds and the remaining ₹10 lakh to buy a house - then claim partial exemption under both sections. But you can’t double dip on the same amount.

Also, you can’t claim Section 54 if you already own more than one residential property on the date of sale - unless you’re selling one to buy another. The rule assumes you’re upgrading, not accumulating.

Common Mistakes That Cost People Thousands

Many people think Section 54 is simple - but small errors can cost them lakhs.

- Buying in someone else’s name: The new property must be in your name (or HUF’s name). Buying it in your child’s or spouse’s name disqualifies you.

- Using part of the money for renovation: Renovation costs don’t count. Only the purchase or construction cost qualifies.

- Missing the timeline: If you sell in March 2025, you must buy by March 2027. Don’t assume you have until December.

- Not using CGAS when needed: If you don’t buy immediately, depositing in CGAS is mandatory. Otherwise, you lose the exemption.

- Assuming land qualifies: Selling a plot and buying a house doesn’t qualify unless you sell a residential property.

Real-Life Example: How Raj Saved ₹12 Lakhs

Raj sold his 3BHK flat in Bangalore in April 2024 for ₹1.2 crore. He bought it in 2010 for ₹45 lakh. After indexation, his gain was ₹68 lakh. He didn’t want to pay ₹15 lakh in tax.

He opened a CGAS account with ₹68 lakh in May 2024. In November 2025, he bought a new 4BHK flat in Hyderabad for ₹75 lakh. Since the cost exceeded his gain, he got full exemption. He saved ₹15 lakh in tax - and upgraded his home.

Had he waited until June 2027 to buy, he’d have lost the exemption. Had he bought a ₹50 lakh flat, he’d owe tax on ₹18 lakh. Every detail matters.

When Section 54 Doesn’t Work

There are cases where Section 54 won’t help:

- You’re selling a commercial property and buying a residential one - use Section 54F instead.

- You already own two residential properties and aren’t selling one - you can’t claim exemption for buying a third.

- Your gain is from inherited property and you sell it within 2 years - it’s treated as short-term.

- You’re a non-resident Indian (NRI) selling property - you can still claim Section 54, but TDS rules are stricter.

If you’re unsure, always get a chartered accountant involved before signing any sale agreement. A simple mistake can turn a tax-saving move into a tax liability.

Final Checklist Before Selling Your Property

Before you sign the sale deed, ask yourself these questions:

- Have I held this property for more than 24 months?

- Is the property classified as residential?

- Do I have a clear plan to buy or build a new residential property?

- Will the new property cost at least as much as my capital gain?

- Am I prepared to wait up to 3 years to complete construction if needed?

- Have I considered opening a CGAS account if I can’t buy immediately?

- Do I own more than one residential property already?

If you answered yes to all, you’re on track. If not, talk to a tax advisor before finalizing the sale.

Can I claim Section 54 if I sell my property and buy abroad?

No. Section 54 only applies if you buy a residential property in India. Buying property overseas - even in the US, UK, or Dubai - doesn’t qualify for this exemption. The law is designed to encourage reinvestment in India’s housing market.

Can I use Section 54 for multiple sales in one year?

Yes, but only if each sale meets the conditions independently. You can sell two properties in the same financial year and use Section 54 for both, as long as you buy two new residential properties and each purchase meets the cost and timeline rules. However, the ₹2 crore limit for buying two properties applies per sale, not per year.

What if I buy a property jointly with my spouse?

You can claim Section 54 if you buy the new property jointly with your spouse, as long as you are one of the co-owners and the sale proceeds are used for the purchase. The exemption is based on your share of the gain and your share of the new property. If you own 50% of the new house and your gain was ₹40 lakh, you must spend at least ₹20 lakh from your share to get full exemption on your portion.

Does the new property need to be ready to move in?

No. You can buy an under-construction property and still claim the exemption. The key is completing construction within 3 years from the date of selling your old property. You must provide proof of construction - like builder agreements, payment receipts, and completion certificates - to the income tax department if asked.

Can I claim Section 54 if I sell a house and buy a farmhouse?

Generally, no. A farmhouse is considered agricultural land if it’s located outside municipal limits and used for farming. Section 54 only applies to residential properties. If the farmhouse is part of a residential colony with municipal water, electricity, and is used solely as a residence, you may have a case - but it’s risky without professional advice.