Direct Mutual Funds: How to Invest Without Agents in India

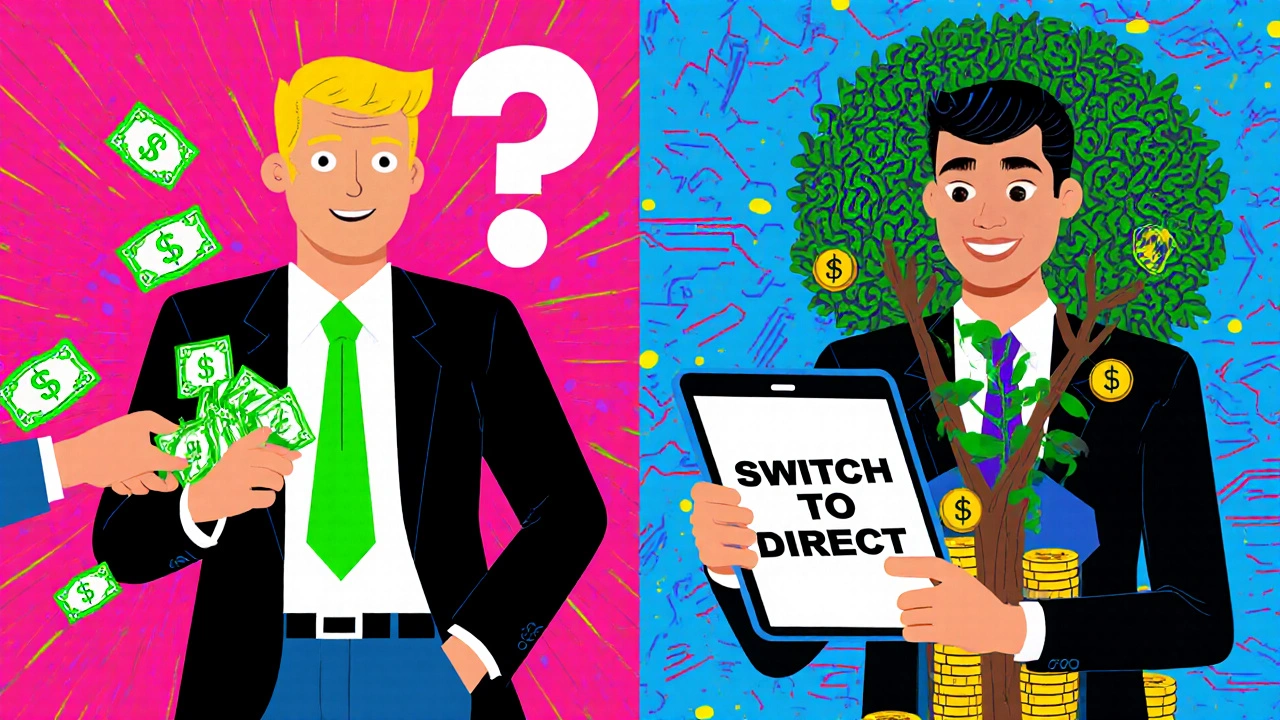

When you invest in direct mutual funds, mutual fund plans bought straight from the fund house without paying commissions to agents or distributors. Also known as direct plans, they let you keep more of your returns because there’s no middleman taking a cut. This small difference can add up to lakhs over time—especially if you’re investing through SIPs. Most people don’t realize that the regular plans they’re offered by advisors have higher expense ratios just to cover those commissions. Direct plans don’t. They’re not harder to buy. You can do it in minutes through the fund house’s website or apps like CAMS or KFinTech.

Investing in direct mutual funds, mutual fund plans bought straight from the fund house without paying commissions to agents or distributors. Also known as direct plans, they let you keep more of your returns because there’s no middleman taking a cut. This small difference can add up to lakhs over time—especially if you’re investing through SIPs. Most people don’t realize that the regular plans they’re offered by advisors have higher expense ratios just to cover those commissions. Direct plans don’t. They’re not harder to buy. You can do it in minutes through the fund house’s website or apps like CAMS or KFinTech.

Setting up a direct mutual fund investment requires just three things: your PAN card, a unique 10-digit identification number issued by the Indian Income Tax Department for tax-related transactions, your Aadhaar, India’s 12-digit biometric ID used for digital KYC verification, and a completed KYC, Know Your Customer process that verifies your identity for financial transactions in India. Once that’s done, you can start investing in any fund—whether it’s large-cap, mid-cap, or a tax-saving ELSS under Section 80C, a section of India’s Income Tax Act allowing deductions up to ₹1.5 lakh on eligible investments. Many investors don’t know that direct plans often outperform regular ones by 0.5% to 1.5% annually. That’s not a small gap—it’s the difference between retiring comfortably or having to keep working.

You’ll find posts here that explain how to set up multi-SIPs across different funds to spread risk, how to link your PAN and Aadhaar correctly, and how to use Section 80C to save taxes while building wealth. You’ll also see what happens when you compare direct plans with regular ones over 10 or 15 years. No fluff. No sales pitches. Just clear, real data from people who’ve done it. Whether you’re new to investing or just tired of paying hidden fees, this collection gives you the tools to take control.

Direct vs Regular Mutual Funds in India: Save More with Direct Plans

Direct mutual funds in India save you thousands by cutting out advisor commissions. Learn how direct vs regular plans work, how much you can save, and how to switch today.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness