Regular Mutual Funds: How They Work and How to Invest Wisely in India

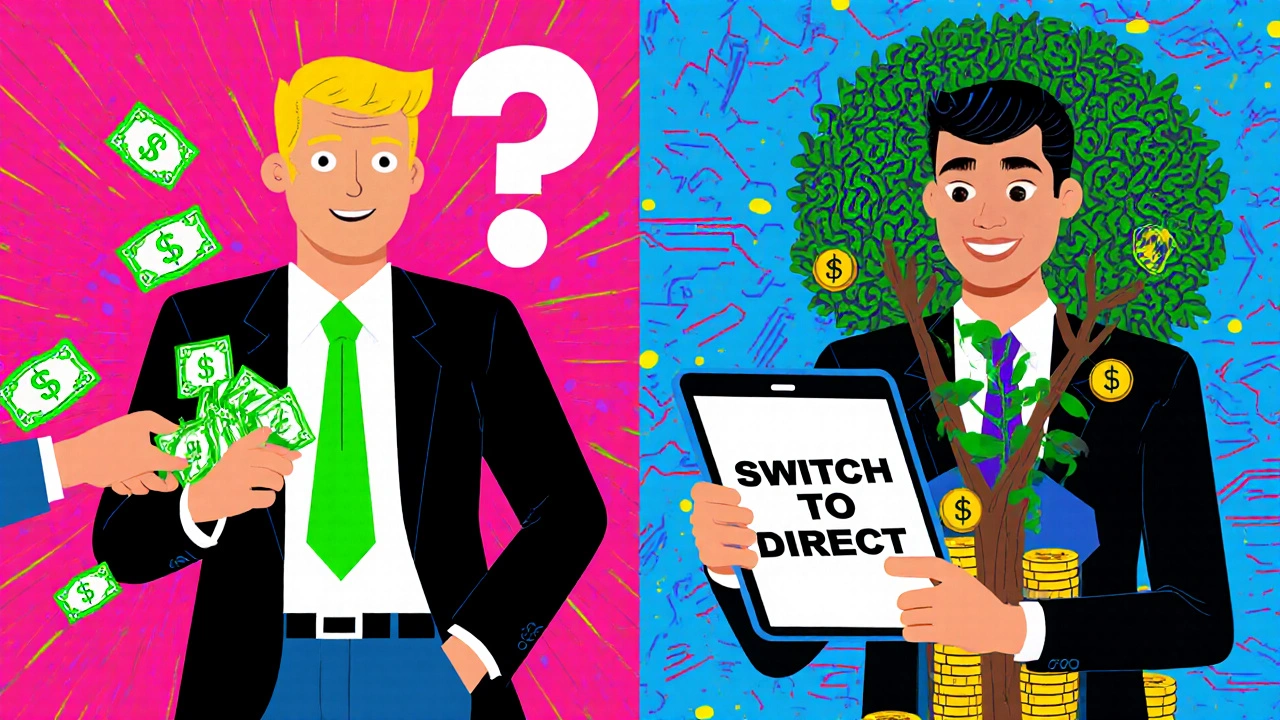

When you invest in a regular mutual fund, a type of mutual fund where the asset management company pays a commission to a financial advisor or distributor. Also known as advised mutual funds, these are the default option most people encounter through banks, brokers, or agents. Unlike direct plans, where you buy straight from the fund house, regular plans include hidden costs—usually 0.5% to 1.5% extra every year—paid to the person who sold you the fund. That’s money taken from your returns, not yours to keep.

That commission doesn’t mean the fund performs better. In fact, studies from SEBI and Value Research show that over 10 years, regular mutual funds often underperform direct plans by 0.5% to 1.2% annually. That might sound small, but on a ₹10 lakh investment, it adds up to over ₹1.5 lakh lost in compounding over a decade. The advisor’s role? Usually, it’s a one-time sale. No ongoing advice. No portfolio reviews. Just a checkbox on a form. And yet, you keep paying for it—year after year.

Who uses regular mutual funds? Mostly beginners who don’t know direct plans exist, or people who trust their bank manager or agent without asking questions. But you don’t need an advisor to pick funds. Platforms like Groww, Zerodha, or Kuvera let you compare funds, check past returns, and invest directly—all for free. If you want advice, hire a fee-only planner for an hour, not pay a commission every year.

Regular mutual funds aren’t bad—they’re just expensive. If you’re already in one, don’t panic. Check your folio. Look for the word "Regular" next to the fund name. Then compare it to the same fund’s "Direct" version. The difference in NAV is clear. Switching is simple: just fill a switch form. No tax penalty if you’ve held it over a year. And you’ll start keeping more of your returns right away.

What else matters? The fund’s track record, the AMC’s reputation, and your own goals. A good fund in a regular plan still beats a bad one in a direct plan. But why settle for less? The market gives you the option to pay less. Use it.

Below, you’ll find real guides on how to build a smart mutual fund portfolio, how SIPs work across multiple funds, how to complete your KYC, and how tax rules like Section 80C affect your choices. No fluff. Just what you need to know to invest better—whether you’re in Mumbai, Delhi, or a small town in Gujarat. Start here. Then take control.

Direct vs Regular Mutual Funds in India: Save More with Direct Plans

Direct mutual funds in India save you thousands by cutting out advisor commissions. Learn how direct vs regular plans work, how much you can save, and how to switch today.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness