Save on Mutual Funds: How to Cut Costs and Boost Returns in India

When you save on mutual funds, you’re not just spending less—you’re keeping more of your money working for you over time. Also known as reducing mutual fund expenses, this isn’t about picking the cheapest fund—it’s about avoiding hidden fees, using tax rules wisely, and investing smarter from day one. Many people in India think mutual funds are expensive because of high returns, but the real cost killers are entry loads, exit loads, and management fees you never see on your statement. The good news? You can cut those costs by over 50% just by choosing direct plans instead of regular plans, and by investing through SIPs instead of lump sums.

One of the biggest ways to save on mutual funds, is by using Section 80C tax deductions. Also known as tax-saving investments, this rule lets you claim up to ₹1.5 lakh in deductions every year. ELSS mutual funds are the fastest way to do this—they lock your money for just three years but give you better returns than PPF or NSC. Combine that with a multi-SIP strategy, where you spread your money across 3-5 diversified funds. Also known as diversified SIP investing, it reduces risk without needing to time the market. And because each SIP is small, you avoid the temptation to pull out during downturns.

Don’t forget about transaction costs. Every time you switch funds or redeem early, you pay stamp duty, STT, and exit loads. In India, stamp duty on mutual fund purchases is now 0.005%, but it adds up if you trade often. The smart move? Pick funds with low turnover and hold them for five years or more. That way, you avoid short-term capital gains tax and let compounding do its job. You’ll also save time—no need to chase hot funds every quarter.

Some people think saving on mutual funds means sacrificing returns. That’s not true. The highest-performing funds in India aren’t the ones with flashy ads—they’re the ones with low expense ratios, clear goals, and steady performance. Look for funds with expense ratios under 1%, and avoid those that charge more than 2%. Use tools like Value Research or Morningstar to compare, not just returns, but risk-adjusted performance over 5 and 10 years.

And here’s something most miss: your tax bracket matters. If you’re in the 30% tax bracket, every ₹1,000 you invest in an ELSS under Section 80C saves you ₹300 in taxes. That’s instant 30% return before the fund even grows. Combine that with a SIP of ₹5,000 a month, and you’re putting ₹60,000 a year to work—with ₹18,000 in tax savings already in your pocket.

Below, you’ll find real guides that break down exactly how to do this—whether you’re new to investing or looking to optimize what you already have. No fluff. Just clear steps on how to cut costs, use tax breaks, and build wealth without guesswork.

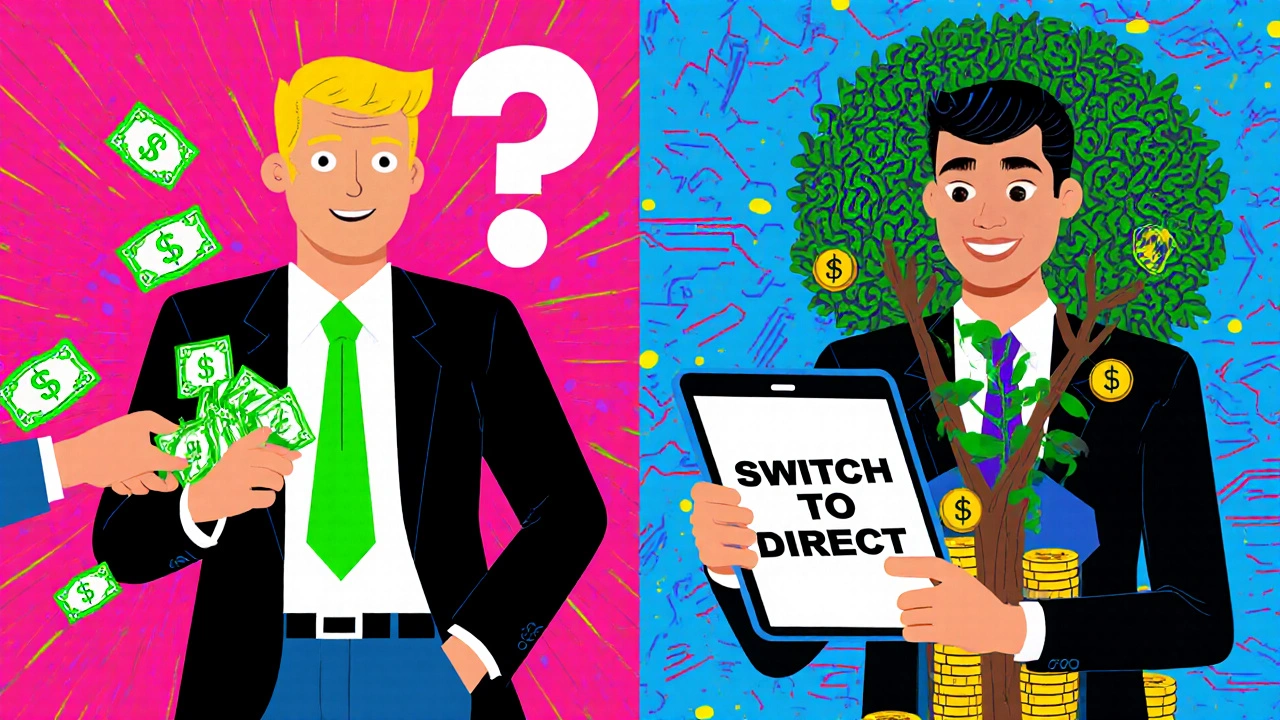

Direct vs Regular Mutual Funds in India: Save More with Direct Plans

Direct mutual funds in India save you thousands by cutting out advisor commissions. Learn how direct vs regular plans work, how much you can save, and how to switch today.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness