Utility vs Governance vs Investment Tokens: What They Really Do and How They Differ

Nov, 20 2025

Nov, 20 2025

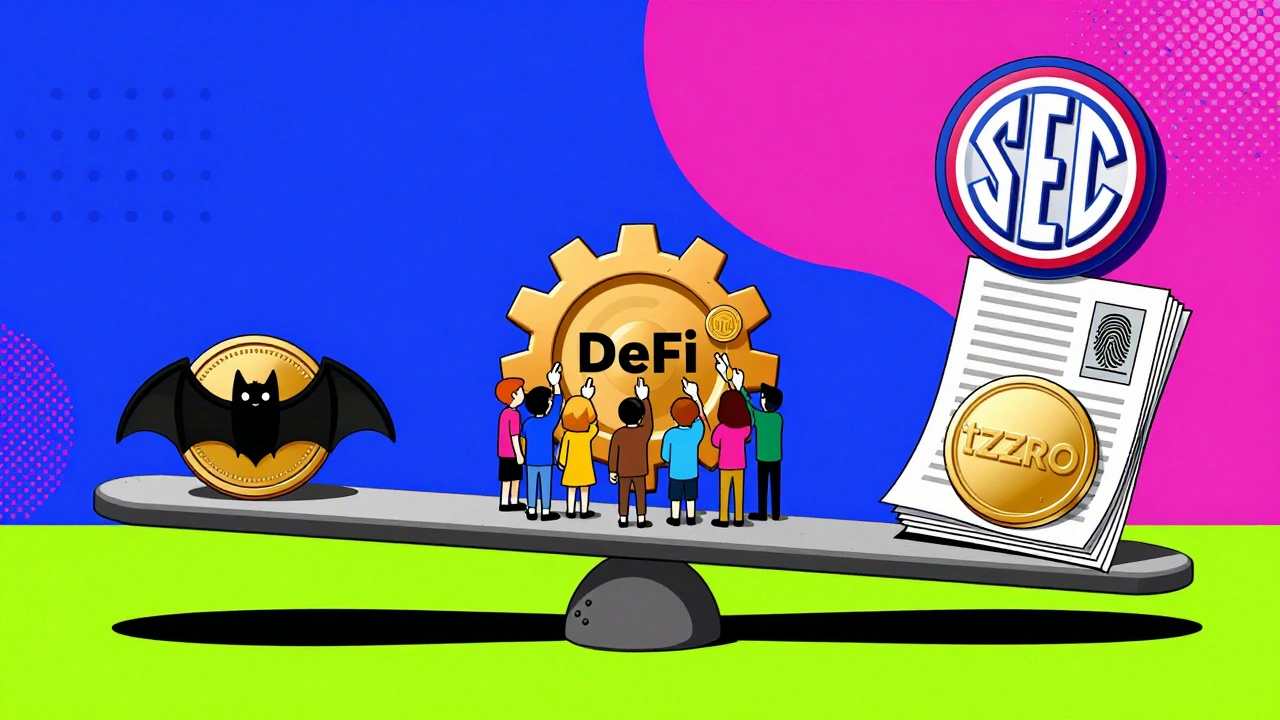

Not all crypto tokens are the same. You might think buying a token means you’re investing in the future - but that’s only true for some. Others are just keys to use a service. Or voting cards for a digital democracy. And some? They’re legally treated like stocks. Confused? You’re not alone. The difference between utility tokens, governance tokens, and investment tokens isn’t just technical - it changes everything about how you hold them, use them, and what happens if things go wrong.

Utility Tokens: The Digital Key Card

Think of utility tokens like a subway pass or a game token at an arcade. You don’t own the train or the arcade machine. You just pay with the token to use it. That’s exactly what utility tokens do. They give you access to a product or service inside a blockchain ecosystem.

Take Binance’s BNB. You don’t own Binance. But if you hold BNB, you get discounted trading fees - up to 25% off in 2023. Filecoin’s FIL? You need it to pay for decentralized cloud storage. You can’t store files on Filecoin without it. No voting rights. No dividends. Just a functional key.

These tokens exploded after Ethereum’s ERC-20 standard launched in 2015. Suddenly, anyone could create a token that worked like a coupon inside their app. By 2022, utility tokens made up 65% of all token offerings, according to the Crypto Council. But here’s the catch: most people never actually use them. A 2022 CoinGecko survey found 63% of utility token holders never used their tokens for their intended purpose. They bought them hoping to flip them, not to use the service.

That’s why many utility tokens have faded. If there’s no real demand for the service, the token has no value. Brave’s BAT is a classic example. Users get BAT for viewing ads, then can tip content creators. But if you stop using Brave, your BAT just sits there - useless. No one’s forcing you to use it. And without usage, the price drops.

Governance Tokens: Voting Power in Code

What if you could vote on how a company runs - but it’s not a company. It’s a software protocol. That’s what governance tokens do. They give holders the right to shape the future of a decentralized system.

Uniswap’s UNI is the poster child. Holders vote on things like fee structures, new token listings, or how the treasury spends money. MakerDAO’s MKR lets people vote on interest rates for loans on its DeFi platform. These aren’t suggestions. They’re binding decisions written into smart contracts.

But voting isn’t free. You usually need to stake your tokens to participate. And there’s a minimum. In Compound, you need at least 1% of the total COMP supply to even submit a proposal. Most proposals pass with over 90% approval - but only 2.3% of all UNI tokens were used to vote in 2023, according to Reddit user DAO_Watcher. That means a tiny group controls the whole system.

That’s the big tension: decentralization vs. concentration. The people with the most tokens - often early investors or whales - have the loudest voice. To fix this, Uniswap introduced delegation in September 2023. Now you can assign your voting power to someone else - like a trusted community member or a professional delegate - without giving up your tokens.

Governance tokens are the backbone of DeFi. As of October 2023, the top 10 governance-token-powered protocols held over $50 billion in total value locked (TVL). But their value isn’t tied to profits. It’s tied to network health. If more people use Uniswap, UNI becomes more valuable. If the protocol gets hacked or loses trust, the token crashes. No dividends. Just influence.

Investment Tokens: Digital Securities

These aren’t tokens you buy because you like the tech. You buy them because you expect a return. That’s what makes them investment tokens - or more accurately, security tokens. They’re legally classified as securities, just like shares of Apple or Tesla.

They represent ownership in something real: a company, a piece of real estate, a revenue stream. The tZERO token, launched in December 2018, was one of the first to be fully approved by the U.S. Securities and Exchange Commission (SEC). Holders get quarterly dividends from the company’s profits. And unlike regular stocks, you can trade it 24/7 on regulated platforms.

But there’s a cost. To buy a security token, you must pass KYC (know your customer) and AML (anti-money laundering) checks. That means government ID, proof of address, and sometimes accreditation as a wealthy investor. The average onboarding time? 14 to 21 days. Compare that to utility tokens - you can buy BNB in five minutes with a credit card.

Security tokens are regulated under U.S. laws like Regulation D and Regulation A+. They must comply with the Howey Test - a 1946 Supreme Court ruling that says an investment contract exists when people invest money in a common enterprise expecting profit from others’ efforts. That’s why the SEC has cracked down on projects pretending their tokens are “utility” when they’re really promising returns. In August 2023, the SEC charged LBX for selling unregistered security tokens disguised as utility tokens.

The market is small but growing fast. In 2023, security token offerings raised $11.8 billion globally, according to Security Token Group. And by 2030, that could hit $16 trillion - mostly from tokenizing real estate, private equity, and bonds. Fortune 500 companies are already exploring this. PwC’s 2023 survey found 73% are looking into security tokens for asset tokenization.

How They Compare: Side by Side

Here’s the clearest way to see the differences:

| Feature | Utility Tokens | Governance Tokens | Investment Tokens |

|---|---|---|---|

| Purpose | Access to services | Voting on protocol changes | Ownership or profit share |

| Example | BNB, FIL, BAT | UNI, AAVE, MKR | tZERO, Polymath tokens |

| Voting Rights | No | Yes | Maybe - depends on asset |

| Regulation | Largely unregulated (but under scrutiny) | Gray area - not clearly defined | Heavily regulated (SEC, MiCA) |

| Value Driver | Demand for service | Protocol adoption and usage | Underlying asset performance |

| Onboarding Time | Under 5 minutes | Under 10 minutes | 14-21 days |

| Typical Use Case | Pay for storage, get exchange discounts | Decide protocol fees, treasury spending | Own shares in a company or property |

Notice how governance tokens don’t promise returns - but their value still rises when the protocol grows. That’s why some experts, like Dr. Aaron Wright, argue they’re a form of utility: the utility of governing. But regulators aren’t convinced. The SEC still treats many governance tokens as securities if they’re sold with the expectation of profit.

What’s Changing in 2025

The lines are blurring. Binance announced in November 2023 that BNB would gain limited governance rights - like voting on which new chains to support. That’s a hybrid: utility + governance.

Meanwhile, security tokens are getting easier to trade. Platforms like ADDX and tZERO are expanding, offering better liquidity than ever. And in the EU, MiCA (Markets in Crypto-Assets Regulation), which took effect in June 2023, finally created clear legal categories. Utility tokens are now officially “other tokens.” Investment tokens are “asset-referenced” or “e-money” tokens. Governance tokens? Still not defined - but they’re being watched closely.

By 2026, Gartner predicts 80% of new tokens will be hybrids. You might buy a token that gives you access to a service, lets you vote on upgrades, and also pays you a share of fees. But that’s also a legal minefield. If it promises returns, regulators will classify it as a security - no matter what you call it.

What Should You Do?

If you’re holding tokens, ask yourself:

- Do I use this token for its intended function? (Utility)

- Do I care about how this protocol evolves? Do I want to vote on its rules? (Governance)

- Am I buying this because I expect it to make money for me? (Investment)

If you’re investing for returns, treat investment tokens like stocks. Research the underlying asset. Check if it’s registered. Don’t trust hype. If you’re into DeFi and want influence, learn governance. Participate. Delegate. Don’t just hold. If you’re buying a utility token, make sure you’ll actually use it. Otherwise, you’re just gambling on speculation.

And always remember: if it smells like a security, regulators will treat it like one. The days of calling a security token a “utility” to avoid the law are over.

Are governance tokens considered securities?

It depends. The SEC doesn’t have a clear rule yet. Many governance tokens - like UNI and AAVE - were initially sold as utility tokens but later used for governance. The SEC has argued that if they’re sold with the expectation of profit from others’ efforts, they’re securities. Courts and regulators are still deciding. Some experts believe governance tokens should have their own category, since their value comes from participation, not dividends.

Can a token be both utility and governance?

Yes, and more are becoming hybrid. Binance’s BNB now allows limited governance votes on ecosystem decisions. Filecoin holders can vote on protocol upgrades while also using FIL to pay for storage. The key is whether the token serves multiple functions. But if it offers profit potential, regulators may still classify it as a security - even if it has utility.

Why do utility tokens lose value so fast?

Because their value is tied to usage. If no one uses the service, the token has no reason to exist. Many utility tokens were sold during the 2021 bull run as speculative assets, not functional tools. When the market cooled, projects with no real product - or poor user adoption - collapsed. CoinGecko’s 2022 survey showed 63% of holders never used their utility tokens. Without usage, demand vanishes.

Is it safe to invest in security tokens?

Compared to other crypto assets, yes - if they’re properly regulated. Security tokens must follow strict rules: KYC, financial disclosures, and legal registration. That reduces fraud risk. But they’re not risk-free. The underlying asset (like real estate or a startup) can still fail. Liquidity is also lower - you can’t trade them on Coinbase or Binance. Only on specialized platforms like tZERO or ADDX.

What happens if a governance token project fails?

The token’s value drops - often sharply. But unlike a security token, you don’t have legal recourse. You didn’t buy ownership. You bought voting rights. If the protocol gets hacked, abandoned, or loses users, your tokens become worthless. There’s no CEO to sue. No financial statements to review. It’s a community effort - and if the community leaves, so does the value.

Final Thought

Tokenomics isn’t about coding. It’s about incentives. Utility tokens incentivize usage. Governance tokens incentivize participation. Investment tokens incentivize capital. Get the category wrong, and you’re either using a tool you don’t need, voting on a system you don’t care about, or risking money without legal protection. Know what you’re holding - and why.