What Are Decentralized Applications (dApps) on Ethereum? A Clear Guide

Dec, 9 2025

Dec, 9 2025

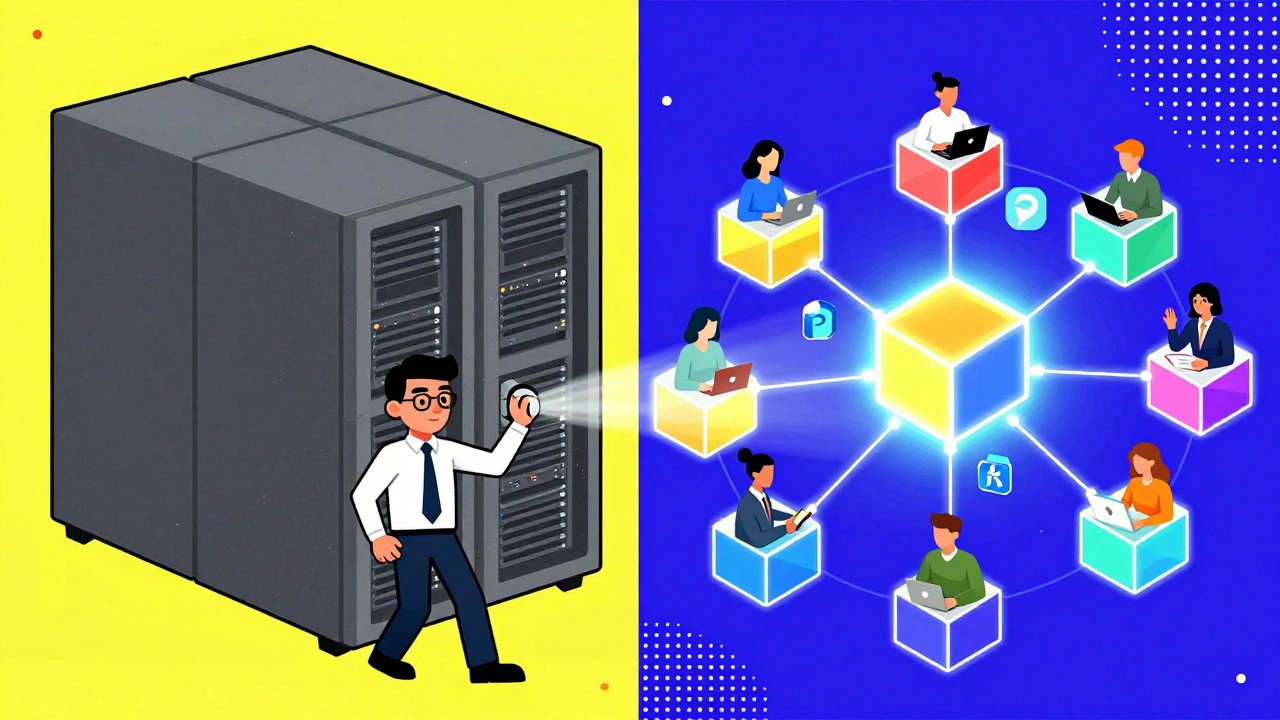

When you use a banking app or a social media platform, you're trusting a company to run the backend - their servers, their rules, their control. But what if the app didn't need a company at all? What if it ran on a network of computers, owned by no one, and couldn't be shut down? That’s what dApps on Ethereum are all about.

What Exactly Is a dApp?

A decentralized application, or dApp, is software that runs on a blockchain - not on a single server. Unlike regular apps, there’s no central company pulling the strings. Instead, the logic is built into code called smart contracts, which automatically execute when certain conditions are met. On Ethereum, these contracts are written in Solidity and live on a public, open network where anyone can see them.The Ethereum Foundation defines a dApp as having three parts: a smart contract backend, a frontend interface (like a website or mobile app), and decentralized storage (usually IPFS) for files. You don’t log in with a password. You connect your wallet - like MetaMask - and interact directly with the code.

Why Ethereum?

Ethereum isn’t just another blockchain. It was built from the start to run programs. When Bitcoin showed that money could be decentralized, Vitalik Buterin asked: What else can we do with this? The answer was the Ethereum Virtual Machine (EVM) - a global computer that can run any code you write, as long as you pay for it.This made Ethereum the go-to platform for dApps. By 2025, over 2,800 active dApps live on Ethereum. That’s more than all other blockchains combined. Why? Because it’s the most secure, the most tested, and the most trusted. Developers know if they build on Ethereum, their app won’t suddenly disappear because a CEO decided to shut it down.

How dApps Are Different From Regular Apps

Traditional apps like Uber or Netflix rely on centralized servers. If Netflix’s servers go down, you can’t stream. If Uber’s system gets hacked, your data leaks. If they change their terms, you have no say.dApps don’t have that problem. They’re:

- Decentralized - No single company owns them. Thousands of computers worldwide run the same code.

- Transparent - Every transaction and change is recorded on the blockchain. You can check it yourself.

- Censorship-resistant - No one can block you from using it. Even if the U.S. government tries, the network keeps running.

- Trustless - You don’t need to trust a company. You trust the code. If the smart contract says you’ll get paid when a condition is met, it happens - no exceptions.

Think of it like a vending machine. You put in money, you pick a snack, and the machine delivers. No clerk. No manager. Just rules written in steel. dApps work the same way - but for complex financial deals, games, and even voting systems.

Where You’ll Find dApps Today

Most dApps fall into three big categories:- DeFi (Decentralized Finance) - 60% of all dApps. These let you lend, borrow, trade, or earn interest without a bank. Uniswap lets you swap tokens directly. Aave lets you earn interest on your crypto. No paperwork. No approval process.

- NFT Marketplaces - 25%. These are digital art galleries where ownership is proven on-chain. You buy a piece of art on OpenSea, and the smart contract guarantees you’re the only owner. Every resale automatically pays the artist - no middleman taking a cut.

- Gaming - 15%. Games like Axie Infinity let you own in-game items as real assets. You can sell your dragon or sword for real money. Unlike in traditional games, the developer can’t delete your stuff.

These aren’t just experiments. In Q3 2023, users locked over $28 billion in value into Ethereum dApps. That’s more than most banks have in digital assets.

The Downsides - Why dApps Aren’t Everywhere Yet

For all their promise, dApps still have big problems.Gas fees - Every action on Ethereum costs money, paid in ETH. During busy times, fees spiked over $100 per transaction in early 2022. That’s not practical for buying a coffee.

Speed - Ethereum can only handle about 15 transactions per second. Visa does 24,000. Waiting 10 seconds for a trade to confirm feels ancient when you’re used to instant payments.

Usability - You need a wallet. You need to understand private keys. You need to know the difference between ERC-20 and ERC-721 tokens. One wrong click, and your money is gone forever. There’s no customer service to call. A Reddit user lost $350 because the interface didn’t warn them they were sending tokens to a scam contract.

And while the code is secure, the people behind it aren’t. Many dApps have been hacked because of sloppy coding - like the 2016 DAO hack that lost $60 million. Bugs in smart contracts are permanent. Once deployed, you can’t patch them.

What’s Changing - And Fast

Ethereum isn’t standing still. The big shift came in September 2022 with the Merge. Ethereum switched from energy-hungry mining to proof-of-stake. It cut energy use by 99.95%. That killed one of the biggest criticisms.Now, scaling is the focus. Layer 2 networks like Arbitrum and Optimism are handling most of the traffic. Arbitrum alone processes over a million transactions daily - faster and cheaper than Ethereum’s main chain. These are like express lanes built on top of Ethereum.

Upcoming upgrades like Verkle trees (early 2024) will make running a node easier, and sharding (late 2024) could push Ethereum to 100,000 transactions per second. That’s Visa-level speed, with blockchain security.

Who Uses dApps - And Why

It’s not just crypto bros. A 2023 ConsenSys survey found that 82% of users value the transparency and lack of counterparty risk. One user on Reddit said: “Uniswap saved me from three scams that would’ve been hidden in traditional finance.”NFT collectors love that artists get paid automatically on every resale. Gamers love owning their items. And businesses? Deloitte found 37% of Fortune 500 companies are testing Ethereum dApps for supply chains - tracking where goods come from, without trusting a single vendor.

But the biggest shift isn’t in finance or art. It’s in control. With a dApp, you’re not a customer. You’re a participant. You own your data. You own your assets. You don’t need permission to use it.

What’s Next?

The SEC sued Uniswap in 2023, saying its interface was an unregistered securities exchange. That’s a wake-up call. Governments are watching. Regulation is coming - and it could make or break dApps.But the trend is clear. Gartner predicts 20% of large companies will use Ethereum dApps for business processes by 2025. Right now, it’s mostly tech-savvy users. But as wallets get simpler, fees drop, and speed improves, that will change.

Ethereum isn’t perfect. It’s slow, expensive, and confusing. But it’s the only platform where you can build something that truly belongs to no one - and yet, works for everyone.

That’s the power of dApps. Not because they’re better at doing what banks do. But because they let us do things banks never could.

Are dApps on Ethereum safe?

The smart contracts running dApps are immutable and transparent, which makes them secure if written correctly. But bugs happen - like the 2016 DAO hack. Once deployed, you can’t fix them. Always check if a dApp has been audited by a trusted firm like CertiK or OpenZeppelin. Also, never connect your wallet to a site you don’t trust. Scammers create fake versions of popular dApps to steal funds.

Do I need to know how to code to use a dApp?

No. You don’t need to write code to use a dApp. You just need a wallet like MetaMask or Coinbase Wallet, and some ETH to pay for transactions. Most dApps have simple web interfaces - you click buttons like you would on any website. The complexity is hidden behind the scenes. But understanding what you’re approving (like signing a transaction) is critical. Mistakes here cost money.

Can I lose money using dApps?

Yes - and it’s permanent. If you send ETH to the wrong address, or approve a malicious contract, there’s no way to reverse it. Unlike banks, there’s no “undo” button. Always double-check addresses. Use small amounts to test new dApps. Never share your private key or recovery phrase with anyone - not even someone claiming to be support.

How do I start using dApps?

First, get a wallet like MetaMask (browser extension or mobile app). Buy some ETH from an exchange like Coinbase or Kraken. Transfer it to your wallet. Then visit a dApp like Uniswap or OpenSea. Click “Connect Wallet,” approve the connection, and you’re ready. Start with simple swaps or NFT browsing. Don’t stake or lend until you understand how it works.

Is Ethereum the only blockchain for dApps?

No. Solana, Polygon, and Base are growing fast. Solana is faster and cheaper, but less decentralized. Polygon is built on Ethereum and offers lower fees. But Ethereum still leads in security, developer tools, and total value locked. If you want maximum safety and trust, Ethereum is still the standard. For speed and low cost, other chains may be better - but you’re trading off decentralization.