Bitcoin ETFs and Institutional Flows: How Big Money Is Changing the Market

Feb, 22 2026

Feb, 22 2026

Before January 2024, buying Bitcoin as an institution felt like trying to sneak into a high-security vault with a key made of paper. You had to handle private keys, worry about hacks, find custodians who actually understood crypto, and face regulatory gray zones that could shut you down overnight. Then came the spot Bitcoin ETFs - and everything changed.

What Bitcoin ETFs Actually Did

Spot Bitcoin ETFs didn’t just make it easier to buy Bitcoin. They made it normal. For the first time, pension funds, endowments, and Wall Street firms could buy Bitcoin the same way they buy Apple or Tesla shares - through a regulated, SEC-approved fund traded on major exchanges. No wallets. No private keys. No midnight panic over custody.

The numbers don’t lie. By Q3 2025, U.S. Bitcoin ETFs held over $103 billion in assets. That’s not a flash in the pan. It’s a structural shift. And the biggest driver? Not retail investors. Not traders. It’s investment advisors managing money for real people - teachers, doctors, retirees. They’re buying Bitcoin not because they think it’ll hit $1 million tomorrow, but because their clients are asking for it. And advisors are answering.

Who’s Really Buying?

Forget hedge funds. The real force behind Bitcoin ETF demand is investment advisors. As of Q3 2025, they controlled 57% of all institutional Bitcoin exposure reported in 13F filings. That’s over 185,000 BTC worth of buying power. Hedge funds? Half that. Mutual funds? Barely on the radar.

Why? Because advisors don’t trade. They allocate. They add Bitcoin to diversified portfolios the same way they add gold or REITs. And they’re doing it slowly - at first. Most institutional portfolios still hold less than 1% in Bitcoin. But that’s not a sign of weakness. It’s a sign of strategy. They’re testing the waters. Watching how it behaves. Waiting for the next wave of client demand.

And the big names are following. Harvard’s endowment more than doubled its Bitcoin ETF position in Q3 2025, jumping to nearly $441 million. Emory University added 91%. Wells Fargo, Morgan Stanley, JPMorgan - each now holds hundreds of millions in Bitcoin ETFs. These aren’t speculative bets. These are portfolio decisions made by teams with fiduciary duties. When institutions like these move, the market listens.

The Price Shift: Bitcoin Isn’t a Hedge Anymore

Before ETFs, Bitcoin was treated like digital gold - a hedge against inflation, a safe haven during market crashes. You bought it when stocks were falling. You held it when the dollar looked shaky.

Now? It’s behaving like a tech stock.

Studies using rolling correlations and advanced statistical models show Bitcoin’s link to the S&P 500 has spiked since ETFs launched. The correlation coefficient jumped from near zero to over 0.7 in under a year. That means when the market goes up, Bitcoin goes up harder. When it crashes, Bitcoin crashes with it.

This isn’t an accident. It’s the result of institutional money flowing in. These investors don’t see Bitcoin as a crisis hedge. They see it as a risk-on asset - like Nvidia or Amazon. So when Fed policy shifts, or tech earnings disappoint, Bitcoin moves with the rest of the market. That’s why it’s no longer moving with gold. The two assets are pulling apart. Bitcoin is becoming a growth play, not a safety net.

Liquidity: Bigger Markets, Smoother Trades

Before ETFs, moving $10 million in Bitcoin could take days. You’d have to find a counterparty, negotiate over-the-counter, and risk slippage of 5% or more. That’s why institutions stayed away. The market was too thin.

Now? Liquidity has exploded. ETFs pool billions in capital, creating deep order books on major exchanges. You can trade $50 million in Bitcoin ETF shares in minutes without moving the price more than 0.3%. That’s the kind of liquidity banks and asset managers need.

It’s a two-way street, though. When ETFs see big outflows - say, during a market panic - liquidity dries up fast. That’s when Bitcoin’s volatility spikes. But overall, the trend is clear: institutional inflows are making the market more stable, not less.

The Concentration Problem

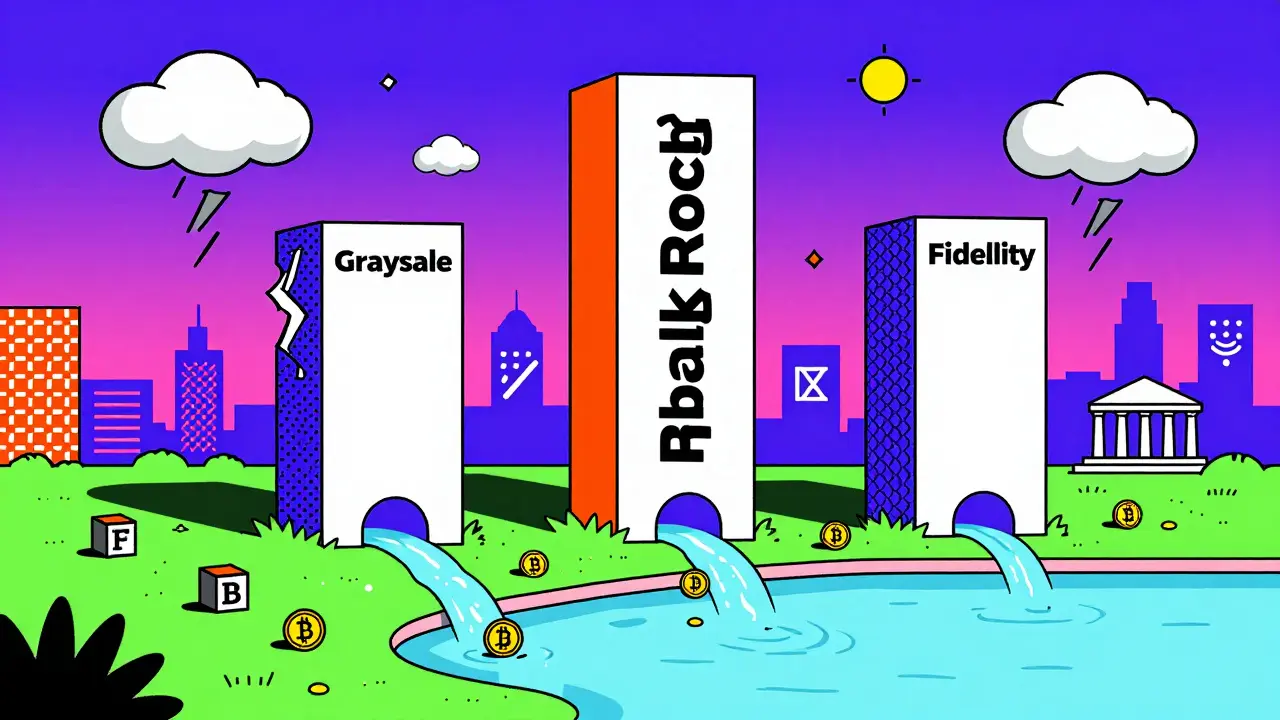

Here’s the uncomfortable truth: 89% of all U.S. Bitcoin ETF assets are held by just three issuers - Grayscale, BlackRock, and Fidelity. That’s not diversification. That’s concentration risk.

If BlackRock’s ETF gets hacked - not likely, but possible - or if Fidelity’s custodian has a system failure, the ripple effect could shake the entire market. Regulators are watching this closely. The SEC has already flagged concentration as a potential systemic risk.

And yet, institutional investors keep choosing these three. Why? Because trust matters. You don’t hand $100 million in assets to a startup with a website built in 2023. You go with the brand names that have decades of regulatory experience. That’s why new ETFs, even with lower fees, struggle to gain traction.

What’s Next? The Real Story Is in the Numbers

As of February 2026, Bitcoin is trading around $67,000. ETF investors are sitting on 20% unrealized losses from the 2024 highs. That sounds bad - until you look deeper.

Those losses aren’t causing mass redemptions. In fact, inflows have kept steady. Why? Because the buyers aren’t day traders. They’re advisors, endowments, and banks. They’re not trying to time the bottom. They’re building positions over years.

And here’s the kicker: institutional investors currently represent only 24% of total ETF AUM. That means 76% of the money in Bitcoin ETFs still comes from retail and smaller players. The real flood of institutional capital hasn’t even started.

Think about it. If every U.S. pension fund with $1 billion in assets added just 0.5% to Bitcoin, that’s $150 billion in new demand overnight. That’s not speculation. That’s infrastructure.

The Bigger Picture: Crypto Is Now Finance

The biggest impact of Bitcoin ETFs isn’t price. It’s perception. Crypto is no longer a fringe experiment. It’s a financial asset class - with its own rules, risks, and players.

That means regulators are now treating Bitcoin like stocks and bonds. Banks are building crypto desks. Auditors are auditing crypto holdings. Tax systems are adapting. Insurance products are emerging.

And with that comes new risks. When Bitcoin moves with the S&P 500, a crash in tech stocks can now trigger a Bitcoin selloff that hits pension funds, hedge funds, and bank balance sheets all at once. The old wall between crypto and traditional finance is gone. The system is connected.

That’s not necessarily bad. But it’s not simple either. We’re no longer watching a wild, unregulated experiment. We’re watching the integration of a new asset into the core of global finance. And that’s a much harder, slower, more complex process than any rally ever was.