Dividend Distribution in India: Record Date, Ex-Date, and Payout Timeline Explained

Feb, 19 2026

Feb, 19 2026

When you own shares in an Indian company, getting paid a dividend isn’t as simple as waiting for money to show up in your account. There’s a chain of dates and rules that determine who gets paid, when, and why. Miss one step, and you could end up watching someone else collect your dividend. This isn’t just paperwork-it’s how the stock market ensures fairness. Let’s break down the three key dates: record date, ex-date, and payout timeline, so you know exactly what to expect.

What Is the Record Date?

The record date is the day the company freezes its shareholder list. If you’re on that list, you’re entitled to the dividend. Simple, right? But here’s the catch: you don’t need to own the stock on the record date itself. You just need to own it before the market closes on the day before the record date. That’s because stock trades in India settle on a T+2 basis. That means if you buy shares on Monday, the transaction officially completes on Wednesday. So, if the record date is Friday, you must buy by close of trading on Wednesday to be counted.

For example, if Tata Steel declares a dividend with a record date of March 10, 2026, you must have purchased your shares by March 6 at the latest. If you buy on March 7, the trade settles on March 9-but the company already locked in its list on March 10. You’re too late.

What Is the Ex-Date and Why It Matters More

The ex-date (short for ex-dividend date) is the real turning point. It’s the first day the stock trades without the dividend attached. If you buy on or after the ex-date, you won’t get the dividend. The ex-date is always set one business day before the record date in India, thanks to the T+2 settlement cycle.

Why does this matter? Because stock prices drop on the ex-date to reflect the dividend payout. If a stock is trading at ₹500 and the company declares a ₹20 dividend, you’ll likely see the price fall to around ₹480 the next day. This isn’t a loss-it’s just the market adjusting. The ₹20 isn’t gone; it’s now in your pocket as cash.

Here’s a real example: Reliance Industries announced a dividend with a record date of April 5, 2026. That means the ex-date was April 3. Anyone who bought shares on April 3 or later wouldn’t receive the dividend. But if you bought on April 2, you’d get it-even though the record date was April 5.

The Payout Timeline: When Do You Actually Get Paid?

After the record date, the company processes payments. In India, dividend payouts typically take 15 to 30 days. Most companies use the National Securities Depository Limited (NSDL) or Central Depository Services (India) Limited (CDSL) to credit dividends directly to your Demat account. You’ll see the money appear as a credit entry, not as a bank transfer.

Some companies pay faster. HDFC Bank, for instance, often credits dividends within 10 business days. Others, especially smaller firms, might take up to 45 days. The company will announce the expected payout date along with the dividend declaration. Always check the investor relations page on the company’s website-this is the most reliable source.

Don’t confuse the payout date with the record or ex-date. You might see your dividend credited in May even if the ex-date was in March. That’s normal.

What Happens If You Sell Before the Ex-Date?

If you sell your shares before the ex-date, you lose the right to the dividend. The buyer gets it. This is why some investors hold stocks through the ex-date even if they’re planning to sell. It’s not about speculation-it’s about not leaving money on the table.

Conversely, if you buy just before the ex-date and sell right after, you’re essentially trading the dividend. That’s called dividend capture. It’s legal, but risky. The price drop on the ex-date can sometimes be sharper than the dividend amount, especially in volatile markets. Plus, you’re still exposed to market risk during those few days.

Dividend Taxation in India: A Quick Note

Since April 2020, dividends are taxed in the hands of the investor, not the company. If you receive more than ₹5,000 in dividends from a single company in a year, the company deducts 10% TDS (tax deducted at source). You’ll get a Form 16A for this. You must report the full dividend amount in your income tax return under ‘Income from Other Sources’ and pay any additional tax if your slab rate is higher than 10%.

For example, if you receive ₹8,000 from Infosys, ₹800 is deducted as TDS. You’ll get ₹7,200 in your account. But if you’re in the 30% tax bracket, you’ll owe another ₹1,600 when you file your return.

How to Track Dividend Dates

Most trading platforms like Zerodha, Upstox, and Groww now show dividend calendars. You can filter by company or sector. The BSE and NSE websites also list upcoming dividend dates under their corporate actions section. Bookmark these pages.

Another trick: set a calendar reminder for 3 days before the expected record date. That gives you a buffer. If you’re unsure, check the company’s latest annual report or investor presentation. They often include a schedule of planned dividends.

Common Mistakes to Avoid

- Buying shares on the record date thinking you’ll get the dividend. You won’t-settlement takes two days.

- Selling after the ex-date and assuming you still get paid. If you sold before the ex-date, you forfeited it.

- Ignoring the payout date. Some investors think dividends arrive instantly. They don’t. Wait 2-4 weeks.

- Forgetting tax implications. Even if TDS is deducted, you still need to report the full amount.

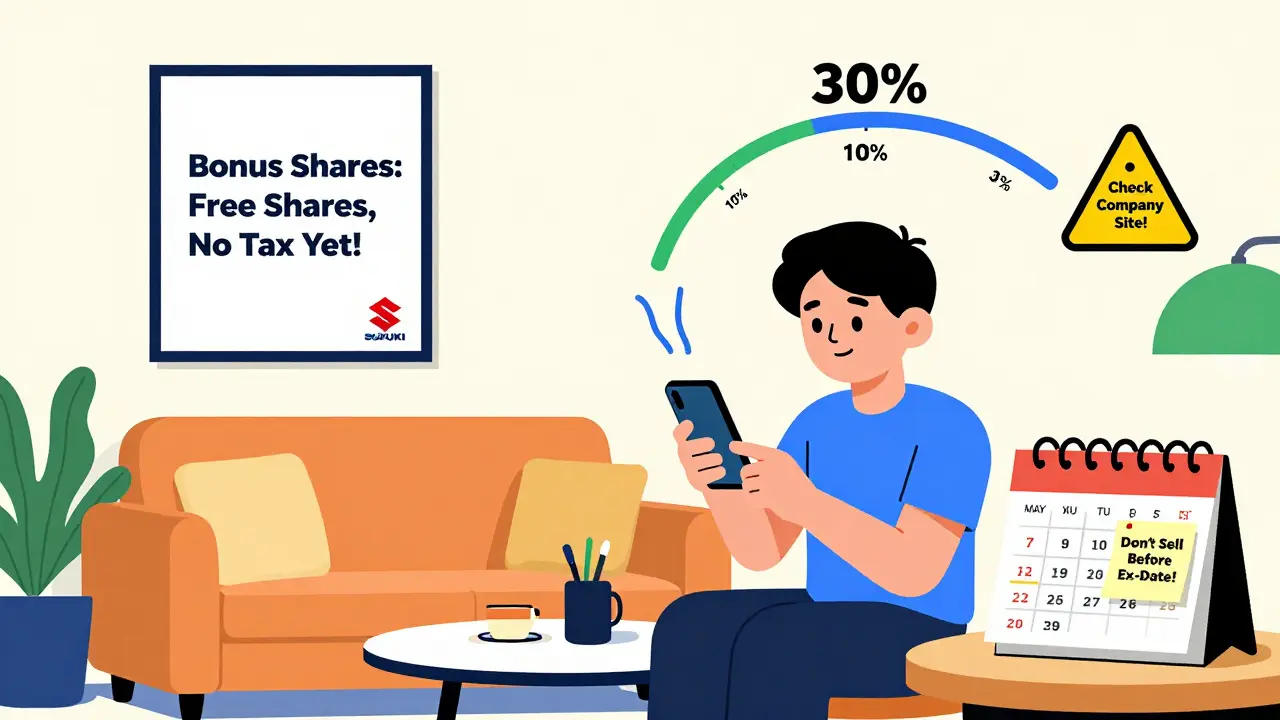

What About Bonus Shares and Stock Dividends?

Not all distributions are cash. Some companies issue bonus shares-extra shares given for free based on your existing holdings. For example, a 1:5 bonus means you get one free share for every five you own. Bonus shares follow the same record and ex-date rules as cash dividends. The only difference? No tax is due at issuance. You pay capital gains tax only when you sell those bonus shares.

Companies like Asian Paints and Maruti Suzuki have used bonus issues to reward shareholders without cash outflow. It’s a way to increase liquidity and signal confidence.

Final Tip: Don’t Chase Dividends Blindly

Dividends are nice, but they shouldn’t be your only reason for buying a stock. A company paying a 5% dividend might look great-until you realize its stock price has dropped 20% in the past year. That’s not income; that’s a sinking ship.

Look at the dividend yield in context: Is the company profitable? Is its debt low? Does it have a history of consistent payouts? Infosys and HCL Tech have paid dividends every year for over a decade. That’s reliability. A startup with a high dividend but negative earnings? That’s a red flag.

Dividend distribution in India is transparent, predictable, and well-regulated. But only if you understand the timeline. Know the record date. Respect the ex-date. Track the payout. And always, always check the company’s official announcements. That’s how you make sure your money works for you-not against you.

What happens if I buy shares on the record date in India?

You won’t receive the dividend. India uses a T+2 settlement cycle, meaning it takes two business days for a stock purchase to be finalized. If you buy on the record date, the trade settles two days later-after the company has already locked in its list of eligible shareholders. To qualify, you must buy at least two days before the record date.

Is the ex-date the same as the record date?

No. The ex-date is always one business day before the record date in India. It’s the first day the stock trades without the dividend. If you buy on or after the ex-date, you’re not entitled to the dividend. The record date is when the company checks its register to see who owns the shares-but because of settlement delays, the ex-date is what actually determines eligibility.

How long does it take to receive dividends after the record date?

Dividends are usually credited to your Demat account within 15 to 30 days after the record date. Larger companies like Reliance or HDFC Bank often pay within 10 days. Smaller firms may take up to 45 days. Always check the company’s investor relations page for the exact payout date listed in their dividend announcement.

Do I pay tax on dividends even if TDS is deducted?

Yes. If you receive more than ₹5,000 in dividends from a single company in a year, 10% TDS is deducted. But if your income tax slab is higher than 10% (e.g., 20% or 30%), you must pay the difference when you file your return. The TDS is just an advance payment, not the final tax.

Can I still get a dividend if I sell my shares after the ex-date?

Yes. As long as you owned the shares before the ex-date, you’re eligible for the dividend, even if you sell afterward. The ex-date is the cutoff for eligibility. After that, ownership changes don’t affect your right to the dividend. The company pays based on who held the shares on the record date, not who holds them when the money is sent.