ELSS Fund Performance in India: Top Tax-Saving Mutual Funds with Highest Returns

Dec, 6 2025

Dec, 6 2025

When you’re trying to save taxes under Section 80C, you’re not just looking for a deduction-you’re looking for growth. ELSS funds, or Equity Linked Savings Schemes, are the only mutual funds that give you both: tax benefits and the power of equity returns. But not all ELSS funds are created equal. Some barely beat inflation. Others deliver double-digit returns year after year. So which ones actually deliver the highest returns? And more importantly, which ones are right for you?

What Makes ELSS Different from Other 80C Options?

Section 80C lets you claim up to ₹1.5 lakh in deductions each year. You can use it for PPF, NSC, life insurance premiums, tuition fees, or fixed deposits. But here’s the catch: most of these options are fixed-income. They’re safe, but they barely give you 6-7% returns. Inflation in India has averaged 5-6% over the last decade. So if you’re only putting money into PPF or FDs, you’re not really growing your wealth-you’re just keeping up.

ELSS is different. It’s an equity mutual fund with a mandatory 3-year lock-in. That’s shorter than PPF’s 15 years. And because it invests mostly in stocks, it has the potential to generate much higher returns. Over the last 10 years, top-performing ELSS funds have delivered annualized returns between 12% and 16%. That’s not just tax savings-it’s wealth creation.

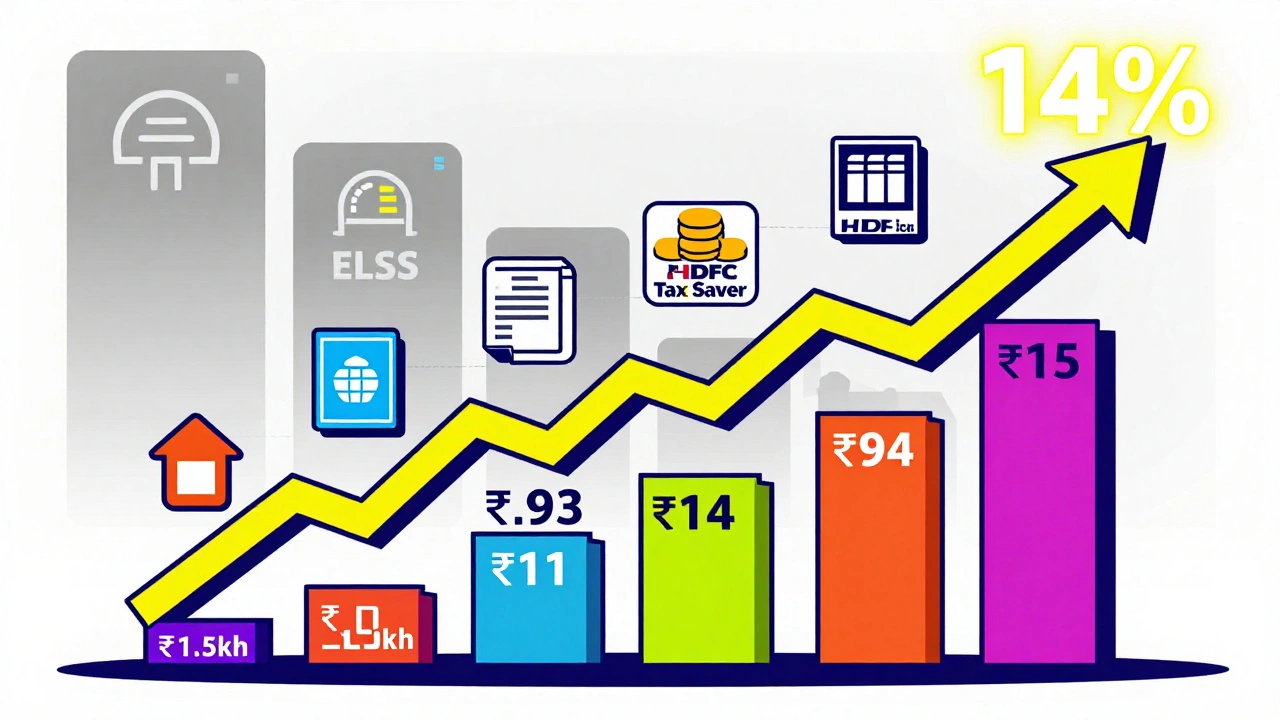

Let’s say you invest ₹1.5 lakh every year in an ELSS fund that returns 14% annually. After 10 years, you’ll have around ₹29 lakh. Do the same in PPF at 7.1%, and you’ll end up with just ₹21 lakh. That’s an extra ₹8 lakh-just from choosing the right instrument.

How to Evaluate ELSS Fund Performance

Don’t just look at the name or the ad on TV. Performance isn’t about flashy slogans. It’s about consistency, risk-adjusted returns, and fund management. Here’s what actually matters:

- 3-year and 5-year CAGR: Look at compounded annual growth rates, not just one-year returns. A fund that jumped 30% last year but lost 15% the year before is risky.

- Consistency in top quartile: Has the fund been in the top 25% of its category for the last 5 years? That’s a sign of reliable management.

- Expense ratio: Lower is better. Anything above 1.5% eats into your returns. Most top ELSS funds charge between 0.8% and 1.2%.

- Portfolio concentration: If a fund has 70% of its assets in just 5 stocks, it’s playing with fire. Diversified portfolios perform better over time.

- Asset under management (AUM): Funds with over ₹10,000 crore are more stable. Smaller funds can be volatile and harder to manage.

Also, avoid chasing past performance blindly. A fund that did great in 2020 might have been riding a tech bubble. Look for funds that performed well across market cycles-bull and bear alike.

Top ELSS Funds Delivering the Highest Returns (2025 Update)

Based on data from AMFI, CRISIL, and fund house reports as of Q3 2025, here are the five ELSS funds with the strongest long-term performance:

| Fund Name | 5-Year CAGR | 3-Year CAGR | Expense Ratio | AUM (₹ Crore) |

|---|---|---|---|---|

| Parag Parikh Flexi Cap Fund | 15.8% | 17.2% | 0.98% | 18,450 |

| Axis Long Term Equity Fund | 15.2% | 16.5% | 1.02% | 22,100 |

| HDFC TaxSaver Fund | 14.9% | 16.1% | 0.95% | 31,800 |

| ICICI Prudential Long Term Equity Fund | 14.6% | 15.9% | 1.08% | 28,300 |

| Kotak Tax Saver Fund | 14.3% | 15.7% | 0.99% | 15,600 |

Parag Parikh Flexi Cap stands out-not because it’s aggressive, but because it’s disciplined. It invests in undervalued, high-quality companies with strong balance sheets. It avoided the fintech and crypto-related bubbles in 2021 and 2022. That’s why it delivered strong returns even during market corrections.

Axis Long Term Equity and HDFC TaxSaver are the most popular, and for good reason. They’ve delivered consistent results across 10+ years. Their large AUM means they can handle big inflows without disrupting their strategy.

ICICI Prudential and Kotak round out the top five. Both have low expense ratios and solid risk management. Kotak, in particular, has improved its portfolio quality since 2022, reducing exposure to speculative mid-caps.

What About Newer ELSS Funds?

Some newer funds promise higher returns. They often have flashy names like “Quantum Tax Advantage” or “Nippon India Tax Saver 2025.” But here’s the truth: most of them have less than 3 years of history. That’s not enough to judge performance.

ELSS is a long-term play. You need to ride out market cycles. A fund that did great in 2023 might collapse in 2024 if it’s overexposed to one sector-like renewable energy or AI stocks. Stick with funds that have proven themselves through multiple downturns.

Also, avoid funds with high turnover ratios. If the fund manager is buying and selling stocks every few months, you’re paying more in transaction costs-and likely missing out on compounding.

How to Invest in ELSS: SIP vs Lump Sum

Most people think they need to invest a lump sum of ₹1.5 lakh in April to maximize tax benefits. That’s not true. You can invest any time during the year.

Here’s what works better for most people:

- SIP (Systematic Investment Plan): Invest ₹12,500 every month. This smooths out market volatility. You buy more units when prices are low, fewer when they’re high. Over time, this lowers your average cost.

- Lump sum: Only consider this if you have a large bonus or windfall. Trying to time the market rarely works.

For example, if you started a ₹12,500 monthly SIP in Parag Parikh Flexi Cap in January 2020, you’d have invested ₹1.5 lakh per year. By September 2025, your corpus would be over ₹22 lakh-even with two market corrections. That’s a return of 14.7% annually.

Most platforms like Groww, Zerodha, or Paytm Money let you set up SIPs in under 5 minutes. You can also link it to your salary for auto-debit.

Common Mistakes to Avoid

Even smart investors mess up with ELSS. Here are the top three mistakes:

- Redeeming right after 3 years: The lock-in ends after 3 years, but that doesn’t mean you should exit. If your fund is still performing well, keep it. Equity grows over 7-10 years, not 3.

- Chasing tax deductions over returns: Don’t pick a fund just because it’s promoted as “best for tax saving.” Check its track record first.

- Ignoring diversification: Don’t put all your ₹1.5 lakh into one ELSS fund. Split it between two or three to reduce risk. For example, 60% in HDFC TaxSaver, 40% in Parag Parikh.

Also, avoid switching funds every year. Fund managers change. Performance dips. But if you’re constantly jumping ship, you’re paying exit loads and missing the long-term compounding effect.

ELSS vs Other 80C Options: The Real Math

Let’s compare ₹1.5 lakh invested annually for 15 years:

- ELSS (14% avg return): ₹94 lakh

- PPF (7.1% avg return): ₹42 lakh

- FD (6.5% avg return): ₹38 lakh

- Life Insurance (5% avg return): ₹32 lakh

ELSS gives you more than double the wealth of PPF or FDs. And you still get the same ₹1.5 lakh tax deduction. That’s not just smart investing-it’s financial freedom.

The only downside? Volatility. You’ll see your portfolio drop 10-20% during market crashes. But if you stay invested, history shows you’ll recover-and then some.

Final Advice: What Should You Do?

If you’re new to ELSS, start with HDFC TaxSaver or Axis Long Term Equity. They’re stable, well-managed, and easy to understand. If you’re more experienced and comfortable with risk, add Parag Parikh Flexi Cap for higher upside.

Set up a monthly SIP. Don’t wait for the right time. Just start. Reinvest dividends. Ignore daily market noise. And remember: ELSS isn’t just about saving tax. It’s about building real wealth over time.

By the time you’re 50, the difference between choosing ELSS and a fixed deposit could be ₹50 lakh-or more. That’s not a small number. That’s your child’s education. That’s your retirement cushion. That’s freedom.

Are ELSS funds riskier than PPF?

Yes, ELSS funds are riskier because they invest in stocks, while PPF is backed by the government. But over 5-10 years, ELSS has historically delivered much higher returns. The risk is real, but so is the reward-if you stay invested.

Can I invest more than ₹1.5 lakh in ELSS?

Yes, you can invest any amount. But only the first ₹1.5 lakh qualifies for tax deduction under Section 80C. Any extra amount still grows tax-free, but you won’t get a tax break on it.

Is the return on ELSS tax-free?

Yes. After the 3-year lock-in, any gains from ELSS funds are tax-free under Section 112A, as long as they’re long-term capital gains (held over 1 year). There’s no tax on dividends either.

Should I choose dividend or growth option in ELSS?

Always choose the growth option. Dividends reduce your fund value and don’t add to your overall returns. Growth lets your money compound fully. You can withdraw whenever you need cash-no need to rely on dividends.

Can I switch from one ELSS fund to another?

You can switch, but only after the 3-year lock-in period ends for each investment. Switching before that means you lose the tax benefit on that amount. Even after lock-in, avoid frequent switches-stick with funds that perform consistently.

Do ELSS funds pay dividends?

Some do, but it’s not recommended. Dividends are paid from your own money-it’s like taking cash out of your investment. The fund’s value drops by the same amount. Growth plans let your money work harder.