ELSS Lock-in Period in India: Why the 3-Year Restriction Makes It Unique

Dec, 25 2025

Dec, 25 2025

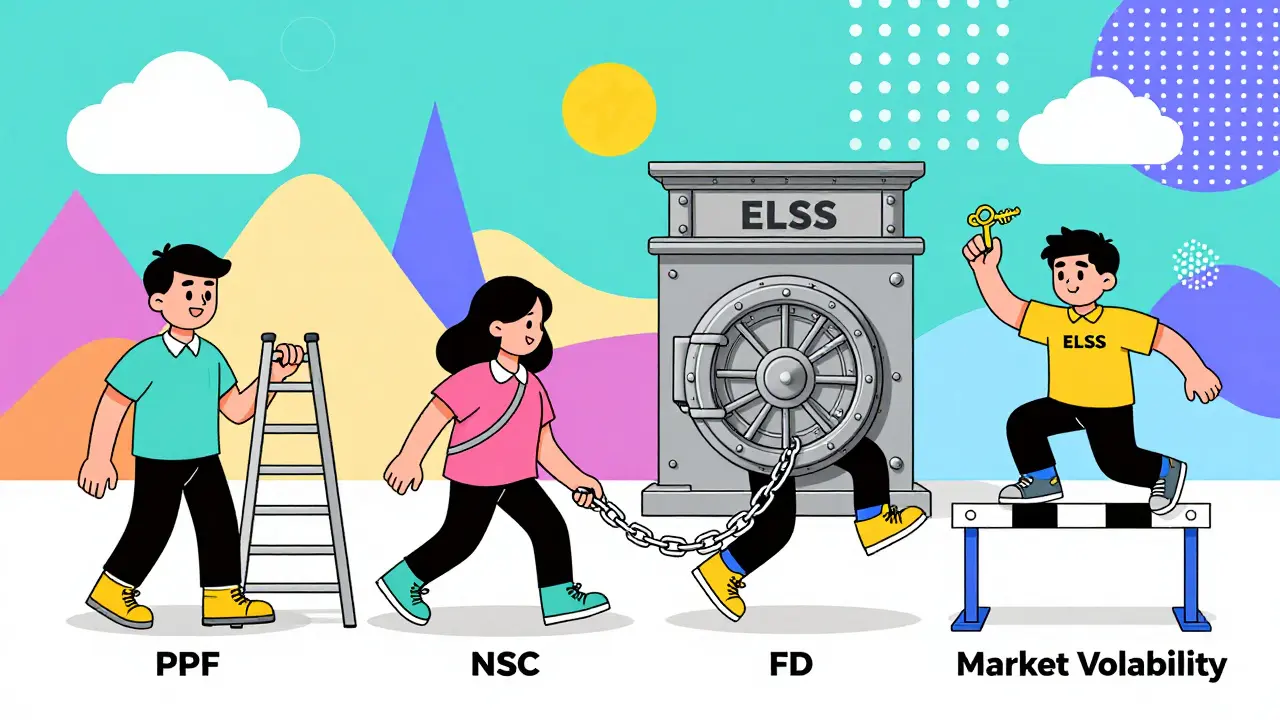

Most people in India know they can save tax by investing under Section 80C-but not everyone understands why ELSS funds are different. If you’ve ever looked at tax-saving options like PPF, NSC, or fixed deposits, you’ve probably noticed one thing: ELSS is the only one with a 3-year lock-in period. That’s it. No more, no less. And that small detail changes everything.

What Exactly Is the ELSS Lock-in Period?

ELSS stands for Equity Linked Savings Scheme. It’s a type of mutual fund that invests mostly in stocks, and it gives you a tax break under Section 80C of the Income Tax Act. The catch? You can’t withdraw your money for three years from the date of investment. This applies whether you invest as a lump sum or through SIPs. Each SIP installment has its own 3-year clock.

For example, if you start a SIP on January 1, 2025, the first installment locks in until January 1, 2028. The second installment, made on February 1, 2025, locks in until February 1, 2028. They don’t all unlock at the same time. This is different from PPF, where the entire balance is locked for 15 years, or NSC, which locks for 5.

Why Is 3 Years the Sweet Spot?

Three years isn’t random. It’s the minimum time the government decided was needed to encourage people to stay invested in equity markets. Shorter than that, and people might treat it like a savings account-deposit and pull out right away. Longer, and it becomes too restrictive for middle-class investors who need flexibility.

Historically, equity markets in India have delivered positive returns over 3-year rolling periods about 85% of the time since 2000, according to data from AMFI. That’s why ELSS was designed this way: to force discipline without being punishing. You’re not locked in for a decade-you’re just forced to ride out the short-term bumps.

Compare that to PPF, where you can’t touch your money for 15 years without penalties, or fixed deposits that give you lower returns and no tax benefit beyond the initial deduction. ELSS gives you the best of both worlds: tax savings now, and exposure to growth markets over a realistic timeframe.

How Does It Compare to Other Section 80C Options?

Section 80C lets you claim up to ₹1.5 lakh in deductions every year. There are over a dozen options under it, but only a few are popular. Here’s how ELSS stacks up:

| Option | Lock-in Period | Average Annual Return (Last 10 Years) | Risk Level | Liquidity After Lock-in |

|---|---|---|---|---|

| ELSS Mutual Funds | 3 years | 12%-15% | High | Full access |

| PPF | 15 years | 7%-7.1% | Low | Partial withdrawals allowed after 5 years |

| NSC | 5 years | 6.8%-7% | Low | Full access at maturity |

| Bank FD (Tax Saving) | 5 years | 6%-7% | Low | No premature withdrawal allowed |

| EPF | Until retirement | 8.15% | Low | Partial withdrawals allowed for specific needs |

ELSS stands out because it offers the shortest lock-in and the highest potential returns. PPF and NSC are safe, but they barely beat inflation. Bank FDs are even lower. EPF is great if you’re employed, but not everyone qualifies. ELSS is the only option that gives you equity growth without a decades-long commitment.

What Happens After the 3 Years?

Once the lock-in ends, you’re free to do whatever you want. You can redeem the entire amount, switch to another fund, or keep it invested. There’s no requirement to withdraw. Many investors choose to keep their ELSS money growing, especially if they’re still in the accumulation phase.

There’s also no tax on gains after the lock-in. ELSS funds are taxed like regular equity mutual funds: no tax if held over one year (long-term capital gains). You only pay 10% on gains above ₹1 lakh in a financial year. That’s better than PPF, which is completely tax-free, but worse than nothing-because you’ve already earned more over the long term.

One common mistake? People think the 3-year lock-in means they should pull out right away. That’s not the point. The goal isn’t to time the exit-it’s to stay invested long enough to let compounding work. Many who stay in ELSS for 7-10 years end up with 2-3x their original investment.

Who Should Invest in ELSS?

ELSS isn’t for everyone. But it’s perfect for:

- People who want to save tax and are okay with some market risk

- Young professionals starting their investment journey

- Those who can invest regularly through SIPs

- Investors who understand that time in the market beats timing the market

If you’re risk-averse and need guaranteed returns, stick with PPF or FDs. But if you’re okay with volatility and want your money to grow faster, ELSS is the smartest choice under Section 80C.

It’s also ideal for people who don’t have access to employer-sponsored retirement plans. In India, only about 30% of the workforce is covered by EPF. For the rest, ELSS is the closest thing to a tax-efficient, growth-oriented retirement tool.

Common Myths About ELSS Lock-in

There are a lot of misunderstandings. Let’s clear a few:

- Myth: You can’t redeem even one rupee before 3 years. Truth: Correct. No partial withdrawals allowed. Not even for emergencies.

- Myth: ELSS is risky because it’s all in stocks. Truth: Yes, it’s volatile-but over 3 years, the chance of loss is under 15%. Over 5 years, it’s near zero.

- Myth: All ELSS funds are the same. Truth: Big difference. Some are large-cap focused, others mid-cap or flexi-cap. Choose based on your risk appetite.

- Myth: You lose the tax benefit if you withdraw after 3 years. Truth: No. The tax deduction was already claimed when you invested. What you do later doesn’t affect it.

How to Start Investing in ELSS

Getting started is simple:

- Decide how much you want to invest under Section 80C (up to ₹1.5 lakh/year).

- Choose between lump sum or SIP. SIPs reduce timing risk and are easier on your cash flow.

- Select a fund. Look at 5-year returns, expense ratio (under 1.5% is good), and portfolio diversification.

- Invest through your bank, a mutual fund platform like Groww or Zerodha, or directly with the AMC.

- Keep track of each SIP date-each has its own lock-in period.

Don’t chase the fund with the highest past returns. Instead, look for consistency. A fund that delivered 14% every year for the last 5 years is better than one that jumped to 25% one year and dropped to 5% the next.

What If You Need Money Before 3 Years?

If you’re in a real emergency and need cash, you can’t access your ELSS money. No exceptions. That’s the trade-off. But here’s the thing: if you’re investing in ELSS properly, you shouldn’t need the money before 3 years. You’re not putting your rent money into it. You’re using surplus income.

If you’re constantly short on cash, you might be investing too much. Reduce your ELSS contribution and keep an emergency fund of 3-6 months’ expenses in a liquid fund or savings account. That way, you won’t be tempted to break your lock-in.

Why This Makes ELSS Unique

No other tax-saving instrument in India balances risk, return, and accessibility the way ELSS does. It’s short enough to be practical, long enough to be effective. It’s risky enough to grow your wealth, but not so risky that it scares off middle-class investors.

That 3-year lock-in isn’t a punishment. It’s a design feature. It forces you to think long-term. It stops you from reacting to market noise. It turns a tax-saving move into a wealth-building habit.

And that’s why, even in 2025, ELSS remains the most popular Section 80C option-used by over 25 million investors in India. Not because it’s the safest. But because it’s the smartest.

Can I exit ELSS before 3 years in case of an emergency?

No, you cannot exit ELSS before the 3-year lock-in period ends, even for emergencies. There are no exceptions or premature withdrawal options. This is a strict rule set by the government to ensure long-term investing. If you need emergency funds, use a separate savings or liquid fund.

Is ELSS better than PPF for tax saving?

It depends on your goals. If you want guaranteed returns and safety, PPF is better. If you want higher growth potential and shorter lock-in, ELSS wins. PPF gives you 7.1% with zero risk. ELSS can deliver 12-15% but comes with market risk. For young investors, ELSS is usually the better long-term choice.

Do I get tax benefits every year if I invest in ELSS via SIP?

Yes. Each SIP installment qualifies for a separate tax deduction under Section 80C in the year it’s made. So if you invest ₹12,500 per month, you get ₹1.5 lakh in deductions each year, as long as you don’t exceed the ₹1.5 lakh limit. Each installment also has its own 3-year lock-in period.

Are ELSS returns taxable after 3 years?

Yes, but only partially. ELSS funds are treated as equity mutual funds. If you sell after 1 year, gains up to ₹1 lakh per financial year are tax-free. Any gains above ₹1 lakh are taxed at 10%. There’s no indexation benefit, but the tax is still lower than on debt funds or FD interest.

Can I invest more than ₹1.5 lakh in ELSS?

Yes, you can invest more than ₹1.5 lakh in ELSS, but only the first ₹1.5 lakh qualifies for tax deduction under Section 80C. Any amount above that still gets invested and grows, but you won’t get any additional tax benefit. Many investors do this to keep building wealth beyond the deduction limit.

Final Thought: The Lock-in Is the Feature, Not the Flaw

Most people see the 3-year lock-in as a downside. But it’s actually the reason ELSS works so well. It’s the thing that separates it from every other tax-saving option. It’s what turns casual savers into long-term investors. It’s why ELSS funds consistently outperform other 80C instruments over time.

If you’re serious about building wealth while saving tax, ELSS isn’t just an option-it’s the best option. The lock-in isn’t a trap. It’s a tool. Use it wisely.