Healthcare Costs in Indian Retirement: Planning for Medical Inflation

Jan, 9 2026

Jan, 9 2026

By the time you turn 65 in India, your monthly medical bills could be three times what they are today. That’s not a guess - it’s what happens when healthcare inflation outpaces your savings by nearly 12% every year. While pensions and fixed incomes stay flat, hospital bills, medicines, and diagnostic tests keep climbing. If you’re planning to retire in India, ignoring medical inflation isn’t just risky - it’s a recipe for financial stress when you need stability the most.

What medical inflation actually means for retirees

Medical inflation in India isn’t the same as general inflation. While consumer prices might rise 5-6% a year, healthcare costs have been hitting 10-12% annually for the last decade. A simple knee replacement that cost ₹2.5 lakh in 2020 now runs closer to ₹4.2 lakh in 2026. A routine MRI? It went from ₹3,500 to ₹7,200. Insulin, blood pressure pills, diabetes monitors - all up by 15% or more in five years.This isn’t just about big procedures. It’s the daily grind: monthly blood tests, cholesterol checks, physiotherapy sessions, and long-term medication. Retirees often need 3-5 different medicines just to manage chronic conditions. Multiply that by 12 months, and you’re looking at ₹15,000-₹30,000 a year just for prescriptions - and that’s before hospital visits.

Why public healthcare won’t cover you

Many assume government hospitals or Ayushman Bharat will save the day. But here’s the reality: public hospitals are overloaded. Waiting times for non-emergency care can stretch to weeks. Specialist consultations are scarce. Even if you qualify for Ayushman Bharat, it doesn’t cover all treatments, and many top doctors won’t take it.Private hospitals are where most retirees end up - especially for complex care. But private care is expensive. A 7-day stay in a private ward in a Tier-1 city like Delhi or Mumbai can cost ₹1.5 lakh. Add a stent, a CT scan, or a specialist’s fee, and you’re looking at ₹3-5 lakh in a single hospitalization. Without insurance, that’s your entire retirement fund gone in one go.

How much you really need to save

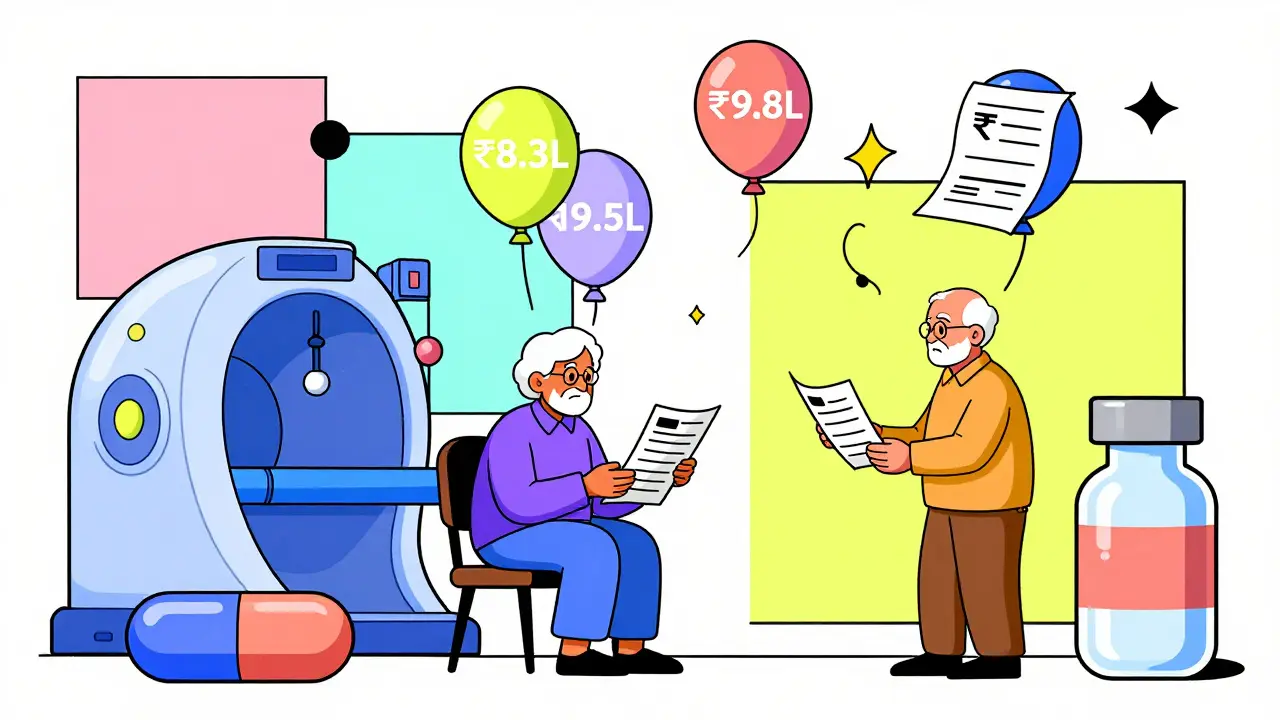

Let’s say you’re 50 today and plan to retire at 60. You expect to live until 85. That’s 25 years of healthcare needs. Based on current trends:- Annual healthcare cost at 60: ₹1.8 lakh

- Annual cost at 75 (after 15 years of 11% inflation): ₹8.3 lakh

- Annual cost at 85: ₹19.5 lakh

By your mid-80s, you could be spending over ₹1.6 lakh a month just on medical care. That’s not a typo. If you don’t plan for this, you’ll either drain your savings or rely on your children - and that’s not fair to anyone.

Most financial advisors suggest setting aside at least ₹25-30 lakh for healthcare alone by retirement age. But that’s the bare minimum. If you want to avoid financial panic, aim for ₹50-75 lakh. That gives you breathing room for unexpected illnesses, better hospitals, and newer treatments.

Health insurance: what actually works

Standard health insurance policies won’t cut it. Most cover up to ₹10 lakh, and many exclude pre-existing conditions for 2-4 years. If you’re 55 and buying your first policy, you’ll pay 2-3 times more than someone who bought it at 40. And even then, you’ll get hit with co-pays, room rent caps, and exclusions.Here’s what actually helps:

- Senior citizen plans - Look for policies with no waiting period for pre-existing diseases (some now offer 1-year waiting periods).

- Top-up or super top-up plans - These kick in after your base policy limit is reached. A ₹10 lakh base plan + ₹20 lakh super top-up = ₹30 lakh total coverage for under ₹15,000/year.

- Family floater with senior inclusion - If your parents are still healthy, add them to your plan. Premiums are lower than individual senior plans.

- Insurance with wellness benefits - Some insurers now offer discounts on premiums if you get annual check-ups or stay active.

Don’t wait until you’re 60 to buy insurance. The best time is 50-55. After 60, premiums jump, and insurers start rejecting applicants with even minor conditions like high cholesterol or borderline diabetes.

What most people get wrong

Many retirees make three big mistakes:- They assume their savings will stretch. They forget that inflation doesn’t stop at retirement. A ₹50 lakh corpus might sound like a lot - until you realize it needs to cover 25+ years of rising medical bills.

- They rely on family. Children may want to help, but they have their own mortgages, kids, and jobs. Relying on them for medical bills creates emotional and financial strain.

- They skip preventive care. Skipping annual check-ups to save money leads to late diagnoses. A simple blood test that costs ₹800 today can prevent a ₹15 lakh heart surgery tomorrow.

The smart move? Treat healthcare like a monthly expense - not an emergency. Budget ₹10,000-₹15,000 a month for medical costs starting 5 years before retirement. Put it in a separate account. Let it grow. Use it only for health.

Other tools to protect your money

Beyond insurance, here are practical steps:- Use government subsidies. If you’re a senior citizen, you’re eligible for discounts on medicines under the National Pharmaceutical Pricing Authority. Ask your pharmacist for the list.

- Buy medicines in bulk. Many pharmacies offer 10-15% discounts for 3-month supplies of chronic disease drugs. Always compare prices across apps like 1mg, PharmEasy, and Netmeds.

- Choose Tier-2 cities for retirement. Healthcare costs in Pune, Jaipur, or Coimbatore are 30-40% lower than in Mumbai or Delhi. You get the same quality care, but lower room rates and doctor fees.

- Invest in a health savings account. Some banks now offer tax-efficient savings accounts tied to health spending. Interest is tax-free, and you can withdraw for medical bills without penalty.

What to do if you’re already retired

If you’re already retired and didn’t plan for this, don’t panic. Start here:- Review your current medical expenses. Track every rupee spent on medicines, tests, and visits for 3 months.

- Apply for a senior citizen health plan immediately - even if you have pre-existing conditions. Some insurers accept applicants up to age 70.

- Switch to generic medicines. Brands like Cipla and Dr. Reddy’s offer identical drugs at 60-70% lower prices.

- Join a senior citizen group. Many cities have free health camps, subsidized diagnostics, and doctor consultations for retirees.

You’re not alone. Millions of Indian retirees are in the same boat. The difference between those who cope and those who struggle isn’t luck - it’s planning.

Final thought: Your health is your most valuable asset

Retirement isn’t just about having enough money to eat. It’s about having enough to stay healthy, mobile, and independent. Medical inflation doesn’t care how much you saved. It only cares how long you live. Plan ahead, buy smart, and don’t wait for a crisis to act. The cost of waiting isn’t just financial - it’s your peace of mind.How much should I save for healthcare by retirement in India?

Most experts recommend saving between ₹50 lakh and ₹75 lakh for healthcare alone by retirement age, especially if you plan to live past 80. This covers rising medical inflation, unexpected hospitalizations, and long-term medication. A ₹25 lakh corpus may seem enough today, but with medical inflation at 11% yearly, it will be wiped out in less than 10 years.

Is Ayushman Bharat enough for retirees?

No. Ayushman Bharat covers hospitalization costs up to ₹5 lakh per family per year, but only at empaneled hospitals. It doesn’t cover outpatient care, diagnostics, or medicines. Many top specialists and private hospitals don’t accept it. It’s a safety net, not a full solution. Retirees should still get private health insurance on top of it.

Can I get health insurance after 60 in India?

Yes, but it’s harder and more expensive. Most insurers accept applications up to age 65-70, but premiums jump dramatically. You’ll face higher co-pays, stricter exclusions, and longer waiting periods for pre-existing conditions. The best time to buy is between 50 and 55 - before health issues arise.

Should I buy a super top-up health plan?

Yes, if you already have a base health plan. A super top-up kicks in after your base coverage is exhausted. For example, a ₹10 lakh base plan + ₹20 lakh super top-up gives you ₹30 lakh total coverage for under ₹15,000 a year. It’s the most cost-effective way to get high coverage without paying for a ₹30 lakh policy outright.

Do generic medicines work as well as branded ones?

Yes. Generic medicines contain the same active ingredients as branded drugs and must meet the same quality standards set by the Indian government. Brands like Cipla, Dr. Reddy’s, and Sun Pharma produce generics that are just as effective but cost 60-80% less. Always check the manufacturer and ask your pharmacist for the generic version.

How does medical inflation compare to general inflation in India?

Medical inflation in India has averaged 10-12% per year over the past 10 years, while general inflation has been around 5-6%. This means your healthcare costs are rising nearly twice as fast as your income or savings. That gap is why retirees who don’t plan specifically for medical inflation end up running out of money.

Can I use my EPF or PPF for medical expenses in retirement?

You can withdraw from your EPF after retirement, but it’s not ideal for medical costs. EPF is meant for overall retirement income, and using it for healthcare means you’re spending your principal, not interest. PPF can be withdrawn in full at maturity, but it’s better saved for emergencies. Consider creating a separate health fund instead - one that grows with inflation and is used only for medical needs.