Inflation and Indian Retirement: How to Plan for Rising Costs

Feb, 21 2026

Feb, 21 2026

Retiring in India used to mean a quiet life with enough savings to cover groceries, medicine, and a little extra for travel. But today, that picture is changing fast. Inflation isn’t just a word on the news-it’s eating into your retirement dreams. If you’re planning to retire in India, you need to rethink what "enough" means. The cost of everything from healthcare to electricity has climbed sharply over the last five years. What used to cost ₹500 a month for basic groceries now costs ₹800. A simple doctor’s visit that was ₹500 five years ago is now ₹1,200. And that’s just the start.

How Inflation Is Changing Retirement in India

India’s average inflation rate has hovered around 5.5% annually since 2020, but essential items like food, fuel, and healthcare have risen much faster. According to the Consumer Price Index (CPI) data from the Ministry of Statistics, food inflation hit 9.3% in 2024. That’s more than double the official rate. For retirees living on fixed incomes, this isn’t just inconvenient-it’s dangerous.

Think about someone who retired in 2020 with ₹30,000 a month in savings. Back then, that was comfortable. Today, with inflation, that same ₹30,000 only buys what ₹21,000 could buy in 2020. That’s a 30% drop in purchasing power in just five years. If you don’t adjust your plan now, you’ll run out of money faster than you think.

What You’re Really Paying For in Retirement

Most people focus on housing and food when planning for retirement. But the real cost killers are healthcare and utilities. In urban India, a basic health insurance plan for a 60-year-old now costs ₹18,000 a year. Five years ago, it was ₹8,500. And that’s just the premium-co-pays, diagnostics, and hospital stays aren’t covered. A single knee replacement can cost ₹4 lakh. A stroke treatment? Over ₹6 lakh. These aren’t rare events. One in four Indians over 60 will need major medical care within five years of retiring.

Electricity bills are up 40% since 2020. Water and sanitation charges have jumped 35%. Even public transport fares have gone up by 25%. If you’re not factoring in these increases, you’re underestimating your monthly needs by at least 40%.

Why Traditional Savings Won’t Cut It

Many Indians rely on fixed deposits, post office savings, or pension schemes like the National Pension System (NPS). But here’s the problem: these offer returns of 6-7% annually. Inflation is running at 5.5% or higher. That means your money is barely keeping up. After taxes and fees, your real return is often less than 2%. You’re not growing your savings-you’re losing value slowly every month.

Let’s say you saved ₹50 lakh for retirement. At 6% interest, you get ₹25,000 a month. Sounds good. But if inflation stays at 6%, your ₹25,000 will be worth only ₹18,500 in ten years. In 15 years? Just ₹13,500. That’s not enough for healthcare, let alone emergencies.

How to Build a Real Retirement Plan

You need more than savings. You need a strategy that fights inflation head-on. Here’s what actually works:

- Invest part of your savings in inflation-protected assets-like gold ETFs, real estate investment trusts (REITs), or equity mutual funds. Historically, Indian equities have returned 12-14% over 10-year periods. That’s enough to outpace inflation.

- Delay retirement by 2-3 years if you can. Even working part-time after 60 adds ₹1-2 lakh a year to your savings. That’s a huge buffer.

- Use the NPS wisely. If you’re enrolled, contribute the maximum. The government adds ₹50,000 as a tax-free bonus each year under Section 80CCD(1B). That’s free money.

- Buy health insurance early. Don’t wait until you’re 60. The earlier you get it, the cheaper it is. A ₹10 lakh policy at age 45 costs ₹12,000/year. At 55? ₹28,000. At 60? Over ₹40,000.

- Plan for urban costs. If you’re moving to a smaller town, assume you’ll still need urban-level expenses for healthcare, internet, and transportation. Rural areas don’t always have reliable services.

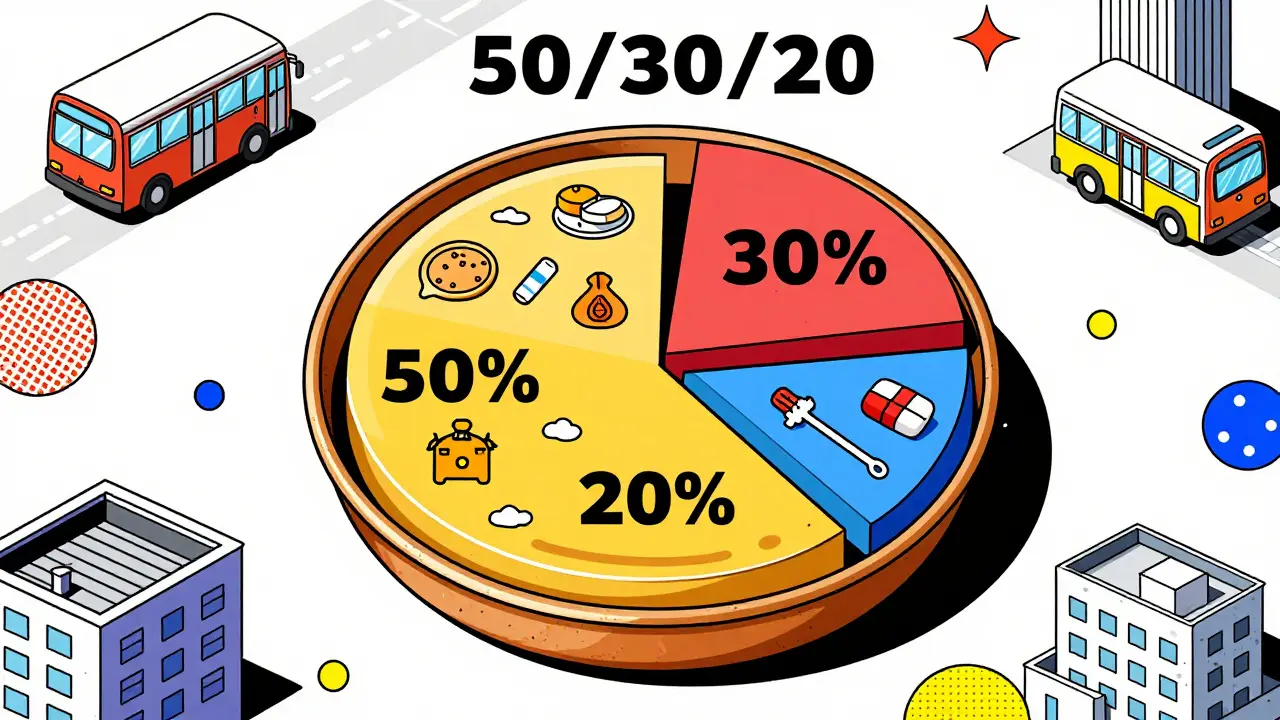

The 50/30/20 Rule for Retirees

Forget the 4% withdrawal rule. It doesn’t work in India’s inflation environment. Instead, use this:

- 50% for essentials-food, housing, medicine, utilities

- 30% for lifestyle-travel, hobbies, family visits

- 20% for emergencies-medical crises, home repairs, sudden costs

This keeps you grounded. If your monthly budget is ₹50,000, that’s ₹25,000 for essentials, ₹15,000 for comfort, and ₹10,000 for surprises. You’ll sleep better knowing you’ve built in room for the unexpected.

What Happens If You Ignore This?

Thousands of retirees in India are already feeling the pinch. In 2024, a survey by the Indian Institute of Public Health found that 68% of retirees over 65 were cutting back on medicine to save money. One in three stopped seeing specialists. Nearly 40% moved in with their children because they couldn’t afford rent. These aren’t extreme cases-they’re becoming the norm.

If you don’t act now, you might end up choosing between buying insulin and paying your electricity bill. That’s not retirement. That’s survival.

Start Now-Even If You’re Close to Retirement

It’s never too late. If you’re 58 and just thinking about this, you still have two years to make changes. Sell an unused property. Downsize your car. Cut subscriptions. Redirect even ₹5,000 a month into an equity mutual fund. Over two years, that’s ₹1.2 lakh. With compounding, it could grow to ₹1.5 lakh by the time you retire. That’s an extra ₹1,250 a month for the rest of your life.

You don’t need to be rich. You just need to be smart. Inflation doesn’t care how old you are. It doesn’t pause for retirement. But you can plan for it.

How much money do I need to retire comfortably in India today?

There’s no single number, but a realistic starting point is ₹50,000-₹70,000 per month for a modest urban lifestyle. This covers basic housing, food, healthcare, utilities, and small emergencies. If you plan to travel or have chronic health needs, aim for ₹80,000+. Remember, this amount must grow with inflation. A ₹50,000 monthly budget today will need to be ₹85,000 in 10 years if inflation stays at 5.5%.

Should I invest in real estate for retirement?

Real estate can help, but not the way most people think. Buying a house to live in doesn’t generate income. Instead, consider REITs (Real Estate Investment Trusts) or renting out a property. REITs give you exposure to commercial buildings and malls without the hassle of managing tenants. They pay regular dividends and have historically returned 9-11% annually in India. Avoid buying land or rural plots-they rarely appreciate fast enough to beat inflation.

Is the National Pension System (NPS) enough for retirement?

NPS is a good foundation, but not enough on its own. The average NPS corpus at age 60 is around ₹30-40 lakh. At a 6% withdrawal rate, that’s ₹15,000-₹20,000 a month. That’s below the inflation-adjusted cost of living for most urban retirees. Use NPS as your base, then add equity investments, health insurance, and part-time income to fill the gap.

Can I rely on my children for financial support in retirement?

Relying on children is risky. Many Indian families are financially stretched. Rising education costs, housing loans, and medical bills for younger generations mean adult children often have little left to give. Planning to depend on them can delay their own financial goals and create family tension. Build your own safety net. If your children help later, consider it a bonus-not a plan.

What’s the best way to protect my savings from inflation?

Diversify. Keep 30-40% in safe assets like fixed deposits or PPF for stability. Put 40-50% in equity mutual funds-especially large-cap and flexi-cap funds that have a long track record. Allocate 10-15% to gold ETFs, which act as a hedge during economic uncertainty. Avoid keeping more than 10% in cash. Cash loses value every month when inflation is high.

If you’re reading this and thinking "I’ll start next year," stop. Next year might be too late. Inflation doesn’t wait. Neither should you.