Lock-In and Liquidity of 80C Options in India: What to Expect Before You Invest

Dec, 18 2025

Dec, 18 2025

When you hear Section 80C, you might think it’s just another tax break. But if you don’t understand lock-in and liquidity, you could end up stuck with money you can’t touch when you need it most. Every year, millions of Indians invest under 80C to save tax-up to ₹1.5 lakh a year. But not all 80C options are created equal. Some tie your money up for 5 years. Others for 15. And some let you withdraw early, under pressure. Knowing the difference isn’t just smart-it’s essential.

What Section 80C Actually Covers

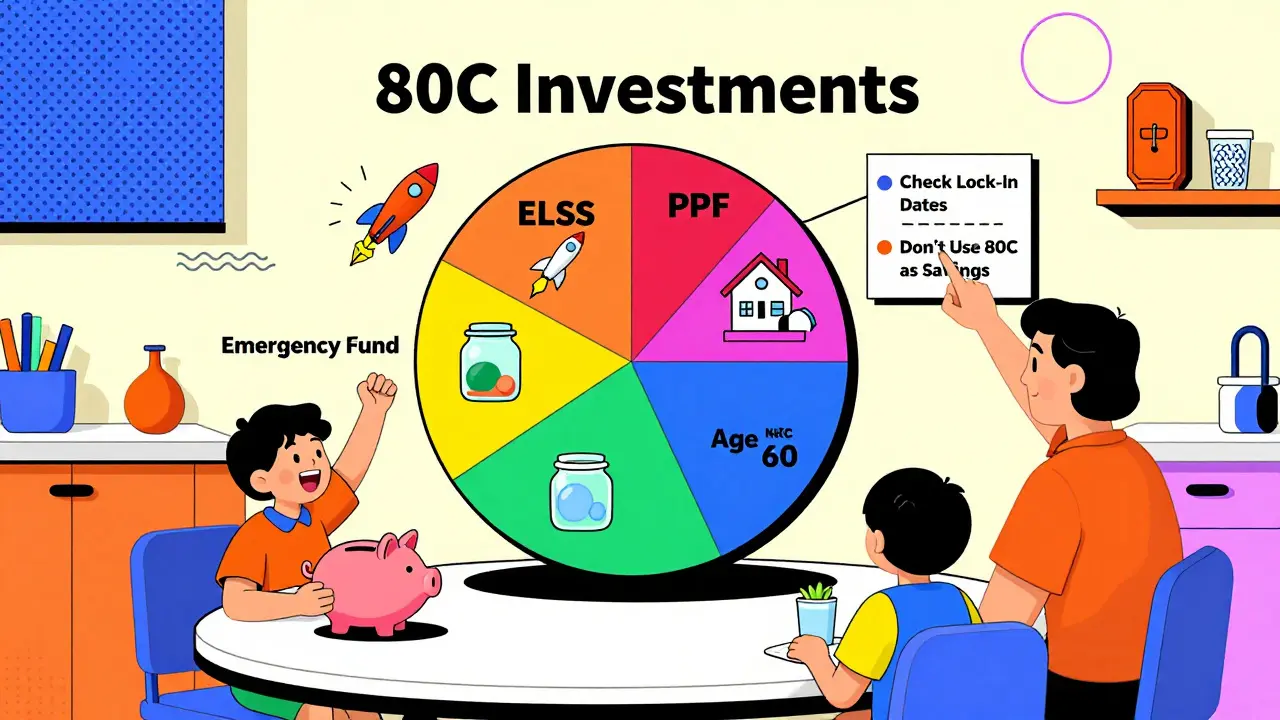

Section 80C of the Income Tax Act lets you reduce your taxable income by investing in certain approved instruments. It’s not one product. It’s a list. The big ones include Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS), National Savings Certificate (NSC), tax-saving fixed deposits, life insurance premiums, and contributions to the National Pension System (NPS). Each has its own rules, returns, and restrictions.

Most people pick ELSS because it promises higher returns. Others go for PPF because it feels safe. But if you’re choosing based on tax savings alone, you’re missing the bigger picture. What happens if your car breaks down in six months? Or you lose your job? Can you access your money? That’s where lock-in and liquidity come in.

Lock-In Periods: How Long Are You Really Tied Up?

Lock-in means your money can’t be withdrawn before a certain date. It’s not a suggestion. It’s a rule enforced by the government.

- ELSS: 3-year lock-in. Shortest among all 80C options. This is why it’s popular among young investors. If you invest in March 2025, you can withdraw in April 2028. No early exits, even for emergencies.

- PPF: 15-year lock-in. You can’t close it before 15 years. After that, you can extend it in blocks of 5 years. Partial withdrawals are allowed from year 7, but only up to 50% of the balance at the end of year 4.

- NSC: 5-year lock-in. No partial withdrawals. You get the full amount only at maturity.

- Tax-saving FDs: 5-year lock-in. No premature withdrawal allowed. If you break it early, you lose the tax benefit and may have to pay back the tax saved, plus interest.

- NPS: Lock-in until age 60. You can withdraw only 60% as a lump sum at retirement. The rest must go into an annuity. Early exit is only allowed in extreme cases like critical illness or death.

Here’s the catch: if you invest in a tax-saving FD in 2025 and quit your job in 2026, you can’t touch that money. And if you did, you’d have to repay the tax benefit you claimed. That’s not a penalty. That’s a clawback.

Liquidity: Can You Get Your Money Out When You Need It?

Liquidity is how fast and easily you can turn your investment into cash. In 80C, liquidity varies wildly.

ELSS offers the best liquidity among locked-in options. After 3 years, you can redeem units anytime. Most fund houses let you withdraw online in 2-3 business days. You can even set up systematic withdrawal plans (SWPs) to get monthly payouts.

PPF is less liquid. You can’t withdraw freely. Even partial withdrawals need paperwork and are capped. If you need ₹50,000 for your child’s education in year 10, you can get it-but only after submitting proof and waiting for approval. And you can’t withdraw more than half of what you had at the end of year 4.

NSC and tax-saving FDs? Zero liquidity. No early withdrawals. No loans against them. If you need cash, you’re out of luck.

NPS is the worst for liquidity. Even after 60, you can’t take all your money out. You’re forced to buy an annuity, which gives you a fixed monthly income for life. If you want flexibility, NPS isn’t for you.

Real-Life Scenarios: What Happens When Life Gets Messy?

Imagine this: You invested ₹1.5 lakh in ELSS in April 2023 to save tax for FY 2023-24. In October 2024, your father falls ill. You need ₹2 lakh for treatment. Can you access your ELSS?

No. The lock-in is still active. You’re stuck. You’ll have to borrow from family, sell other assets, or take a personal loan.

Now, imagine you invested the same amount in PPF in 2023. By 2029, you can withdraw up to 50% of the balance from year 4. So if you need money in year 7, you can. But you can’t take it all. And you can’t touch it before year 7.

What if you put it in a tax-saving FD? You’re locked in. No exceptions. Not for medical emergencies. Not for job loss. Not even for buying a house.

This isn’t hypothetical. In 2023, over 1.2 million people had to repay 80C tax benefits because they broke their tax-saving FDs early. The Income Tax Department flagged them. Notices followed. Penalties were added. Interest was charged.

Choosing the Right 80C Option for Your Life Stage

Your choice should depend on your age, income stability, and financial goals.

- Under 30, stable job, no major liabilities: Go for ELSS. Higher returns. Short lock-in. You have time to ride market ups and downs. A 12% average return over 10 years beats PPF’s 7.1% easily.

- 30-45, married, kids, home loan: Mix ELSS and PPF. Use ELSS for growth. Use PPF for safety and future cash needs. PPF’s partial withdrawal option kicks in after year 7-perfect for education or marriage expenses.

- 45+, nearing retirement: Avoid ELSS. Stick to PPF and NSC. You don’t want market risk now. Focus on guaranteed returns and predictable maturity.

- Self-employed or irregular income: Avoid tax-saving FDs and NSC. If you miss a payment, you lose the benefit. ELSS lets you invest monthly via SIPs. PPF lets you deposit anytime between ₹500 and ₹1.5 lakh per year.

Don’t just copy your neighbor. They might be 10 years older. Their needs are different.

What to Do If You’re Already Locked In

You already invested in a tax-saving FD. Now you realize you can’t touch the money. What now?

First, don’t panic. You still get the tax benefit. But plan around it.

- Build an emergency fund outside 80C. Keep 6-12 months of expenses in a savings account or liquid mutual fund.

- Don’t use 80C as your emergency fund. That’s a common mistake.

- If you’re stuck in NSC or FD, treat it as a long-term goal. Don’t expect to touch it until maturity.

- For future investments, always check the lock-in period before you invest. Read the fine print. Ask your advisor. Don’t assume.

Many people regret choosing NSC or tax-saving FDs after seeing how ELSS performed. But the real mistake wasn’t the product. It was not understanding liquidity.

Bottom Line: Lock-In Isn’t a Feature. It’s a Constraint.

Section 80C is a powerful tool. But it’s not a free lunch. Every rupee you invest under 80C comes with strings attached. The shorter the lock-in, the more flexibility you have. The longer the lock-in, the more you’re betting on future stability.

ELSS gives you growth with a 3-year leash. PPF gives you safety with a 15-year leash. NSC and FDs? They’re like a vault-secure, but impossible to open until the key is handed to you.

Before you invest, ask yourself: What if I need this money in 18 months? If the answer makes you uncomfortable, pick something with better liquidity. Don’t let tax savings trap you.

80C isn’t about saving tax. It’s about saving money-without losing control of it.

Can I withdraw money from ELSS before 3 years?

No. ELSS has a mandatory 3-year lock-in from the date of each investment. Even in emergencies like medical crises or job loss, you cannot withdraw early. If you try to redeem before 3 years, the fund house will reject the request. Breaking the lock-in also means losing the tax benefit under Section 80C, and the tax department may demand repayment with interest.

Is PPF better than ELSS for long-term savings?

It depends. PPF offers guaranteed returns (currently 7.1% as of 2025), tax-free maturity, and partial withdrawals after year 7. ELSS offers higher potential returns (historically 10-12% over 10 years) but comes with market risk. If you want safety and predictable growth, PPF wins. If you’re young and can handle volatility, ELSS grows your wealth faster. Many investors use both: ELSS for growth, PPF for stability.

What happens if I break a tax-saving FD before 5 years?

You cannot break a tax-saving FD before 5 years. If you do, the bank will not allow it. Even if you manage to close it (e.g., through fraud or error), the Income Tax Department will reverse the tax benefit you claimed under Section 80C. You’ll have to pay back the tax saved, plus interest under Section 234A. This has happened to thousands of people who assumed they could access their money like a regular FD.

Can I use 80C investments as collateral for a loan?

Only PPF and NSC can be pledged as collateral for loans, and even then, only after certain conditions. For PPF, you can get a loan against it between year 3 and year 6. For NSC, you can use it as collateral after one year. ELSS, tax-saving FDs, and NPS cannot be pledged. Most banks don’t accept them as security because of lock-in restrictions and lack of liquidity.

Is NPS a good 80C option for young professionals?

Only if you’re okay with never touching your money until 60. NPS offers tax benefits under 80C (up to ₹50,000 extra under 80CCD(1B)), but 40% of your corpus must go into an annuity at retirement. You can’t withdraw it freely. For young professionals who want flexibility, ELSS or PPF are far better. NPS is best for those who want to force themselves to save for retirement and don’t mind the lack of access.

How do I track my 80C investments and lock-in periods?

Keep a simple spreadsheet with the investment date, amount, instrument, and lock-in end date. For ELSS, check your folio statement from the fund house. For PPF, use your passbook or online portal through your bank or post office. For NSC and FDs, keep the certificate or receipt. Many banks now send SMS alerts when lock-in ends. Set calendar reminders for each investment’s maturity date to avoid surprises.

Next Steps: What to Do Right Now

Don’t wait until March to plan your 80C investments. Here’s what to do today:

- List all your current 80C investments. Note their lock-in end dates.

- Check your emergency fund. Do you have 6 months of expenses saved outside 80C? If not, build it first.

- Decide your goal: growth or safety? Pick ELSS for growth, PPF for safety.

- If you’re unsure, split your ₹1.5 lakh: ₹1 lakh in ELSS, ₹50,000 in PPF.

- Set up auto-debit for SIPs. Don’t miss deadlines.

Section 80C isn’t a race to save the most tax. It’s a long game. Play it right, and your money works for you. Play it wrong, and it works against you.