PPF Maturity in India and What to Do After It Ends: Extend Your Investment Wisely

Dec, 4 2025

Dec, 4 2025

When your Public Provident Fund (PPF) account hits its 15-year mark in India, you don’t just get a lump sum-you get a choice that can shape your retirement for the next decade or more. Many people think the moment the account matures, they must withdraw everything. But that’s not true. You can extend it. And if you do it right, your PPF can keep growing tax-free for years after maturity.

What Happens When Your PPF Account Matures?

Your PPF account automatically matures after 15 full financial years from the end of the year you opened it. For example, if you opened it in April 2010, it matures on March 31, 2025. At that point, you can withdraw the full balance-principal plus interest-without any tax. The interest earned is completely tax-free under Section 80C and Section 10(11) of the Income Tax Act.

But here’s what most people miss: you’re not forced to close it. The government lets you extend your PPF account in blocks of five years. You can extend it once, twice, or even more. There’s no limit on how many times you can renew it, as long as you follow the rules.

How to Extend Your PPF After Maturity

Extending your PPF isn’t automatic. You have to take action. Within one year after maturity, you need to submit Form H to your bank or post office where your account is held. If you miss this window, your account will still earn interest-but you won’t be able to make new deposits until you submit the form. And if you don’t deposit anything during the extension period, your account will just sit idle, earning interest on the existing balance.

You have two options when extending:

- Extend without deposits: You leave your money in the account. No new contributions. Interest keeps compounding tax-free. This is ideal if you don’t need the cash and want to let your savings grow.

- Extend with deposits: You keep adding up to ₹1.5 lakh per year. This lets you keep benefiting from tax deductions under Section 80C and keep compounding your returns. But you must submit Form H and actively choose this option.

Many retirees choose Option 1. They don’t need more contributions-they just want their money to keep growing safely. Others, especially those still working, choose Option 2 to keep sheltering income from tax while building a larger corpus.

Why Extend Instead of Withdrawing?

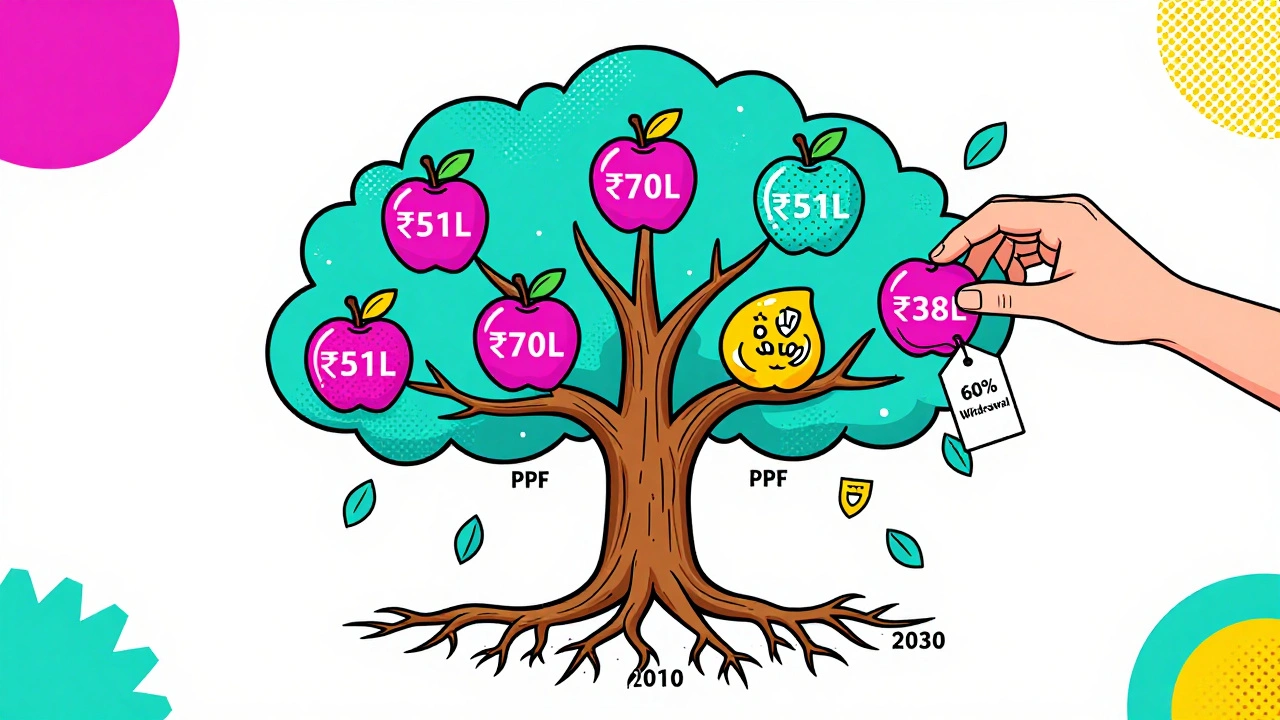

Let’s say you’ve invested ₹1.5 lakh every year for 15 years. That’s ₹22.5 lakh in contributions. With an average annual return of 7.1% (the current rate as of 2025), your account balance could be around ₹48-52 lakh at maturity. If you withdraw it all, you get a nice lump sum. But if you extend it for another five years without adding money, that ₹50 lakh could grow to over ₹70 lakh-just from compounding.

That’s the power of tax-free compounding. No other investment in India offers this kind of guaranteed, risk-free growth over such a long time. Even fixed deposits pay interest that’s taxable every year. PPF doesn’t. Even after maturity, as long as you extend it, the interest stays tax-free.

Also, PPF is backed by the Indian government. It’s one of the safest places to park long-term savings. In times of market volatility-stock crashes, bond rate swings, inflation spikes-PPF remains steady. That’s why so many government employees, teachers, and middle-class families rely on it as the core of their retirement plan.

What If You Need Money After Maturity?

You don’t have to take out everything at once. Even after extension, you can withdraw up to 60% of the balance at the start of each five-year block. For example, if your account has ₹70 lakh after the first extension, you can withdraw ₹42 lakh (60%) at the start of year 20. The rest keeps earning interest.

You can make one withdrawal per financial year during the extension period. No loans are allowed after maturity, but withdrawals are flexible. This gives you control. You can take out what you need, when you need it, while letting the rest grow.

PPF vs Other Retirement Options After Maturity

After PPF matures, people often look at other options:

- Senior Citizen Savings Scheme (SCSS): Offers 8.2% interest (as of 2025), but only for people over 60. You can invest up to ₹30 lakh. Interest is taxable annually.

- Fixed Deposits (FDs): Rates vary from 6.5% to 7.5%. Interest is taxed every year. No tax benefits under 80C.

- Systematic Withdrawal Plans (SWPs) from Mutual Funds: Higher returns possible, but subject to market risk. Capital gains are taxable.

- PPF Extension: Still tax-free interest, zero risk, flexible withdrawals, no age limit.

If safety and tax efficiency matter more than high returns, PPF extension wins. If you’re comfortable with some risk and want higher growth, you might combine PPF with a small portion in mutual funds. But PPF should remain your anchor.

Common Mistakes to Avoid

People make three big mistakes with matured PPF accounts:

- Waiting too long to extend: If you miss the one-year window, you lose the ability to add new money until you submit Form H. Interest still accrues, but you miss out on tax benefits.

- Assuming you must withdraw everything: Many think maturity = end of the story. But extending keeps your money working harder.

- Not checking your account status: Some banks don’t notify you. You need to track your maturity date yourself. Set a reminder in your phone or calendar.

Also, if you’re extending with deposits, make sure you don’t exceed ₹1.5 lakh per year. Excess amounts won’t earn interest and won’t be refunded unless you withdraw them.

Who Should Extend Their PPF?

Extending your PPF makes the most sense if:

- You’re still working and want to keep reducing taxable income

- You don’t need the money right away and want to grow it safely

- You want to leave a tax-free legacy for your family

- You’re looking for a stable, predictable income stream in retirement

If you’re retired, living off savings, and need cash monthly, withdrawing and moving to a fixed deposit or annuity might make more sense. But even then, consider keeping a portion in PPF for emergencies or future medical costs.

Real-Life Example: Priya’s PPF Journey

Priya, 58, opened her PPF in 2010. She invested ₹1.5 lakh every year. By 2025, her balance was ₹51.3 lakh. She didn’t need the money yet. Her pension covered her monthly expenses. So she extended her PPF for five more years without adding more money.

By 2030, her balance grew to ₹70.6 lakh-just from interest. In 2030, she withdrew ₹42.4 lakh (60%) to help her daughter buy a home. The remaining ₹28.2 lakh kept growing. She plans to extend again. By 2035, it could be over ₹38 lakh.

Priya didn’t chase high returns. She didn’t gamble in stocks. She just let PPF do its job. Now, she has a tax-free safety net that outlasts most retirement plans.

Final Thought: PPF Isn’t Just a Savings Account

PPF is one of the few instruments in India that combines safety, tax benefits, and long-term compounding. It’s not flashy. It doesn’t make headlines. But over 20, 25, or even 30 years, it builds something rare: financial peace.

Don’t treat maturity as an endpoint. Treat it as a turning point. Extend it. Let your money keep working. You’ve already waited 15 years. Why stop now?

Can I extend my PPF account after maturity without making any new deposits?

Yes, you can extend your PPF account after maturity without making any new deposits. You just need to submit Form H within one year of maturity. Your existing balance will continue to earn tax-free interest for another five years. You can also make partial withdrawals during this period, up to 60% of the balance at the start of each extension block.

What happens if I miss the one-year window to extend my PPF?

If you miss the one-year window to submit Form H, your account will still earn interest on the existing balance, but you won’t be able to make new deposits until you submit the form. Once you submit Form H, even late, you can resume deposits and continue earning interest. However, you’ll lose out on potential tax deductions and compounding during the gap period.

Can I withdraw money from my PPF after maturity?

Yes, you can withdraw money after maturity. You can withdraw the full amount at any time. If you extend your account, you can withdraw up to 60% of the balance at the start of each five-year extension period. Only one withdrawal is allowed per financial year during the extension phase.

Is PPF interest taxable after maturity?

No, PPF interest remains completely tax-free even after maturity and during extension periods. Whether you withdraw or extend, the interest earned under PPF is exempt from income tax under Section 10(11) of the Income Tax Act. This is one of the biggest advantages over other savings instruments like fixed deposits.

Can I extend my PPF account more than once?

Yes, you can extend your PPF account multiple times in blocks of five years. There’s no limit on the number of extensions. Many people extend it twice or even three times, letting their savings grow tax-free for 25, 30, or more years. Each extension requires submitting Form H before the previous block ends.

What’s the maximum amount I can deposit during extension?

During each five-year extension period, you can deposit up to ₹1.5 lakh per financial year, just like during the original 15-year term. This allows you to keep claiming tax deductions under Section 80C. Any amount above ₹1.5 lakh in a year won’t earn interest and won’t be refunded unless you withdraw it.

Can I transfer my PPF account to another bank or post office after maturity?

Yes, you can transfer your PPF account to another bank or post office even after maturity. The process is the same as before maturity-you need to submit Form H along with the transfer request. The new institution will verify your account and continue the extension terms. Make sure to update your KYC details during the transfer.