PPF Partial Withdrawal Rules in India: Limits, Timelines, and Strategies

Jan, 28 2026

Jan, 28 2026

Many Indians rely on the Public Provident Fund (PPF) as their main retirement safety net. But life doesn’t wait for maturity dates. What if you need cash for a medical emergency, a child’s education, or a home down payment before the 15-year lock-in ends? That’s where partial withdrawals come in. The rules aren’t complicated, but they’re easy to mess up. Get them wrong, and you lose out on interest, delay your goals, or even trigger penalties.

When Can You Start Withdrawing from PPF?

You can’t touch your PPF money until the end of the 7th financial year from the year you opened the account. For example, if you opened your PPF account in April 2020, the 7th financial year ends on March 31, 2027. That’s when you become eligible for your first partial withdrawal.

This rule is strict. No exceptions. Even if you’ve been contributing for 6 years and 11 months, you still can’t withdraw. The government wants PPF to stay locked in long enough to build real wealth. The 7-year mark is the gateway - not a suggestion, not a guideline. It’s the law.

How Much Can You Withdraw?

Once you’re eligible, you can withdraw up to 50% of the balance at the end of the 4th financial year preceding the year of withdrawal.

Let’s break that down with a real example. Say you opened your PPF account in FY 2019-20. By the end of FY 2022-23 (the 4th year before your withdrawal year), your account balance was ₹8,50,000. In FY 2026-27, you apply for withdrawal. You can take out 50% of ₹8,50,000 - that’s ₹4,25,000. Not your current balance. Not your total contributions. Just half of what was there four years ago.

This means your withdrawal amount is frozen in time. Even if your account has grown to ₹15 lakh by the time you apply, you’re still capped at half of what it was back in FY 2022-23. It’s designed to protect the long-term growth of your corpus.

How Many Times Can You Withdraw?

You’re allowed only one partial withdrawal per financial year. That’s it. No second chances. No loopholes. If you withdraw ₹3 lakh in July 2026, you can’t touch your PPF again until April 2027, even if you face another emergency.

Some people try to open multiple PPF accounts to get around this. Don’t. The Income Tax Department tracks all accounts under your PAN. If you’re caught with more than one active PPF account, you’ll face penalties, and the extra account may be closed with no interest paid.

What Documents Do You Need?

Getting your money isn’t automatic. You need to submit a formal request. Here’s what you’ll need:

- PPF withdrawal form (Form C)

- Your PPF passbook or account statement

- Proof of identity (Aadhaar, PAN, or passport)

- Bank account details for transfer

If you’re withdrawing for a child’s higher education or medical treatment, you might need supporting documents - like admission letters or hospital bills. Banks and post offices usually ask for these to avoid misuse.

Submit the form to the bank or post office where your PPF account is held. Processing takes 5 to 10 working days. The money goes directly to your savings account - no cash withdrawals allowed.

PPF Withdrawal vs. Loan: Which Is Better?

Before you withdraw, consider a PPF loan instead. You can take a loan between the 3rd and 6th financial years. The maximum loan amount is 25% of the balance at the end of the 2nd year. Loans must be repaid within 36 months, and interest is charged at 1% above the PPF rate.

Why choose a loan over a withdrawal?

- Loans don’t reduce your corpus - you pay it back.

- Interest is low and tax-free.

- You keep earning full interest on your balance.

But loans are only available for a short window. If you’re past year 6, withdrawal is your only option. If you’re in year 4 and need cash, a loan makes more sense. If you’re in year 8 and need a big sum, withdrawal is your only path.

Strategies to Maximize Your PPF Withdrawal

Here’s how smart investors plan their withdrawals:

- Time it with major expenses - Plan your withdrawal for when you actually need the money. Don’t withdraw early just because you can. Let your money grow.

- Use it for tax-free goals - PPF withdrawals are completely tax-free. Use the money for education, medical bills, or home down payments - things that don’t have other tax advantages.

- Don’t touch it for daily expenses - PPF isn’t an emergency fund. Use your savings account for that. Reserve PPF for big, one-time needs.

- Reinvest the rest - If you withdraw ₹4 lakh but only need ₹2.5 lakh, consider putting the leftover ₹1.5 lakh into a mutual fund or fixed deposit. Don’t let it sit idle.

- Extend your PPF account - After 15 years, you can extend your account in blocks of 5 years. During extension, you can still make withdrawals - up to 60% of the balance at the start of the extension period. This lets you keep earning tax-free interest while accessing funds gradually.

What Happens If You Withdraw Too Early or Too Often?

There are no formal penalties for following the rules. But breaking them has real consequences:

- If you withdraw before year 7, your request will be rejected.

- If you withdraw more than 50% of the 4th-year balance, only the allowed amount will be paid - the rest is returned.

- If you try to withdraw twice in one year, the second request is ignored.

- If you use fake documents, your account may be frozen, and you could face legal action.

There’s also an opportunity cost. Every rupee you withdraw early is a rupee that stops earning compound interest. That lost growth can cost you lakhs over time.

PPF Withdrawal After 15 Years

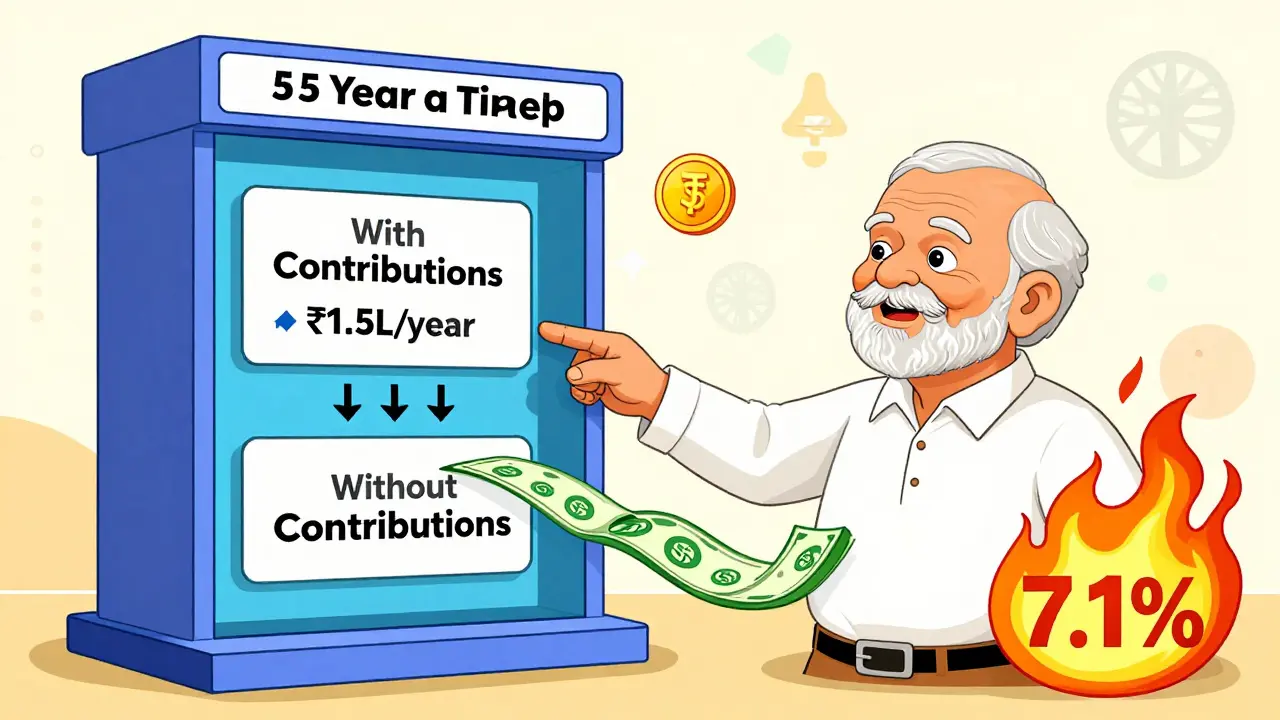

After 15 years, your PPF account matures. You can either withdraw the full amount - tax-free - or extend it. Most people choose extension because the interest rate (currently 7.1%) is still better than most fixed deposits.

If you extend, you have two options:

- With contributions - You can keep adding money (up to ₹1.5 lakh per year). You can withdraw up to 60% of the balance at the start of the extension period, in one or more installments.

- Without contributions - You stop adding money, but your balance keeps growing. You can withdraw any amount, once a year, with no limit - as long as you leave at least ₹1,000 in the account.

This makes PPF a powerful retirement tool. You can stretch your corpus over 20, 25, or even 30 years - all while earning tax-free interest.

Common Myths About PPF Withdrawals

- Myth: You can withdraw anytime after 5 years. Truth: Only after 7 years.

- Myth: You can withdraw 50% of your current balance. Truth: It’s 50% of the balance from 4 years ago.

- Myth: You can withdraw multiple times in a year. Truth: Only once per financial year.

- Myth: PPF withdrawals are taxable. Truth: Completely tax-free under Section 80C and Section 10(11).

These myths lead people to make costly mistakes. Always check the latest rules on the Ministry of Finance website or ask your bank directly.

Final Tip: Track Your PPF Balance Every Year

Keep a simple spreadsheet. Note your balance at the end of each financial year. That way, when you’re eligible for withdrawal, you know exactly how much you can take out - no guesswork. Many people lose out because they don’t track their 4th-year balance. Don’t be one of them.

Can I withdraw from PPF before 7 years?

No. Partial withdrawals are only allowed from the 7th financial year onwards. Any request before that will be rejected by the bank or post office.

Is PPF withdrawal taxable?

No. Both the contributions and withdrawals from PPF are completely tax-free under Section 80C and Section 10(11) of the Income Tax Act. You get triple tax benefits - tax deduction on investment, tax-free growth, and tax-free withdrawal.

Can I withdraw from PPF for my child’s education?

Yes. You can withdraw for higher education of your children, but only after the 7th year. You’ll need to submit proof like admission letters or fee receipts. The withdrawal limit still applies - 50% of the balance at the end of the 4th year.

What happens if I don’t extend my PPF after 15 years?

If you don’t extend, your account will automatically mature, and you can withdraw the full balance. If you leave the money in the account without extending, no interest will be paid after the 15-year mark.

Can I have two PPF accounts and withdraw from both?

No. You’re only allowed one active PPF account per person. If you open a second account, it will be considered invalid. You won’t earn interest on it, and you may face penalties. The government tracks accounts through your PAN.