Property Insurance in India: Coverage Types and Claim Process for Owners

Dec, 4 2025

Dec, 4 2025

Buying a home in India is one thing. Protecting it is another. Many owners assume their property is safe once the keys are handed over-but natural disasters, fires, theft, or even structural damage can turn your biggest investment into a financial nightmare overnight. Property insurance in India isn’t optional if you want real security. It’s the safety net that keeps your home-and your peace of mind-intact when things go wrong.

What Property Insurance Actually Covers in India

Not all property insurance policies are the same. In India, most standard home insurance plans cover two main areas: the structure of the building and your personal belongings inside it. The building coverage includes walls, floors, ceilings, fixed fittings like kitchens and bathrooms, and even attached structures like garages or compound walls. Personal property coverage includes furniture, electronics, appliances, jewelry, and other valuables stored inside.

But here’s what most people miss: standard policies often exclude damage from earthquakes, floods, or landslides unless you buy an add-on. If you live in Mumbai, Kerala, or Assam-areas prone to heavy rains and flooding-you need to specifically ask for flood coverage. Same goes for earthquake protection. These aren’t automatic. You have to add them, and they’ll cost extra.

Some insurers also offer optional covers like terrorism, malicious damage, or even loss of rent if your property becomes uninhabitable. If you rent out your apartment or house, loss of rent coverage can be a lifesaver. One owner in Bangalore lost six months of rental income after a fire destroyed his unit. His policy didn’t include loss of rent. He had to pay his tenants’ refunds out of pocket.

Types of Property Insurance Policies in India

There are three main types of property insurance policies available to owners in India:

- Basic Structure Cover - Only protects the physical building against fire, lightning, explosion, and riots. This is the cheapest option but leaves you exposed to most risks.

- Comprehensive Home Insurance - Covers both structure and contents. Includes fire, theft, natural disasters (if added), and sometimes accidental damage. Most homeowners choose this.

- Reconstruction Value Policy - Pays out based on the current cost to rebuild your home, not its market value. This is critical. Many owners think they’re covered for the price they paid or the property’s resale value. That’s wrong. If your house was bought for ₹80 lakh in 2018 but now costs ₹1.2 crore to rebuild, your payout will be ₹1.2 crore only if you have a reconstruction value policy.

Always check whether your policy is based on market value or reconstruction value. Market value policies deduct depreciation. So if your 10-year-old TV gets stolen, you might get ₹5,000 instead of the ₹30,000 it would cost to replace it. Reconstruction value policies don’t do that. They cover the full cost of replacing or rebuilding.

How to Calculate How Much Coverage You Need

Underinsuring your property is one of the biggest mistakes owners make. You might think ₹50 lakh is enough. But when you break it down:

- Rebuilding a 1,200 sq. ft. home in Delhi costs around ₹2,500-₹3,500 per sq. ft. → That’s ₹3-4.2 crore just for the structure.

- Furniture, electronics, and valuables? Add another ₹10-20 lakh depending on what you own.

Most people insure for ₹1-2 crore. That’s not enough. A 2024 survey by the Insurance Regulatory and Development Authority of India (IRDAI) found that 68% of policyholders were underinsured by at least 40%. That means if disaster strikes, you’re paying a big chunk yourself.

Use this simple formula: Reconstruction cost = Built-up area × Local construction rate per sq. ft. Then add 15-20% for fixtures, flooring, and fittings. Don’t guess. Get a contractor’s estimate. Or use online calculators from major insurers like HDFC Ergo, ICICI Lombard, or Bajaj Allianz.

The Claim Process: What Happens After Damage

When something happens-fire, burglary, storm damage-you have 24 to 48 hours to report it. Delayed claims often get rejected. Call your insurer immediately. Don’t wait until the next day. Then take photos. Lots of them. From every angle. Keep damaged items where they are until the surveyor arrives. Don’t throw anything away.

Here’s the step-by-step:

- Notify the insurer - Call their helpline or use their app. File a First Information Report (FIR) if theft or vandalism is involved.

- Submit documents - Policy copy, ID proof, ownership papers (sale deed or registry), FIR (if applicable), and photos/videos of damage.

- Surveyor visit - The insurer sends a surveyor within 48 hours. They’ll inspect the damage and estimate repair costs. You can ask for a second opinion if you disagree.

- Approval and settlement - Once approved, you’ll get the payout. For minor claims (under ₹1 lakh), it’s often direct bank transfer within 7 days. Larger claims may require repair estimates and invoices.

One owner in Chennai had his claim delayed for 11 weeks because he didn’t submit the original sale deed. He thought a photocopy was enough. It wasn’t. Always keep digital and physical copies of everything.

Common Reasons Claims Get Rejected

Claims aren’t always approved. Here’s what can go wrong:

- Not disclosing previous claims - If you’ve claimed for water damage last year and didn’t mention it, your new claim could be denied.

- Unmaintained property - If your roof was leaking for months and you ignored it, and then a storm causes major damage, the insurer can say you didn’t maintain the property.

- Overstating value - Listing a ₹5 lakh diamond necklace when it’s actually ₹1.5 lakh? That’s fraud. They’ll investigate.

- Excluded perils - Termite damage? Normal wear and tear? These are almost always excluded.

Read the fine print. Not the marketing brochure. The actual policy document. If something isn’t listed as covered, assume it’s not.

How to Lower Your Premium Without Losing Coverage

You don’t have to pay ₹15,000 a year for good coverage. Here’s how to save:

- Install security systems - Smoke detectors, burglar alarms, and CCTV can reduce premiums by 10-20%.

- Bundle with other insurance - If you have car insurance with the same company, ask about a multi-policy discount.

- Choose a higher deductible - Pay ₹10,000 out of pocket per claim instead of ₹5,000? Your annual premium drops by 15-25%.

- Renew early - Most insurers offer 10-15% discounts for early renewals.

Also, avoid insuring for more than you need. Over-insuring doesn’t mean higher payouts. You only get the actual cost of repair or replacement. Paying extra for unnecessary coverage is just throwing money away.

Top 5 Insurers for Property Insurance in India (2025)

Not all insurers are equal. Based on claim settlement ratios, customer service speed, and policy clarity, these five stand out:

| Insurer | Claim Settlement Ratio | Standard Coverage | Earthquake Add-on | Mobile App Rating |

|---|---|---|---|---|

| HDFC Ergo | 94% | Structure + Contents | Yes | 4.7/5 |

| ICICI Lombard | 92% | Structure + Contents | Yes | 4.6/5 |

| Bajaj Allianz | 90% | Structure + Contents | Yes | 4.5/5 |

| Reliance General | 89% | Structure only (add-ons available) | Yes | 4.3/5 |

| Future Generali | 88% | Structure + Contents | Yes | 4.4/5 |

HDFC Ergo leads in speed and clarity. ICICI Lombard has the best customer support. Bajaj Allianz offers the most flexible add-ons. Choose based on what matters most to you: speed, support, or customization.

What to Do After You Get Your Policy

Don’t just file it away. Do this:

- Take a video walkthrough of every room. Record serial numbers of expensive items.

- Store digital copies of your policy, deed, and inventory in the cloud (Google Drive, Dropbox).

- Update your inventory every 6 months. Bought a new TV? Added a safe? Note it down.

- Review your policy every year. Construction costs rise. Your coverage should too.

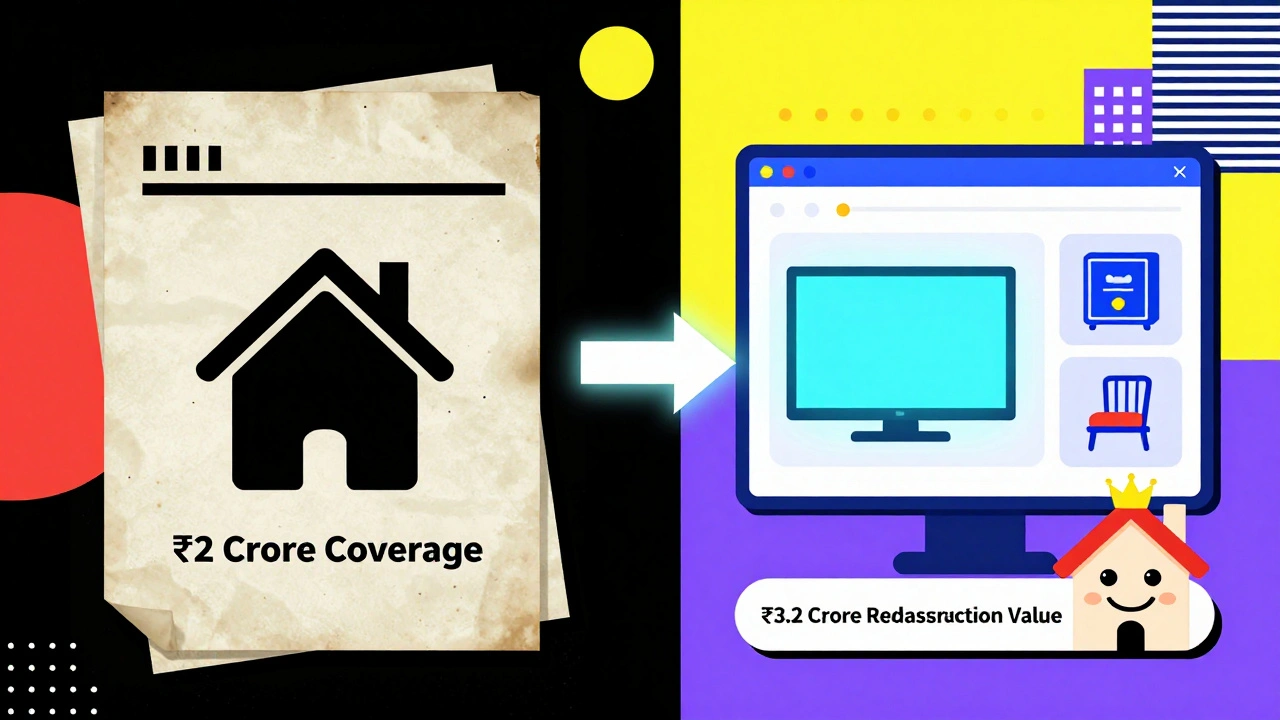

One owner in Pune didn’t update his policy for seven years. His house was worth ₹1.8 crore when he bought it. By 2025, it was worth ₹3.2 crore. He still had ₹2 crore coverage. When a fire destroyed his home, he got ₹2 crore. He lost ₹1.2 crore out of pocket.

Property insurance isn’t about fear. It’s about control. You can’t stop a storm. But you can make sure it doesn’t ruin you.

Is property insurance mandatory in India?

No, property insurance is not legally mandatory for homeowners in India. However, if you have a home loan, your bank will require you to have insurance covering the structure until the loan is fully repaid. Even if you own your home outright, skipping insurance leaves you vulnerable to massive financial loss from fire, theft, or natural disasters.

Can I insure a rented property?

Yes, but only the structure. If you’re the landlord, you can insure the building and any fixtures you own, like built-in cabinets or appliances. Tenants can buy contents insurance to cover their furniture, electronics, and personal items. Landlords cannot insure a tenant’s belongings-only the property itself.

How long does it take to get a claim payout?

For simple claims under ₹1 lakh, most insurers pay within 7 days after documents are submitted. Larger claims or those requiring repairs can take 15-30 days. Delays usually happen because of missing documents or disputes over the surveyor’s estimate. Always follow up in writing.

Does property insurance cover renovation damage?

No. If you’re doing renovations and something goes wrong-like a contractor accidentally causes a fire-the insurance won’t cover it unless the damage is from an insured peril like lightning or burglary. Renovation-related damage is considered a construction risk and needs separate contractor liability coverage.

Can I switch insurers before my policy expires?

Yes, but you’ll lose any unused premium unless you have a new policy ready. Most insurers allow you to cancel and get a pro-rata refund if you provide proof of a new policy. Never let your coverage lapse. Even a one-day gap can lead to claim denial if damage occurs during that time.