Real Estate vs Equity in India: How to Allocate Your Portfolio for Long-Term Wealth

Jan, 29 2026

Jan, 29 2026

When you’re building wealth in India over decades, two assets keep showing up in every serious conversation: real estate and equities. One is a physical thing you can touch-the house, the apartment, the plot of land. The other is a piece of paper, or a digital entry, representing ownership in a company. Both have shaped fortunes. But which one should you put more money into? And how much? There’s no single answer, but there’s a clear way to think about it.

Real Estate in India: The Traditional Anchor

For generations, Indian families have trusted real estate. It’s not just about shelter-it’s security, status, and a way to pass something tangible to the next generation. In cities like Delhi, Mumbai, or Bengaluru, a 2BHK apartment bought in 2005 for ₹30 lakh could be worth ₹1.2 crore today. That’s a 4x return over 20 years, not counting rental income.

But here’s what most people miss: returns aren’t uniform. In Tier-2 cities like Indore or Coimbatore, the same property might have doubled, not quadrupled. And in some areas, prices flatlined for years. Liquidity is another issue. Selling a property takes months. You need buyers, paperwork, legal checks, and often, a broker. Transaction costs add up-registration fees, stamp duty, brokerage-often 6% to 8% of the sale price.

Then there’s maintenance. Roof leaks, pipe bursts, tenant issues, property tax hikes. If you’re not living there, you’re paying someone to manage it. And if you’re renting it out, you’re at the mercy of rent control laws in some states, which cap how much you can charge.

Still, real estate has one unbeatable advantage: it’s hard to fake. You can’t inflate a building’s value with hype. Its worth is tied to location, demand, and infrastructure. If a metro line is coming to your neighborhood, your property will likely rise in value. That’s real, measurable growth.

Equity Investments: The Silent Wealth Multiplier

Equities-stocks and mutual funds-have outperformed real estate in India over the long term. The Nifty 50 index, which tracks the top 50 companies, delivered an average annual return of 14.5% between 2000 and 2025. That’s nearly double the average annual return of residential real estate in major cities, which hovered around 7-8% after accounting for costs and vacancies.

How? Because equities capture the growth of India’s economy. When companies like Reliance, HDFC Bank, or Tata Motors grow, their stock prices rise. When exports increase, when digital adoption surges, when manufacturing picks up-equities benefit. Real estate only benefits if that growth translates into more people needing homes or offices.

And unlike property, equities are liquid. You can sell your mutual fund units in minutes. No paperwork, no brokers, no waiting. Costs are low too-direct mutual funds charge as little as 0.25% annually. You can start with ₹500 a month through SIPs.

But equities come with volatility. In 2020, the market dropped 35% in three weeks. In 2022, inflation and rate hikes wiped out 20% of gains in six months. If you panic-sell during a downturn, you lock in losses. That’s why most people lose money in equities-not because the market is bad, but because they time it wrong.

Why You Can’t Just Pick One

Some people say, “I’m putting everything in real estate because stocks are risky.” Others say, “Real estate is dead-only stocks matter.” Both are wrong.

Real estate gives you stability. Equities give you growth. Together, they balance each other. When inflation spikes, property values rise. When interest rates go up, real estate slows down-but equities often rebound if corporate profits stay strong.

Think of it like a bicycle. Real estate is the back wheel-it keeps you steady. Equities are the front wheel-they steer you forward. If you only have one wheel, you crash.

Also, diversification isn’t just about asset types-it’s about risk exposure. Real estate is concentrated. If you own one apartment in Mumbai, your entire wealth is tied to one city, one building, one tenant. Equities spread risk across dozens of companies, sectors, and even geographies. A mutual fund holding 50 stocks isn’t hurt if one company fails.

How to Allocate: A Practical Framework

There’s no magic number. But here’s a simple, tested approach based on age and goals:

- Under 30: 70% equities, 30% real estate

- 30-45: 60% equities, 40% real estate

- 45-60: 50% equities, 50% real estate

- Over 60: 40% equities, 60% real estate

This isn’t rigid. It’s a starting point. Adjust based on your income, savings rate, and risk tolerance.

Here’s how to build it:

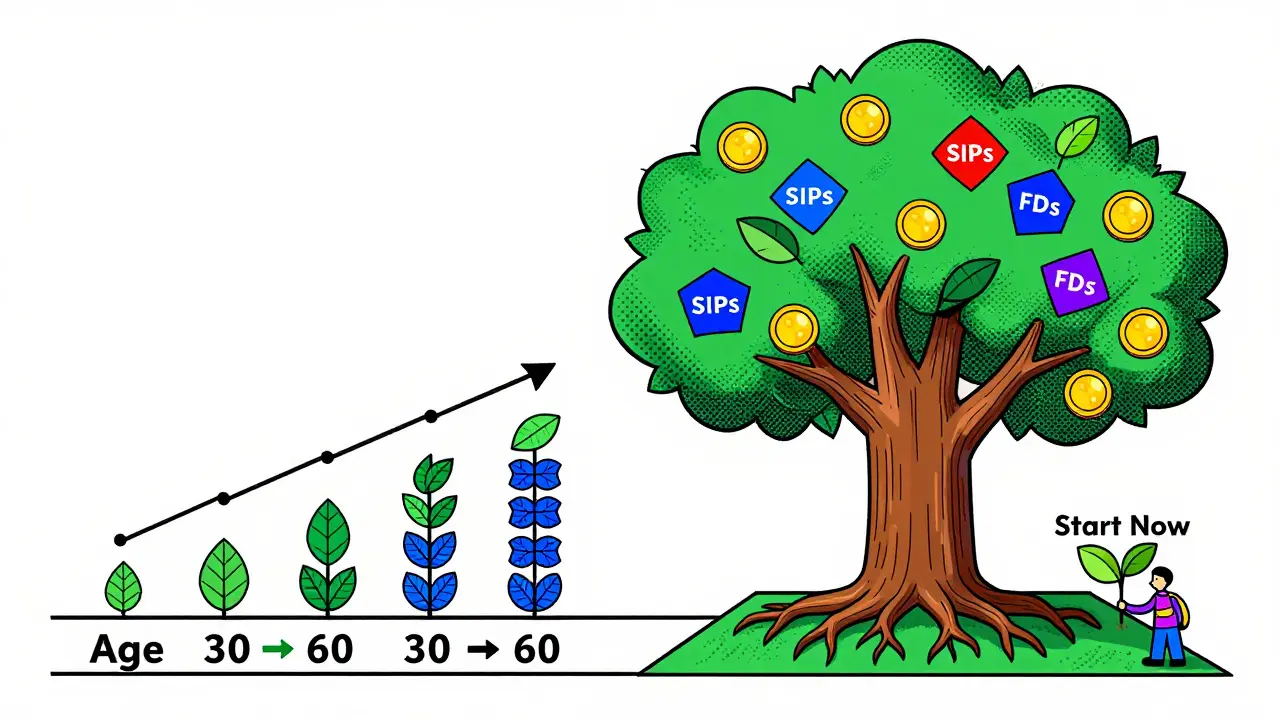

- Start with equities first. Use SIPs in index funds like Nifty 50 or Flexi-Cap funds. Aim for 10-15% of your monthly income. Let compounding work.

- Save for real estate separately. Don’t mix your emergency fund or education fund with your property down payment. Keep that money in liquid instruments like FDs or debt funds until you’re ready to buy.

- When buying property, limit it to 20-30% of your total net worth. Don’t stretch for a bigger house just because prices are rising.

- Rebalance every 3-5 years. If equities surged and now make up 80% of your portfolio, sell some and buy more property. Or vice versa.

For example: A 35-year-old engineer earning ₹15 lakh/year saves ₹50,000/month. He invests ₹30,000 in SIPs (₹15,000 in Nifty 50 index fund, ₹10,000 in flexi-cap fund, ₹5,000 in small-cap fund). He saves ₹15,000/month for 4 years to buy a flat in Pune. After purchase, he rents it out and lets the rent cover EMIs. He keeps investing in equities. In 15 years, his equity portfolio could be worth ₹3.5 crore. His property, if bought at ₹80 lakh, could be worth ₹2.5 crore. Together, that’s ₹6 crore in wealth-without touching either asset after purchase.

Common Mistakes to Avoid

People make the same errors over and over.

- Buying property for rental income alone. In most Indian cities, rental yields are 2-3%. That’s less than what a fixed deposit gives you. You’re not getting rich off rent-you’re getting rich off price appreciation. Don’t assume rent will cover your costs.

- Investing in stocks based on tips. That WhatsApp group saying “Buy XYZ stock-it’ll double in a month”? That’s gambling. Stick to funds managed by professionals with proven track records.

- Waiting for the “right time” to invest. The best time to buy equities was 10 years ago. The second best time is now. Real estate? Don’t wait for prices to drop-they rarely do in growing cities.

- Ignoring taxes. Long-term capital gains on equities (after 1 year) are taxed at 10% above ₹1 lakh. On real estate (after 2 years), it’s 20% with indexation. That indexation benefit is huge-it cuts your tax bill by 30-40% in many cases.

What About Gold, FDs, or Crypto?

Gold is a hedge, not a wealth builder. It doesn’t generate income. FDs are safe but barely beat inflation. Crypto? Too volatile, too unregulated, too speculative for long-term portfolio allocation.

Stick to the two pillars: equities and real estate. Add gold only if you want emotional comfort-no more than 5-10% of your portfolio. Keep FDs for emergencies only.

Final Thought: Wealth Is Built Slowly

The richest people in India didn’t get rich by timing the market or flipping houses. They got rich by consistently putting money into assets that grow with the economy-and letting time do the heavy lifting.

Real estate gives you roots. Equities give you wings. You don’t have to choose one. Build both. Start small. Stay consistent. Don’t chase trends. Let your portfolio grow quietly, steadily, over decades.

That’s how real wealth is made in India.

Should I buy property or invest in stocks first?

Start with equities if you’re under 35 and have no major liabilities. Stocks are more liquid, require smaller amounts to start, and historically deliver higher returns. Use SIPs to build discipline. Buy property when you have a stable income, a down payment saved, and a clear need-like settling in a city where you’ll live long-term. Don’t rush into property just because others are buying.

Can I rely only on real estate for retirement?

It’s risky. Real estate doesn’t generate regular income unless rented out, and rental yields in India are low. You also face maintenance, vacancy, and legal risks. Plus, selling property to fund retirement can be slow and costly. A balanced portfolio with equities gives you liquid, growing assets you can withdraw from safely. Real estate should be part of your retirement plan-not the whole plan.

Is it better to invest in commercial or residential real estate?

Commercial properties-offices, retail spaces-offer higher rental yields (5-7%) but come with longer vacancies and higher entry costs. Residential is more stable, easier to rent, and has broader demand. For beginners, start with residential. If you have experience and capital, add commercial as a secondary asset. Avoid speculative commercial projects in unproven locations.

How much of my income should I save for investments?

Aim for 20-30% of your take-home income. If you earn ₹1 lakh/month, save ₹20,000-30,000. Split it between equities (60-70%) and real estate savings (30-40%). This ensures you’re building wealth without sacrificing your lifestyle. The key isn’t how much you earn-it’s how much you consistently save and invest.

What happens if the real estate market crashes?

Real estate doesn’t crash like stocks-it corrects slowly. Prices may stagnate for 3-5 years, but they rarely collapse unless there’s a major economic crisis. If you’re buying for long-term use or rental income, short-term dips don’t matter. Your equity portfolio will likely recover faster, helping balance your overall wealth. Don’t panic. Hold. Rebalance later.