Residential vs Commercial Property Investment in India: Which Gives Better Returns?

Dec, 29 2025

Dec, 29 2025

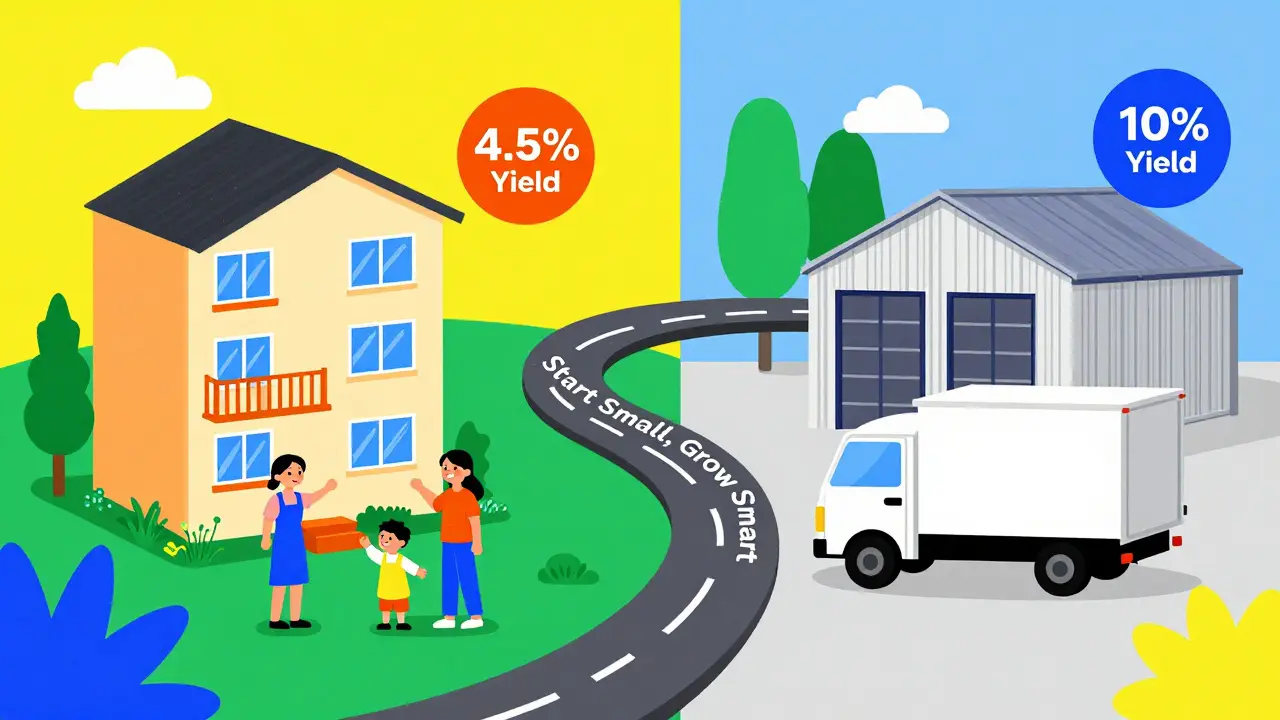

When you think about investing in property in India, two paths quickly come up: residential or commercial. One feels safe-families need homes. The other feels profitable-businesses need space. But which one actually gives you more money over time? The answer isn’t simple. It depends on your goals, your risk tolerance, and where you’re putting your money.

Residential Property: Steady, But Slower

Residential property in India is the default choice for most first-time investors. Why? Because it’s familiar. Everyone understands renting out a flat or house. In cities like Bangalore, Hyderabad, or Pune, you can buy a 2BHK apartment for ₹40-60 lakh and rent it out for ₹15,000-₹25,000 a month. That’s a gross yield of 4.5% to 6% annually-solid, but not flashy.

The big advantage? Demand doesn’t vanish. People always need a place to live. Even during economic slowdowns, residential rentals hold up better than offices or retail spaces. In 2024, residential rental occupancy rates in Tier-1 cities stayed above 92%, according to Knight Frank’s India Report. That’s stability.

But here’s the catch: appreciation is slow. Over the last five years, residential prices in most Indian cities rose 3-5% per year after inflation. That’s barely better than bank fixed deposits. And you’re stuck with maintenance, tenant turnover, and repair costs. A leaking pipe or broken AC can eat up a month’s rent before you know it.

Also, selling residential property takes time. Buyers are emotional. They want to see the neighborhood, check the school zones, compare layouts. It’s not a quick flip. If you need cash fast, residential won’t help.

Commercial Property: Higher Risk, Higher Reward

Commercial property-offices, retail shops, warehouses-offers something residential can’t: higher yields. In prime locations like Delhi’s Connaught Place, Mumbai’s Bandra Kurla Complex, or Hyderabad’s HITEC City, you can get rental yields of 7% to 10%. Some well-located retail spaces in Tier-2 cities like Indore or Ahmedabad are hitting 11%.

Why? Because businesses pay more. A 1,000 sq.ft. office space might rent for ₹80-1,200 per sq.ft. annually. That’s ₹8-12 lakh a year in rent. Compare that to a 1,200 sq.ft. home renting for ₹20,000/month-₹2.4 lakh. The commercial unit earns five times more, even if it’s smaller.

Longer leases help too. Commercial tenants often sign 3-5 year contracts. That means less vacancy risk and fewer turnovers. You don’t need to re-advertise every year. You get predictable income.

But here’s the flip side: one bad tenant can sink you. If a company shuts down or moves out, your space could sit empty for 6-12 months. And finding a new tenant isn’t easy. You need to convince a business that your building has good connectivity, parking, and security. That’s not just about location-it’s about infrastructure.

Also, commercial properties cost more upfront. A small retail unit in a good mall might cost ₹1.5-2.5 crore. That’s three to five times the price of a residential flat. You need serious capital. And if you’re financing it, banks are stricter. They want higher down payments-often 40-50%-and proof of tenant income.

Location Matters More Than Type

It’s easy to think commercial is always better. But that’s not true. A commercial space in a dying town? Worthless. A residential flat in a growing satellite city? Gold.

Look at Noida Extension. Five years ago, it was quiet. Now, it’s home to thousands of young professionals working in Delhi. Residential demand exploded. Apartments that sold for ₹50 lakh in 2020 now go for ₹90 lakh. Rental yields jumped from 4% to 6.5%.

Meanwhile, some commercial buildings in older parts of Pune are sitting empty. Offices built during the 2015 boom now have 30% vacancy rates. Companies moved to co-working spaces or remote setups. The space is still there-but no one wants it.

The lesson? Don’t pick a property type first. Pick a location with strong job growth, good transport, and rising population. Then see what kind of property fits best.

Tax and Legal Differences

Here’s where things get technical, but you need to know this.

Residential rentals are taxed under ‘Income from House Property’. You get a standard 30% deduction for maintenance, and you can claim interest on home loans. If you’re in the 30% tax bracket, that reduces your taxable income significantly.

Commercial rentals fall under ‘Income from Business or Profession’. No automatic 30% deduction. You can only claim actual expenses-repairs, insurance, property tax, management fees. But you can also depreciate the building at 5% per year, which helps.

Capital gains tax is the same for both: 20% with indexation if held over two years. But here’s the kicker: if you sell a residential property and buy another residential one within two years, you can defer capital gains tax. No such rule for commercial. Sell a shop, and you pay the tax-even if you buy another shop.

Also, property registration charges are higher for commercial. In Maharashtra, residential registration is 5% of market value. Commercial is 6%. In Karnataka, it’s 5.6% vs 6.5%. Small difference? Maybe. But on a ₹2 crore property, that’s ₹1.8 lakh extra.

Who Should Invest in What?

Let’s cut through the noise. Who wins?

If you’re a beginner with ₹50-80 lakh to invest, and you want steady, low-stress income-go residential. You can manage it yourself. You’ll sleep better. You’ll get used to being a landlord. It’s a solid foundation.

If you have ₹1.5 crore or more, you’re comfortable with longer vacancy periods, and you’re okay with dealing with corporate tenants-commercial could be your path. The returns are higher, and the leases are longer. But you need to treat it like a business, not a passive investment.

Some investors split the difference. Buy one residential property for stability. Use the rental income to fund a commercial unit later. That way, you get the best of both: safety and growth.

The Hidden Costs No One Talks About

Residential: You’ll spend ₹5,000-₹15,000 a year on repairs, cleaning, and tenant screening. You’ll deal with noisy neighbors, late rent, and broken geysers. Tenants don’t always pay on time.

Commercial: You’ll spend ₹1-2 lakh a year on maintenance for elevators, AC systems, fire safety, and security. You’ll need a property manager. You’ll spend months negotiating leases. One legal dispute with a tenant can drag on for years.

Both require time. Neither is truly passive. The myth of ‘buy and forget’ is dangerous. Real estate is a job.

2025 Outlook: What’s Changing?

India’s commercial real estate is being reshaped by three trends:

- Warehousing boom: E-commerce is pushing demand for logistics hubs. Cities like Chennai, Ahmedabad, and Jaipur are seeing 8-12% rental growth in warehouses.

- Co-working spaces: Startups and SMEs prefer flexible leases. Traditional offices are losing appeal unless they’re modern and tech-ready.

- Hybrid work: Companies need less office space. But they still need some. Demand is shifting from large towers to smaller, well-located units.

On the residential side:

- Suburban growth: People are moving out of city centers. Properties in Gurgaon’s Sector 87, Noida’s Sector 150, or Bangalore’s Sarjapur Road are seeing 10-15% annual price growth.

- Government housing schemes: PMAY (Pradhan Mantri Awas Yojana) is pushing affordable housing. Demand is strong in Tier-2 cities like Lucknow, Bhopal, and Coimbatore.

- Foreign buyers: NRIs are returning. They’re buying in cities with strong Indian diaspora networks-Chennai, Hyderabad, Pune.

Final Decision: It’s Not Either/Or

There’s no single ‘better’ option. Residential is reliable. Commercial is powerful. The smart investor doesn’t choose one. They build a mix.

Start with residential to learn the ropes. Use the cash flow to grow. Then, when you’re ready, add one commercial asset-maybe a small retail shop in a growing neighborhood or a warehouse near a highway. That’s how you balance risk and reward.

Property in India isn’t a lottery ticket. It’s a long game. The winners aren’t the ones chasing the highest yield. They’re the ones who understand the market, manage their costs, and stay patient.

Is residential property a good investment in India right now?

Yes, if you’re looking for stable, long-term growth with lower risk. Residential property in growing suburbs of Tier-1 cities and Tier-2 cities like Coimbatore, Lucknow, or Indore is seeing strong demand. Rental yields range from 4% to 7%, and prices are rising steadily due to urban migration and government housing schemes. It’s ideal for beginners or those seeking passive income.

Can commercial property give me higher returns than residential?

Yes, but with higher risk. Commercial properties in prime locations can yield 7% to 11% annually, compared to 4%-6% for residential. However, vacancies can last 6-12 months, maintenance costs are higher, and you need more capital upfront. It’s better suited for experienced investors who can handle tenant negotiations and property management.

What’s the minimum budget to invest in commercial property in India?

You’ll need at least ₹1.2-1.5 crore for a small retail shop or office in a Tier-1 city. In Tier-2 cities like Pune or Ahmedabad, you might find units starting at ₹80 lakh, but they’ll be in less central areas. Warehousing units near logistics hubs can be bought for ₹1 crore in places like Chennai or Jaipur. Always factor in registration fees, legal checks, and renovation costs.

Which is easier to rent out: residential or commercial?

Residential is easier. Finding tenants is faster because demand is constant. Commercial tenants require more vetting-you need to check their business stability, credit history, and lease duration. A single commercial vacancy can mean months of lost income. Residential turnover is quicker, but more frequent.

Should I buy property in a Tier-1 or Tier-2 city?

It depends on your goal. Tier-1 cities like Mumbai or Delhi offer liquidity and higher rental yields but come with higher prices and more competition. Tier-2 cities like Surat, Indore, or Coimbatore offer better price-to-rent ratios and faster appreciation due to infrastructure growth. If you’re starting out, Tier-2 cities give more room for growth with less upfront cost.