Rupee Cost Averaging in India: Why SIPs Work for Long-Term Investing

Dec, 30 2025

Dec, 30 2025

Every month, millions of Indians quietly invest small amounts into mutual funds through SIPs. Not because they’re financial experts, but because it’s simple, stress-free, and works - even when the market crashes. If you’ve ever wondered why SIPs keep growing in popularity across tier-2 and tier-3 cities in India, the answer isn’t hype. It’s math. And it’s called rupee cost averaging.

What is rupee cost averaging, really?

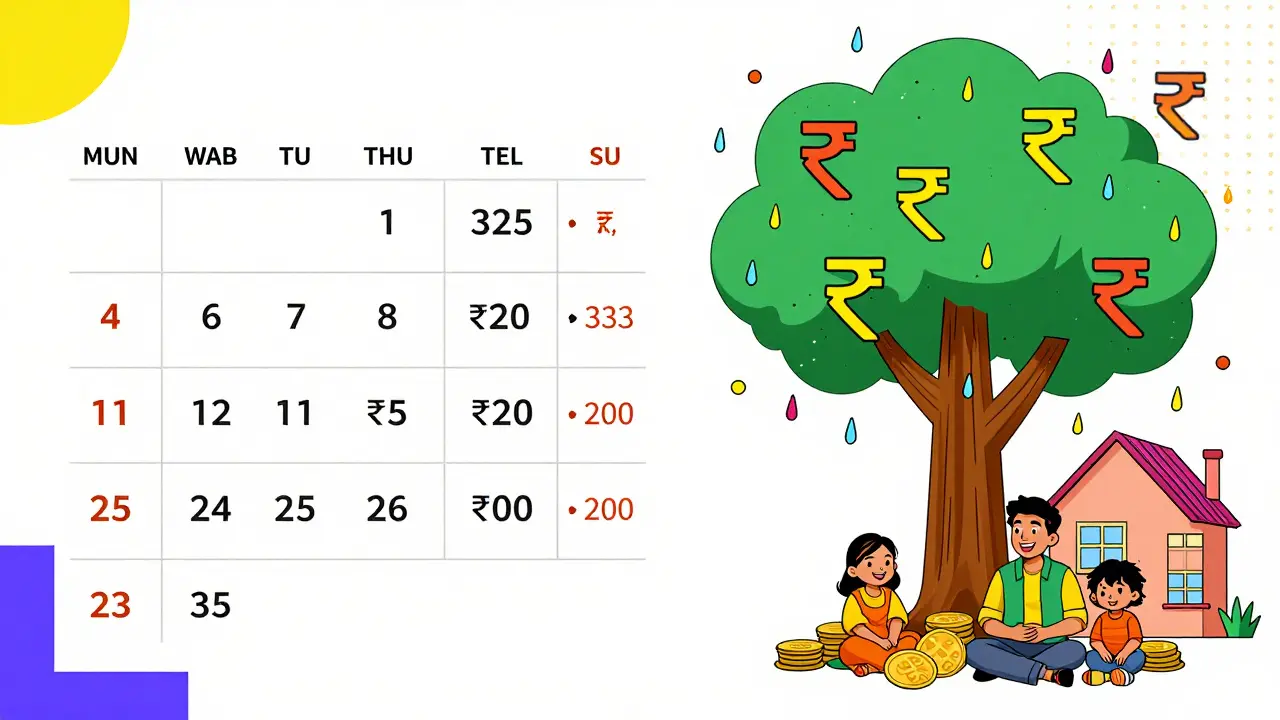

Rupee cost averaging isn’t a fancy investment trick. It’s just buying the same amount of something every month, no matter if prices are high or low. Imagine you buy ₹5,000 worth of a mutual fund every month. When the NAV (net asset value) is ₹20, you get 250 units. When it drops to ₹15, you get 333 units. When it jumps to ₹25, you get only 200 units. Over time, your average cost per unit comes down - even if the price swings wildly.This isn’t theory. In 2020, when the Nifty 50 dropped 37% in March, SIP investors kept buying. By December, those who stuck with it were up 18%. Why? Because they bought more units when prices were low. That’s rupee cost averaging in action.

Why SIPs are perfect for Indian investors

Most Indians don’t have large lump sums to invest. Salaries come monthly. Expenses eat up the rest. SIPs match that rhythm. You don’t need to time the market. You don’t need to watch charts all day. You just set up an auto-debit and forget it.Compare that to trying to invest ₹1 lakh all at once. What if you put it in right before a crash? You’d feel stuck. With SIPs, you spread the risk. Every month, you’re buying at a different price. Over 5-10 years, that smooths out the highs and lows.

A 2023 SEBI report showed that over 70% of SIP investors in India stay invested for more than 3 years. That’s the sweet spot. Shorter than that, and you’re just gambling. Longer than that, and compounding starts doing the heavy lifting.

How SIPs beat lump-sum investing - in real numbers

Let’s say you want to invest ₹6 lakh over 5 years. You could dump it all in January 2021. Or you could invest ₹10,000 every month.In 2021, the Nifty 50 started at 13,800. By end of 2025, it hit 22,500. If you’d invested ₹6 lakh all at once in Jan 2021, you’d have earned about 63% returns.

But if you’d used SIPs - ₹10,000 every month for 60 months - you’d have invested the same ₹6 lakh. Your average cost per unit was lower because you bought during dips in 2022 and 2023. Your final value? ₹9.8 lakh. That’s 63% returns - but with far less stress.

Here’s the kicker: in volatile markets, SIPs often beat lump-sum investing. A 2024 study by Value Research found that over 10-year periods, SIPs outperformed lump-sum investments in 68% of cases in India. Why? Because markets don’t move in straight lines. They zigzag. SIPs ride the waves.

What SIPs can’t do - and what you should know

Rupee cost averaging isn’t magic. It won’t turn ₹5,000 a month into a crore overnight. It also doesn’t protect you from bad funds.If you pick a mutual fund with high expense ratios, poor management, or a track record of underperformance, SIPs will just make you lose money slowly. That’s why fund selection matters more than the SIP itself.

Look for funds with:

- Consistent returns over 5+ years (not just 1-year spikes)

- Low expense ratio (under 1.5% for equity funds)

- Large AUM (assets under management) - above ₹5,000 crore

- Top quartile performance in its category

Don’t chase last year’s winner. A fund that was #1 in 2023 might be in the bottom half by 2025. Stick to consistency.

Real people, real results

Take Priya, a school teacher in Pune. She started SIPs in 2019 with ₹3,000/month in a large-cap fund. In 2022, her salary didn’t increase. She kept investing ₹3,000 - even when her bonus was cut. By 2025, she had ₹3.1 lakh invested. Her portfolio was worth ₹5.8 lakh. She didn’t make a single trade. She didn’t panic in 2020 or 2022. She just kept going.Or Arjun, a delivery rider in Hyderabad. He started with ₹1,500/month in a balanced fund. He didn’t know what an NFO was. He just clicked ‘invest’ on his phone every month. In 2025, he bought his first bike outright - with gains from his SIP. He didn’t win the lottery. He just used time and discipline.

How to start a SIP in India - step by step

You don’t need a broker. You don’t need to visit a bank. Here’s how to begin:- Choose a fund house: HDFC, ICICI Prudential, Axis, SBI, or Kotak - all are reliable.

- Sign up on their app or website. KYC takes 10 minutes if you have Aadhaar and PAN.

- Select a fund: Start with a large-cap or flexi-cap fund. Avoid sectoral or thematic funds as a beginner.

- Set your SIP amount: ₹500 is enough to start. Many apps let you invest as low as ₹100.

- Choose the date: Pick a day after your salary hits - say, the 5th or 10th.

- Link your bank account: Use UPI or NEFT. No need for cheques.

- Press ‘Start SIP’ and forget it.

Set a reminder to review your SIP once a year. If the fund’s performance drops below its category average for two years straight, switch. Otherwise, leave it alone.

Common mistakes to avoid

Most people who fail with SIPs don’t fail because the system doesn’t work. They fail because they break the rules.- Stopping SIPs during market dips - That’s when you need it most. Don’t pause. Double down if you can.

- Chasing returns - If your fund jumped 30% last year, don’t assume it’ll do it again. Stick to your plan.

- Investing in too many funds - 2-3 SIPs are enough. Ten funds just mean more paperwork and diluted returns.

- Ignoring taxes - Equity mutual funds held over 1 year are taxed at 10% on gains above ₹1 lakh. Plan for it.

- Not increasing SIPs over time - When you get a raise, increase your SIP by 10-20%. Small boosts compound big over time.

What comes after SIPs?

SIPs are the foundation, not the finish line. Once you’ve built a habit and your portfolio grows, you can add:- Index funds for lower costs

- Debt funds for stability as you near retirement

- ELSS funds for tax savings under Section 80C

But don’t rush. Most people who become wealthy through mutual funds didn’t find the perfect fund. They just kept investing, year after year, through good markets and bad.

Final thought: It’s not about timing. It’s about showing up.

The stock market doesn’t reward the smartest investor. It rewards the most consistent one. You don’t need to predict the next crash. You don’t need to know when to buy low. You just need to keep buying - every month, no matter what.Rupee cost averaging works because it removes emotion from investing. It turns investing from a stressful guess into a quiet, reliable habit. And in India, where income is unpredictable and expenses are high, that’s the real superpower.

Is SIP better than FD for long-term investing?

Yes, for long-term goals like retirement or buying a house, SIPs in equity mutual funds almost always outperform fixed deposits. FDs give you 6-7% returns, but SIPs in well-chosen funds have returned 12-15% annually over the last 15 years. The difference isn’t just in returns - it’s in beating inflation. FDs protect your money. SIPs grow it.

Can I start a SIP with ₹500?

Absolutely. Most fund houses allow SIPs starting at ₹500. Some apps like Groww, Zerodha Coin, or Paytm Money let you start with ₹100. The key isn’t the amount - it’s consistency. Even ₹500 a month for 20 years can grow to over ₹4 lakh with 12% annual returns.

Do I need to pay taxes on SIP gains?

Yes, but only if you sell. For equity mutual funds, if you hold for more than 1 year, you pay 10% tax on profits above ₹1 lakh in a financial year. If you hold less than a year, it’s taxed at your income tax slab rate. You don’t pay tax on the SIP itself - only on withdrawals.

Should I stop SIPs during a market crash?

Never. Market crashes are when SIPs work best. You’re buying more units at lower prices. History shows that investors who kept investing during 2008, 2020, and 2022 ended up with higher returns than those who paused. Stopping during a crash is like stopping your workout because you’re tired - you undo all the progress.

How long should I stay invested in SIPs?

At least 5-7 years. Shorter than that, and you’re exposed to market volatility. Seven years gives time for compounding and market cycles to even out. For retirement or children’s education, aim for 10-15 years. The longer you stay, the less you need to worry about timing.