SCSS vs PMVVY in India: Which Senior Citizen Income Scheme Should You Choose?

Jan, 14 2026

Jan, 14 2026

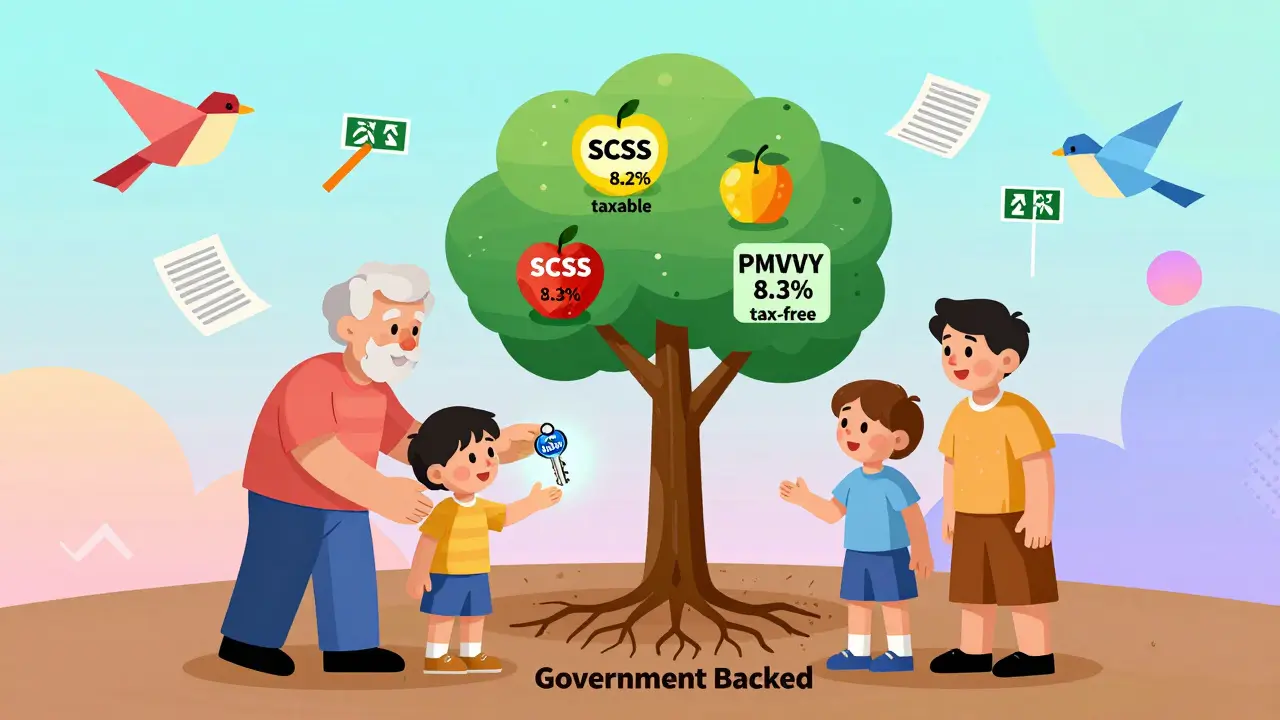

If you're a senior citizen in India or helping a parent plan for retirement, you've probably heard of SCSS and PMVVY. Both promise regular income and safety-but they’re not the same. Choosing the wrong one could cost you thousands in lost returns or flexibility. Let’s cut through the confusion and show you exactly how these two government-backed schemes compare, so you can pick the one that fits your life.

What Is SCSS?

SCSS stands for Senior Citizens Savings Scheme. It’s run by the Ministry of Finance and offered through post offices and authorized banks like SBI, HDFC, and ICICI. You can open an account if you’re 60 or older. If you’re 55 to 59 and retired under a voluntary scheme, you’re eligible too.

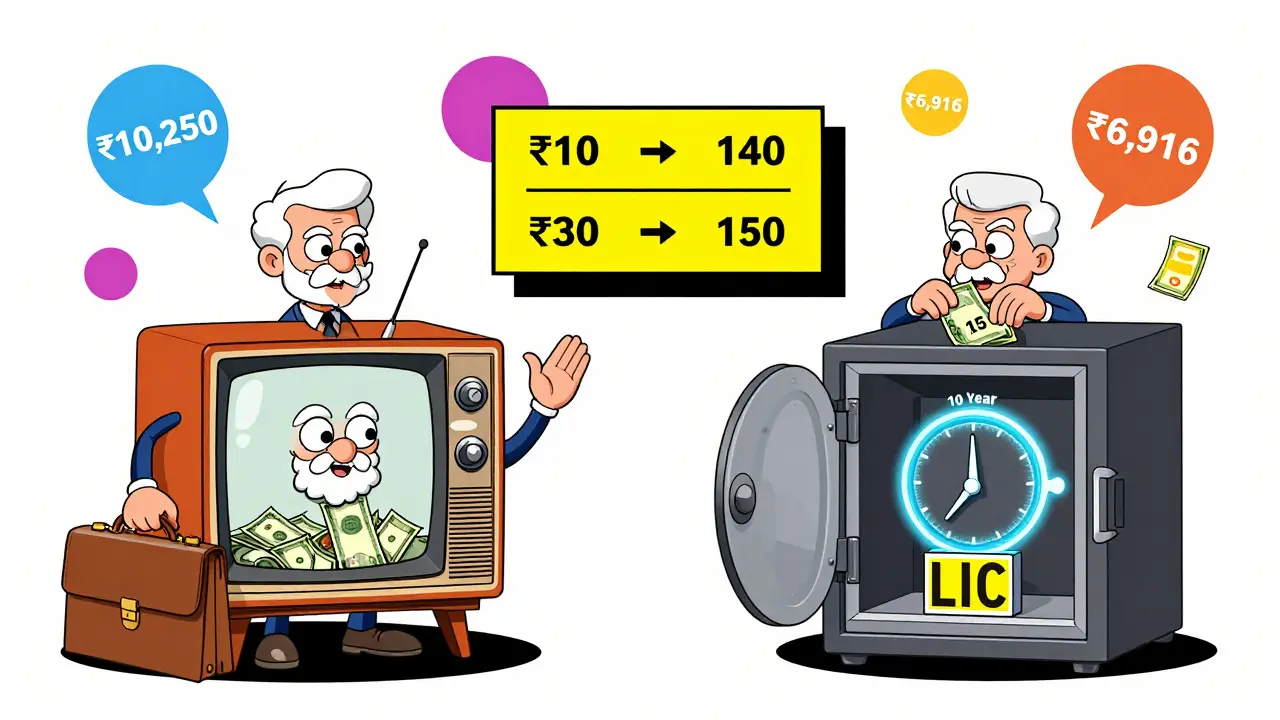

The minimum deposit is ₹1,000, and you can put in up to ₹30 lakh in a single account. Joint accounts are allowed, but only with your spouse. The interest rate is revised every quarter by the government. As of January 2026, it’s 8.2% per year, paid monthly. That means if you deposit ₹15 lakh, you get around ₹10,250 every month.

SCSS has a five-year term, but you can extend it for another three years after maturity. It’s fully backed by the government, so your money is safe. You can also claim tax deductions under Section 80C-up to ₹1.5 lakh per year. But here’s the catch: interest earned is taxable. You’ll need to pay income tax on it, even though the principal is safe.

What Is PMVVY?

PMVVY stands for Pradhan Mantri Vaya Vandana Yojana. It’s managed by Life Insurance Corporation of India (LIC). Launched in 2017 and extended till 2027, this scheme is designed specifically for seniors who want guaranteed monthly income without worrying about market swings.

You can invest between ₹1.5 lakh and ₹15 lakh. The interest rate is fixed for the entire 10-year term. As of 2026, it’s 8.3% per year, paid monthly. So if you invest ₹10 lakh, you get ₹6,916 every month. The best part? The entire monthly payout is tax-free. No TDS. No income tax. That’s rare for any fixed-income product in India.

Unlike SCSS, PMVVY doesn’t let you extend the term. After 10 years, you get your full principal back. No partial withdrawals. No loans. But you can exit early in emergencies-like if you’re diagnosed with a critical illness-by surrendering the policy and getting 98% of your investment back.

SCSS vs PMVVY: Key Differences at a Glance

| Feature | SCSS | PMVVY |

|---|---|---|

| Maximum Investment | ₹30 lakh | ₹15 lakh |

| Interest Rate (2026) | 8.2% (quarterly revised) | 8.3% (fixed for 10 years) |

| Interest Payment | Monthly | Monthly |

| Term | 5 years (extendable by 3) | 10 years (non-renewable) |

| Tax on Interest | Taxable | Tax-free |

| Principal Return | Yes, at maturity | Yes, after 10 years |

| Early Withdrawal | Penalty after 1 year | Allowed for critical illness (98% refund) |

| Section 80C Benefit | Yes, up to ₹1.5 lakh | No |

| Eligibility Age | 60+ (55+ if retired) | 60+ |

Who Should Pick SCSS?

Choose SCSS if you need more flexibility and higher investment limits. If you have ₹20-30 lakh to invest and want the option to renew after five years, SCSS gives you breathing room. It’s also better if you’re still working part-time or have other income sources and want to reduce your taxable income through Section 80C.

Let’s say you’re 62, retired, and have ₹25 lakh saved. You invest it all in SCSS. You get ₹17,083 monthly. You claim ₹1.5 lakh deduction under 80C, lowering your tax burden. Even though you pay tax on the interest, your overall cash flow stays strong. And if interest rates go up next quarter, your payout increases too.

But if you’re worried about rates falling? That’s the risk. SCSS rates change every three months. In 2023, they were at 7.4%. In 2025, they jumped to 8.2%. You can’t lock in a rate forever.

Who Should Pick PMVVY?

PMVVY is ideal if you want peace of mind. If you’re 65+, don’t want to deal with changing rates, and want every rupee of your monthly income to be tax-free, this is your best bet. It’s also perfect if you’re relying solely on this income-no pensions, no other savings.

Imagine you’re 68, living on a fixed budget. You invest ₹10 lakh in PMVVY. You get ₹6,916 every month, forever, for 10 years. No tax. No surprises. Even if inflation rises, your payout doesn’t shrink. And when the 10 years are up? You get your ₹10 lakh back. That’s rare. Most fixed deposits don’t return your principal in full.

PMVVY’s biggest weakness? You can’t invest more than ₹15 lakh. If you have more than that, you’ll need to split your money between PMVVY and another option. Also, if you need access to cash before 10 years, your options are limited-only critical illness qualifies for early exit.

Can You Use Both?

Yes. Many seniors use both. For example: invest ₹15 lakh in PMVVY for tax-free monthly income, and put another ₹10 lakh in SCSS for higher flexibility and Section 80C benefits. This gives you a total monthly income of around ₹17,000, with half of it tax-free.

This combo works well if you have a moderate corpus and want to hedge against both tax and rate risks. You get the safety of government backing on both, and you spread your exposure. Just make sure you don’t exceed the ₹30 lakh limit in SCSS across all accounts.

What Happens If You Die Before Maturity?

With SCSS, your nominee gets the remaining balance. No penalty. No delay. The account closes, and the money goes to your heir.

With PMVVY, your nominee gets the full invested amount back. Even if you’ve received only 3 years of payouts, your family still gets ₹15 lakh (if you invested the maximum). That’s a strong safety net.

Common Mistakes to Avoid

- Investing more than ₹30 lakh in SCSS. Excess amount won’t earn interest.

- Assuming PMVVY is renewable. It’s not. After 10 years, you’re done unless you reapply-new rates apply.

- Ignoring tax implications. SCSS interest is taxable. Don’t forget to file returns.

- Waiting too long to apply. Both schemes require ID proof, address proof, and PAN. Get documents ready early.

- Thinking these replace health insurance. They don’t. Always keep a separate medical plan.

Real-Life Scenario: Two Seniors, Two Choices

Mr. Sharma, 70, has ₹18 lakh. He’s healthy, lives with his son, and doesn’t need immediate access to cash. He puts ₹15 lakh in PMVVY and ₹3 lakh in SCSS. His monthly income: ₹10,875 tax-free + ₹2,050 taxable = ₹12,925 total. He sleeps well knowing his principal is safe and his income won’t vanish.

Mrs. Rao, 63, has ₹25 lakh. She’s active, travels often, and wants to reduce her tax bill. She invests ₹30 lakh in SCSS (max limit). She gets ₹20,500 monthly, claims ₹1.5 lakh under 80C, and pays only a small amount of tax. She plans to renew after five years and may shift to PMVVY later.

Both made smart choices. Neither followed a template. They matched their choices to their needs.

Final Decision Checklist

- Do you have more than ₹15 lakh to invest? → SCSS gives you higher limits.

- Do you want tax-free monthly income? → PMVVY wins.

- Are you okay with changing interest rates? → SCSS is fine.

- Do you need to lock in a rate for 10 years? → PMVVY is better.

- Do you want to reduce taxable income now? → SCSS lets you claim 80C.

- Are you worried about inflation? → Neither scheme adjusts for inflation. Consider adding a small SIP in balanced funds.

There’s no single best option. Only the best option for you. If you’re still unsure, visit your nearest post office or LIC branch. Bring your documents. Ask for a printed projection. Compare the numbers on paper. Don’t rely on memory.

Retirement isn’t about picking the highest rate. It’s about picking the most reliable income that fits your life. SCSS and PMVVY are both excellent tools. Just use them the right way.

Is SCSS better than PMVVY for senior citizens?

Neither is universally better. SCSS offers higher investment limits and tax deductions under Section 80C, but the interest is taxable. PMVVY offers tax-free monthly income and a fixed 10-year term, but caps investment at ₹15 lakh. Choose SCSS if you want flexibility and tax savings. Choose PMVVY if you want guaranteed, tax-free income.

Can I invest in both SCSS and PMVVY at the same time?

Yes. You can invest up to ₹30 lakh in SCSS and up to ₹15 lakh in PMVVY simultaneously. Many seniors use this combo to balance tax benefits and guaranteed income. Just ensure your total SCSS deposits across all accounts don’t exceed ₹30 lakh.

What happens to SCSS if interest rates fall?

If interest rates fall, your SCSS payout drops when you renew after five years. But while your account is active, the rate stays locked in until maturity. You can’t change it mid-term. That’s why some seniors prefer PMVVY’s fixed 10-year rate to avoid rate volatility.

Is PMVVY risk-free?

Yes. PMVVY is backed by the Government of India through LIC. Your principal is 100% safe. The only risk is that you can’t access your money before 10 years unless you have a critical illness. But your investment won’t lose value.

Can I withdraw money from SCSS before 5 years?

Yes, but only after one year, and you’ll lose 1.5% of the deposit as penalty. After two years, the penalty drops to 1%. After three years, you can close without penalty. But you’ll lose the interest for the remaining term. It’s best to treat SCSS as a long-term commitment.

Is the interest from SCSS taxable?

Yes. The monthly interest from SCSS is fully taxable as income. You must include it in your annual income tax return. However, you can claim a deduction of up to ₹1.5 lakh under Section 80C for the principal amount invested.

Can I transfer my SCSS account to another bank?

Yes. SCSS accounts can be transferred between authorized banks and post offices without penalty. Just submit a transfer request form and provide proof of identity. Your interest rate and term remain unchanged.

What documents do I need to open SCSS or PMVVY?

You need your Aadhaar card, PAN card, proof of age (birth certificate or passport), and a recent photograph. For PMVVY, you’ll also need a completed application form from LIC. Banks and post offices usually provide these forms on-site.