Section 80C Documentation Checklist in India: Proofs Required at Filing Time

Dec, 14 2025

Dec, 14 2025

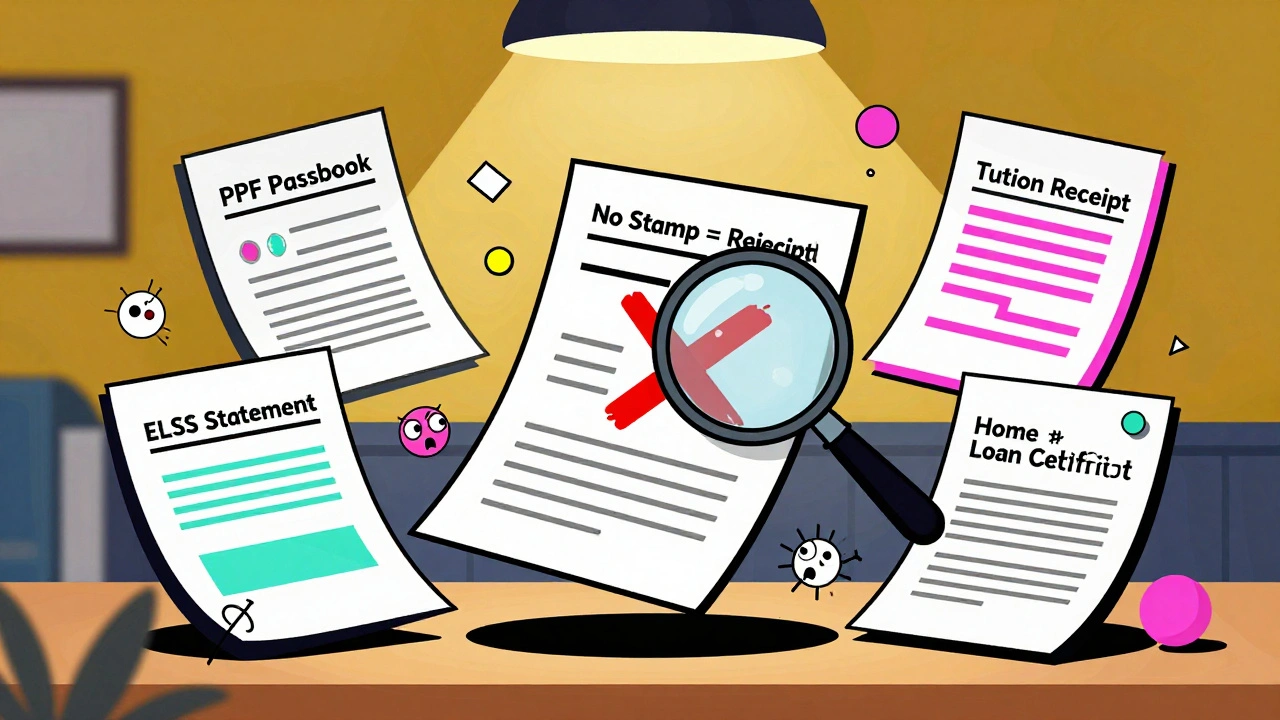

When you file your income tax return in India, claiming deductions under Section 80C can cut your taxable income by up to ₹1.5 lakh. But if you don’t have the right papers ready, your claim gets rejected - no second chances. It’s not about guessing what’s accepted. It’s about having the exact documents the Income Tax Department asks for. This isn’t a suggestion. It’s a rule.

What Section 80C Actually Covers

Section 80C lets you reduce your taxable income by investing in specific instruments. It’s not just about fixed deposits or life insurance. It includes tuition fees, home loan principal payments, EPF contributions, NSC, PPF, and even Sukanya Samriddhi accounts. Each of these has its own proof requirement. You can’t just say, ‘I paid for my kid’s school.’ You need a receipt with the school’s stamp, the student’s name, and the exact amount paid.

The limit is ₹1.5 lakh per financial year, and you can split it across multiple options. But here’s the catch: the total of all your claims must not cross that number. If you invest ₹80,000 in PPF and ₹90,000 in LIC, you’re over by ₹20,000. That extra amount won’t be allowed. You’ll pay tax on it. Simple as that.

Documents You Must Keep for Each 80C Investment

Not all proofs are the same. What works for one investment won’t work for another. Here’s what you need for each major 80C option:

- Public Provident Fund (PPF): Passbook or statement showing annual deposits. If you deposited via net banking, keep the transaction receipt. The bank or post office must stamp the passbook with your name and account number.

- Employee Provident Fund (EPF): Your Form 16 from your employer will list your EPF contribution. If you made extra voluntary contributions, you need a certificate from your employer or EPFO portal printout with your UAN.

- Life Insurance Premiums: Policy number, premium receipt with insurer’s seal, and the policyholder’s name. If you paid via UPI, save the screenshot with transaction ID and date.

- Home Loan Principal Repayment: Bank statement showing principal payments (not interest), a certificate from your lender, and your loan agreement. The bank must clearly mark which part of your EMI went to principal.

- Tuition Fees: Receipts from recognized schools or universities. Must include child’s name, course, fee amount, and institution stamp. No handwritten notes. No receipts without the school’s official seal.

- National Savings Certificate (NSC): Certificate of purchase issued by post office. If you bought it online, download the e-certificate from India Post’s portal.

- Sukanya Samriddhi Yojana (SSY): Passbook from the post office or bank where the account is held. Deposits must be made in the girl’s name, and the account must be opened before she turns 10.

- Fixed Deposits (5-year tenure): FD receipt with tenure clearly marked as 5 years. Banks sometimes label these as ‘Tax Saving FDs’ - make sure yours says ‘Section 80C’ on the receipt.

- Equity-Linked Savings Scheme (ELSS): Mutual fund statement showing purchase date, units, and amount. The fund must be registered as an ELSS under Section 80C. Check the fund’s fact sheet to confirm.

Common Mistakes That Get Your Claim Rejected

People lose out on ₹1.5 lakh in deductions every year because of simple errors. Here’s what goes wrong most often:

- Using interest receipts instead of principal receipts. If you paid ₹1.2 lakh in EMI, but ₹90,000 was interest, only ₹30,000 counts. Your bank’s statement must separate principal from interest.

- Missing official stamps. Handwritten receipts, WhatsApp screenshots, or unverified PDFs won’t fly. The document must come from the institution - bank, school, insurer - with their official seal or digital signature.

- Claiming for someone else’s investment. You can claim tuition fees only for your own children. Not for nieces, cousins, or friends’ kids. Even your spouse’s tuition doesn’t count unless you’re the one paying.

- Forgetting to include all investments. You might have paid ₹50,000 in PPF, ₹40,000 in LIC, and ₹30,000 in tuition. That’s ₹1.2 lakh. But if you forgot your ₹30,000 ELSS, you’re leaving ₹30,000 on the table. Track everything.

- Using old documents. If you paid tuition in March 2024 but only got the receipt in April 2025, it won’t count for FY 2023-24. The payment date matters, not when you received the paper.

How to Organize Your 80C Proof Folder

Don’t wait until April to sort through piles of receipts. Start now. Create a digital folder and a physical one. Name each file clearly: PPF_2024_YourName.pdf, Tuition_Fees_SchoolName_2024.jpg.

Use a simple spreadsheet to track:

- Investment type

- Amount paid

- Date of payment

- Receipt ID or reference number

- Proof file name

Update it every time you make a payment. When tax season comes, you’ll have everything ready in under 10 minutes. No panic. No last-minute calls to your bank.

What If You Don’t Have the Original Receipt?

Some people lose receipts. Others never got them. Here’s what you can do:

- For EPF or PPF: Download statements from the EPFO or post office portal. These are legally valid.

- For ELSS or mutual funds: Log in to your demat or fund house account. Download the transaction history. It must show the investment as ‘80C eligible’.

- For home loan: Request a principal payment certificate from your bank. Most banks provide this for free on request.

- For tuition fees: Contact the school’s accounts department. They can reissue a receipt with their stamp. Many schools now send digital receipts via email.

If all else fails, write a declaration on plain paper stating: ‘I hereby declare that I have invested ₹X in [investment name] during FY 2024-25 for tax deduction under Section 80C.’ Sign it and attach bank statements or screenshots as supporting proof. The IT department may accept this - but only if you have other strong evidence.

When to Submit These Documents

You don’t submit them with your return. You keep them safe. The Income Tax Department only asks for them if you’re selected for scrutiny. That could be months after you file. If you’re audited, you’ll have 30 days to produce the proofs. If you don’t have them, your deduction is canceled - and you’ll owe tax, interest, and possibly a penalty.

Store your documents for at least 6 years. That’s the legal window for tax reassessment. Use cloud storage (Google Drive, Dropbox) with password protection. Back up your physical copies in a fireproof box. Don’t rely on your email inbox - it gets deleted.

What Doesn’t Count as 80C Proof

Here’s a list of things that look like proof but aren’t accepted:

- Bank transfer screenshots without bank statement confirmation

- WhatsApp messages from your school saying ‘fee paid’

- Generic receipts without the institution’s name or seal

- Receipts in someone else’s name

- Investments made after March 31, 2025, for FY 2024-25

- Payments made via cash for ELSS or NSC (digital payments only)

If you’re unsure, ask the institution: ‘Is this receipt valid for Section 80C deduction?’ Most will say yes or no right away.

Final Tip: Double-Check Before Filing

Before you hit ‘submit’ on your ITR, go through this checklist:

- Did you list every 80C investment you made?

- Is the total under ₹1.5 lakh?

- Do you have a stamped receipt or official statement for each?

- Are all names and amounts matching across documents?

- Did you keep digital and physical copies?

One small mistake can cost you thousands in taxes. Don’t let that happen. Take 15 minutes now to organize your papers. Your future self will thank you when the tax notice arrives - and you’re ready.

Can I claim Section 80C deductions if I’m self-employed?

Yes. Self-employed individuals can claim Section 80C deductions on the same investments as salaried employees - PPF, ELSS, life insurance, tuition fees, home loan principal, etc. You need the same proofs: official receipts, bank statements, or certificates. Your income tax return will be filed under ITR-3 or ITR-4, and you’ll report these deductions under the ‘Deductions under Chapter VI-A’ section.

Can I claim tuition fees for my spouse’s education?

No. Section 80C only allows tuition fee deductions for your own children - biological or adopted. You cannot claim fees paid for your spouse, parents, siblings, or extended family members. The law is very specific: the student must be your child, and the institution must be recognized by the government or a university.

Is the interest on NSC eligible under Section 80C?

No. Only the principal amount invested in NSC qualifies for Section 80C. The interest earned each year is taxable and must be declared under ‘Income from Other Sources’. However, if you reinvest the interest into another NSC, that new investment can be claimed under 80C - as long as you have the purchase receipt.

What happens if I miss the deadline to invest for 80C?

The deadline for Section 80C investments is March 31 of the financial year. If you miss it, you can’t claim the deduction for that year. There are no extensions. Don’t wait until April. Most banks and mutual funds get overwhelmed in the last week, and transactions may get delayed. Plan ahead - invest by mid-March to avoid last-minute issues.

Can I claim 80C deductions if I’m filing ITR-1?

Yes. ITR-1 (Sahaj) allows you to claim deductions under Section 80C if your income is from salary, one house property, and other sources like interest. You don’t need to file a more complex form unless you have business income or multiple properties. Just make sure your total 80C claims are correctly entered in Schedule VI-A of the form.

Do I need to submit proofs with my income tax return?

No. You only submit your tax return online. But you must keep all proofs for at least six years. The Income Tax Department can ask for them during a scrutiny assessment, even years after filing. If you can’t produce them, your deduction will be disallowed, and you’ll owe tax plus interest.