Stamp Duty and Registration Charges Under Section 80C in India: How They Reduce Your Tax on Home Purchase

Feb, 1 2026

Feb, 1 2026

Buying a home in India isn’t just about the price tag. There’s a whole layer of hidden costs-stamp duty, registration fees, legal paperwork-that can add up to 5-10% of the property value. But here’s the part most first-time buyers miss: stamp duty and registration charges can be claimed as a deduction under Section 80C of the Income Tax Act. That means you can reduce your taxable income by up to ₹1.5 lakh every year, just by buying a house.

What Exactly Counts Under Section 80C for Home Buyers?

Section 80C lets you claim deductions on certain investments and expenses, including life insurance premiums, PPF contributions, and tuition fees. But many people don’t realize that the money you pay to the government for stamp duty and registration when buying a residential property also qualifies.

It’s not the entire property cost. It’s only the actual amount you paid to the state government for:

- Stamp duty (a tax on the legal transfer of property)

- Registration charges (the fee to record the sale deed in government records)

These are one-time payments made at the time of purchase. You can’t claim them for renovations, resale properties (unless it’s your first home), or rental properties. Only new or under-construction homes bought for self-occupation qualify.

How Much Can You Save?

The maximum deduction under Section 80C is ₹1.5 lakh per financial year. That’s the total you can claim across all eligible investments. So if you paid ₹80,000 in stamp duty and ₹40,000 in registration fees, you can claim the full ₹1.2 lakh right away.

But here’s the catch: you can’t claim more than what you actually paid. If your stamp duty was ₹2 lakh but your total 80C limit is already used up by your EPF and insurance, you lose the rest. That’s why timing matters.

For example, a couple in Pune bought a flat for ₹75 lakh in 2024-25. They paid ₹5.2 lakh in stamp duty and ₹1.1 lakh in registration-total ₹6.3 lakh. But since they already contributed ₹1.2 lakh to their EPF and ₹10,000 to PPF, they could only claim ₹1.5 lakh minus ₹1.3 lakh = ₹20,000 from the property charges. The rest? Lost for that year.

When Can You Claim It?

You can claim stamp duty and registration charges only in the financial year when the payment was made and the property was registered. Not the year you signed the agreement. Not the year you moved in. The year the sale deed was officially recorded.

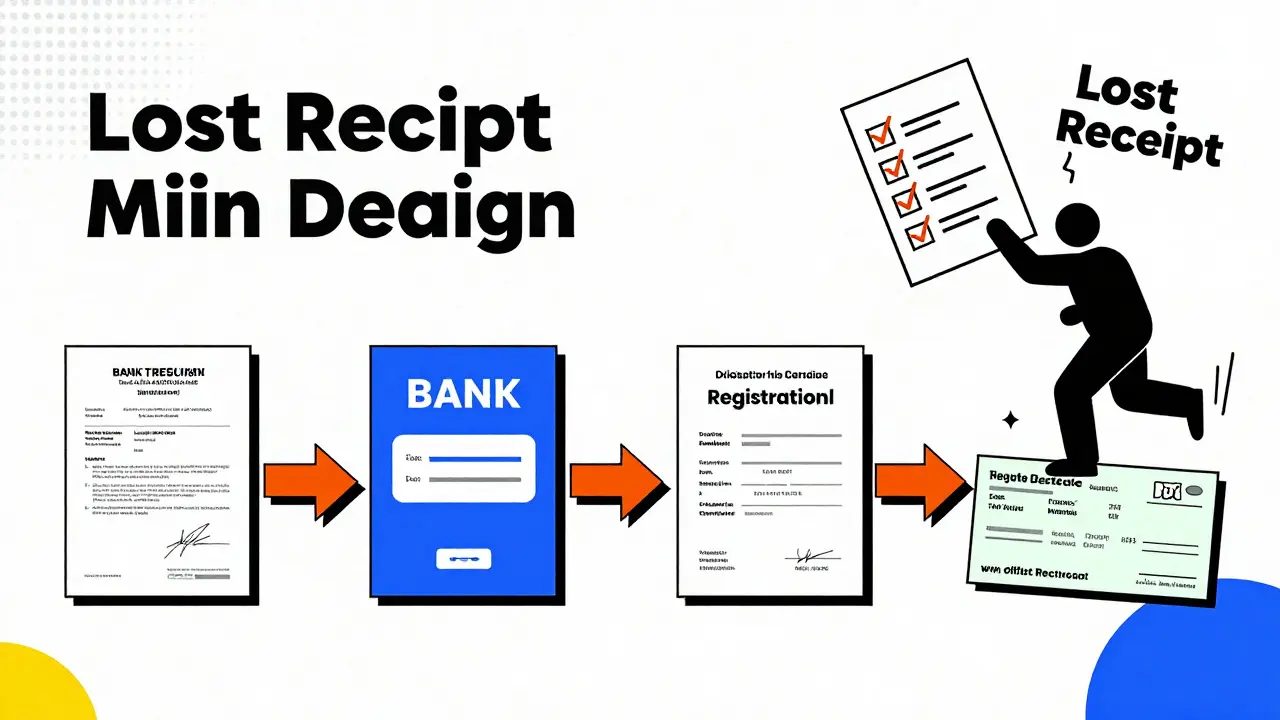

That’s why it’s critical to keep your receipts. The Income Tax Department doesn’t ask for them automatically, but if you’re audited or your return is flagged, you need proof. Save:

- Original stamp duty receipt from the sub-registrar’s office

- Bank statement showing payment to government portal or authorized agent

- Registration certificate with your name and property details

Many people pay through online portals like M-Registration (Maharashtra) or e-Stamping (Karnataka). Keep screenshots and payment confirmations. A PDF receipt isn’t enough if it doesn’t show your name, property address, and government seal.

Can You Claim It Twice?

No. Section 80C is a lifetime limit per person per financial year. You can’t claim stamp duty on two different homes in the same year. And if you already claimed it on a previous home purchase, you can’t claim it again-even if you sold the first house and bought a new one.

But here’s an exception: if you and your spouse are both earning and filing separate tax returns, you can each claim up to ₹1.5 lakh. So if you bought a home jointly, split the stamp duty and registration costs between you. For example:

- Stamp duty: ₹90,000

- Registration: ₹60,000

- Total: ₹1.5 lakh

You claim ₹75,000. Your spouse claims ₹75,000. Both of you hit the 80C limit and get the full tax benefit. This is one of the smartest moves for dual-income couples.

What About Under-Construction Properties?

Yes, you can claim stamp duty and registration charges even if the house isn’t ready yet. As long as you’ve paid the fees and signed the sale agreement, you’re eligible. You don’t have to wait until possession.

But you can’t claim interest on home loans under Section 80C during construction. That’s under Section 24(b). Keep these two separate:

- Section 80C: Only principal + stamp duty + registration

- Section 24: Only home loan interest (up to ₹2 lakh)

Many buyers mix them up. One client in Bengaluru paid ₹1.8 lakh in stamp duty in 2023 and started paying EMI in 2024. She claimed the full ₹1.8 lakh under 80C in 2023-24, even though the flat wasn’t ready. Then in 2024-25, she claimed ₹1.5 lakh for her home loan interest under Section 24. Two separate deductions. Two separate benefits.

Common Mistakes That Cost People Money

Here’s what goes wrong most often:

- Claiming after the fact: Some wait until filing returns in July and realize they lost the receipt. Don’t do this. Save documents the day you pay.

- Assuming all property costs qualify: Brokerage fees, interior design, or maintenance deposits? Not eligible. Only government charges.

- Overlooking joint ownership: If you’re buying with parents or siblings who aren’t co-applicants on the loan, they can’t claim 80C unless they’re co-owners on the title.

- Confusing it with HRA: You can’t claim both HRA and 80C for the same house. If you’re living in the property you bought, you lose HRA. But you gain 80C. That’s a fair trade.

Who Shouldn’t Claim This?

If your total income is below ₹5 lakh, you pay zero tax. Claiming ₹1.5 lakh deduction won’t save you anything. In that case, it’s better to save the receipt for next year-maybe you’ll earn more and move into a higher tax bracket.

Also, if you’re buying a second home, and you’ve already claimed stamp duty on your first one, you can’t claim it again. The rule is one-time per person, not per property.

Real-Life Example: How a Family Saved ₹46,800

Meet Ravi and Priya, both software engineers in Hyderabad. They bought a 2BHK for ₹68 lakh in March 2025. Their breakdown:

- Stamp duty: ₹5.44 lakh (8% of property value)

- Registration: ₹1.36 lakh (2%)

- Total: ₹6.8 lakh

They also contributed ₹80,000 to EPF and ₹30,000 to PPF that year. Total 80C investments: ₹1.1 lakh. That left ₹40,000 of their 80C limit unused.

They split the stamp duty and registration equally. Ravi claimed ₹3.4 lakh from property costs. Priya claimed ₹3.4 lakh. But each could only claim up to ₹40,000 because that’s what was left in their individual limits.

So each claimed ₹40,000. At a 30% tax rate, that’s ₹12,000 saved per person. Together: ₹24,000.

Wait-that’s not all. They also claimed ₹1.5 lakh in home loan interest under Section 24. That’s another ₹45,000 saved (30% of ₹1.5 lakh). Total tax saved in Year 1: ₹69,000.

That’s more than their monthly EMI.

What If You’re Buying in a Different State?

Stamp duty rates vary wildly:

- Maharashtra: 5% (6% for women in some cities)

- Karnataka: 5% + 1% additional cess

- Tamil Nadu: 7%

- Delhi: 6% for men, 4% for women

- Uttar Pradesh: 7% (8% for non-residents)

Registration is usually 1% across states. But in some places like Telangana, it’s 0.5%. Always check your state’s official portal before paying.

The deduction limit is still ₹1.5 lakh nationwide. So if you’re in a high-stamp-duty state like Tamil Nadu, you might hit the limit faster. In Delhi, you might have room left over for other 80C investments.

How to Maximize Your Benefit

Here’s a simple checklist:

- Calculate your total 80C investments before buying: EPF, PPF, insurance, FDs, etc.

- Subtract that from ₹1.5 lakh. What’s left? That’s your room for stamp duty and registration.

- Ask your builder or lawyer: “What’s the exact stamp duty and registration amount?” Get it in writing.

- Pay via bank transfer, not cash. Keep the transaction ID.

- Split the claim with your spouse if you’re joint owners.

- Don’t wait. Claim in the year you pay, not the year you move in.

If you’re planning to buy a home in the next 6 months, run this calculation now. You might realize you need to increase your EPF contribution or delay your PPF deposit to free up space for property charges.

Final Thought: It’s Not Just a Tax Trick

Section 80C isn’t a loophole. It’s a policy designed to encourage homeownership. The government wants you to buy, not rent. And they’re willing to give you back a chunk of your money to make it easier.

But you have to act smart. Don’t assume the builder will tell you this. Don’t assume your CA will remind you. Most don’t. You need to know this yourself.

That ₹1.5 lakh deduction? It’s not just tax savings. It’s real money back in your pocket-money you can use to pay down your loan faster, buy furniture, or just breathe easier.

Can I claim stamp duty and registration charges under Section 80C for a second home?

No. You can claim stamp duty and registration charges under Section 80C only once per person, regardless of how many homes you buy. If you claimed it for your first home purchase, you cannot claim it again-even if you sell the first property and buy a new one.

Can my spouse and I both claim stamp duty under Section 80C?

Yes, if you both are co-owners of the property and file separate income tax returns. Each of you can claim up to ₹1.5 lakh under Section 80C. You can split the stamp duty and registration costs between you to maximize the benefit. For example, if the total charges are ₹1.5 lakh, each can claim ₹75,000.

Do I need to own the property to claim the deduction?

Yes. You must be the legal owner of the property as per the registered sale deed. If you’re buying in someone else’s name-even a family member-you cannot claim the deduction. The name on the stamp duty receipt must match your name on your income tax return.

Can I claim stamp duty if I’m buying an under-construction property?

Yes. You can claim stamp duty and registration charges in the financial year you pay them-even if the property is still under construction. You don’t need to wait until possession. The key is that the sale agreement must be registered and payment made.

Is there a time limit to claim this deduction?

Yes. You can only claim the deduction in the financial year when the stamp duty and registration payments were made. You cannot carry forward unused amounts to future years. If you miss claiming it in the year you paid, you lose it permanently.

What documents do I need to claim stamp duty under Section 80C?

You need the original stamp duty receipt issued by the sub-registrar’s office or a government-approved e-stamping portal. Also keep the registration certificate with your name and property details. Bank statements showing the payment are useful backup. Always keep these documents for at least six years in case of an income tax notice.

Can I claim stamp duty if I’m paying through a home loan disbursement?

Yes. If your bank disburses the loan amount directly to the government for stamp duty and registration, you can still claim it under Section 80C. The source of payment doesn’t matter-only that you are the legal owner and the payment was made for the property registration.

Are registration charges the same across all Indian states?

No. Registration charges are usually around 1% of the property value, but some states charge less-like 0.5% in Telangana-or more in certain cities. Stamp duty varies even more: 4% in Delhi for women, 7% in Tamil Nadu, and 5% in Maharashtra. Always check your state’s official revenue department website before paying.