Sukanya Samriddhi Yojana (SSY) in India: Tax-Free Savings for a Girl Child

Jan, 8 2026

Jan, 8 2026

When you have a daughter in India, planning for her future isn’t just about saving money-it’s about securing her independence. The Sukanya Samriddhi Yojana (SSY) is one of the few government-backed savings schemes designed specifically for girls under 10 years old. It’s not just a bank account. It’s a long-term financial shield that grows tax-free, earns higher interest than most fixed deposits, and helps families meet education and marriage expenses without dipping into other savings.

What Is the Sukanya Samriddhi Yojana?

The Sukanya Samriddhi Yojana (SSY) was launched in 2015 under the Indian government’s Beti Bachao, Beti Padhao campaign. It’s a small savings scheme available through post offices and authorized banks like SBI, HDFC, and ICICI. The goal? To encourage parents to save for their daughter’s higher education or marriage by offering attractive returns and full tax benefits.

Only one account can be opened per girl, and a family can open accounts for up to two daughters. In special cases-like twins or triplets-you can open a third account. The account must be opened before the girl turns 10. After that, no new accounts can be created.

How Does SSY Work?

Opening an SSY account is simple. You need the girl’s birth certificate, your ID proof, and a minimum deposit of ₹250. You can deposit up to ₹1.5 lakh per financial year. Payments can be made in lump sums or installments-monthly, quarterly, or annually. The account stays active for 21 years from the date of opening, or until the girl turns 21, whichever comes later.

Interest is compounded annually and credited to the account. As of January 2026, the interest rate is 8.2% per year, set quarterly by the Ministry of Finance. That’s higher than most bank FDs, which hover around 6.5-7%. The rate is always announced on April 1 each year, so it can change-but it’s never been lower than 7.6% since the scheme started.

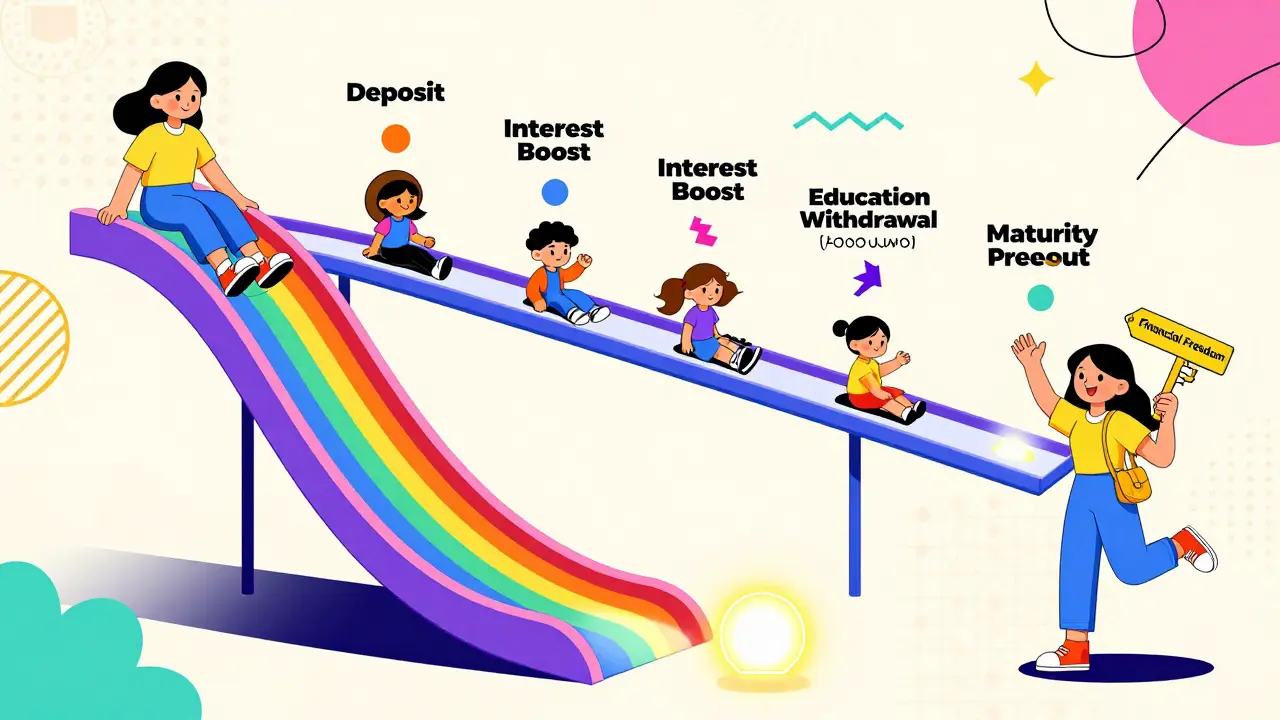

You can make deposits for the first 15 years. After that, the money keeps earning interest until maturity at 21 years. Withdrawals are allowed after the girl turns 18, but only for education-related expenses. Up to 50% of the balance can be withdrawn for tuition, books, or other approved costs. The rest stays locked until she turns 21.

Tax Benefits Under Section 80C

The biggest draw of SSY is its triple tax advantage-EEE status. That means:

- Exempt on contribution: You can claim up to ₹1.5 lakh per year under Section 80C of the Income Tax Act. This reduces your taxable income.

- Exempt on interest: All interest earned inside the account is completely tax-free.

- Exempt on maturity: The full amount you get back at 21 years is tax-free.

This makes SSY one of the most tax-efficient savings tools available in India. Even if you’re already using your ₹1.5 lakh 80C limit with PPF or life insurance, SSY can still be added-it doesn’t count against that cap. You get an extra ₹1.5 lakh deduction just for SSY, as long as you’re depositing in it.

For example, if you invest ₹1.5 lakh in PPF and another ₹1.5 lakh in SSY, you can claim ₹3 lakh in deductions under 80C. That’s a direct tax saving of up to ₹46,800 per year if you’re in the 30% tax bracket.

Who Can Open an SSY Account?

Only the biological or legal guardian of a girl child under 10 can open the account. Parents can open it for their daughters, and in case of orphaned girls, a legal guardian can do so with court approval.

The account must be opened in the girl’s name. The parent or guardian acts as the account operator until the girl turns 18. After that, she takes control, but the funds remain locked until 21.

Non-resident Indians (NRIs) cannot open SSY accounts. If the girl becomes an NRI after opening the account, the account will be closed immediately, and interest will stop accruing from the date of status change.

How Does SSY Compare to Other Savings Options?

Many parents compare SSY with PPF, mutual funds, or fixed deposits. Here’s how it stacks up:

| Feature | SSY | PPF | Fixed Deposit (FD) | Equity Mutual Fund (15-year horizon) |

|---|---|---|---|---|

| Eligibility | Girl child under 10 | Any Indian resident | Any individual | Any individual |

| Max Annual Deposit | ₹1.5 lakh | ₹1.5 lakh | No limit | No limit |

| Interest Rate | 8.2% | 7.1% | 6.5-7.5% | 10-12% (average) |

| Tax Benefit under 80C | Yes | Yes | No | No |

| Lock-in Period | 21 years | 15 years | As chosen (3+ years for tax-saving FD) | No lock-in |

| Withdrawal Before Maturity | Yes, at 18 for education | Yes, after 5 years | Yes, but penalty | Yes, anytime |

| Guaranteed Returns | Yes | Yes | Yes | No |

SSY beats PPF in interest rate and offers better tax efficiency than FDs. Compared to mutual funds, it’s less risky but also has lower growth potential. If your goal is safety and guaranteed returns for your daughter’s future, SSY is unmatched. If you’re comfortable with market risk and want higher returns, you might pair SSY with a small SIP in equity funds.

What Happens If You Miss a Deposit?

If you miss a deposit in any year, the account becomes inactive. To reactivate it, you must pay the missed amount plus a penalty of ₹50 per year of default. You can’t skip years without consequences. That’s why it’s better to set up auto-debits from your bank account.

Once reactivated, the account continues earning interest from the date of reactivation, not retroactively. So, missing a year means losing out on compounding growth.

Can You Transfer the Account?

Yes. If you move cities, you can transfer the SSY account from a post office to a bank, or vice versa. You need to fill out a transfer form and submit it along with the passbook and ID proof. The process takes about 15-20 days. The interest rate remains unchanged, and no penalties apply.

When Can the Girl Access the Money?

She can withdraw up to 50% of the balance after turning 18 for higher education. You’ll need to submit proof like an admission letter or fee receipt. The rest remains locked until she turns 21.

At 21, the account matures automatically. The full amount-principal + all interest-is paid out in one lump sum. There’s no requirement to use it for marriage, but that’s the original intent. She can use it for anything: buying a car, starting a business, paying off student loans, or even investing further.

What If the Girl Dies Before 21?

If the girl passes away before the account matures, the account is closed, and the entire balance is paid to the guardian or legal heir. No penalties apply. The interest earned up to the date of death is still tax-free.

Is SSY Right for You?

SSY is ideal if:

- You have a daughter under 10 and want to start saving early

- You want guaranteed, tax-free returns

- You’re already using your 80C limit and want to maximize deductions

- You prefer safety over market risk

- You’re planning for education or future financial independence

It’s not ideal if:

- You need liquidity before 18

- You’re looking for high-growth investments

- You’re an NRI

- You’re unsure about long-term commitment

Many parents use SSY as the foundation of their daughter’s financial plan, then add a mutual fund SIP or NPS for growth. That way, they get safety + growth.

How to Open an SSY Account

Here’s how to get started:

- Visit any authorized bank branch or post office

- Carry the girl’s birth certificate, your ID proof (Aadhaar, PAN, passport), and address proof

- Fill out the SSY application form

- Make the first deposit (minimum ₹250)

- Choose auto-debit from your savings account for future payments

Some banks let you open SSY accounts online through net banking. Check with your bank’s website for the option.

Final Thoughts

The Sukanya Samriddhi Yojana isn’t just a savings account. It’s a promise-to your daughter, to her future, and to the idea that every girl deserves financial security from day one. With its high interest, tax-free growth, and government backing, it’s one of the smartest financial moves a parent can make in India.

Start early. Save consistently. Let compounding work its magic. By the time your daughter turns 21, you won’t just have money-you’ll have peace of mind.

Can I open an SSY account for my adopted daughter?

Yes, if the adoption is legally recognized under Indian law. You must submit the adoption certificate along with the birth certificate when opening the account.

Is the interest rate fixed for the entire 21 years?

No. The rate is revised quarterly by the Ministry of Finance and announced on April 1 each year. But once you deposit, your money earns the rate applicable at the time of deposit, and future deposits earn the new rate. The rate has never dropped below 7.6% since the scheme began.

Can I open an SSY account for my granddaughter?

No. Only the biological or legal guardian of the girl child can open the account. Grandparents cannot open an SSY account unless they are the legal guardians.

What happens if I move abroad after opening the account?

If the girl becomes a non-resident Indian (NRI) after the account is opened, the account will be closed immediately. Interest will stop accruing from the date her residential status changes. The balance will be paid out, but no further deposits are allowed.

Can I withdraw money for my daughter’s marriage?

Yes, but only after she turns 18. You can withdraw up to 50% of the balance for marriage expenses. You’ll need to submit proof like a marriage invitation or certificate. The rest remains locked until she turns 21.

Is SSY better than a child insurance plan?

SSY is generally better for pure savings. Child insurance plans often come with high fees, lower returns, and forced coverage you may not need. SSY offers higher interest, full tax benefits, and no insurance component. Use insurance only if you want life cover for the parent.