Chain Split: What It Means and How It Affects Crypto Markets

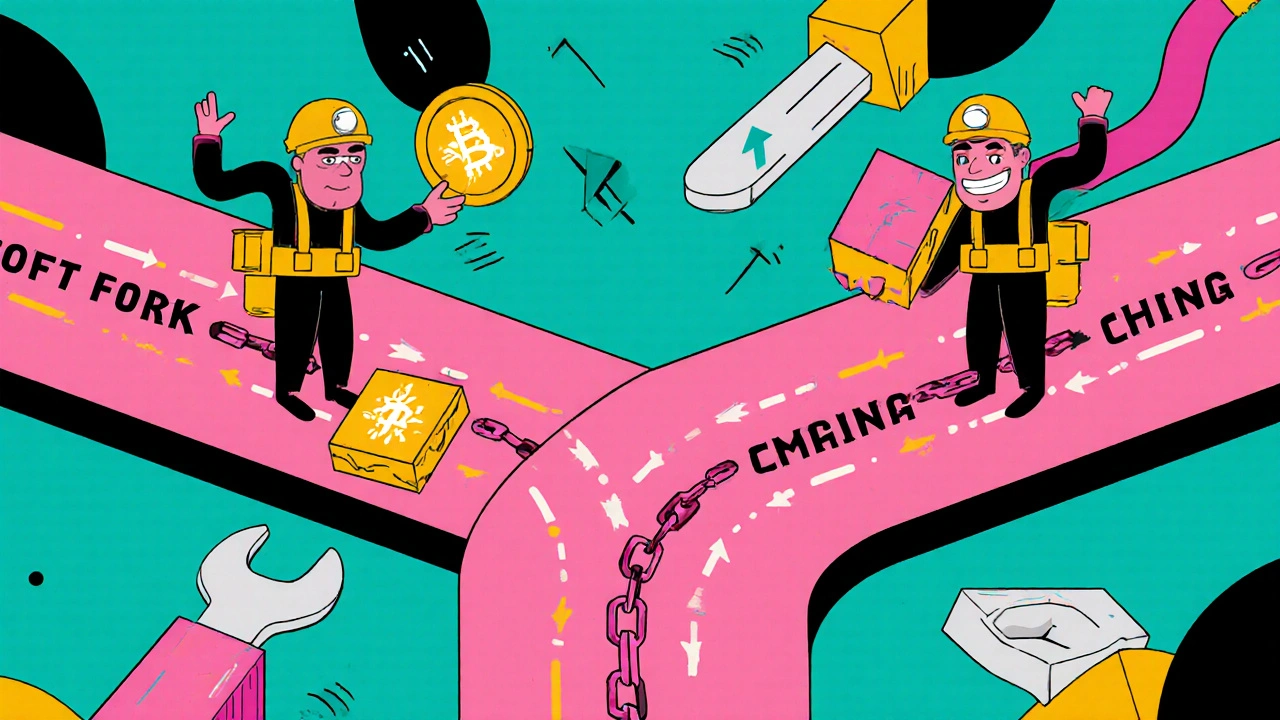

When a chain split, a divergence in a blockchain’s protocol that creates two separate versions of the ledger. Also known as a blockchain fork, it happens when developers or miners can’t agree on the rules — and the network splits in two. This isn’t just a technical glitch. A chain split can turn one coin into two, erase your balance if you’re not careful, or create new investment opportunities overnight.

Most chain splits happen because of disagreements over upgrades. Take Bitcoin, the original cryptocurrency that runs on a decentralized ledger verified by miners. In 2017, a split created Bitcoin Cash because some wanted bigger blocks to handle more transactions. Others stuck with the original chain. Both still exist. Same with Ethereum, a platform that runs smart contracts and decentralized apps. Its 2016 hard fork after the DAO hack gave us Ethereum and Ethereum Classic — two separate blockchains with different histories and values.

Not every split is dramatic. Some are planned upgrades — like a software patch that forces everyone to update. Others are accidental, caused by bugs or network delays. The key thing to know: if you hold crypto during a split, you usually get coins on both chains — but only if you control your private keys. If your coins are on an exchange, you might miss out. Exchanges decide whether to support the new chain, and many don’t bother.

Chain splits also affect prices. New coins often crash after launch because supply spikes and demand is uncertain. But sometimes, they surge — especially if the split solves a real problem, like slow transactions or high fees. Tracking splits matters because they’re not just technical events — they’re market events. People buy, sell, and panic around them.

What you’ll find below are real-world examples of how chain splits have played out — from Bitcoin forks that created million-dollar opportunities to obscure altcoin splits that vanished in weeks. You’ll see how they impact wallet balances, trading strategies, and tax reporting. No theory. Just what actually happened — and what you need to know if one hits your portfolio.

Blockchain Forks Explained: Soft Forks, Hard Forks, and Chain Splits in Cryptocurrency

Learn how soft forks, hard forks, and chain splits work in cryptocurrency. Understand what happens to your coins during a fork, why they occur, and how to stay safe.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness