India Real Estate: Home Loans, Tenancy Laws, and Builder Schemes Explained

When you think about India real estate, the market where homes, apartments, and land are bought, sold, or rented across Indian cities. Also known as Indian property market, it’s not just about buying a house—it’s about navigating loans, legal contracts, and hidden risks that can cost you lakhs. Whether you’re renting in Mumbai or buying a flat in Bangalore, the rules change fast, and most people don’t know what they’re signing up for.

One big piece of the puzzle is home loan interest rates, the cost you pay banks to borrow money for a house. In 2025, these rates vary wildly between lenders, and even a 0.5% difference can save you over ₹5 lakh over 20 years. Then there’s subvention schemes, builder offers that promise zero EMIs until you move in. Sounds great, right? But if the project gets delayed, you’re stuck paying interest retroactively—with no home to show for it. And if you’re renting, Model Tenancy Act, India’s new law that sets clear rules for security deposits, rent hikes, and evictions. It’s meant to protect both tenants and landlords, but most people still use old, unfair agreements.

It’s not just about money. The rent agreement India, the legal document that binds you to a landlord or tenant. Many skip registration, don’t list key clauses like maintenance costs or notice periods, and end up in court. Meanwhile, Section 80C lets you claim tax deductions on home loan principal payments—up to ₹1.5 lakh a year—but only if you know how to claim it right. And if you’re thinking of buying under a builder’s payment plan, you need to check their track record, not just their brochures.

What you’ll find below isn’t theory. It’s real advice from people who’ve been burned—by delayed projects, surprise interest charges, illegal deposits, or bad rent deals. We cover how to spot safe subvention plans, what clauses to demand in a rent agreement, how to compare home loan offers, and why the Model Tenancy Act is your best friend if you know how to use it. No fluff. No sales pitches. Just what actually matters when you’re dealing with India real estate.

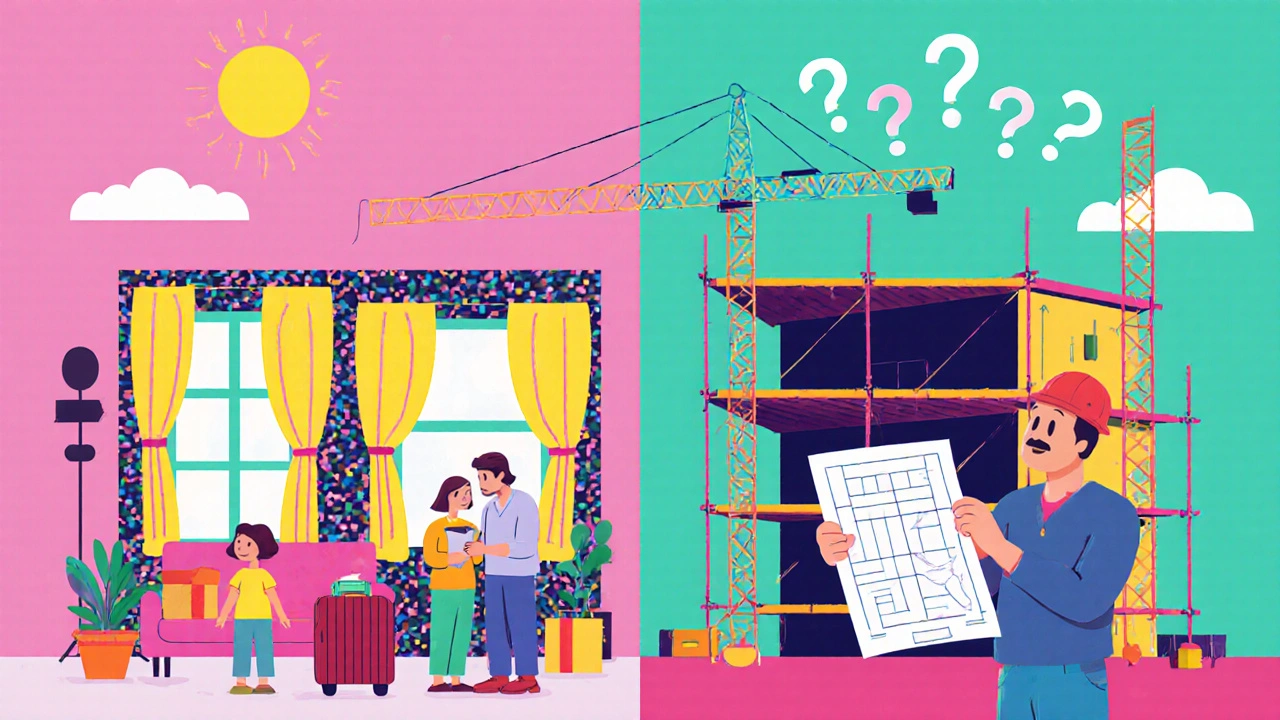

Ready-to-Occupy vs Under-Construction Property in India: Which Is Better for Buyers?

Choosing between ready-to-occupy and under-construction property in India depends on your timeline, budget, and risk tolerance. Ready units offer instant possession but cost more. Under-construction offers higher returns but comes with delays and uncertainty.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness