Mutual Fund Expense Ratio: What It Is and How It Affects Your Returns

When you invest in a mutual fund expense ratio, the annual fee mutual funds charge to cover management and operational costs. Also known as fund expense ratio, it's the hidden cost that quietly eats into your returns every year, no matter if the fund goes up or down. Many investors in India focus only on past performance, but two funds with identical returns can leave you with very different amounts in your account—because of this one number.

The mutual fund expense ratio includes management fees, administrative costs, and marketing expenses. It’s expressed as a percentage of your total investment. For example, a 1.5% expense ratio on ₹1 lakh means you pay ₹1,500 every year just to keep your money in the fund. Over 10 years, that’s ₹15,000 gone—money that could’ve kept growing. Lower expense ratios don’t always mean better performance, but they almost always mean more money stays in your pocket. In India, index funds often have ratios under 0.5%, while actively managed funds can run 1.5% to 2.5% or more. The mutual funds India market has grown fast, but most investors still don’t check this number before investing.

It’s not just about the ratio itself—it’s how it connects to other things. A fund with high turnover (buying and selling stocks often) usually has a higher expense ratio because trading costs add up. The investment costs you pay directly affect your net returns, and over time, even a 0.5% difference can mean tens of thousands of rupees. Some funds offer lower fees for larger investments, and direct plans (bought online without a broker) often have expense ratios 0.5% to 1% lower than regular plans. Knowing this helps you make smarter choices without needing a financial advisor.

You’ll find posts here that break down how to compare funds, spot hidden fees, and pick low-cost options that actually work for Indian investors. Whether you’re new to SIPs or have been investing for years, understanding the expense ratio is the first step to keeping more of what you earn.

Mutual Fund Expense Ratio in India: How Fees Impact Your Long-Term Returns

Mutual fund expense ratios in India directly impact your long-term returns. Learn how fees like direct vs regular plans, SEBI caps, and hidden costs affect your wealth-and how to cut them to keep more of your money.

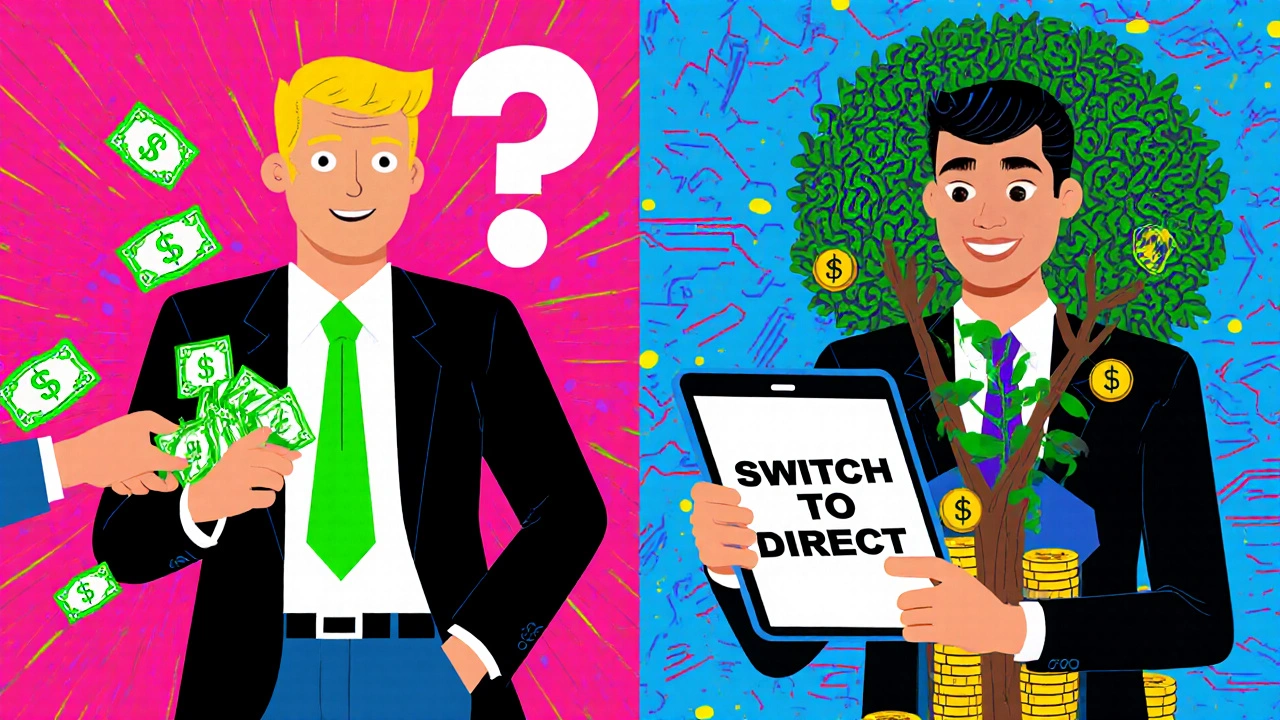

Direct vs Regular Mutual Funds in India: Save More with Direct Plans

Direct mutual funds in India save you thousands by cutting out advisor commissions. Learn how direct vs regular plans work, how much you can save, and how to switch today.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness