Mutual Funds India: How to Invest Smartly and Save on Fees

When you invest in mutual funds India, a pooled investment vehicle where money from many people is managed by professionals to buy stocks, bonds, or other assets. Also known as unit trusts, they let you grow your money without needing to pick individual stocks. But not all mutual funds are created equal—some cost you thousands more over time just because of how they’re sold.

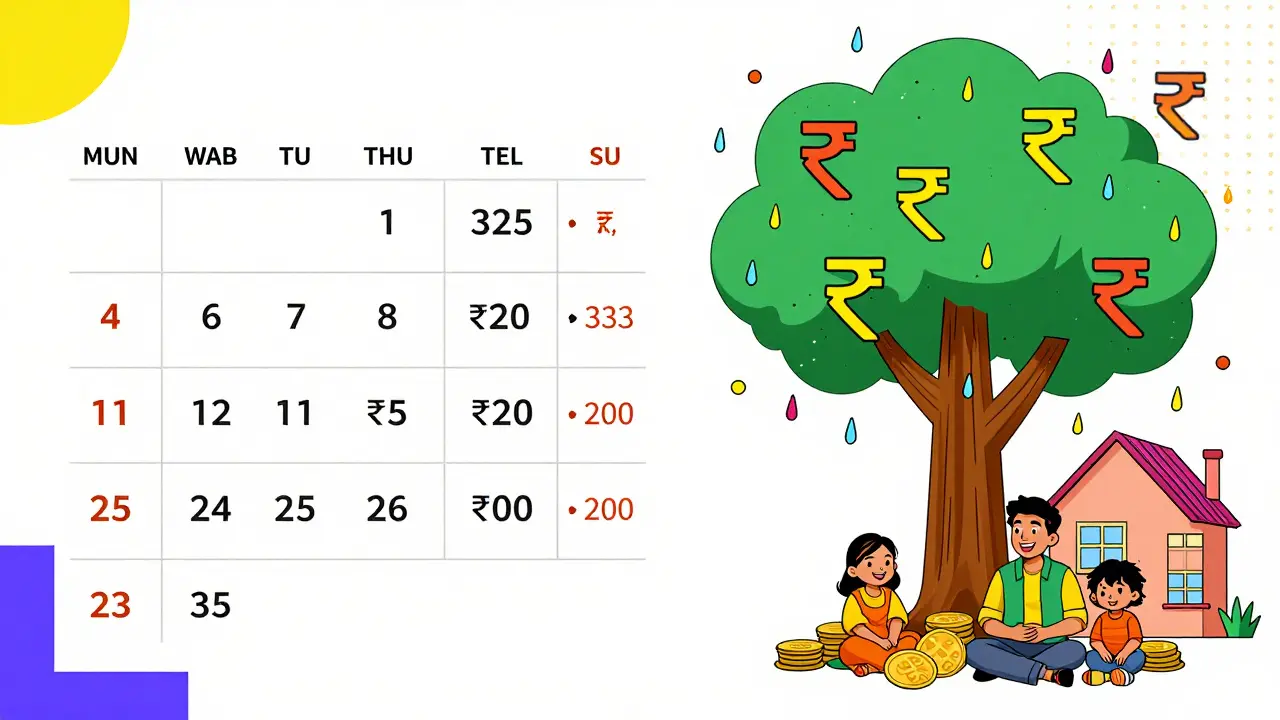

The big difference is between direct mutual funds, plans bought straight from the fund house without a middleman and regular mutual funds, those sold through advisors or platforms that charge commissions. Direct plans cut out the middleman, lowering the expense ratio by 0.5% to 1.5%. Over 10 years, that small difference can mean tens of thousands in extra returns. If you’re buying mutual funds in India, switching to direct plans is one of the easiest ways to boost your wealth.

Investing also means dealing with Section 80C, a tax rule that lets you reduce your taxable income by up to ₹1.5 lakh per year through eligible investments. Many mutual funds—especially ELSS—are eligible under this section. That means your investment not only grows but also cuts your tax bill. And before you even start, you’ll need to complete your KYC for mutual funds, the legal process that verifies your identity using PAN and Aadhaar. It’s a one-time step, but skipping it blocks you from investing entirely.

People in India often mix up mutual funds with fixed deposits or gold, but mutual funds offer real growth potential if you stay invested. You don’t need to be an expert—you just need to know what you’re paying for, how to claim tax benefits, and how to avoid hidden fees. The posts below break down exactly how to choose between direct and regular plans, how to link your PAN and Aadhaar, how much you can save under Section 80C, and why so many investors are missing out on better returns by sticking with regular plans.

Rupee Cost Averaging in India: Why SIPs Work for Long-Term Investing

Rupee cost averaging through SIPs helps Indian investors build wealth over time without timing the market. Learn why consistent monthly investing in mutual funds beats lump-sum investing and how to start smart.

Multi-SIP Strategy in India: How to Invest in Multiple Mutual Funds at Once

Learn how to build wealth in India using a multi-SIP strategy - investing in multiple mutual funds at once to reduce risk and boost long-term returns without timing the market.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness