Soft Fork: What It Means for Blockchain Upgrades and Crypto Users

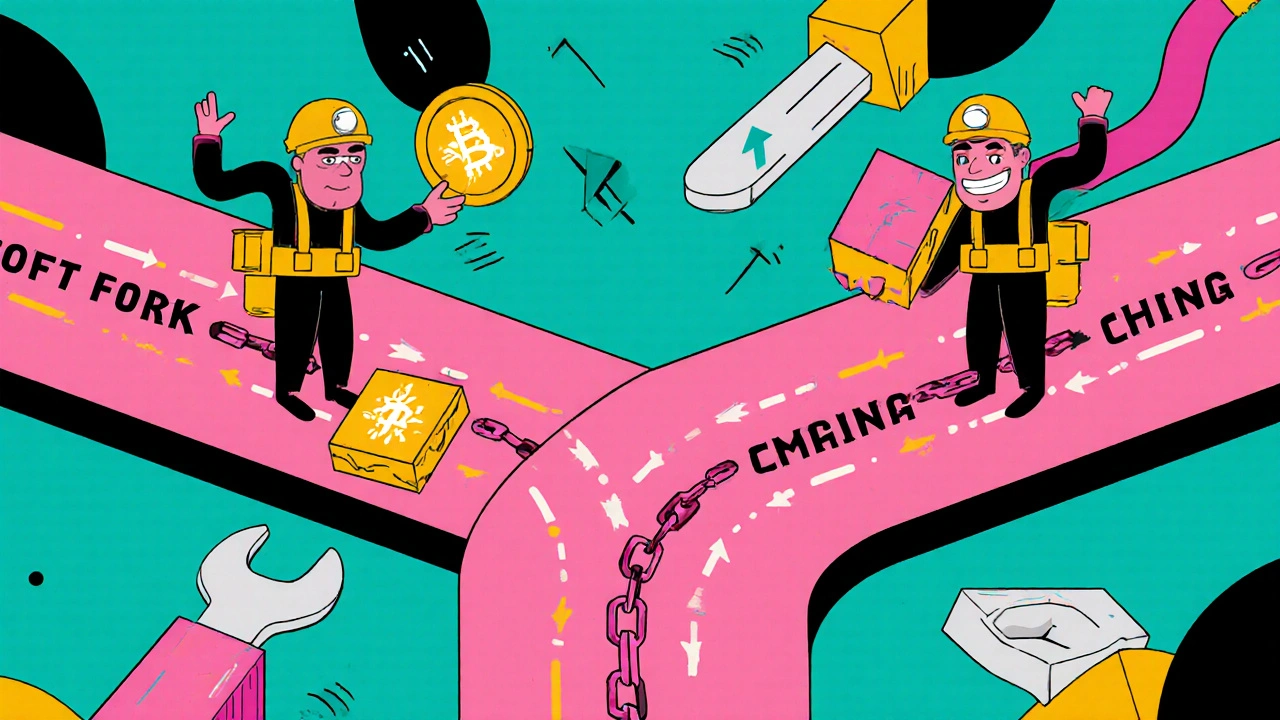

When a blockchain like Bitcoin, a decentralized digital currency network that runs on a public ledger updates its rules, it doesn’t shut down or restart. Instead, it changes how transactions are validated—either through a soft fork, a backward-compatible protocol upgrade that keeps older nodes running or a hard fork. A soft fork is like upgrading your phone’s software without forcing everyone else to update right away. Nodes that don’t upgrade still accept the new rules, but they can’t create blocks that follow them. This keeps the network unified, unlike a hard fork, which splits the chain into two separate versions.

Soft forks are often used to add new features or fix security issues without risking a network split. For example, Bitcoin’s SegWit upgrade in 2017 was a soft fork that made transactions cheaper and faster by changing how data was stored. Miners had to adopt the new rules to mine valid blocks, but regular users and older wallets kept working without changes. This is why soft forks are preferred for major networks like Bitcoin—they reduce chaos. Other blockchains, like Ethereum, also use soft forks to roll out upgrades like the London hard fork’s EIP-1559, which changed how transaction fees work. Even though EIP-1559 was called a "hard fork" in some places, its core fee mechanism was implemented in a way that didn’t break compatibility, making it functionally similar to a soft fork in impact.

What does this mean for you? If you hold Bitcoin or any other crypto, a soft fork doesn’t require you to take action. Your wallet will still work. You won’t get new coins. You won’t lose access. But if miners and developers push through a soft fork, it can make your transactions faster, cheaper, or more secure. On the flip side, if a soft fork fails to gain enough support, it might not work at all—like the 2017 Bitcoin Cash soft fork attempt that got abandoned because miners didn’t adopt it. The success of a soft fork depends on community and miner cooperation, not just code.

Looking at the posts in this collection, you’ll see topics like ASIC mining, specialized hardware built for mining Bitcoin efficiently, crypto mining, the process of validating blockchain transactions and earning rewards, and token unlock calendars, timelines showing when locked crypto tokens become tradable. These are all connected to how blockchains evolve. Mining hardware affects who controls the network, and token unlocks influence market behavior—both of which can trigger or resist soft fork changes. Understanding soft forks helps you see why some upgrades happen quietly, while others spark debates. The posts below cover real-world examples of how these systems work, from Bitcoin’s core changes to how altcoins handle upgrades under pressure. You’ll find what matters, what doesn’t, and how to stay ahead without overcomplicating things.

Blockchain Forks Explained: Soft Forks, Hard Forks, and Chain Splits in Cryptocurrency

Learn how soft forks, hard forks, and chain splits work in cryptocurrency. Understand what happens to your coins during a fork, why they occur, and how to stay safe.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness