SSY: What It Is, How It Works, and Why It Matters for Indian Savers

When you hear SSY, a government-backed savings scheme designed to secure the future of girls in India. Also known as Sukanya Samriddhi Yojana, it’s not just another fixed deposit—it’s a long-term financial tool built into India’s social safety net. Launched in 2015 under the Beti Bachao, Beti Padhao campaign, SSY lets parents or guardians open an account for a girl child before she turns 10. The money grows with interest set by the government—currently at 8.2%—and all contributions, interest, and withdrawals are completely tax-free.

What makes SSY different from other savings options is its focus and structure. Unlike PPF or FDs, SSY is locked in until the girl turns 21, or until she gets married after 18. This forces discipline. You can deposit up to ₹1.5 lakh a year, and those deposits count toward your Section 80C tax deduction. That means you’re saving for your daughter’s education or wedding while also cutting your taxable income. The account can be opened at any post office or authorized bank, and only one account per girl is allowed—though you can open two for two girls in the same family.

SSY isn’t just about money. It’s about shifting how families think about girls’ futures. In a country where dowry and education costs still weigh heavily on households, SSY gives parents a clear, safe, and legal way to build financial security without relying on uncertain returns or risky investments. It’s not a magic solution, but it’s one of the few financial products that’s designed with a single goal: to ensure a girl has resources when she needs them most.

What you’ll find below are real, practical guides on how to open an SSY account, how to maximize its benefits, how it compares to other schemes like PPF, and what happens if you miss a deposit. You’ll also see how families in Mumbai and beyond are using SSY alongside other tools—like domestic worker savings plans or home loan tax breaks—to build layered financial security. These aren’t theoretical articles. They’re written by people who’ve done the math, filled the forms, and faced the paperwork. If you’re thinking about SSY, these posts will show you exactly how to make it work.

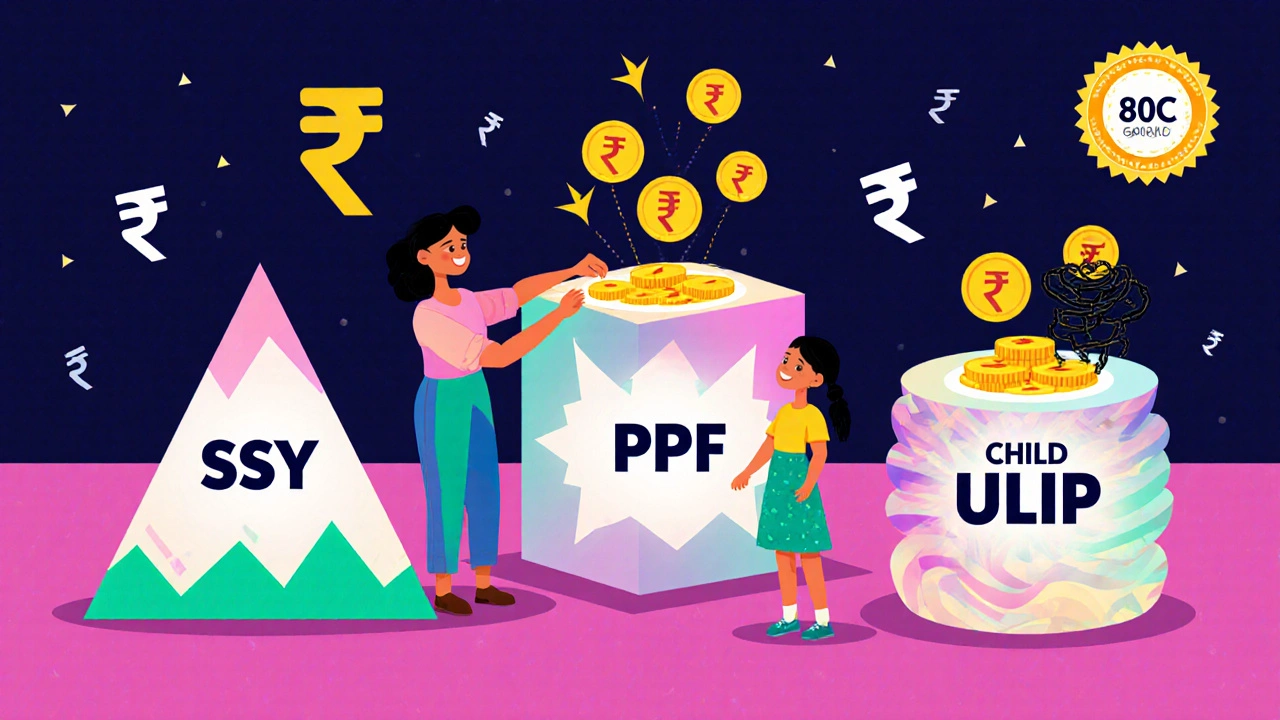

Section 80C and Children’s Plans in India: SSY vs Child ULIPs vs PPF

Compare SSY, PPF, and Child ULIPs under Section 80C to find the best tax-saving investment for your child's future in India. Learn which option offers higher returns, lower risk, and true financial security.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness