Under-Construction Property: What You Need to Know Before Buying in India

When you buy an under-construction property, a residential or commercial unit still being built by a developer before it’s ready for occupancy. Also known as pre-launch property, it’s often marketed with lower prices and flexible payment plans—but these deals come with serious trade-offs. Many buyers are drawn in by promises of zero EMIs until possession, but what happens when the project stalls? Or when the builder disappears? Or when interest suddenly kicks in retroactively?

Subvention schemes, a payment plan where the builder pays your home loan EMIs until you take possession sound like a gift, but they’re often a trap. These plans rely on the builder finishing on time, and if they don’t, you’re left paying double—back interest plus new EMIs. Home loan interest rates in India, the cost of borrowing money to buy property, which changes based on RBI policy, lender competition, and your credit score can spike overnight, turning a "low-cost" deal into a financial nightmare. And real estate risks in India, the dangers buyers face when investing in properties not yet completed, including fraud, delays, and legal disputes aren’t theoretical—they’re common. Builders delay projects for months, sometimes years. Some vanish entirely. Others change plans without telling you. And if you’ve already paid 50% or more, you’re stuck.

That’s why knowing how builder payment plans, structured ways developers ask buyers to pay for under-construction homes, often in stages tied to construction milestones really work is critical. It’s not just about the down payment. It’s about when each payment is due, what happens if construction misses a deadline, and whether your money is in a government-regulated escrow account. Most buyers don’t ask these questions. They sign quickly, trusting the brochure. But the real test comes later—when the site goes quiet, and the sales agent stops answering calls.

If you’re considering an under-construction property, you need more than a good deal. You need a clear understanding of your rights, the builder’s track record, and the legal protections available. The posts below break down exactly what to look for, what to avoid, and how to protect your money before you sign anything.

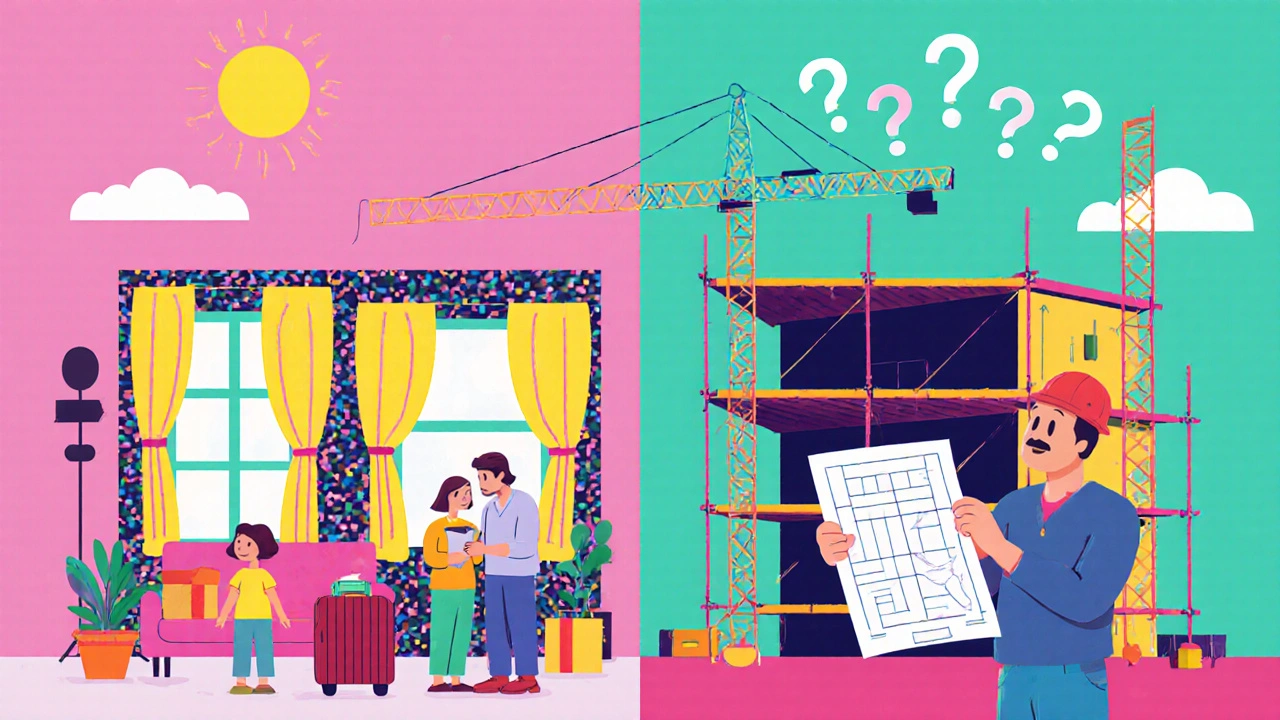

Ready-to-Occupy vs Under-Construction Property in India: Which Is Better for Buyers?

Choosing between ready-to-occupy and under-construction property in India depends on your timeline, budget, and risk tolerance. Ready units offer instant possession but cost more. Under-construction offers higher returns but comes with delays and uncertainty.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness