Understanding Index Rebalancing in India: How It Moves NIFTY and Sector Indices

Jan, 11 2026

Jan, 11 2026

Every quarter, something quiet but powerful happens in India’s stock market. Thousands of mutual funds, ETFs, and institutional portfolios automatically buy or sell shares-not because of news, earnings, or rumors-but because of a mechanical reset. This is index rebalancing. And if you’re invested in Indian markets, especially through NIFTY-based funds, you’re already feeling its effects, even if you don’t realize it.

What Is Index Rebalancing?

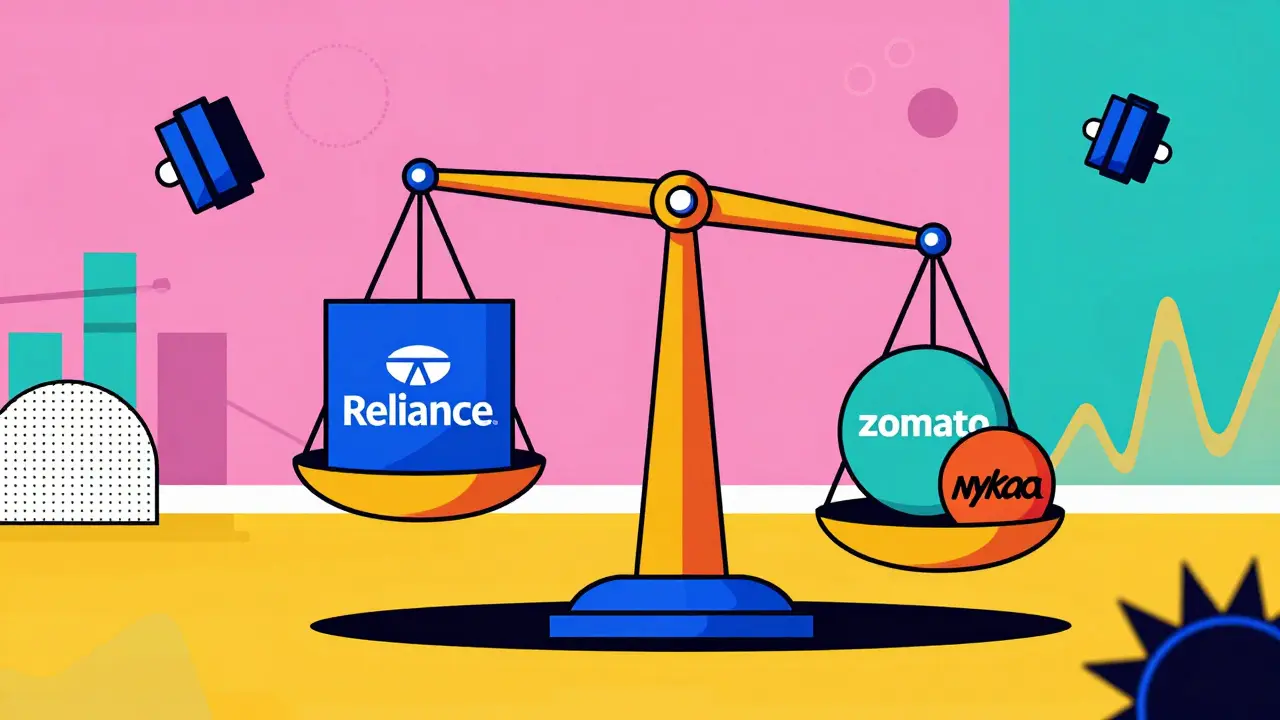

Index rebalancing is the process of adjusting the weights of stocks inside a market index to match their current market value. Think of it like keeping a scale balanced. If one side gets too heavy, you add weight to the other. In the case of the NIFTY 50, if Reliance Industries’ stock price jumps 30% while Tata Motors falls 20%, their influence on the index becomes unbalanced. Rebalancing fixes that.

The NIFTY 50, managed by NSE Indices Limited, is a free-float market capitalization-weighted index. That means larger companies (by market value) have more impact on the index’s movement. But markets move fast. A company can grow or shrink quickly. Without rebalancing, the index would slowly become a snapshot of past performance, not current reality.

Rebalancing happens every six months-in March and September. The index committee reviews the top 200 companies by market cap and liquidity. They calculate what each stock should weigh based on its current value. Then they adjust holdings to match the target weights. This isn’t a guess. It’s math. And it’s done with precision.

Why Does It Matter for Investors?

Over 80% of Indian equity mutual funds track or benchmark against the NIFTY 50. That means when the index changes, these funds must buy or sell shares to stay aligned. If a stock is added to the index, funds must buy it. If it’s removed, they must sell it. That creates predictable buying and selling pressure.

Here’s what happened in the last rebalance in September 2025: Adani Ports was removed from the NIFTY 50 after its weight dropped below 1.5%. Overnight, passive funds sold over ₹12,000 crore worth of its shares. The stock fell 12% in two days. Meanwhile, Zomato and Nykaa were added. They saw buying pressure worth ₹8,500 crore in just 48 hours. Their prices jumped 15% and 18% respectively.

This isn’t speculation. It’s mechanics. And it’s repeatable. If you know when rebalancing happens, you can anticipate these moves. Many retail investors time their trades around these dates-not to predict the market, but to ride the wave of forced buying and selling.

How Sector Indices Get Affected

It’s not just the NIFTY 50. Sector indices like NIFTY Bank, NIFTY IT, NIFTY Pharma, and NIFTY Auto also rebalance. But here’s the twist: sector indices often move before the main index. Why? Because the index committee reviews sector eligibility before finalizing the NIFTY 50 list.

Take the NIFTY IT index. In March 2025, Infosys and TCS were both growing fast, but smaller players like Mphasis and Tech Mahindra were losing market share. During the rebalance, Mphasis was removed from the index. Tech Mahindra’s weight dropped from 12% to 6%. The result? Mphasis stock dropped 9% in a week, while Tech Mahindra fell 7%. Investors who held those stocks saw their portfolio’s tech exposure shrink overnight.

On the flip side, when Mindtree was added to the NIFTY IT index in September 2025, its weight jumped from 0.2% to 2.1%. The stock rose 14% in the week before the rebalance as funds started accumulating ahead of time. This is called “rebalance anticipation.” Smart investors watch sector index changes closely-they often signal what’s coming in the broader index.

Who Decides What Gets Added or Removed?

The NSE Indices Committee, made up of market experts, academics, and fund managers, runs the process. They don’t pick stocks based on opinion. They use strict rules:

- Minimum free-float market cap: ₹10,000 crore

- Liquidity: Average daily turnover must be at least 0.5% of total market turnover

- Listing history: At least 6 months on NSE

- Trading frequency: Must be traded on 90% of trading days in the past 6 months

They also cap any single stock’s weight at 15% of the index. If a stock grows beyond that, it gets trimmed. That’s why Reliance, despite being the largest company in India, can’t dominate the index like it did in 2020. Its weight was cut from 17% to 13.5% in the last rebalance.

There’s no lobbying. No insider influence. Just data. And that’s what makes the system trustworthy.

How to Use Rebalancing to Your Advantage

You don’t need to be a fund manager to benefit from rebalancing. Here’s how regular investors can use it:

- Track the announcement dates: Rebalance dates are published on nseindia.com at least 2 weeks in advance. Mark your calendar.

- Watch the draft list: A week before the rebalance, NSE releases a preliminary list of additions and deletions. This is your early warning.

- Buy before the buy wave: If a stock is likely to be added, it often rises 5-10% in the week before the rebalance. That’s your signal.

- Avoid the sell-off: Stocks being removed often drop 8-15% in the week after. If you hold them, consider selling before the rebalance.

- Use ETFs wisely: If you’re in NIFTY 50 ETFs like Nippon India ETF Nifty BeES, you’re already automatically rebalanced. But if you hold individual stocks, you’re exposed to the volatility.

One investor in Pune bought shares of Bharat Forge in August 2025 after seeing it on the draft list for NIFTY Auto. It was added in September. He held for three months and made a 22% return. He didn’t guess the market-he followed the rules.

Common Myths About Rebalancing

There are a few misunderstandings that cost people money:

- Myth: Rebalancing is manipulation. Truth: It’s mechanical. No one is trying to push prices up or down-it’s just fund tracking.

- Myth: Only big players benefit. Truth: Retail investors who know the schedule can trade around it just like institutions.

- Myth: Rebalancing always causes big price swings. Truth: Most moves are moderate. Only stocks being added or removed see sharp moves. The rest just get weight adjustments.

- Myth: You need to time it perfectly. Truth: You don’t. Just be aware. Even knowing the week helps you avoid panic selling.

What’s Changing in 2026?

This year, NSE introduced a new rule: companies with foreign ownership above 75% will be reviewed for inclusion. That’s a big shift. Companies like PepsiCo India and Unilever India, which were previously excluded due to foreign control limits, are now being evaluated. If they’re added, it could bring in billions in new foreign investment.

Also, the liquidity requirement is being raised from 0.5% to 0.7% of total market turnover. That means smaller, less-traded stocks-even if profitable-will have a harder time getting in. Expect more focus on truly liquid names like SBI, HDFC Bank, and Infosys.

And for the first time, NSE will publish real-time rebalance impact estimates. You’ll be able to see how much money is expected to flow into each stock before the rebalance day. This transparency is new-and it’s a game-changer for retail investors.

Final Thoughts

Index rebalancing isn’t magic. It’s math. And it’s predictable. If you understand how it works, you’re not gambling-you’re playing a game with known rules. The NIFTY 50 and sector indices don’t move because of hype. They move because thousands of funds are forced to adjust their portfolios. That creates opportunities.

You don’t need to trade every rebalance. But if you ignore it, you’re leaving money on the table-or worse, holding stocks that are about to be dumped. Stay informed. Track the dates. Watch the draft lists. And let the system work for you.

When does index rebalancing happen in India?

Index rebalancing for the NIFTY 50 and most sector indices happens twice a year-in March and September. The exact date is announced by NSE Indices Limited at least two weeks in advance. The actual changes take effect on the last Thursday of the month.

Why do stock prices jump when a company is added to NIFTY 50?

When a stock is added to the NIFTY 50, mutual funds and ETFs that track the index must buy it to match the index’s composition. This creates a sudden surge in demand. For example, when Zomato was added in September 2025, over ₹8,500 crore flowed into the stock within 48 hours, pushing its price up by 15%. The same happens when a stock is removed-funds sell, causing the price to drop.

Can retail investors profit from rebalancing?

Yes. Retail investors can benefit by watching the preliminary list of additions and deletions released before the rebalance. Stocks likely to be added often rise 5-10% in the week before the change. Stocks being removed often fall 8-15% after. By acting on this information, investors can time their trades around these predictable moves.

How are stocks selected for inclusion in NIFTY 50?

Stocks must meet four key criteria: a minimum free-float market cap of ₹10,000 crore, average daily turnover of at least 0.5% of total market turnover, a listing history of at least 6 months on NSE, and trading on 90% of trading days in the past six months. No single stock can exceed 15% weight in the index.

Does rebalancing affect sector indices like NIFTY Bank or NIFTY IT?

Yes. Sector indices like NIFTY Bank, NIFTY IT, and NIFTY Pharma also rebalance twice a year using similar rules. Changes in these indices often happen before the NIFTY 50 list is finalized. For example, if Mphasis is removed from NIFTY IT, its stock drops because funds tracking that index must sell it-even if the company is still profitable.