Domestic Help in Mumbai: Cleaning, Cooking, and Chores Guide for 2025

When you need help around the house in Mumbai, domestic help, a trusted professional who handles daily household tasks like cleaning, cooking, and errands. Also known as maid, it’s not just about saving time—it’s about reducing stress and keeping your home running smoothly. Whether you’re juggling work, kids, or aging parents, having the right person in your home makes a real difference.

Most households in Mumbai rely on domestic workers for more than just sweeping floors. They cook meals, wash clothes, care for children, run errands, and even manage grocery lists. But not all services are the same. Some helpers work full-time, others come in for a few hours. Some specialize in cooking, others in childcare. Knowing exactly what you need—before you hire—stops misunderstandings later. For example, if you expect your helper to clean the bathroom daily, say so upfront. If you want them to cook Indian meals three times a week, clarify that too. Clear expectations mean fewer conflicts and better service.

It’s not just about what they do, but how they do it. Reliable domestic help in Mumbai comes with experience, references, and sometimes even background checks. Many families now use local agencies or community networks to find workers who’ve been vetted. Others rely on word-of-mouth from neighbors in Andheri, Bandra, or Thane. The cost varies by area, hours, and skills—cooking help usually costs more than cleaning alone. And don’t forget: a good helper isn’t just a task-doer. They become part of your routine, sometimes even part of your family.

What you’ll find below are real, practical guides from 2025 that break down exactly what domestic help includes, how much it costs, what to watch out for when hiring, and how to make sure both you and your helper are on the same page. No fluff. No guesswork. Just clear, honest advice from people who’ve been there.

Blockchain Forks Explained: Soft Forks, Hard Forks, and Chain Splits in Cryptocurrency

Learn how soft forks, hard forks, and chain splits work in cryptocurrency. Understand what happens to your coins during a fork, why they occur, and how to stay safe.

ASIC Mining vs GPU Mining: Which Is Right for You in 2025

ASIC mining offers unmatched efficiency for Bitcoin but requires high upfront costs and cheap power. GPU mining is flexible, affordable, and great for altcoins. Learn which is right for your budget and goals in 2025.

Land Investment in India: Due Diligence, Zoning, and Conversion (NA/NOC) Basics

Learn the essential steps for safe land investment in India: verify due diligence, understand zoning laws, and secure NA/NOC conversion to avoid legal traps and costly mistakes.

Ethereum Account Abstraction: How ERC-4337 and Smart Wallets Are Changing Crypto Access

ERC-4337 enables smart contract wallets on Ethereum, letting users pay gas in tokens, recover accounts socially, and batch transactions-without needing private keys. Here's how it works and why it matters.

How to Use a Home Loan Balance Transfer in India to Reduce EMI

Learn how to lower your home loan EMI in India by switching lenders through a balance transfer. Save lakhs in interest and reduce monthly payments with smart refinancing.

How to Nominate Beneficiaries in Indian Mutual Funds and Update Details

Learn how to nominate beneficiaries in Indian mutual funds and update details easily. Avoid probate delays and ensure your loved ones get your investments quickly with the right nominee.

Ready-to-Occupy vs Under-Construction Property in India: Which Is Better for Buyers?

Choosing between ready-to-occupy and under-construction property in India depends on your timeline, budget, and risk tolerance. Ready units offer instant possession but cost more. Under-construction offers higher returns but comes with delays and uncertainty.

Home Loan Interest Rates in India: How They Work and How to Get the Best Deal

Understand how home loan interest rates work in India in 2025, what affects your rate, how to compare lenders, negotiate better terms, and avoid hidden costs to save lakhs over your loan term.

Subvention Schemes in India: How Builder Payment Plans Work and What Risks You Face

Subvention schemes in India promise zero EMIs until possession, but hidden risks like project delays, builder defaults, and retroactive interest can leave buyers with debt and no home. Learn how to spot safe plans and avoid costly traps.

Utility vs Governance vs Investment Tokens: What They Really Do and How They Differ

Utility, governance, and investment tokens serve completely different roles in blockchain. One gives you access, another gives you votes, and the third gives you ownership. Understand the difference before you buy.

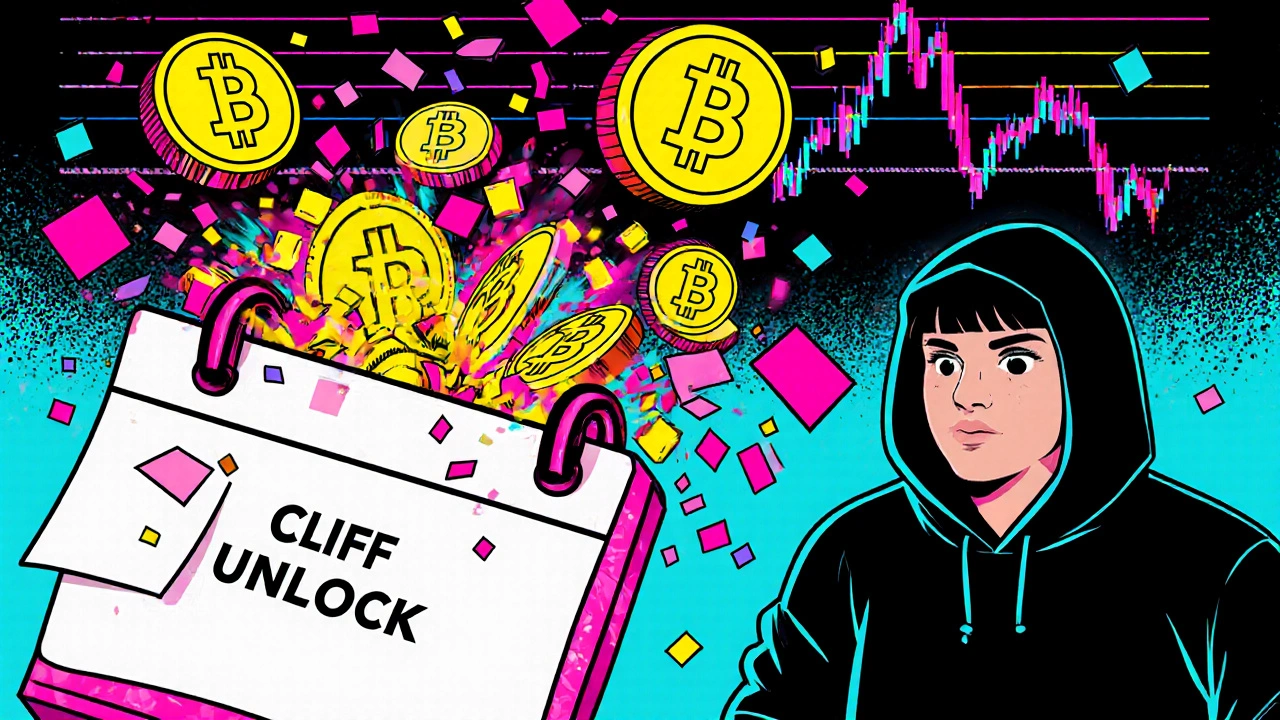

Token Unlock Calendars for Altcoins: How They Move Prices and What to Do About It

Token unlocks can crash altcoin prices if not tracked properly. Learn how unlock size, timing, and recipient type affect market movement-and what to do before, during, and after the event.

NFT Tax Rules 2025: How Digital Art Is Classified as Collectibles vs. Standard Capital Gains

NFT tax rules in 2025 treat digital art as either standard capital assets or collectibles-with tax rates jumping from 20% to 28%. Learn how the IRS classifies your NFTs, what records to keep, and how to avoid costly penalties.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness