Second Homes in India: Investment vs Vacation Home Considerations

Feb, 16 2026

Feb, 16 2026

Buying a second home in India isn’t just about having a place to escape to during holidays. For many, it’s a financial decision-with risks, rewards, and hidden costs that aren’t always obvious upfront. Whether you’re thinking of it as a rental investment or a personal getaway, the choices you make today will shape your returns, taxes, and peace of mind for years. Let’s cut through the noise and look at what really matters when you’re deciding between a vacation home and an investment property in India.

What’s the real difference between a vacation home and an investment property?

A vacation home is meant for your family’s use. You might rent it out occasionally, but your priority is comfort, location, and personal enjoyment. An investment property? That’s a business. You care about rental income, occupancy rates, maintenance costs, and capital appreciation. The same house in Goa can be both-but your mindset changes everything.

Here’s the catch: if you treat an investment property like a vacation home, you’ll bleed money. Too many people buy in scenic spots-Munnar, Pondicherry, Alibaug-thinking they’ll use it 3 weeks a year and rent it the rest. But if you don’t manage it like a business, vacancy rates climb, repairs pile up, and your ROI vanishes.

Where are second homes actually making money in India?

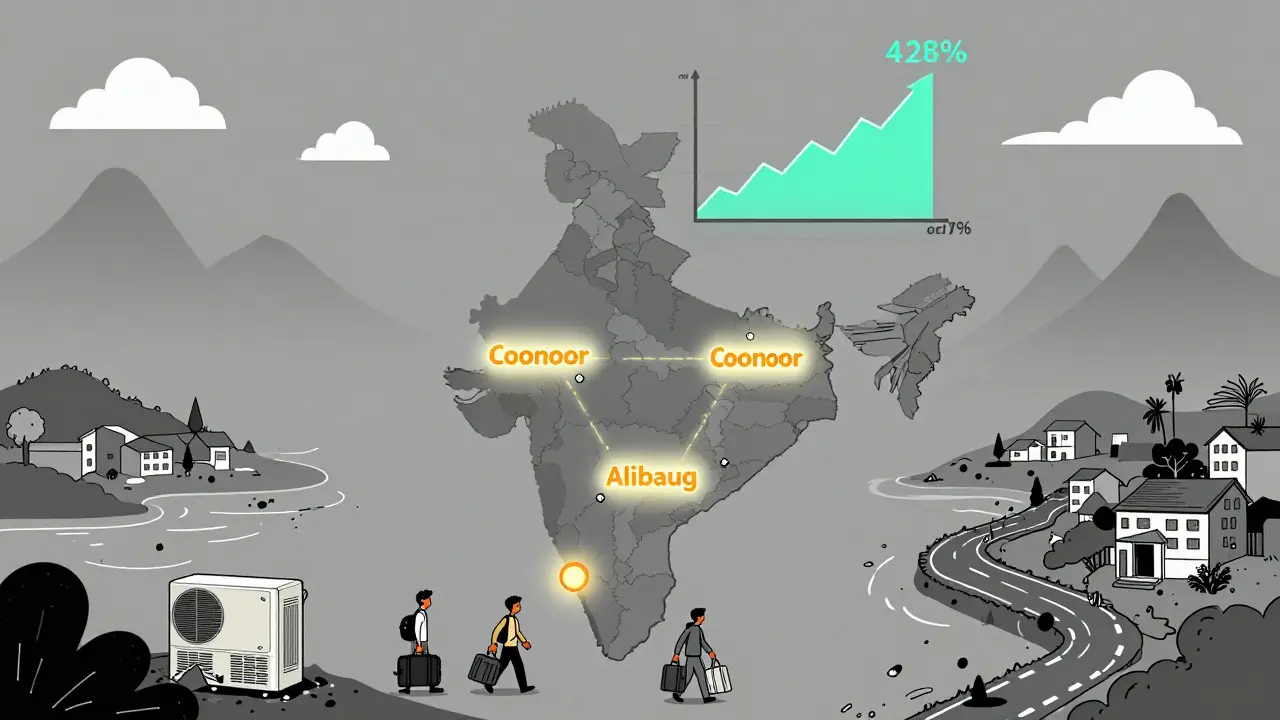

Not every beach or hill station delivers. A 2025 report from Knight Frank showed that properties in Goa, Coonoor, and Alibaug had average annual rental yields between 6% and 9%. That’s higher than most urban apartments. But outside these hotspots, yields drop below 3%-sometimes below 2%.

Why? Demand. Goa gets 3 million tourists a year. Coonoor’s cool climate draws families from Chennai and Bengaluru. Alibaug’s proximity to Mumbai makes weekend getaways easy. These places have consistent renters-corporate teams, families, retirees. Elsewhere? You might wait 6 months between bookings.

Also, look at infrastructure. A property near a highway or train station in Jaipur or Pune can outperform a remote villa in Uttarakhand-even if the view is better. People don’t rent for silence. They rent for convenience.

Costs no one talks about

Most buyers focus on the purchase price. But here’s what really eats into your profits:

- Property taxes: Vary wildly. In Goa, it’s 0.5% of the circle rate. In Delhi, it can hit 2%. Check local rates before you buy.

- Maintenance: Coastal homes need anti-corrosion treatments. Hill homes need heating and pest control. Budget at least 1% of the property value yearly.

- Management fees: If you hire a local agent to handle rentals, expect 15-20% of monthly rent. DIY? You’ll spend 20+ hours a month on calls, cleaners, and repairs.

- Utilities: Electricity, water, internet-often paid by owners in rental agreements. Factor in 5-10% of rent as utility cost.

- Capital gains tax: If you sell within 2 years, it’s taxed as income. After 2 years, it’s 20% with indexation. Plan ahead.

One owner in Lonavala spent ₹4.2 lakh on repairs over 3 years because he didn’t seal his walls against monsoon moisture. His rental income? ₹3.6 lakh. He broke even. Not profit. Just break-even.

Can you really use it as a vacation home and rent it out?

Yes-but it’s harder than it looks.

Let’s say you own a 2-bedroom apartment in Alibaug. You plan to use it 4 weekends a year. Sounds perfect. But here’s what happens:

- You cancel a booking because your cousin wants to visit. Guests leave bad reviews.

- You forget to clean after your stay. The next guest complains about dust.

- You don’t replace the AC filter. The tenant calls the management company.

One bad review can cost you 20% of bookings. If you’re not consistent, renters will go elsewhere. Platforms like Airbnb and StayUncle now have algorithms that rank properties by reliability-not just photos.

Smart owners separate the two. They keep a second set of linens, towels, and toiletries. They schedule deep cleaning right after personal use. They hire a local cleaner for ₹800/day when they’re around. It’s extra work-but it keeps the ratings high.

Tax implications: What you must know

India doesn’t tax your primary residence. But second homes? They’re treated differently.

If you rent it out, you pay tax on rental income after deductions. You can deduct:

- Property tax paid

- Interest on home loan (if you took one)

- 30% of rent as standard repair allowance

But here’s the trap: if you don’t rent it out at all, the government still taxes you on notional rent. That means even if your second home sits empty, you owe tax based on what it could earn. This applies if you own more than one house.

Example: You own a flat in Mumbai (your primary home) and a villa in Lonavala. The villa is empty. The tax department estimates its potential rent at ₹1.2 lakh/year. You owe tax on that-even if you never earned a rupee from it.

Only way out? Rent it out for at least 300 days a year. Then you report actual income, not notional. But that’s tough unless you’re in a high-demand area.

Who should buy a second home in India?

Not everyone should. Here’s who wins:

- Retirees near cities: A 2BHK in Coonoor or Mysore lets you live cheaper than in Bengaluru, with better air and peace.

- Remote workers: If you work online, a second home in a quiet town gives you focus-and a change of scenery.

- Investors with local help: If you have family or a trusted property manager nearby, you can handle repairs and tenant issues without flying in every month.

Who should skip it?

- People without a budget for upkeep: A ₹40 lakh property isn’t cheap-but ₹50,000/year in maintenance is invisible until it hits you.

- Those who think it’s a quick flip: Real estate in India moves slowly. Don’t expect to double your money in 3 years.

- Anyone who can’t handle paperwork: RERA registration, rental agreements, tax filings-it adds up.

What to look for before you buy

Here’s a simple checklist:

- Location: Is it within 3 hours of a major city? Can people get there without a flight?

- Legal status: Does the project have RERA registration? Is the title clear? Avoid land in green zones or near forests.

- Rental history: Ask the builder or agent: “How many months a year do units here stay rented?” If they hesitate, walk away.

- Access to services: Reliable water, electricity, internet, and medical access matter more than a pool.

- Exit strategy: If you need to sell in 5 years, will there be buyers? Look at resale trends in that area.

One investor bought a villa in Mahabaleshwar because it had a good view. But no internet, no hospital nearby, and the road flooded in monsoon. He couldn’t rent it. He couldn’t live there. He sold it for 20% less than he paid.

Final advice: Pick your goal first

Don’t buy a second home because it looks nice. Don’t buy it because your friend did. Buy it because it fits your goal.

Want income? Go for high-demand areas with proven occupancy. Skip the dream villas. Go for clean, simple, functional units.

Want peace? Choose a place you’ll genuinely enjoy-even if it earns less. But still, budget for upkeep. Don’t romanticize it.

And never assume the market will bail you out. Real estate in India isn’t like stocks. It’s slow, sticky, and personal. Do the math. Talk to local managers. Visit off-season. Then decide.

Can I claim tax benefits on a home loan for a second home in India?

Yes, but only if you rent it out. You can deduct the full interest paid on the home loan from your rental income. If you don’t rent it, you still owe tax on notional rent, but you can’t claim the interest deduction. The principal repayment (under Section 80C) is only allowed for your primary residence.

Is it better to buy a ready-to-move-in property or under-construction?

Ready-to-move-in properties give you immediate rental income and let you verify quality. Under-construction projects often have lower upfront costs, but delays are common. In 2025, over 40% of under-construction projects in tier-2 cities were delayed by more than 6 months. If you’re buying for income, go ready. If you’re buying long-term and can wait, under-construction might work.

How much of a down payment do I need for a second home in India?

Banks usually require 30-40% down for a second home, compared to 10-20% for a first. Interest rates are also 0.5-1% higher. Some lenders won’t approve loans if you already have a home loan. Check with multiple banks-some NBFCs are more flexible.

Can NRIs buy second homes in India?

Yes, NRIs can buy residential property without restrictions. But they can’t buy agricultural land or farmhouses. Rental income can be repatriated, but taxes must be paid in India first. NRIs often use local representatives to manage properties, which adds cost but saves time.

What’s the minimum rental income needed to make a second home profitable?

Break-even depends on location. In Goa, a ₹50 lakh property needs ₹30,000-₹35,000/month in rent to cover taxes, maintenance, and loan payments. In smaller towns, ₹20,000-₹25,000 might be enough. Always calculate occupancy-assume 6-7 months of rent per year, not 12.

If you’re serious about a second home in India, start with data-not emotion. Visit during monsoon. Talk to property managers. Run the numbers. The right property can give you income, escape, and long-term value. The wrong one? It becomes a financial burden with a nice view.