Best ELSS Funds in India: Tax Savings and Long-Term Growth Explained

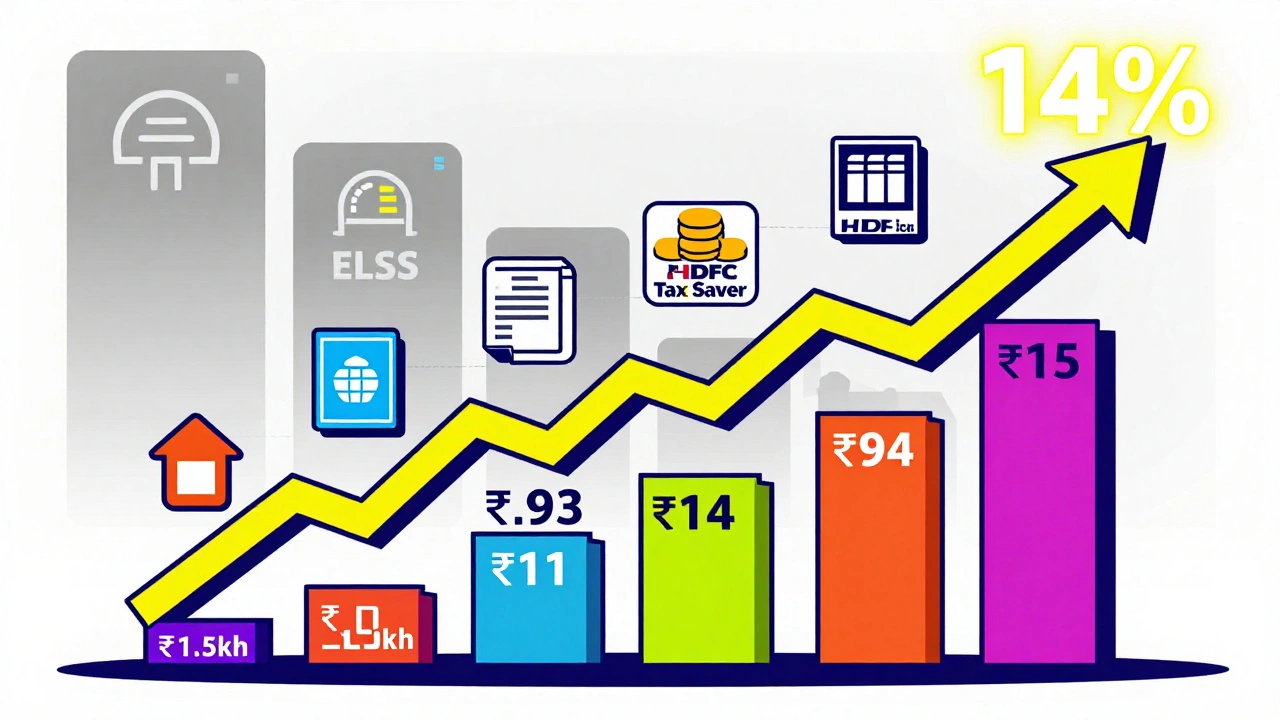

When you hear ELSS funds, Equity Linked Savings Schemes that offer tax benefits under Section 80C of the Indian Income Tax Act. Also known as tax-saving mutual funds, they combine the power of equity investing with immediate tax deductions. Unlike fixed deposits or PPF, ELSS funds lock your money for just three years—and put it to work in the stock market, where long-term returns can outpace inflation by a wide margin.

What makes the best ELSS funds different isn’t just their past performance. It’s how they balance risk, cost, and consistency. Top performers don’t chase hype—they stick to solid companies, keep expenses low, and avoid overtrading. They’re built for people who want to save on taxes without sacrificing growth. Many investors mix ELSS with PPF or NPS, but ELSS stands out because it’s the only tax-saving option that gives you exposure to equities with the shortest lock-in. And unlike Section 80C instruments like ULIPs or NSC, ELSS funds let you start with as little as ₹500 a month through SIPs.

When you pick an ELSS fund, you’re not just choosing a product—you’re choosing a strategy. Look at how the fund manager handles volatility. Do they hold quality stocks through market dips? Do they rebalance or chase momentum? Check the expense ratio: even a 0.5% difference adds up to thousands over ten years. Also, don’t ignore the fund’s track record during downturns. The best ELSS funds don’t always top the charts in bull markets—they protect your capital when things go wrong. And remember, tax savings under Section 80C cap out at ₹1.5 lakh a year, so your ELSS contribution should fit within that limit alongside other investments like home loan principal or PPF.

These funds are especially useful for young professionals, salaried earners, and anyone starting to think about long-term wealth. If you’ve been putting money into fixed deposits because you’re scared of the stock market, ELSS might be your gentle entry point. You get diversification, professional management, and tax relief—all in one package. And because they’re mutual funds, you can pause, increase, or stop your SIP anytime without penalties.

Below, you’ll find real-world insights from posts that dig into how mutual funds work, how to pick direct plans over regular ones, how SIPs build wealth over time, and how to link your investments with KYC and nominee rules. These aren’t theory pieces—they’re practical guides written for people who want to do the right thing without getting lost in jargon. Whether you’re new to investing or looking to optimize your portfolio, the posts here will help you make smarter choices with your ELSS funds—and your money.

ELSS Fund Performance in India: Top Tax-Saving Mutual Funds with Highest Returns

Discover which ELSS mutual funds deliver the highest returns under Section 80C in India. Compare top performers, avoid common mistakes, and learn how to build tax-free wealth with equity-linked savings.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness