Buy Property in India: What You Need to Know Before You Invest

When you buy property in India, a major financial decision involving legal contracts, financing, and long-term ownership. Also known as real estate investment in India, it’s not just about picking a location—it’s about understanding how home loan interest rates, subvention schemes, and rent agreements shape your actual cost and risk.

Most people think buying a home is simple: find a place, get a loan, move in. But in India, the real game happens behind the scenes. Builders promise zero EMIs until possession—that’s a subvention scheme. Sounds great, right? Until the project stalls for two years and suddenly you owe interest on money you never received. Or you sign a rent agreement thinking it’s just a formality, only to find out it’s legally required to be registered or you lose all protection. And if you’re using your Section 80C limit to pay off your home loan principal, you need to know exactly what counts—and what doesn’t. These aren’t edge cases. They’re everyday traps.

When you buy property in India, you’re not just buying bricks and mortar. You’re stepping into a system where Model Tenancy Act rules apply to rentals, stamp duty can add 5-10% to your cost, and your PAN and Aadhaar become mandatory for every transaction. Even your tax savings depend on whether you choose a direct or regular mutual fund to fund your down payment. The pieces are all connected.

Below, you’ll find real, practical guides written for people who’ve been burned before. No fluff. No sales pitches. Just clear breakdowns of how home loans really work, what builder payment plans hide, how to avoid rent agreement mistakes, and how to use your tax rules to your advantage. If you’re serious about buying property in India, this is the context you need before you hand over a single rupee.

Residential vs Commercial Property Investment in India: Which Gives Better Returns?

Residential property in India offers steady rental income and lower risk, while commercial property delivers higher returns but demands more capital and management. Learn which suits your goals in 2025.

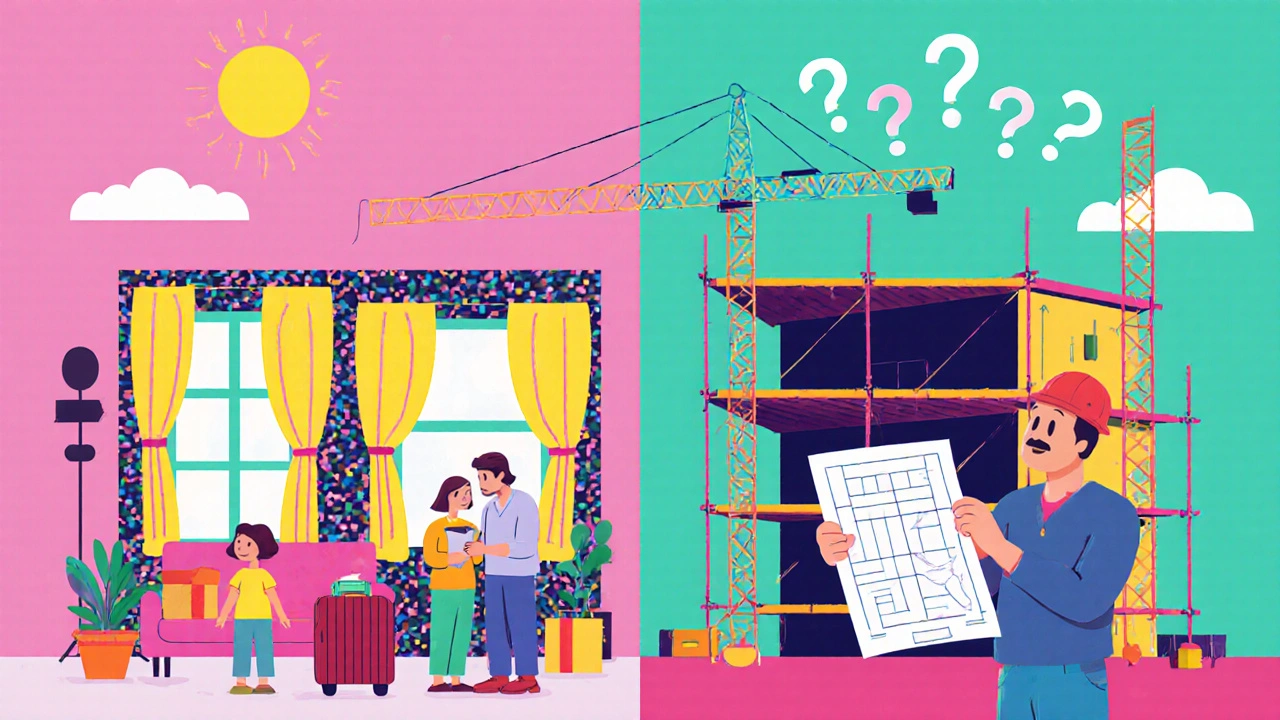

Ready-to-Occupy vs Under-Construction Property in India: Which Is Better for Buyers?

Choosing between ready-to-occupy and under-construction property in India depends on your timeline, budget, and risk tolerance. Ready units offer instant possession but cost more. Under-construction offers higher returns but comes with delays and uncertainty.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness