Crypto Disclosures: What You Need to Know About Tax, Regulation, and Token Rules

When you trade or hold crypto disclosures, the legal and financial requirements that force transparency around cryptocurrency ownership, transactions, and tax obligations. Also known as digital asset reporting, these rules are no longer optional—they’re enforced by tax agencies, exchanges, and governments worldwide. If you’ve bought Bitcoin, sold an NFT, or staked Ethereum, you’re already part of this system. Ignoring disclosures doesn’t make them disappear—it just makes your next tax season harder.

Three big things shape crypto disclosures today: cryptocurrency regulation, the laws governments use to control how digital assets are traded, taxed, and reported, crypto tax, the way income, capital gains, and losses from crypto are calculated and reported to tax authorities, and utility tokens, digital assets that give access to a service or platform, like paying for cloud storage or voting in a decentralized network. These aren’t abstract ideas—they directly affect how much you owe, what records you need to keep, and whether your wallet activity gets flagged. For example, India’s 30% tax on crypto gains isn’t just a rate—it’s a disclosure trigger. Every trade, swap, or transfer could require documentation. Meanwhile, governance tokens, which let you vote on protocol changes, aren’t just tech—they’re assets that may be taxed as property or income depending on how you use them.

There’s no single global rule. The EU’s MiCA framework demands full transparency, while China bans crypto entirely. In the U.S., the IRS treats crypto like property. In India, you pay tax even on transfers between your own wallets. That’s why disclosures aren’t about being suspicious—they’re about being prepared. If you’re holding tokens from a project with upcoming unlocks, you need to track not just price but also timing and tax impact. If you’re using stablecoins to avoid volatility, you still need to log every trade. Even if you didn’t cash out, you might still owe tax.

What you’ll find below isn’t theory. These are real guides from people who’ve filed disclosures, survived audits, and avoided penalties. You’ll learn how to use tax-loss harvesting to lower your bill, why NFTs are classified as collectibles, how token unlocks move prices, and what the latest rules mean for your portfolio. No fluff. No jargon. Just what you need to stay compliant and in control.

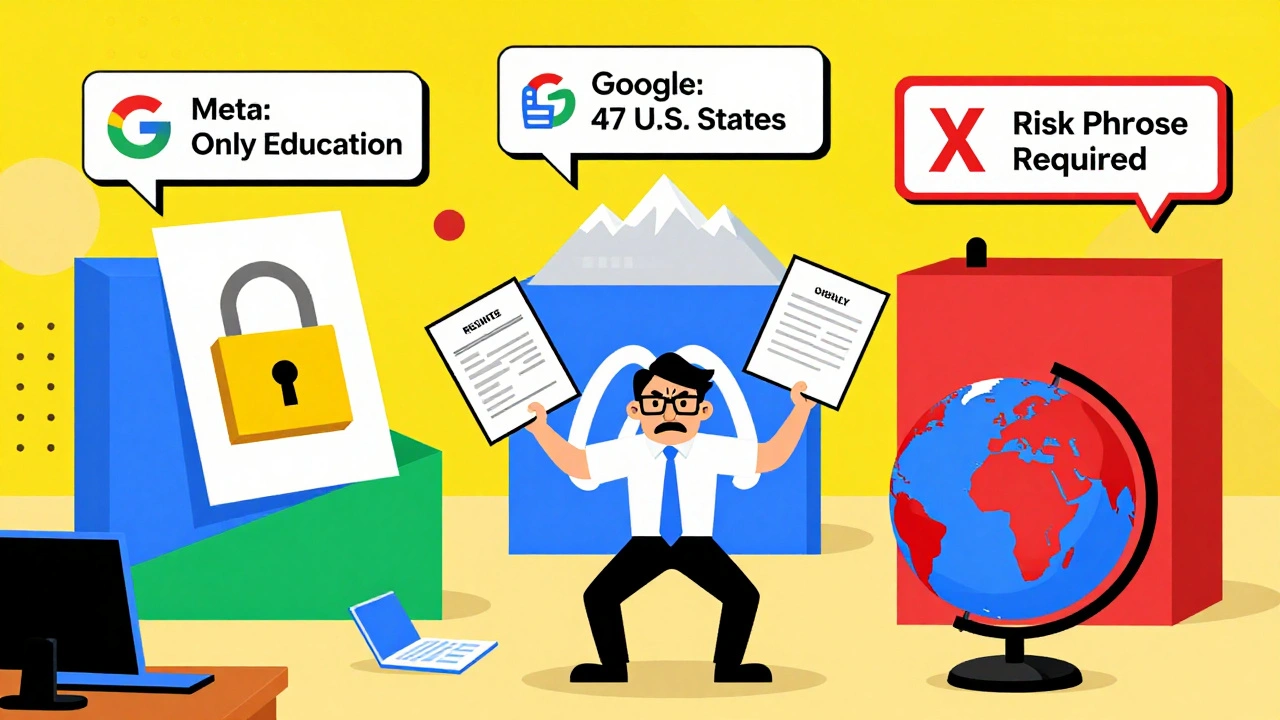

Advertising Rules for Crypto: Disclosures and Jurisdictions

Crypto advertising rules vary wildly by platform and country. Learn the exact disclosures required by Google, Meta, and X in 2025, plus how U.S. state laws and global regulations like MiCA impact your campaigns.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- hire domestic help in Mumbai

- Home & Lifestyle

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness