Crypto Regulation: What’s Legal, What’s Not in 2025

When it comes to crypto regulation, the rules governing how digital currencies are taxed, traded, and monitored by governments. Also known as cryptocurrency laws, it’s no longer a gray area—it’s a patchwork of conflicting policies that can make or break your investments. In 2025, if you’re holding Bitcoin, Ethereum, or any token, you’re not just betting on price—you’re betting on whether your country lets you keep it.

Some places, like the EU’s MiCA, a unified framework for crypto asset markets that sets clear rules for exchanges, issuers, and stablecoins, treat crypto like any other financial product. Others, like India, a country with a 30% tax on crypto gains and no legal recognition of crypto as currency, tax you heavily but don’t stop you from trading. Then there’s China, where owning crypto is effectively banned, and the U.S., where the SEC picks fights with exchanges one by one. The FATF Travel Rule, a global standard requiring crypto exchanges to share sender and receiver data for transactions over $1,000 adds another layer—your wallet address might now be tracked like a bank account.

What does this mean for you? If you’re trading on an Indian exchange, you’re paying 30% tax on every profit, no deductions allowed. If you’re in the EU, you might have to prove your coin’s origin before selling. If you’re using a stablecoin like USDT or USDC, you’re not just avoiding volatility—you’re navigating whether your provider is licensed in your region. And forget about anonymity. Even decentralized wallets are getting pulled into compliance nets through KYC checks on on-ramps and off-ramps.

There’s no global standard. No single rulebook. That’s why knowing where you live matters more than knowing which coin you own. Your tax bill, your ability to cash out, even your right to hold crypto—all depend on the country you’re in. The posts below break down exactly how this plays out across major markets, what changes happened in 2025, and how to stay compliant without giving up your position. You’ll find real examples, real tax numbers, and real stories from people who got caught off guard—and how they fixed it.

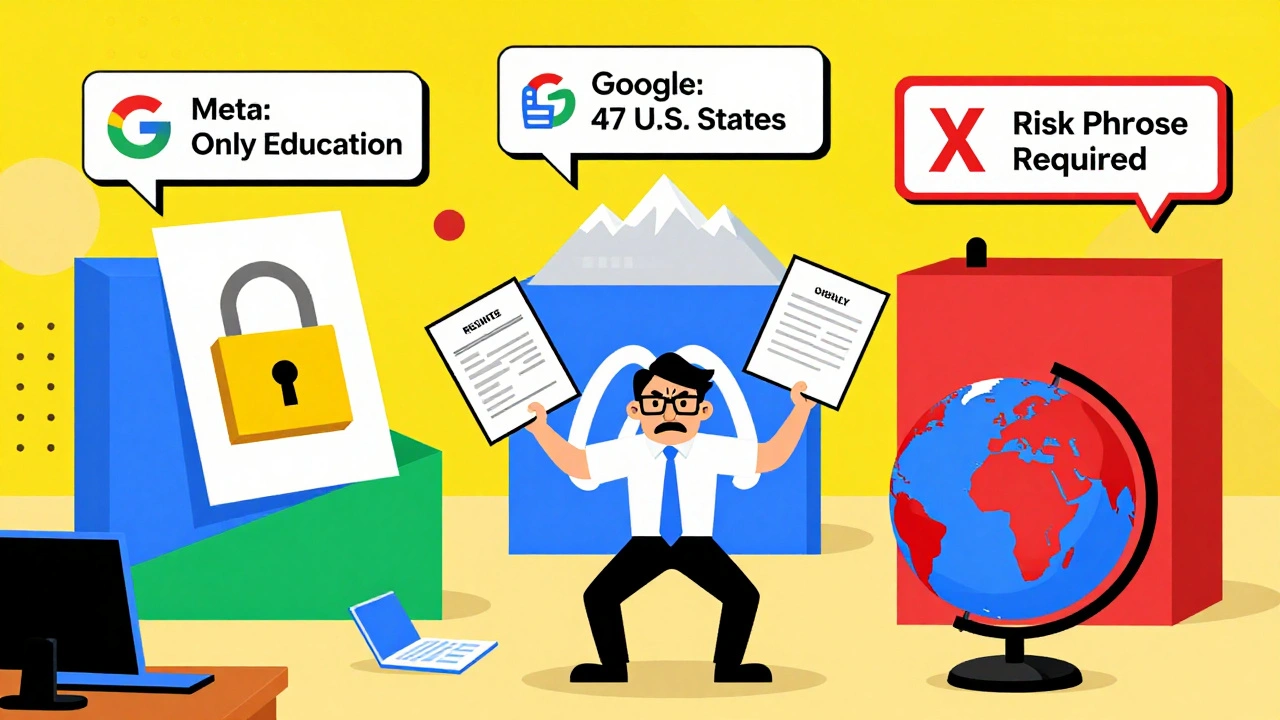

Advertising Rules for Crypto: Disclosures and Jurisdictions

Crypto advertising rules vary wildly by platform and country. Learn the exact disclosures required by Google, Meta, and X in 2025, plus how U.S. state laws and global regulations like MiCA impact your campaigns.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- hire domestic help in Mumbai

- Home & Lifestyle

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness