ELSS Funds: Tax-Saving Mutual Funds Explained for Indian Investors

When you hear ELSS funds, Equity Linked Savings Schemes are tax-saving mutual funds that invest primarily in equities and offer deductions under Section 80C of the Income Tax Act. Also known as tax-saving mutual funds, they’re one of the few investment options that combine market-linked growth with immediate tax benefits. Unlike fixed deposits or PPF, ELSS funds give you exposure to the stock market while letting you claim up to ₹1.5 lakh in tax deductions each year.

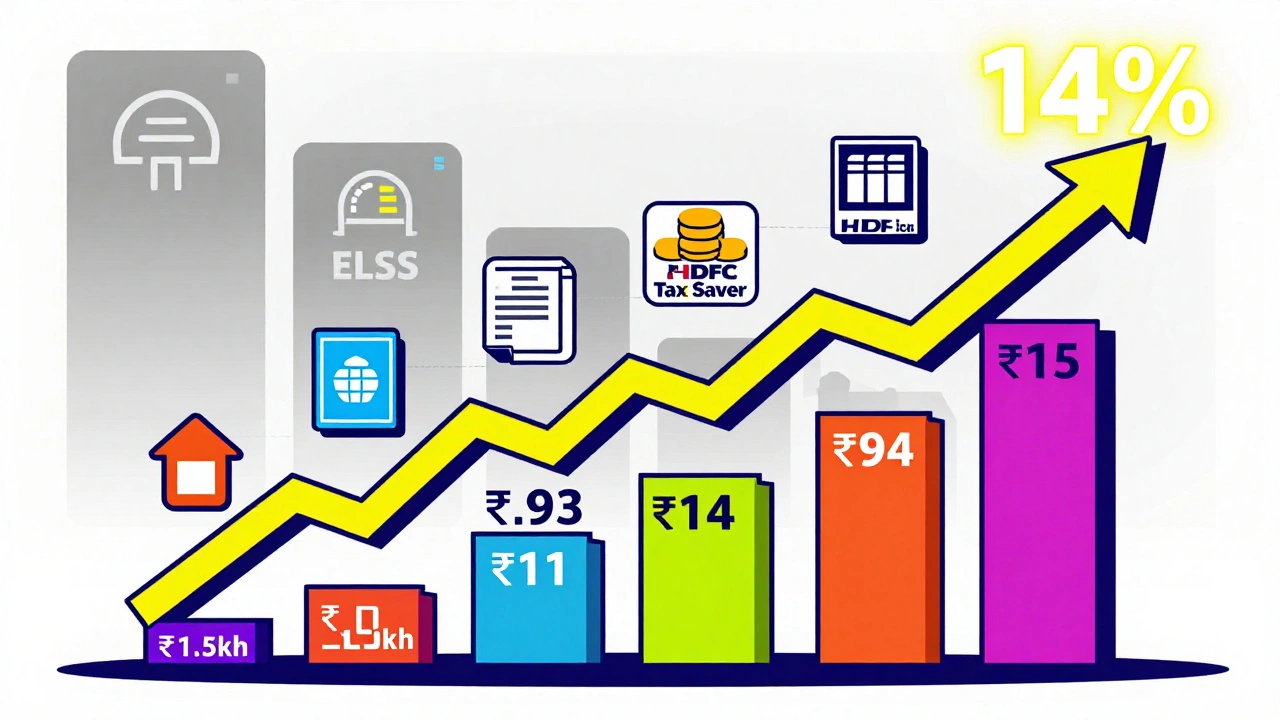

What makes ELSS stand out isn’t just the tax break—it’s the lock-in period, the shortest among all Section 80C instruments at just three years. 3-year lock-in means your money stays invested, helping you avoid impulsive withdrawals and encouraging long-term thinking. Compare that to PPF’s 15 years or NSC’s 5, and you see why ELSS is popular among young professionals and salaried investors looking to build wealth without tying up cash for decades. The returns? Historically, top-performing ELSS funds have delivered 12-15% annualized returns over the last decade, outpacing inflation and traditional savings tools.

ELSS funds work by pooling your money with other investors and putting it into a mix of large-cap, mid-cap, and sometimes small-cap stocks. The fund manager picks companies they believe will grow over time. Because they’re equity-focused, ELSS funds can be volatile in the short term, but that volatility is the price of higher long-term gains. If you’re already investing in SIPs or mutual funds, adding an ELSS fund is a simple way to reduce your tax bill without changing your investment habits.

Many people confuse ELSS with regular mutual funds. The key difference? Only ELSS qualifies for Section 80C deductions. Regular funds don’t offer tax savings, even if they’re equity-based. Also, while you can withdraw from a regular fund anytime, ELSS locks your money for three years from the date of each SIP installment. So if you invest ₹5,000 monthly, each installment has its own 3-year lock-in clock.

Another thing to watch: expense ratios. Since ELSS funds are actively managed, fees can eat into returns. Look for funds with expense ratios under 1.5%. Some newer direct plans offer even lower costs, and switching from a regular to a direct plan can save you thousands over time. Don’t just pick the fund with the highest past returns—check consistency, fund manager tenure, and portfolio diversification.

ELSS funds also tie into broader financial planning. If you’re using your ₹1.5 lakh Section 80C limit for home loan principal repayment, you can still add ELSS to your strategy by using the extra ₹50,000 deduction under Section 80CCD(1B) for NPS. That means you can stack tax savings across multiple instruments without exceeding legal limits.

What you’ll find below are real, practical guides that cut through the noise. We cover how to pick the best ELSS funds for your risk profile, how to time your SIPs to avoid market peaks, how to switch between funds without losing tax benefits, and what happens if you miss a SIP payment. You’ll also see how ELSS compares with other Section 80C options like PPF, NSC, and life insurance policies—no fluff, no sales pitches, just clear comparisons based on returns, liquidity, and safety.

ELSS Fund Performance in India: Top Tax-Saving Mutual Funds with Highest Returns

Discover which ELSS mutual funds deliver the highest returns under Section 80C in India. Compare top performers, avoid common mistakes, and learn how to build tax-free wealth with equity-linked savings.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness