ELSS Returns 2025: How Tax-Saving Mutual Funds Deliver Real Gains

When you hear ELSS, Equity Linked Savings Scheme, a type of mutual fund in India that offers tax benefits under Section 80C. Also known as tax-saving mutual funds, it’s one of the few investment options that lets you reduce your taxable income while putting money into the stock market. Unlike fixed deposits or PPF, ELSS funds invest mostly in equities, which means your returns depend on how the market performs—but they also have the highest potential growth among all Section 80C options.

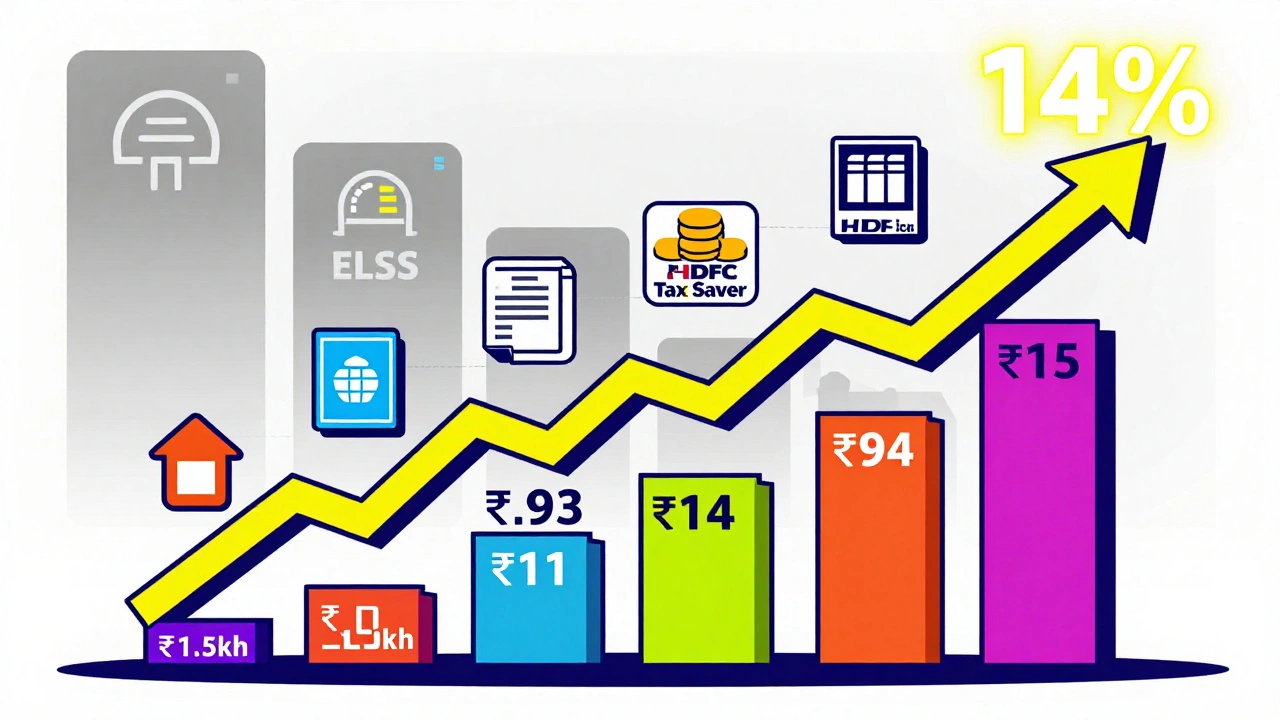

What makes ELSS stand out isn’t just the tax break—it’s the lock-in period. At just three years, it’s the shortest lock-in among all tax-saving instruments like PPF (15 years) or NSC (5 years). That means your money isn’t trapped for decades, but you still get the full ₹1.5 lakh deduction under Section 80C. And because these funds are actively managed, they don’t just sit idle—they chase growth. In 2024, top-performing ELSS schemes returned between 15% and 22% annually. While past performance doesn’t guarantee future results, historical trends show that consistent investors in ELSS have built wealth faster than those sticking to low-yield savings tools.

ELSS returns in 2025 will be shaped by two big factors: market conditions and how fund managers pick stocks. If the broader Indian equity market keeps growing—driven by digital adoption, manufacturing growth, and consumer spending—ELSS funds will likely keep outperforming other tax-saving options. But you don’t need to time the market. The best approach is to invest through SIPs, spreading your money over months to reduce risk. Many people think ELSS is only for experts, but it’s designed for regular earners who want to save tax without giving up growth. You don’t need to pick the fund yourself; platforms and advisors can help you choose based on your risk level.

It’s also important to know what ELSS doesn’t do. It won’t protect you from short-term losses. If the market drops, your fund value will too. But over three years and beyond, volatility tends to smooth out. And unlike fixed deposits, you won’t pay tax on the gains after the lock-in—making ELSS one of the few truly tax-efficient long-term tools.

Below, you’ll find real-world guides on how to pick the right ELSS fund, how to maximize your ₹1.5 lakh deduction, and how to combine it with other tax-saving moves like NPS and PPF. These aren’t theory pieces—they’re practical breakdowns from people who’ve done it, saved money, and grown their wealth without taking unnecessary risks.

ELSS Fund Performance in India: Top Tax-Saving Mutual Funds with Highest Returns

Discover which ELSS mutual funds deliver the highest returns under Section 80C in India. Compare top performers, avoid common mistakes, and learn how to build tax-free wealth with equity-linked savings.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness