SIP Investing: How Systematic Investment Plans Work in India

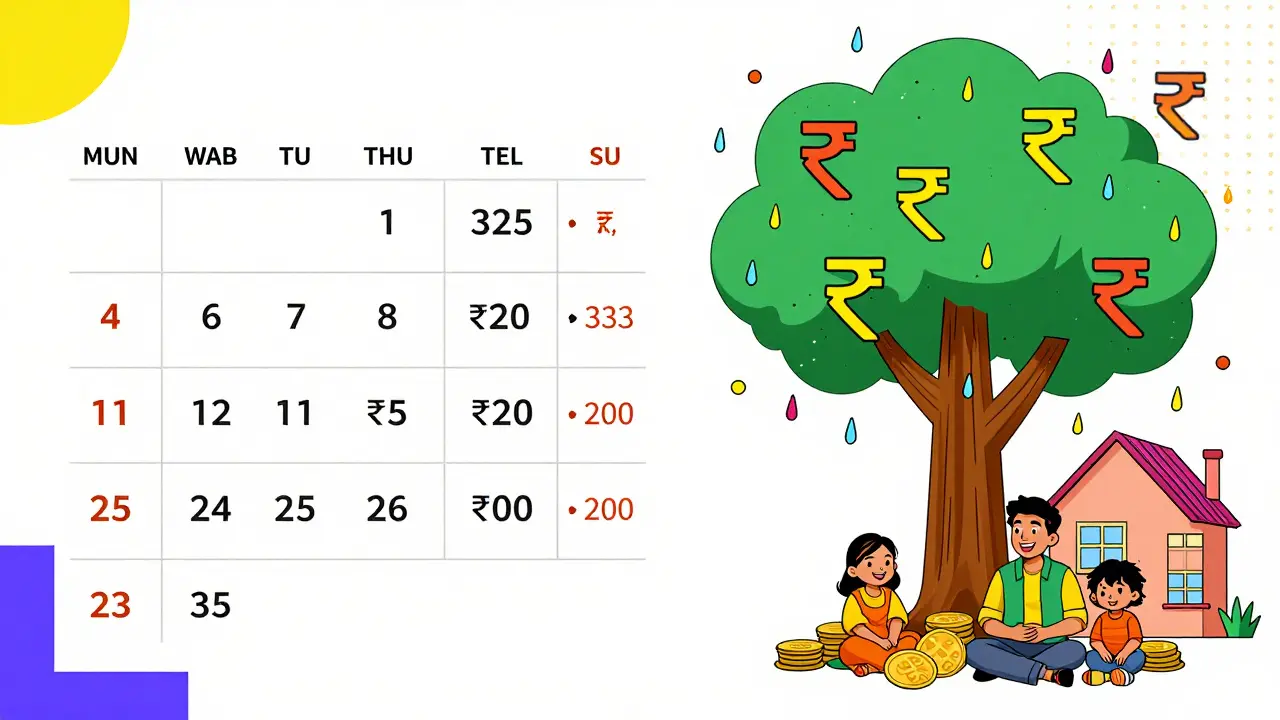

When you start SIP investing, a Systematic Investment Plan that lets you invest fixed amounts regularly into mutual funds. It's not a product—it's a habit. And in India, it’s one of the most common ways people build long-term wealth without needing to time the market. You don’t need a big lump sum. Just ₹500 a month, set on autopilot, and your money starts working for you. This is how millions of middle-class families in Mumbai, Delhi, and Pune are quietly growing their savings—without brokers, without stress, without guessing when to buy.

Direct mutual funds, funds bought straight from the asset management company without paying advisor commissions are the smartest way to do SIP investing. They cut costs, boost returns, and let you keep more of what you earn. And when you pair them with Section 80C, a tax-saving rule under India’s Income Tax Act that lets you deduct up to ₹1.5 lakh annually from your taxable income, your SIP doesn’t just grow—it shrinks your tax bill too. ELSS funds, for example, are tax-saving mutual funds that lock in your money for three years but give you the dual benefit of growth and deduction.

SIP investing isn’t magic. It doesn’t promise quick riches. But it’s reliable. It works whether you’re a teacher in Andheri, a driver in Thane, or a homemaker in Borivali. It doesn’t care if you know the difference between large-cap and small-cap stocks. It just needs consistency. And that’s why the posts below cover everything you actually need: how to pick the right fund, how to switch from regular to direct plans, how to link your KYC and PAN, and how to use SIPs alongside other tax-saving tools like PPF or child plans. You’ll find real numbers, real costs, and real advice—no fluff, no hype. Just what works for people like you, investing slowly, steadily, and smartly.

Rupee Cost Averaging in India: Why SIPs Work for Long-Term Investing

Rupee cost averaging through SIPs helps Indian investors build wealth over time without timing the market. Learn why consistent monthly investing in mutual funds beats lump-sum investing and how to start smart.

Multi-SIP Strategy in India: How to Invest in Multiple Mutual Funds at Once

Learn how to build wealth in India using a multi-SIP strategy - investing in multiple mutual funds at once to reduce risk and boost long-term returns without timing the market.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness