Tax Saving Mutual Funds: How to Lower Your Tax Bill in India

When you invest in tax saving mutual funds, a type of equity mutual fund in India designed to reduce taxable income under Section 80C of the Income Tax Act. Also known as ELSS (Equity Linked Savings Scheme), these funds lock your money for three years but offer the highest potential returns among all Section 80C options. Unlike fixed deposits or PPF, which give you steady but low returns, tax saving mutual funds put your money into stocks—giving you a real shot at beating inflation and building long-term wealth.

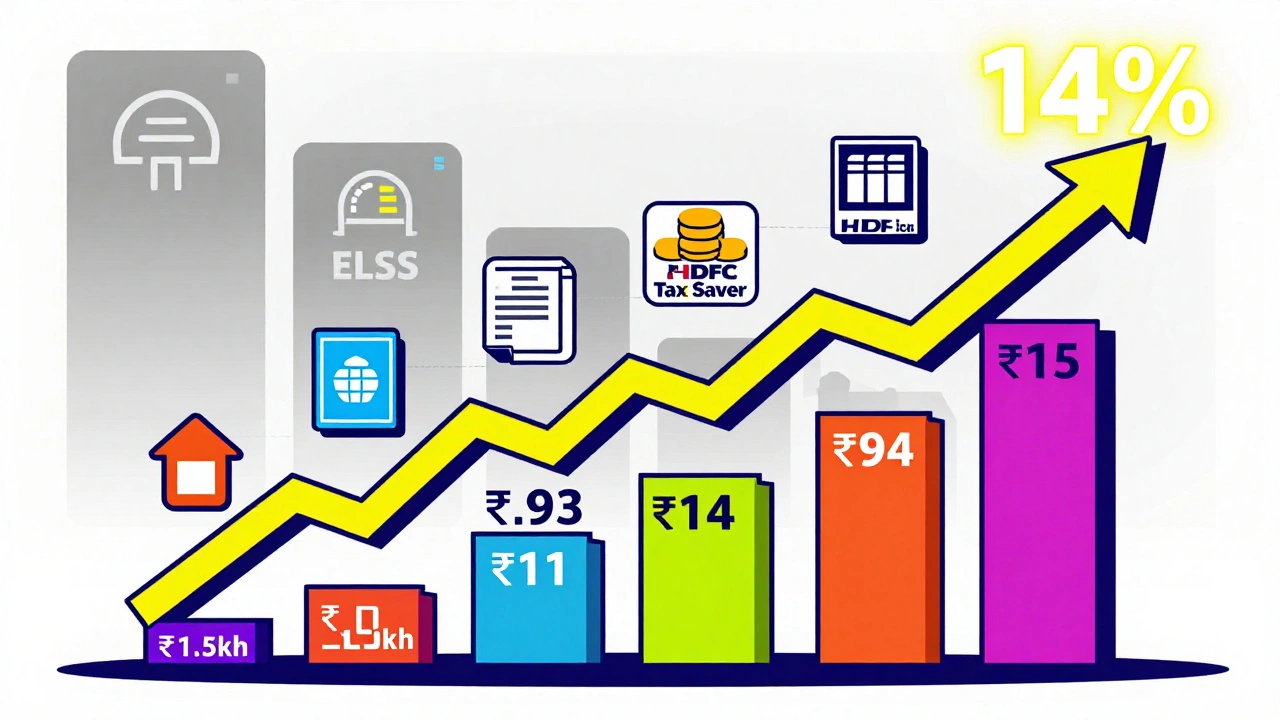

What makes them stand out? You get two benefits at once: Section 80C, a tax deduction limit of ₹1.5 lakh per year for eligible investments and the power of equity growth. You can claim up to ₹46,800 in tax savings annually if you’re in the highest slab. And unlike NPS or life insurance, you’re not stuck with rigid payout rules—you can withdraw after three years, reinvest, or let it keep growing. Many people confuse ELSS with regular mutual funds, but the key difference is the lock-in period and the tax benefit. If you’re already investing in mutual funds, switching to a direct ELSS plan can save you even more by cutting out advisor commissions.

These funds aren’t just for high earners. Even if you earn ₹8 lakh a year, using ELSS can drop your taxable income below a tax bracket, saving you thousands. They’re also flexible—you can start with ₹500 a month through SIPs, and the three-year lock-in feels less painful when you’re investing small amounts regularly. Compare them to PPF or NSC, and you’ll see ELSS usually delivers better returns over 5–10 years. But they’re not risk-free. If the market drops, your fund value drops too. That’s why it’s smart to combine them with other Section 80C tools like PPF or home loan principal repayments.

Below, you’ll find real guides on how to pick the right ELSS fund, how to switch from regular to direct plans, how to link your KYC and PAN for seamless investing, and how to combine tax saving mutual funds with other strategies like multi-SIP or NPS contributions to maximize your savings. No fluff. Just clear, practical steps to keep more of your money—legally.

ELSS Fund Performance in India: Top Tax-Saving Mutual Funds with Highest Returns

Discover which ELSS mutual funds deliver the highest returns under Section 80C in India. Compare top performers, avoid common mistakes, and learn how to build tax-free wealth with equity-linked savings.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness