Tokenomics Explained: How Digital Tokens Drive Rewards, Crypto, and Retail Systems

When you hear tokenomics, the economic design behind digital tokens that determines their supply, distribution, and real-world value. Also known as token economy, it’s not just crypto jargon—it’s the engine behind how you earn rewards, trade assets, and even get paid in digital points by your favorite brands. Think of it like the rules of a game, but for money that lives on a blockchain. Some tokens are built to grow in value over time, others are meant to be spent, and a few exist just to keep you coming back to a service. The difference between a token that crashes and one that lasts comes down to how its tokenomics were planned from day one.

Tokenomics isn’t just about crypto. It’s in your grocery store’s loyalty app, your favorite coffee shop’s rewards program, and even how you earn points for using a credit card. tokenized loyalty, when reward points become digital assets you truly own, not just store credits is changing how brands keep customers. Instead of points that expire, you get tokens you can hold, trade, or even use across apps. That’s a big shift—from being a customer to being a stakeholder. Meanwhile, crypto tokens, digital assets built on blockchains like Ethereum or Solana that represent ownership, access, or utility rely on tokenomics to stay stable. If too many tokens are released at once, prices crash. If too few are ever released, no one can use them. That’s why token unlock, the scheduled release of locked tokens to investors or teams is watched like a clock. A big unlock can tank a coin’s price overnight if traders expect a flood of selling.

And it’s not just about price. Tokenomics affects how you use crypto. Some tokens let you pay gas fees in other coins. Others let you recover your wallet using friends’ help instead of a seed phrase. That’s all part of the design. Whether you’re holding Bitcoin, earning points for buying shampoo, or trading altcoins, you’re interacting with tokenomics. The best systems make it invisible—so you just feel like you’re getting more value. The worst ones feel like a scam because the rules were written to benefit insiders, not users.

Below, you’ll find real examples of how tokenomics plays out in the wild—from crypto traders watching unlock calendars to retail brands using blockchain to cut reward breakage. No theory. No fluff. Just what’s working, what’s failing, and why it matters to you.

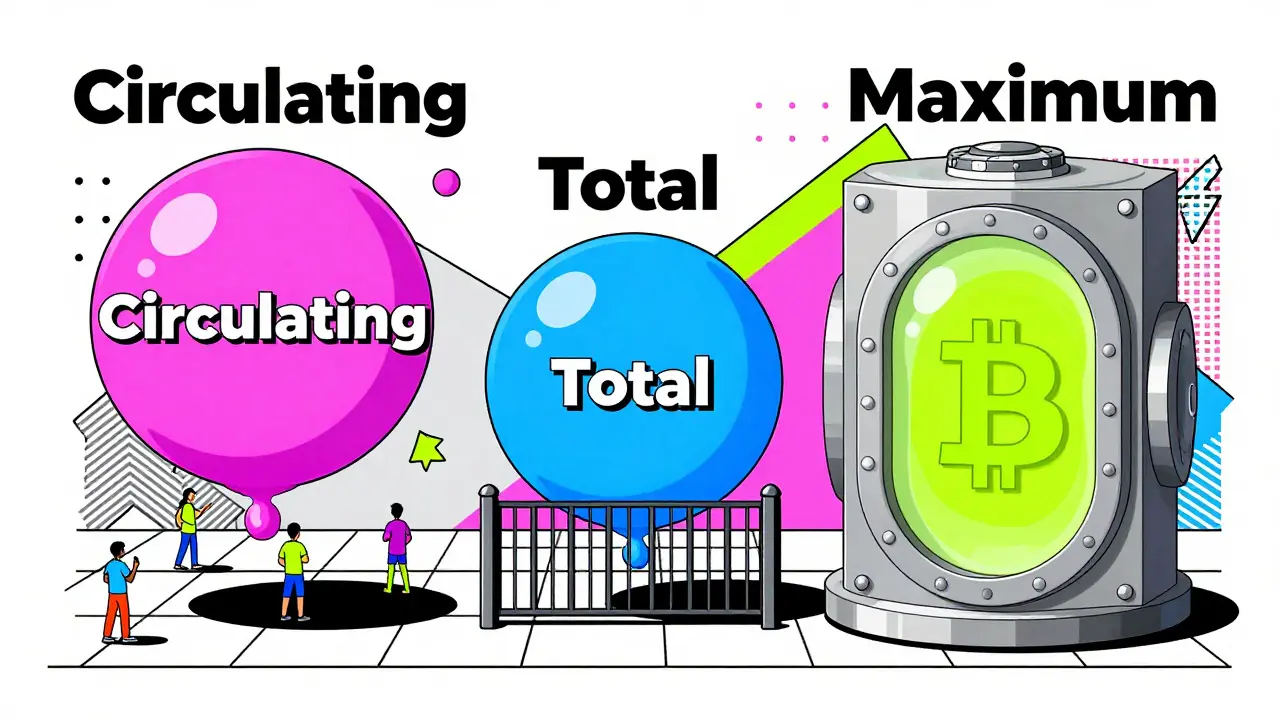

Token Supply Explained: Maximum, Circulating, and Total Supply in Crypto

Understand the three key token supply metrics - circulating, total, and maximum - to avoid costly crypto investing mistakes. Learn how they affect price, valuation, and long-term scarcity.

Utility vs Governance vs Investment Tokens: What They Really Do and How They Differ

Utility, governance, and investment tokens serve completely different roles in blockchain. One gives you access, another gives you votes, and the third gives you ownership. Understand the difference before you buy.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness