Tax-Loss Harvesting in Crypto: How to Offset Gains and Lower Your Tax Bill

Dec, 2 2025

Dec, 2 2025

When Bitcoin dropped from $69,000 to $15,500 in 2022, thousands of crypto investors didn’t just lose money-they also faced huge tax bills on gains they’d made earlier. That’s the cruel twist of crypto taxation: you owe taxes on profits, even if your overall portfolio is underwater. But there’s a legal, smart way to fight back: tax-loss harvesting.

What Is Tax-Loss Harvesting in Crypto?

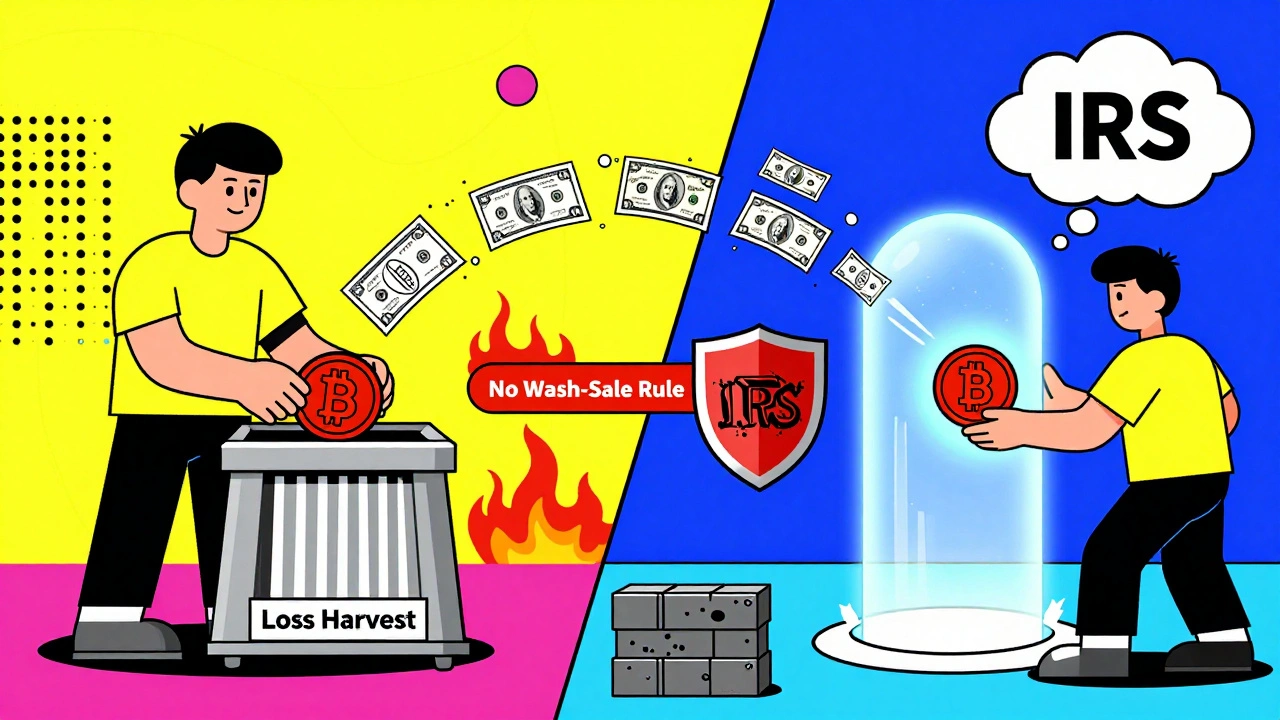

Tax-loss harvesting means selling crypto you own at a loss to cancel out gains you’ve made elsewhere. The IRS treats cryptocurrency as property, not currency. That means every time you sell, trade, or spend crypto, it’s a taxable event. If you bought Ethereum at $3,000 and sold it at $4,500, you made a $1,500 gain. But if you also bought Solana at $200 and sold it at $80, you lost $120. You can use that $120 loss to reduce your $1,500 gain-so you only pay tax on $1,380.This isn’t just for big investors. Someone with $5,000 in crypto gains can wipe out their entire tax bill by harvesting $5,000 in losses. And if your losses exceed your gains, you can deduct up to $3,000 from your regular income each year. Any extra losses? They roll over to next year-no limit.

Why Crypto Makes This Strategy Powerful

Unlike stocks, there’s no wash-sale rule for crypto in the U.S. as of 2025. That means you can sell your Bitcoin at a loss today and buy it back five minutes later. No 30-day waiting period. No penalty. That’s a huge advantage.Why does this matter? Because crypto is wild. Bitcoin’s price swings 78% on average in a year. Ethereum, Cardano, and other altcoins often drop 50-90% in bear markets. That creates constant opportunities to lock in losses. In November 2023, Glassnode found 72% of Bitcoin addresses were underwater. That’s not a market crash-it’s a tax harvesters’ playground.

Compare that to the S&P 500, which swings only 15% annually. In stocks, you wait years for a big enough dip. In crypto, you get them every few months.

How to Do It Right: Step by Step

- Find your losses. Look at every coin you own. Which ones are worth less than what you paid? Don’t guess-check your purchase price and fees. Your cost basis is what you paid + transaction fees.

- Separate short-term and long-term. If you held a coin for a year or less, it’s a short-term gain/loss. More than a year? Long-term. Losses first offset gains of the same type. So short-term losses cancel short-term gains before touching long-term ones.

- Sell the losers. Execute the trade on your exchange. Keep the transaction ID and timestamp. You must complete the sale before December 31 to count for that tax year.

- Buy back immediately. Since there’s no wash-sale rule, you can repurchase the same coin right away. You’re not avoiding the market-you’re just resetting your cost basis lower.

- Track everything. Use tax software like Koinly, CoinTracker, or Blockpit. They auto-import your trades, calculate cost basis, and flag harvestable losses. Manual tracking across multiple wallets? Nearly impossible.

Real Examples That Work

User u/CryptoSaver2022 on Reddit sold 5 ETH at $1,200 each in October 2023. They bought it at $4,300. That’s a $15,500 loss. They used it to offset $15,500 in BTC gains from earlier in the year. Result? Zero capital gains tax for that year. They bought ETH back the same day. No IRS notice. No issues.Another investor had $15,000 in crypto gains and $10,221 in losses. After harvesting, they only paid tax on $4,779. That’s a 68% reduction in taxable income. Over 30 years, the tax savings reinvested at 7% annual return grew to $76,123.

These aren’t outliers. CoinLedger’s 2023 data shows users who used tax-loss harvesting saved an average of $1,427 per year. And 87% of users who tried it rated the experience 4+ stars on Trustpilot.

What Can Go Wrong

The biggest mistake? Poor record-keeping. Fidelity found 68% of crypto investors can’t accurately track their cost basis across exchanges. If you bought Bitcoin on Coinbase, traded it for Solana on Binance, then sold Solana on Kraken-your spreadsheet is probably wrong.One Reddit user, u/TaxNightmare99, miscalculated cost basis across three platforms. The IRS came back demanding $2,300 more in taxes. They now use Blockpit. Lesson: don’t wing it.

Another risk: timing. If you wait until December 28 to start harvesting, your exchange might be down. Or the market might spike on the 30th, killing your loss. Start early. Review your portfolio quarterly. Harvest losses in July and October too-not just in December.

Tools That Make It Easy

You don’t need to be an accountant. Tax software handles the heavy lifting:- Koinly: Connects to 500+ exchanges. Auto-calculates gains/losses. Flags harvest opportunities.

- Blockpit: Tracks wallet addresses, DeFi swaps, and NFT sales. Great for complex traders.

- CoinTracker: Simple interface. Good for beginners. Integrates with TurboTax.

Seventy-eight percent of successful crypto tax-harvesters use one of these tools. The cost? $50-$150 a year. That’s less than most people spend on coffee. The average savings? Over $1,400.

What’s Coming Next

The IRS is watching. The 2021 Infrastructure Bill gave them $3.3 billion to crack down on crypto taxes. Brokers will start reporting cost basis in 2025. That means the IRS will know exactly what you bought and sold.And there’s talk of adding wash-sale rules to crypto. The proposed DART Act and Crypto-Currency Act could ban immediate repurchases. If that happens, you’ll need to wait 30 days before buying back the same coin. Some experts predict it’s inevitable-within 3 to 5 years.

But even if wash-sale rules come, there’s still a workaround: loss swapping. Sell Bitcoin, buy Ethereum. Sell Cardano, buy Polygon. You keep your market exposure while locking in the loss. It’s not perfect, but it’s legal.

Should You Do It?

If you’ve made gains in crypto this year-and you own any coins that are down-yes. This isn’t gambling. It’s accounting. You’re not avoiding taxes. You’re just timing them better.It’s especially powerful if you’re:

- A retail investor with modest gains

- Trading across multiple exchanges

- Hold crypto in wallets, not just exchanges

- Looking to rebalance your portfolio

It’s not worth it if you’re a long-term holder with no gains. Or if you’re in a bull market where almost everything is up. In 2021, only 17% of Bitcoin addresses were underwater. No losses to harvest.

Right now, in late 2025, with markets still recovering from the 2022 crash, many coins are below their 2021 highs. This is one of the best windows you’ll get.

Final Tip: Don’t Wait

The clock is ticking. December 31 is the deadline. If you haven’t reviewed your portfolio this year, do it now. Export your trade history. Run it through free tax software. See what losses you can harvest.Remember: you don’t need to sell everything. Just the ones that are down. You can still believe in Bitcoin. You can still believe in crypto. You’re just making sure the government doesn’t take more than it should.

Can I harvest losses on crypto I still believe in?

Yes. Tax-loss harvesting doesn’t mean you’re giving up on the asset. You sell it to lock in the loss, then immediately buy it back. You keep your position. You just reset your cost basis lower, which reduces future taxes.

Do I need to report harvested losses to the IRS?

Yes. All crypto transactions must be reported on Form 8949 and Schedule D of your Form 1040. Even if you only had losses and no gains, you still report them. The IRS now requires all crypto transactions to be disclosed on the tax return.

Can I use crypto losses to offset stock gains?

Yes. Crypto losses can offset any capital gains-stocks, real estate, NFTs, even gold. The IRS treats all capital assets the same. Losses from crypto reduce your total capital gains for the year.

What if I don’t have any gains this year?

You can still deduct up to $3,000 of crypto losses against your ordinary income-like wages or side hustle earnings. Any losses beyond that carry forward to next year. So even if you didn’t make gains, harvesting losses still saves you money.

Is tax-loss harvesting legal in the UK?

The UK treats crypto as an asset, not currency, and has its own capital gains tax rules. You can offset crypto losses against crypto gains, but you cannot use them to reduce other income like salary. The UK doesn’t have wash-sale rules either, so you can repurchase immediately. But the rules are different from the U.S.-consult a UK tax professional if you’re based there.