ULIPs Under Section 80C in India: Premium Limits, Returns, and Tax Treatment

Feb, 13 2026

Feb, 13 2026

When you hear "tax-saving investment," what comes to mind? Fixed deposits? PPF? Mutual funds? For millions in India, the answer is ULIPs - Unit Linked Insurance Plans. These aren’t just insurance policies. They’re hybrid tools that mix life coverage with market-linked returns, all while helping you claim deductions under Section 80C of the Income Tax Act. But here’s the truth most people miss: ULIPs aren’t for everyone. And if you’re using them just to save tax, you might be setting yourself up for a long, expensive wait.

What Exactly Is a ULIP?

A ULIP is a single product that bundles life insurance and investment. When you pay a premium, part of it goes toward buying life cover - the death benefit your family gets if you pass away. The rest is invested in funds you choose: equity, debt, or balanced. Unlike traditional insurance plans, ULIPs give you control over where your money grows. You can switch between funds, increase your premium, or even pause payments under certain conditions.

But here’s the catch: ULIPs come with high charges in the first few years. Premium allocation charges, mortality charges, fund management fees - they all eat into your returns early on. If you exit before five years, you could lose money. That’s why the government set a lock-in period of five years. It’s not a penalty. It’s a protection.

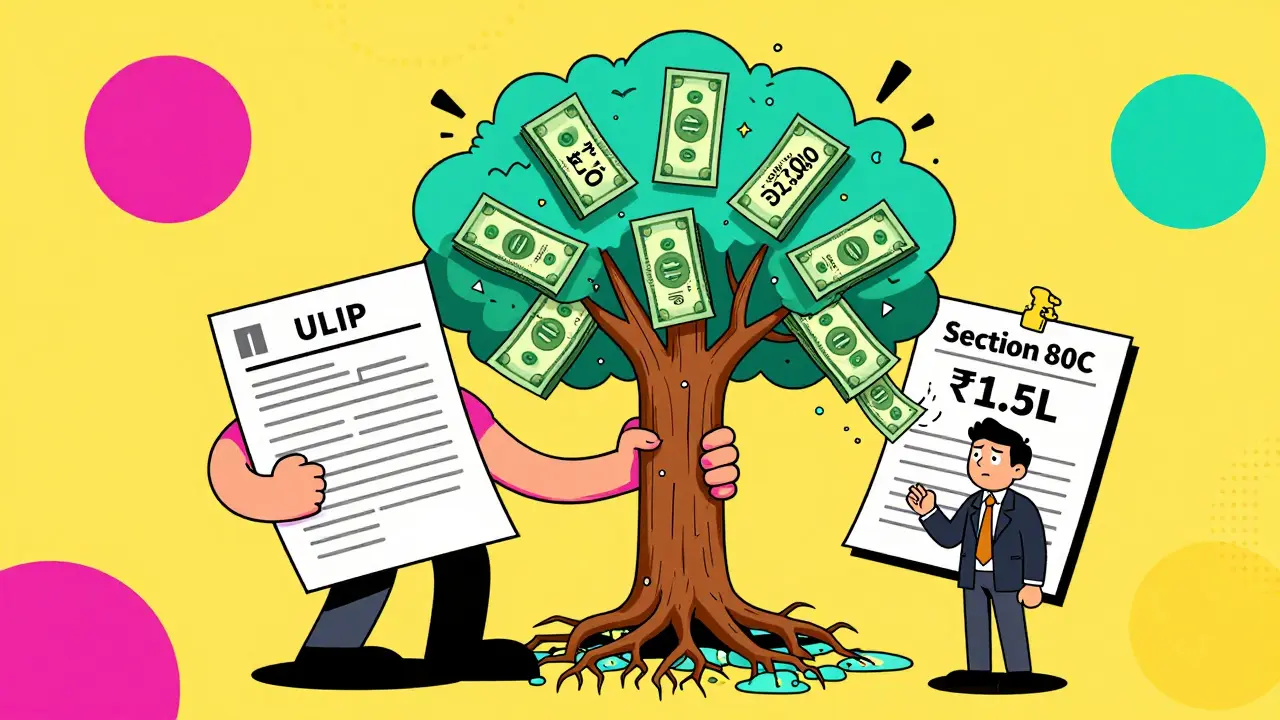

Section 80C and ULIP Premium Limits

Section 80C lets you reduce your taxable income by up to ₹1.5 lakh per year. This limit covers multiple investments: EPF, PPF, ELSS, tuition fees, home loan principal, and yes - ULIP premiums. But there’s a rule you can’t ignore: the premium you pay for a ULIP must not exceed 10% of the sum assured.

Let’s say your ULIP has a sum assured of ₹10 lakh. That means your total annual premium can’t be more than ₹1 lakh. If you pay ₹1.2 lakh, only ₹1 lakh qualifies for Section 80C. The rest? No tax benefit. And if you’re buying a ULIP with a sum assured of ₹5 lakh, your max deductible premium is just ₹50,000.

This rule doesn’t apply to policies bought before February 1, 2021. But for new policies, it’s strict. The government introduced this to stop people from gaming the system - like buying a ₹10 lakh policy with a ₹50,000 premium and claiming the full ₹1.5 lakh deduction. That loophole is closed.

How ULIP Returns Work - And Why They’re Often Overhyped

Insurance agents often show you charts with 12% or 15% annual returns. But those are based on historical equity market performance. They don’t account for charges. Let’s break it down with a real example.

Imagine you invest ₹1 lakh annually in a ULIP for 15 years. The fund earns 10% per year on average. Sounds good? Now subtract:

- First-year premium allocation charge: 30% (₹30,000 gone before investment even starts)

- Annual fund management fee: 1.35% (₹1,350 each year)

- Mortality charge: ₹2,000/year (depends on age and sum assured)

- Policy administration fee: ₹500/year

After 15 years, your corpus might be around ₹22-24 lakh. Sounds okay? Now compare that to investing ₹1 lakh yearly in an ELSS mutual fund - which has only 1.5% expense ratio. With the same 10% return, you’d end up with ₹38-40 lakh. No insurance. No lock-in beyond three years. Just pure investment.

ULIPs work best if you need life cover and want to invest long-term. If you already have a term plan, adding a ULIP for tax savings rarely makes sense.

Tax Treatment: What You Get and What You Lose

There are two tax benefits with ULIPs:

- Premium deduction under Section 80C - up to ₹1.5 lakh (with the 10% rule)

- Death benefit is completely tax-free under Section 10(10D)

But here’s where people get surprised: when you maturity the ULIP, the payout is tax-free too - if the premium paid was under 10% of the sum assured. If you paid more, the entire maturity amount becomes taxable. That’s a hidden trap.

For example, if you paid ₹2 lakh premium on a ₹10 lakh sum assured policy (20% - over the limit), your maturity amount will be added to your income and taxed at your slab rate. That could mean paying ₹30,000-₹50,000 extra in taxes. No one warns you about this until it’s too late.

Also, if you surrender the policy before five years, the entire amount you claimed under Section 80C gets added back to your income in the year of surrender. You’ll owe taxes plus interest. It’s a clawback.

Who Should Buy a ULIP? And Who Should Avoid It?

ULIPs make sense only in three cases:

- You don’t have life insurance and need affordable coverage

- You’re a long-term investor (15+ years) and want to avoid managing multiple instruments

- You’re in a high tax bracket and can’t max out other Section 80C options

But avoid ULIPs if:

- You already have a term plan (₹50-75 lakh coverage) - you don’t need extra life cover

- You want high returns - ELSS or index funds will outperform

- You might need money in 5-7 years - ULIPs lock you in

- You’re risk-averse - debt ULIPs offer lower returns than PPF or FDs

Here’s a simple test: Ask yourself - if this policy had no tax benefit, would I still buy it? If the answer is no, then it’s not an investment. It’s a tax gimmick.

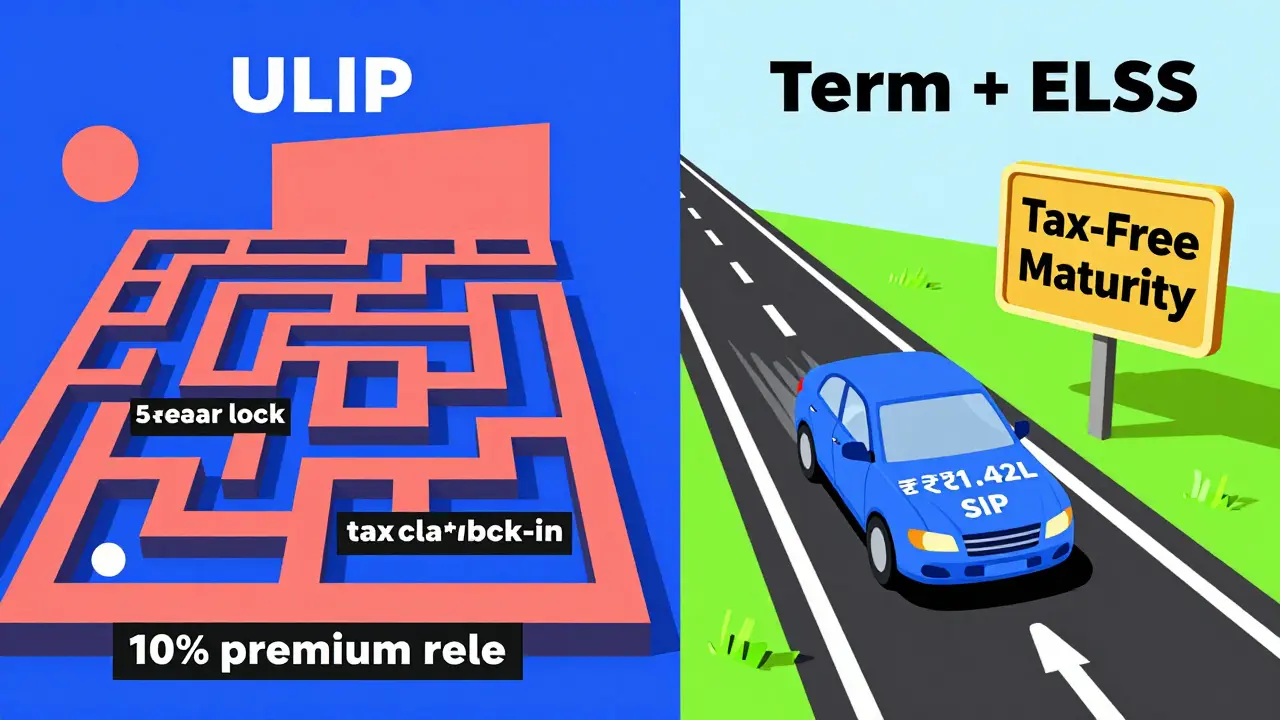

Alternatives That Outperform ULIPs

Let’s say you want to save ₹1.5 lakh under Section 80C. Here’s a smarter way:

| Option | Lock-in | Expected Return | Flexibility | Tax on Maturity |

|---|---|---|---|---|

| ULIP | 5 years | 7-9% | Medium (fund switches allowed) | Taxable if premium >10% of sum assured |

| ELSS Mutual Fund | 3 years | 10-12% | High (redeem anytime after lock-in) | Completely tax-free |

| PPF | 15 years | 7.1% (govt. fixed) | Low (partial withdrawals allowed after 7 years) | Completely tax-free |

| Term Insurance + Equity SIP | None | 10-14% | Very High | Investment gains taxed as per capital gains rules |

The term insurance + SIP combo is the gold standard. Buy a ₹50 lakh term plan for ₹8,000/year. Invest ₹1.42 lakh/year in ELSS. You get full tax benefit, better returns, zero insurance charges, and full control. No one’s selling you this because commissions are low.

Final Advice: Don’t Mix Insurance With Investment

The biggest mistake people make is letting insurance agents sell them a ULIP as an investment. It’s not. It’s insurance with investment features. And insurance is expensive. Investment is cheap.

If you need life cover - get term insurance. If you want to grow wealth - invest in mutual funds or index funds. If you want tax savings - max out PPF and ELSS first. ULIPs have a place, but only if you’re clear on why you’re buying them.

And remember: tax savings today shouldn’t cost you returns tomorrow. A ₹1.5 lakh deduction is worth ₹45,000 in tax (if you’re in 30% slab). But if your ULIP underperforms by 3% annually over 15 years, you lose over ₹3 lakh in potential gains. That’s not smart. That’s surrendering wealth for a short-term tax break.

Can I claim ULIP premium under Section 80C if I pay more than ₹1.5 lakh annually?

Yes, but only up to ₹1.5 lakh total across all Section 80C investments. If you pay ₹2 lakh in ULIP premiums, only ₹1.5 lakh qualifies - and even that depends on the 10% of sum assured rule. If your premium exceeds 10% of the sum assured, the excess doesn’t qualify at all.

Are ULIP returns guaranteed?

No. ULIP returns are market-linked. They depend on the performance of the equity or debt funds you choose. Past performance doesn’t guarantee future results. Returns can be negative in the short term, especially if markets fall.

What happens if I stop paying ULIP premiums after 3 years?

If you stop paying premiums before 5 years, the policy lapses. Any tax benefits claimed so far will be reversed - the entire amount you deducted under Section 80C will be added back to your income in the year of lapse, and you’ll owe taxes plus interest. After 5 years, you can surrender the policy, but you’ll get only the fund value minus surrender charges.

Is the maturity amount from ULIP tax-free?

Yes - but only if the annual premium paid was 10% or less of the sum assured. If you paid more, the entire maturity amount becomes taxable as income. This rule applies to policies bought on or after February 1, 2021.

Can I switch funds within a ULIP without tax implications?

Yes. Fund switches within a ULIP are not taxable events. You can move money between equity, debt, or balanced funds as often as your policy allows (usually 4-12 free switches per year). No capital gains tax applies, even if you’re switching from equity to debt.