Indian Mutual Funds: Direct vs Regular, SIPs, Tax Benefits, and How to Invest

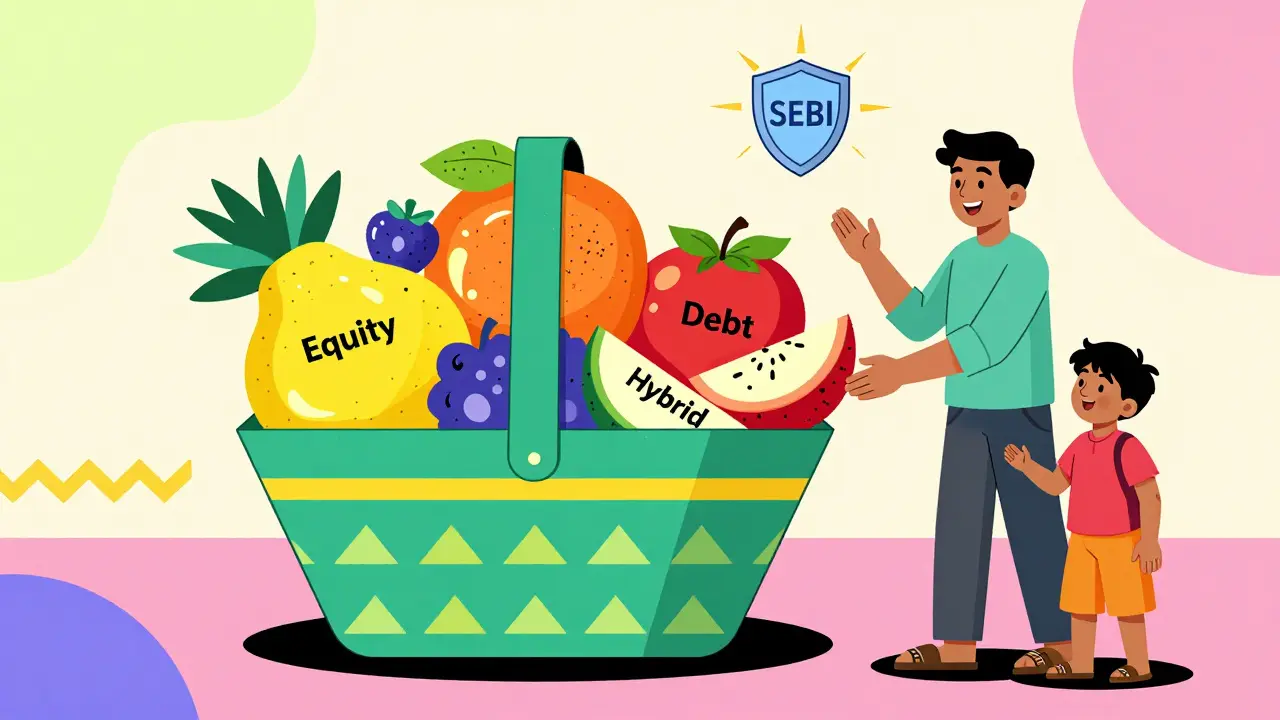

When you invest in Indian mutual funds, pooled investment vehicles managed by professionals that let you buy small pieces of stocks, bonds, or other assets. Also known as mutual investment schemes, they’re one of the most popular ways for middle-class families in India to grow money without needing to pick individual stocks. But not all mutual funds are the same. The biggest difference you’ll face is between direct mutual funds, plans bought straight from the fund house with no advisor commission and regular mutual funds, plans sold through advisors or platforms that charge a commission. That small difference can cost you lakhs over time.

Most people start with a SIP investing, systematic investment plan where you invest a fixed amount every month. It’s not magic—it’s just discipline. By investing regularly, you buy more units when prices are low and fewer when they’re high, smoothing out market swings. You don’t need to time the market. You just need to stay consistent. And when you pair SIPs with mutual fund tax benefits, deductions under Section 80C for investments like ELSS funds, you’re not just growing money—you’re keeping more of it. The government lets you save up to ₹1.5 lakh a year in taxes by putting money into eligible mutual funds. That’s free money you’d otherwise pay to the income tax department.

Before you start, you need the basics: a PAN card, your Aadhaar, and a completed KYC. These aren’t red tape—they’re your ticket in. Without them, you can’t invest legally. Many people get stuck here because they think it’s complicated. It’s not. You can finish digital KYC in 10 minutes using your phone. Once that’s done, you can switch from regular to direct plans in minutes and start saving on fees immediately.

What you’ll find below isn’t theory. It’s real advice from people who’ve done this. You’ll see how much you can save by switching to direct plans, how to build a multi-SIP portfolio that balances risk, how tax rules like Section 80C actually work in practice, and why some funds that look good on paper lose money because of hidden costs. There’s no fluff. No jargon. Just what you need to know to make better choices with your money in India.

How to Track Mutual Fund Performance in India and Evaluate Your Portfolio

Learn how to track mutual fund performance in India, evaluate your portfolio, and make smarter investment decisions with practical steps, benchmarks, and tools. Avoid common mistakes and beat inflation with confidence.

What Are Mutual Funds? A Complete Guide for Indian Investors

Mutual funds are the most practical way for Indian investors to grow wealth without needing expertise. Learn how they work, how to choose one, start a SIP, avoid common mistakes, and make your money work for you.

How to Nominate Beneficiaries in Indian Mutual Funds and Update Details

Learn how to nominate beneficiaries in Indian mutual funds and update details easily. Avoid probate delays and ensure your loved ones get your investments quickly with the right nominee.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- hire domestic help in Mumbai

- Home & Lifestyle

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness