NPS Deduction: How Employer Contributions and Tax Benefits Work in India

When you hear NPS deduction, a tax-saving mechanism under India’s National Pension System that lets you reduce your taxable income by contributing to a government-backed retirement fund. Also known as National Pension System, it’s not just another investment—it’s a structured way to build retirement savings with help from your employer and the government. Many people think NPS is only for government workers, but it’s open to everyone, and if your company offers it, you’re already halfway there.

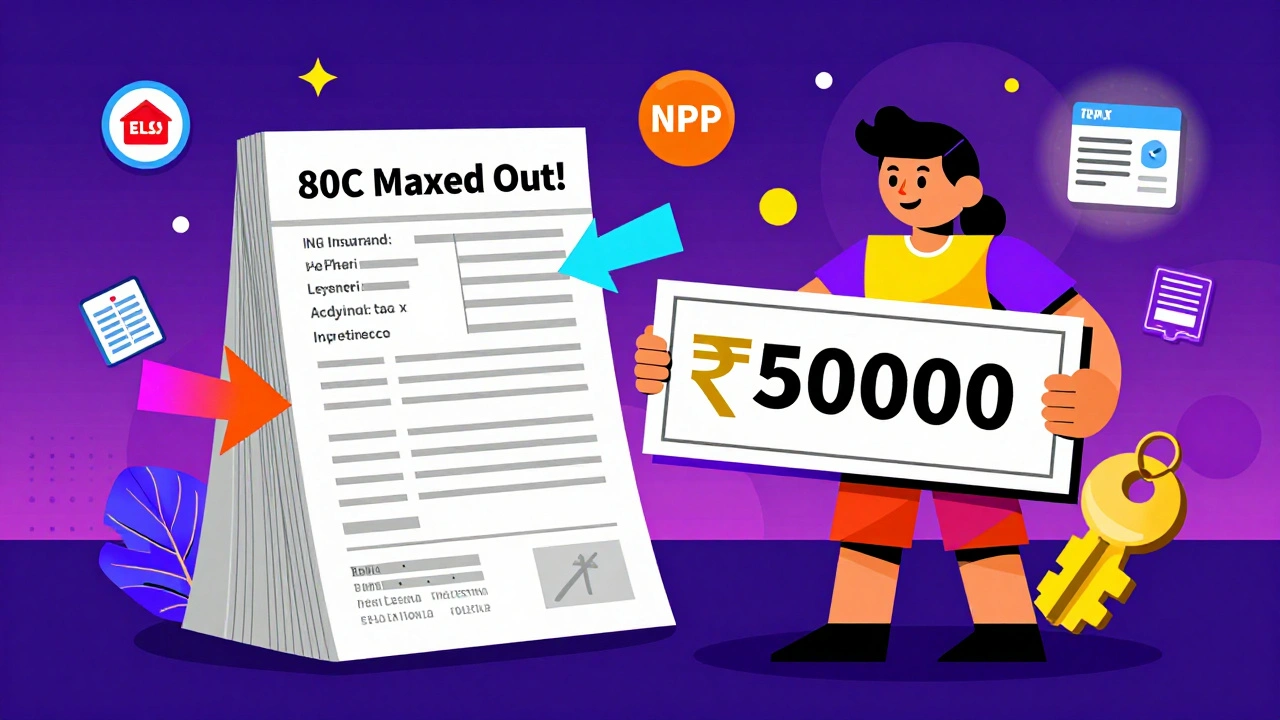

Corporate NPS is where things get interesting. Your employer doesn’t just match your contribution—they often pay part of it outright. That’s free money going straight into your retirement account. And here’s the kicker: both your contribution and your employer’s can qualify for tax deductions under Section 80C, up to ₹1.5 lakh. On top of that, you get an extra ₹50,000 deduction under Section 80CCD(1B), which is only for NPS. That’s ₹2 lakh in tax savings you can claim just by signing up. No other retirement plan gives you that kind of double benefit.

But NPS isn’t just about tax breaks. It’s designed to grow your money over time with a mix of equity and debt, and you get to choose how much goes where. Unlike fixed deposits or PPF, you’re not locked into low returns. The returns are market-linked, which means higher potential growth—especially if you start early. And when you retire, you can take up to 60% as a lump sum tax-free. The rest goes into an annuity to give you a monthly income. It’s not perfect, but for most people, it’s the most efficient retirement tool available in India.

What you’ll find in the posts below are real breakdowns of how Corporate NPS works, how to maximize your deduction, what happens if you change jobs, and why some people miss out on the full benefit because they don’t know the rules. You’ll also see how NPS compares to other options like PPF and ELSS, and why it’s often the smarter long-term play—even if it feels complicated at first. No fluff. No jargon. Just what you need to make your NPS work for you.

Section 80CCD(1B) in India: How to Claim an Extra ₹50,000 Deduction for NPS Contributions

Section 80CCD(1B) lets you claim an extra ₹50,000 tax deduction for NPS contributions, on top of the ₹1.5 lakh limit under 80C. Learn how to use it, who qualifies, and how much you can save.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness