Archive: 2025/12 - Page 3

PPF Maturity in India and What to Do After It Ends: Extend Your Investment Wisely

Learn how to extend your PPF account after 15 years in India to keep earning tax-free interest. Discover withdrawal rules, extension options, and why many retirees choose to leave their money in PPF instead of cashing out.

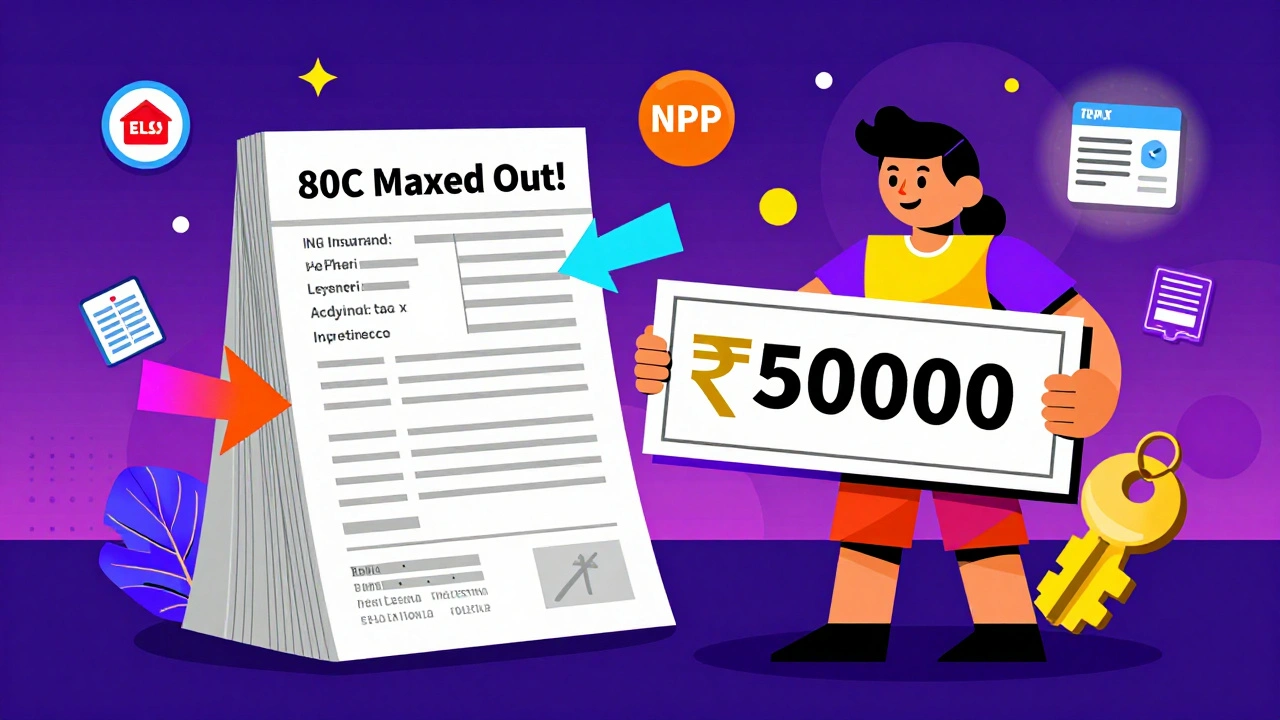

Section 80CCD(1B) in India: How to Claim an Extra ₹50,000 Deduction for NPS Contributions

Section 80CCD(1B) lets you claim an extra ₹50,000 tax deduction for NPS contributions, on top of the ₹1.5 lakh limit under 80C. Learn how to use it, who qualifies, and how much you can save.

Tax-Loss Harvesting in Crypto: How to Offset Gains and Lower Your Tax Bill

Learn how to use crypto tax-loss harvesting to legally offset capital gains, reduce your tax bill, and reset your cost basis-without giving up your investments. Works even if you still believe in the asset.

Stablecoin Pairs in Crypto Trading: How to Reduce Volatility Exposure

Stablecoin pairs like BTC/USDT let crypto traders avoid volatility without leaving the market. Learn how USDC, USDT, and DAI work, which pairs to use, and how to protect your portfolio from crashes.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- hire domestic help in Mumbai

- Home & Lifestyle

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness